Coinbase Acquires Echo for $375M, Betting on Onchain Crowdfunding Revival

- Coinbase acquired Echo, a decentralized crowdfunding platform, for $375 million.

- Echo’s founder, Jordan “Cobie” Fish, confirmed the sale after Coinbase sent $25 million in USDC to acquire an NFT and revive his podcast.

- Echo previously raised $51 million in funding, with Ethena as its first project.

- The acquisition signals Coinbase’s move into onchain ICO-style crowdfunding through Echo’s Sonar product.

- Coinbase plans to expand Echo’s infrastructure to tokenized securities and real-world assets (RWAs).

Coinbase, one of the world’s largest cryptocurrency exchanges, is making a major bet on the future of onchain community crowdfunding. The company has acquired Echo, a platform designed for collective investment in early-stage crypto projects, in a deal valued at $375 million.

The acquisition was confirmed by Jordan Fish, known in the crypto community as Cobie, who founded Echo in April 2024. The move came just one day after Coinbase transferred $25 million in USDC to Cobie’s wallet – reportedly to acquire and burn an NFT, marking the revival of his popular UpOnly podcast. “I certainly didn’t think Echo would be sold to Coinbase, but here we are,” Cobie wrote on X.

Echo’s early success was notable. In just eight months since its beta launch, the platform facilitated 131 deals and raised over $51 million, with its first major project being Ethena, the synthetic dollar protocol behind the fast-growing USDe stablecoin. Echo’s appeal lies in its ability to bring communities together to fund early-stage ventures, democratizing access to private investment rounds previously reserved for institutional players.

Earlier this year, Echo introduced Sonar, a product that allows founders to self-host public token sales across multiple blockchains, including Hyperliquid, Base, Solana, and Cardano. This innovation allowed project teams to directly manage their own fundraising, minimizing reliance on intermediaries.

Following the acquisition, Cobie announced that Echo will remain a standalone brand “for now”, but confirmed that Sonar will be integrated into Coinbase’s ecosystem. This integration, Coinbase said, will create “new ways for founders to access investors” while expanding investment opportunities for users on its platform.

In an official statement, Coinbase explained:

“Integrating Echo’s tools will help us enable more direct community participation, joining projects with capital, entirely onchain. While we’ll start with crypto token sales via Sonar, we plan to expand support to tokenized securities and real-world assets over time.”

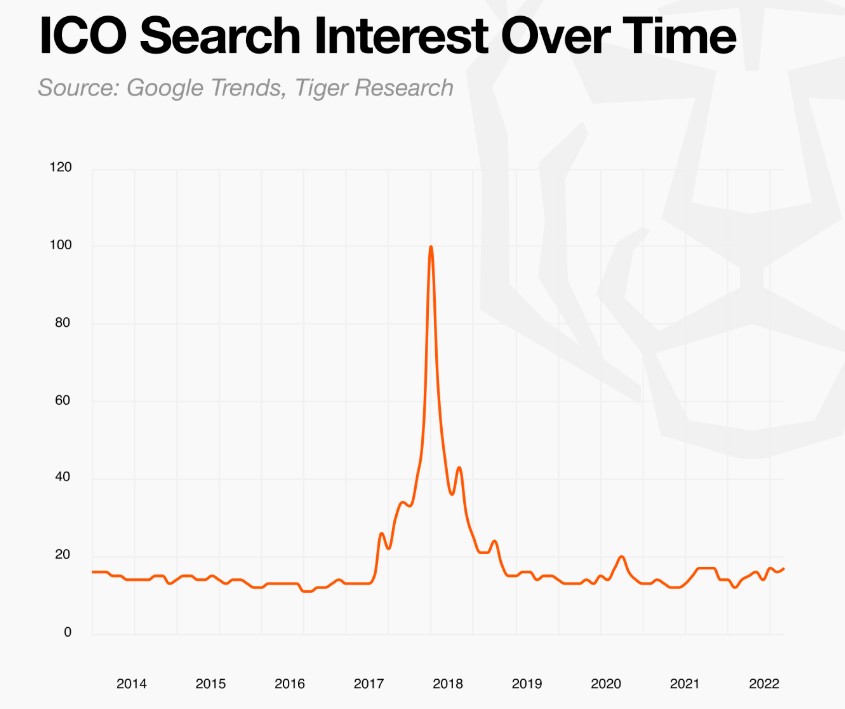

The move reflects a growing industry trend reminiscent of the Initial Coin Offering (ICO) boom of 2017. While ICOs once fueled the early wave of crypto innovation, they faded following regulatory scrutiny and rampant fraud. However, new onchain crowdfunding models are now emerging through public launchpads such as Legion, Buidlpad, Sonar, and Kaito – platforms that emphasize transparency, compliance, and community-driven funding.

According to Tiger Research, public token sales are making a comeback, serving as a bridge between retail investors and blockchain startups. “Short-term hype around public launchpads may cool down,” Tiger Research wrote, “but structural demand will persist as these tools secure early users and liquidity.”

Coinbase’s acquisition of Echo is more than a business expansion – it’s a signal of intent. By bringing community-driven funding onchain, Coinbase is positioning itself at the forefront of a new era of decentralized capital formation.

Final Thought

Coinbase’s $375 million acquisition of Echo marks a pivotal moment for the rebirth of onchain crowdfunding. As the exchange integrates Echo’s infrastructure, it aims to merge compliance with decentralization – potentially rekindling the ICO model in a more transparent, regulated form. With tokenized assets and public launchpads gaining traction, this move may define the next wave of crypto’s evolution, where investors and communities co-create the future of finance.