Coinbase Launches ETH-Backed Loans as Onchain Lending Surpasses $1.25 Billion

- Coinbase now lets U.S. users borrow USDC by using their ETH as collateral.

- Borrowers can get up to $1 million in USDC with variable rates and liquidation risks.

- The service is powered by Morpho and runs on Coinbase’s Base network.

- Coinbase plans to expand the program to include cbETH and other assets.

- Onchain lending through Coinbase has already passed $1.25B in originations.

- The company is rapidly expanding new products following clearer U.S. crypto regulations.

- Coinbase has recently launched new offerings, acquisitions, and partnerships.

Coinbase has launched a new lending product that allows U.S. customers to borrow USDC by using their Ether (ETH) holdings as collateral. This service lets users access liquidity without selling their crypto, and it operates on Base, Coinbase’s Layer-2 network.

The ETH-backed loan program is available in most U.S. states, except New York. Users can borrow up to $1 million in USDC, with variable interest rates and liquidation risks depending on market conditions. Coinbase also confirmed that it plans to expand this offering to other assets, including loans backed by its own staked Ether token, cbETH.

This new lending feature is powered by Morpho, a popular decentralized finance (DeFi) lending protocol. Coinbase integrated Morpho into its app in September, offering users yields of up to 10.8% on their USDC. The integration shows Coinbase’s push to bring DeFi tools into a more user-friendly and regulated environment.

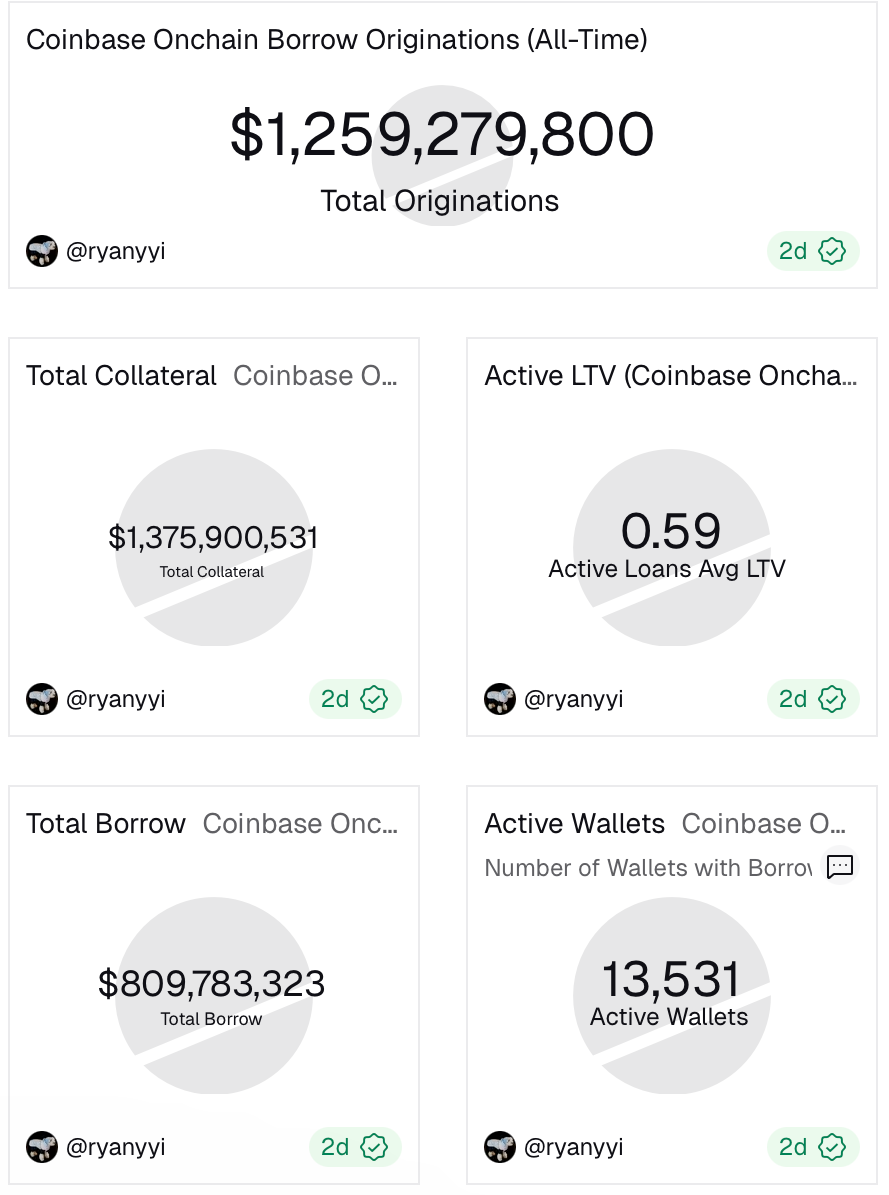

Onchain data from Dune Analytics shows strong demand for Coinbase’s lending ecosystem. The platform has processed more than $1.25 billion in total loans, backed by around $1.37 billion in collateral deposits. At the moment, roughly $810 million in loans remain active, with more than 13,500 wallets currently borrowing through the system.

Coinbase Expands Rapidly After U.S. Regulatory Clarity

Crypto regulation in the United States has shifted quickly under the Trump administration’s pro-crypto stance. The GENIUS Act, passed in July, gave the country its first clear regulatory framework for stablecoins. With more certainty in the legal landscape, Coinbase has increased the speed of its expansion.

In October, Coinbase acquired the platform Echo for $375 million. Echo, founded by crypto investor Jordan Fish (also known as Cobie), helps communities fund early-stage startups and crypto projects.

Around the same time, Coinbase launched staking services for users in New York—a state known for strict regulations—and partnered with Citigroup to help the bank improve the movement of funds between crypto and traditional finance.

On November 10, Coinbase announced a new platform for regulated initial coin offerings (ICOs). This marks the first time U.S. retail investors have had regulated access to token sales since 2018. Coinbase expects to list about one token sale per month, starting with Monad’s sale.

Additionally, tech researcher Jane Manchun Wong shared that Coinbase appears to be developing a prediction market platform, likely in partnership with Kalshi, a regulated event-trading exchange.

All of these moves show that Coinbase is positioning itself to lead the next wave of U.S.-based crypto innovation, combining DeFi tools with mainstream access.

Final Thought

Coinbase’s new ETH-backed loan program highlights the company’s push to bring DeFi lending into a regulated, user-friendly environment. With over $1.25 billion already flowing through its onchain lending markets and a wave of new product launches, Coinbase is rapidly expanding as U.S. crypto regulation becomes clearer.