Coinbase Ventures Unveils 9 Crypto Investment Themes Set to Shape 2026

- Coinbase Ventures revealed nine core areas it plans to fund in 2026

- Focus sectors include RWAs, new exchange models, DeFi innovation, and AI-powered tools

- The firm expects synthetic RWA products and prop-AMMs to grow

- Prediction market aggregators could consolidate $600M+ in liquidity

- Next-gen DeFi may blend leverage, lending, and yield into one system

- Onchain privacy tools and reputation-based borrowing expected to expand

- AI, robotics data networks, and “proof of humanity” standards predicted to rise

- AI agents may build onchain businesses with little human input

Coinbase Ventures, the investment arm of Coinbase, has released a clear outline of nine crypto ideas it aims to support in 2026. These themes reflect what the company believes will become the strongest growth areas in the next wave of the crypto market. According to the firm, these sectors include real-world asset trading, advanced decentralized finance, new exchange models, and AI-driven innovation.

In its latest blog post, Coinbase Ventures explained that it is looking to invest in teams building real-world asset (RWA) tokenization systems, specialized trading terminals, new forms of perpetuals, next-generation DeFi protocols, and AI tools designed for onchain development. The company said these categories show the highest potential to produce major breakout projects.

Since 2018, Coinbase Ventures has made more than 600 investments and now has over 420 companies in its portfolio. Its recent investments include compliance tools, prediction market platforms, and crypto payment infrastructure. This track record shows that the company continues to target areas where blockchain adoption has strong long-term potential.

One major trend the team highlighted is RWA perpetual futures, which provide synthetic exposure to off-chain assets. According to Coinbase Ventures, synthetic RWA trading can become a major market because it allows traders to access traditional assets in a fully onchain environment.

The firm also emphasized a new category of exchanges called prop-AMMs. These proprietary automated market makers aim to protect liquidity providers from being exploited by bots and advanced arbitrage strategies. Coinbase Ventures believes this exchange design could improve fairness and liquidity efficiency in the ecosystem.

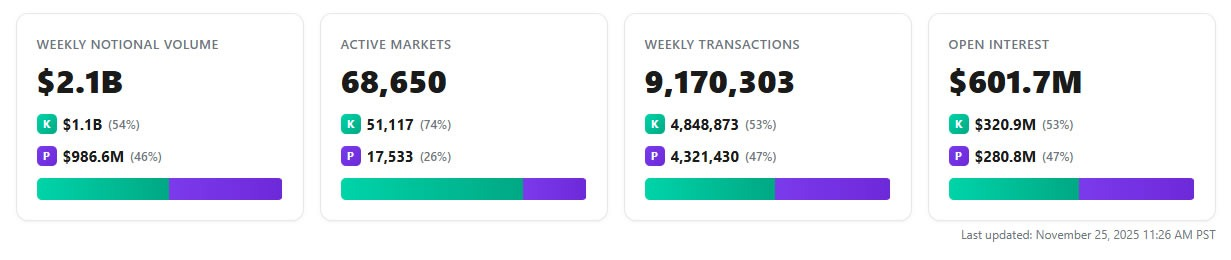

Another area set for major growth is prediction markets. The firm expects prediction market aggregators to emerge and unite over $600 million in fragmented liquidity across multiple platforms. This would allow traders to view real-time event odds from different venues in a single interface.

Next-generation DeFi development is also expected to expand significantly in 2026. Coinbase Ventures predicts deeper integration between perpetual futures exchanges, lending protocols, and yield markets. This would allow traders to use collateral more efficiently — for example, maintaining leverage while earning yield at the same time.

Privacy-focused tools are also receiving strong developer attention. The company noted increased activity around privacy-preserving assets such as Zcash, along with new concepts for protecting financial data onchain.

The firm also highlighted the future of unsecured lending in crypto. By blending onchain reputation with offchain data, new DeFi protocols could enable large-scale unsecured credit systems. Coinbase Ventures said the opportunity is huge, pointing out that the U.S. alone has over $1.3 trillion in unsecured credit lines.

The final set of themes revolves around AI. According to Coinbase Ventures, robotic and embodied AI systems currently face major limitations due to small and fragmented datasets. They believe that DePIN networks could solve this by collecting high-quality physical interaction data at scale.

They also expect proof-of-humanity systems to grow rapidly in 2026. These tools combine biometrics, cryptographic signatures, and open standards to help verify whether content is human-made or AI-generated.

Lastly, the company believes that AI agents will make onchain building simpler for non-technical founders. These agents may be able to generate smart contracts, run audits, and monitor protocols automatically. Coinbase Ventures expects this to lower barriers for founders and speed up onchain innovation.

Overall, the nine areas listed by Coinbase Ventures provide a clear picture of where the company sees major potential growth in crypto over the next few years.

Final Thought

Coinbase Ventures is essentially revealing where the next wave of high-impact crypto projects may come from. Its focus on RWAs, advanced DeFi, prediction markets, and AI shows how quickly the industry is evolving toward more complex and efficient systems. For builders, investors, and researchers, these nine categories offer a strong roadmap for understanding where crypto innovation is heading in 2026.