Citi Invests in Stablecoin Firm BVNK as Wall Street Deepens Blockchain Push

Citigroup’s venture capital arm, Citi Ventures, has made a strategic investment in BVNK, a London-based stablecoin infrastructure company. The move marks another step in Wall Street’s increasing embrace of blockchain technology and digital payments.

- Citi Ventures invests in BVNK, joining earlier backers Coinbase and Tiger Global.

- BVNK’s valuation now exceeds $750 million following the latest funding.

- The investment follows the passage of the GENIUS Act, providing stablecoin regulatory clarity in the US.

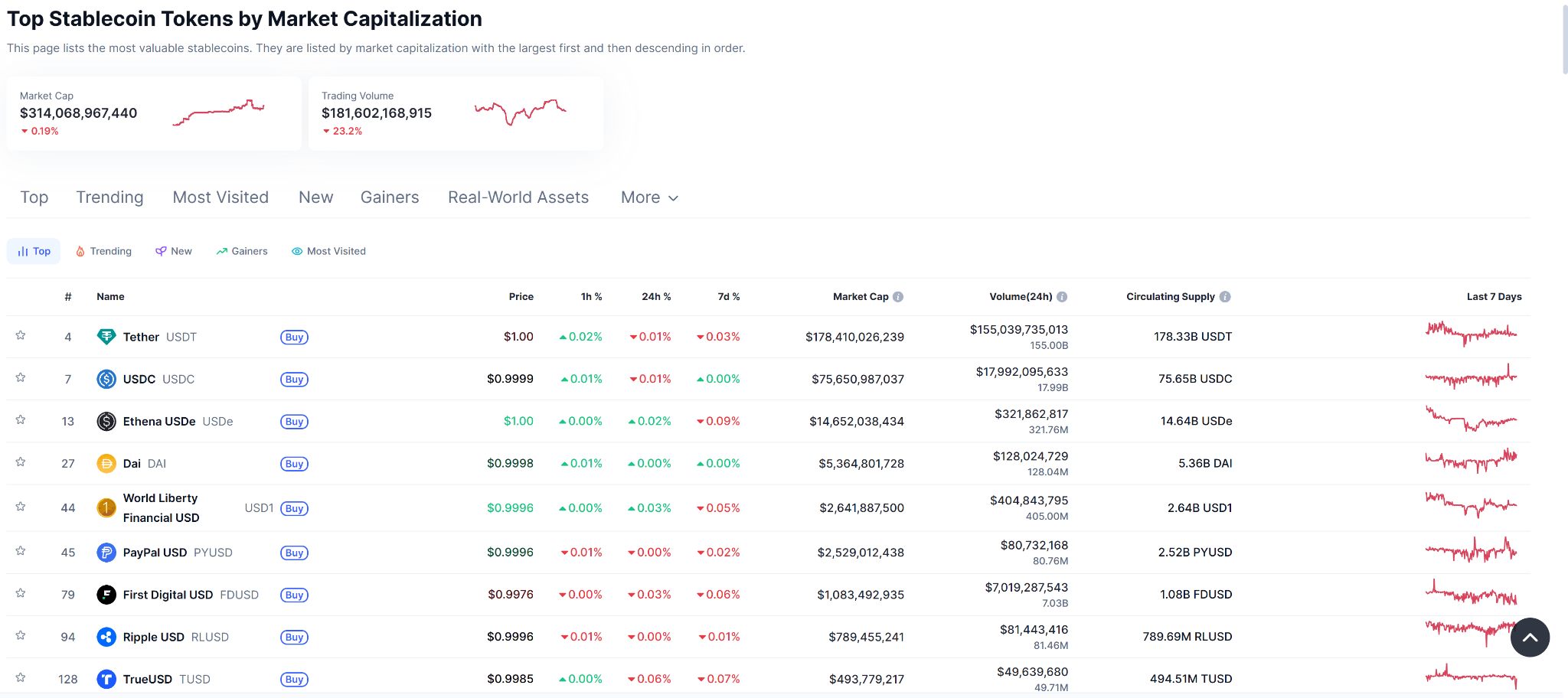

- Citi projects the stablecoin market could reach $4 trillion by 2030.

- Bank of England considers easing corporate stablecoin limits amid global competition.

Wall Street’s interest in digital assets continues to accelerate as Citi Ventures takes a stake in BVNK, a London-based firm specializing in global payment rails built on stablecoin infrastructure. BVNK co-founder Chris Harmse confirmed that the company’s valuation now exceeds $750 million, though the size of Citi’s investment was not disclosed.

Harmse said the company is witnessing “an explosion of demand for building on top of stablecoin infrastructure,” particularly in the United States, where BVNK’s growth has been fastest over the past 18 months. The boost, he added, comes in part from the GENIUS Act, a new U.S. law providing clearer oversight and regulation of stablecoins, helping traditional institutions gain confidence in the space.

This latest investment underscores how major Wall Street banks are strengthening their foothold in blockchain-powered finance. “US banks at the scale of Citi are putting their weight behind leading businesses in the space,” Harmse said, noting that regulatory clarity has opened the door for innovation in global payments.

Citi has been increasingly bullish on stablecoins. The bank’s research team recently revised its projections for the sector, estimating a base case of $1.9 trillion and a potential bull case of $4 trillion by 2030, driven by surging adoption and growing institutional use.

Citi’s interest mirrors similar moves from other financial giants — Visa invested in BVNK earlier this year through its Visa Ventures division, following a $50 million Series B round led by Haun Ventures. BVNK’s platform enables businesses to integrate stablecoin payments, liquidity, and compliance tools, bridging traditional finance with digital assets.

Meanwhile, the Bank of England (BoE) is also reassessing its approach to stablecoins. The BoE had proposed strict holding limits — £20,000 for individuals and £10 million for companies — but is now reconsidering after feedback from the crypto sector and pressure to remain competitive with the U.S. market.

Analysts say these policy shifts and investments signal a broader trend — major institutions are no longer avoiding digital assets but are actively building the financial infrastructure that will define the next generation of global payments.

Final Thought

Citi’s investment in BVNK is another milestone in the fusion of traditional banking and blockchain. As regulatory clarity grows and institutions adopt stablecoins at scale, stablecoin infrastructure firms like BVNK are positioned at the forefront of the world’s evolving financial landscape.