Circle Moves Toward Privacy-Focused Stablecoin With USDCx Project

- Circle is developing USDCx, a privacy-enhanced version of USDC

- Built in partnership with Aleo, using zero-knowledge privacy tech

- Designed for banks and enterprises needing confidential transactions

- USDCx promises “banking-level privacy” while preserving regulatory compliance

- Part of a wider industry push toward private stablecoin infrastructure

- Corporate adoption of stablecoins accelerating after the US GENIUS Act

- Major institutions including Citi, JPMorgan, BofA and Visa are experimenting with stablecoin payment rails

Circle is moving deeper into institutional blockchain infrastructure with USDCx, a new privacy-enhanced version of its widely used USDC stablecoin. The project, revealed through reporting by Fortune, aims to solve one of the biggest barriers preventing banks and enterprises from adopting blockchain payments: the lack of privacy.

USDCx is being developed in collaboration with Aleo, a zero-knowledge–focused blockchain company that specializes in privacy-preserving computation. Unlike standard stablecoins — where wallet addresses and transaction histories are publicly transparent — USDCx is engineered to deliver “banking-level privacy” while retaining the oversight capabilities necessary for regulatory compliance. Circle would still be able to provide transaction records to authorities upon request.

Solving institutions’ biggest blockchain hesitation

Many large financial institutions have been reluctant to adopt blockchain rails because transaction flows become visible to anyone onchain. For corporations moving salaries, supplier payments or internal transfers, full transparency is a dealbreaker.

Aleo’s team has argued for years that privacy must be built into any stablecoin designed for enterprise usage. In a May post, the company noted that transparency becomes a vulnerability when payments involve sensitive financial information. USDCx attempts to fix this by enabling encrypted, private transactions that still meet compliance standards.

Privacy-focused stablecoin solutions are gaining momentum beyond Aleo as well. Digital asset infrastructure provider Taurus recently unveiled a private smart-contract system that allows stablecoin transfers to occur confidentially, helping companies manage payroll and internal settlements without exposing financial data onchain.

Corporate America enters the stablecoin race

Circle’s USDCx push comes at a time when stablecoin adoption is accelerating inside the financial sector, driven in part by new U.S. regulation under the GENIUS Act, which formalizes oversight of dollar-pegged tokens.

A wave of corporate experimentation is now underway:

- Citigroup is testing stablecoin-based payment rails through a partnership with Coinbase

- JPMorgan and Bank of America are exploring similar blockchain payment technologies

- Western Union is building a Solana-based digital asset settlement system, including a new USD payment token

- Visa continues to expand its stablecoin integrations and global onchain settlement tools

These initiatives point toward a future where stablecoins — especially privacy-enabled versions — become embedded across payroll, remittances, corporate treasury operations and global settlement networks.

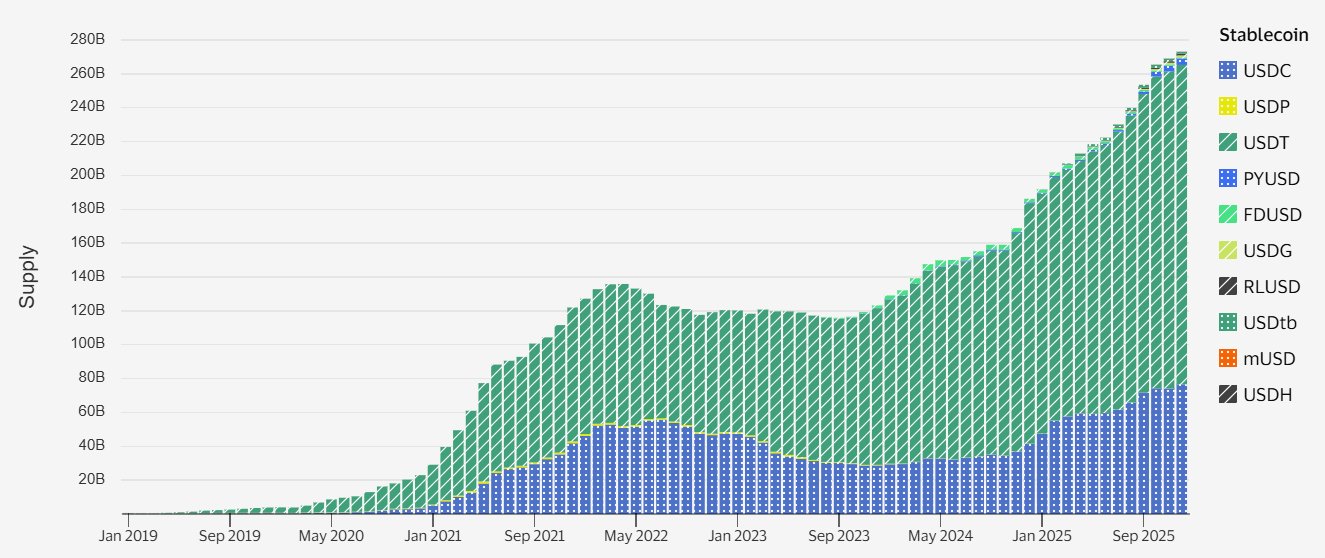

Stablecoins dominate the digital dollar economy

Dollar-pegged stablecoins remain the backbone of the global digital asset ecosystem.

USDC and Tether’s USDT together control roughly 85% of the market, with other notable entrants such as PayPal USD (PYUSD) and various synthetic dollar systems also gaining traction.

As enterprises seek secure, private and compliant ways to adopt blockchain-based settlement, Circle’s USDCx may emerge as the first major bridge between traditional finance and privacy-preserving digital dollars.