Coinbase Integrates Morpho to Offer Up to 10.8% DeFi Yield on USDC

Coinbase is stepping deeper into decentralized finance by integrating the Morpho lending protocol, giving USDC holders a direct way to earn up to 10.8% yield—all from within the Coinbase app.

- Morpho lending protocol now integrated into the Coinbase app.

- USDC holders can earn up to 10.8% DeFi yields, compared to the 4.5% APY for holding USDC on Coinbase.

- Vaults curated by Steakhouse Financial streamline the experience.

- Move comes amid rising stablecoin adoption and debates over the US GENIUS Act yield restrictions.

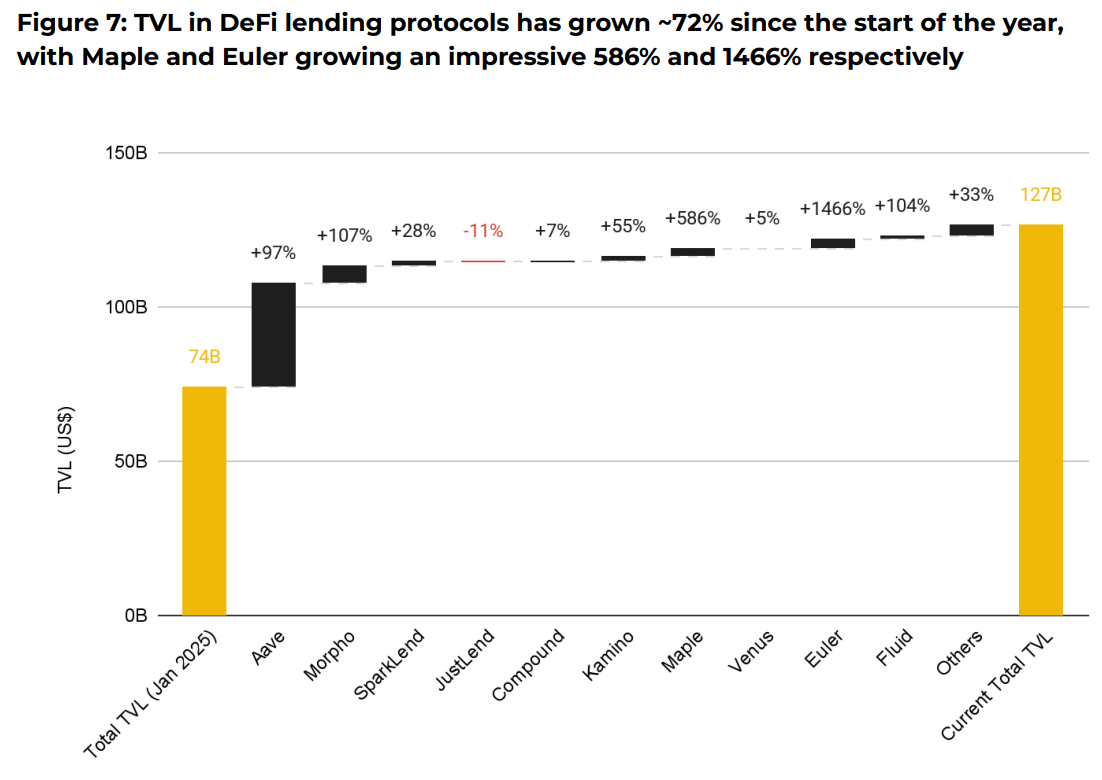

- DeFi lending TVL surges, with Morpho topping $8.3B and institutional interest up 72% YTD.

Coinbase is making a bold play in decentralized finance, enabling users to earn significantly higher returns on their USDC holdings without leaving its platform. Through a new integration with the Morpho lending protocol, Coinbase users can lend USDC and access onchain yields reaching 10.8%, far exceeding the 4.5% APY currently offered for simply holding USDC on the exchange. The integration is curated by DeFi advisory firm Steakhouse Financial, and users can interact directly through the Coinbase app, avoiding the complexity of third-party wallets or separate DeFi platforms.

Morpho, one of crypto’s largest decentralized lending protocols, has more than $8.3 billion in total value locked (TVL) according to DefiLlama, with its dollar-denominated TVL climbing sharply in 2024 as demand for onchain lending accelerates. Institutional adoption of DeFi lending is also gaining momentum, with Binance Research reporting a 72% year-to-date increase in activity, underscoring the growing interest from professional investors. Coinbase highlighted the potential benefits but cautioned users to understand the inherent risks of DeFi lending, which are clearly outlined within the app.

The move lands amid a shifting regulatory environment for stablecoins in the United States. The recently passed GENIUS Act explicitly bans yield-bearing stablecoins, a stance that has sparked industry backlash. In August, the Bank Policy Institute (BPI) urged regulators to close what it called a loophole that could allow exchanges to offer yield through third-party partners. The BPI argued that payment stablecoins serve a distinct purpose, unlike bank deposits or money market funds that directly fund loans or investments. Coinbase countered in a blog post that stablecoins “don’t threaten lending” but instead provide a competitive alternative to banks’ lucrative $187 billion annual swipe-fee market.

This regulatory tension is unfolding alongside rapid stablecoin growth, with circulating supply surpassing $300 billion according to CoinMarketCap. A recent survey by the DeFi Education Fund found that 40% of U.S. adults would consider using DeFi protocols if new crypto legislation were passed, suggesting a receptive market. For Coinbase, the Morpho partnership positions the exchange at the intersection of rising stablecoin adoption and mainstream interest in DeFi yields, signaling a strategic push to stay ahead in the evolving financial landscape.

Final Thought

Coinbase’s integration of Morpho lending brings DeFi yields to the fingertips of everyday users, merging institutional-grade protocols with a user-friendly interface. As stablecoin adoption and regulatory debates heat up, the move underscores how major exchanges are reshaping traditional finance by offering competitive alternatives to banks while carefully navigating compliance challenges.