CoinShares Withdraws Filing for Staked Solana ETF

Key Takeaways

- Solana ETF plans were halted after CoinShares withdrew its SEC application when the underlying deal failed to close.

- REX-Osprey and Bitwise already launched staked SOL ETFs earlier this year.

- SOL ETFs saw more than $369M in November inflows despite market-wide downturns.

- SOL price has dropped nearly 60% from its January all-time high.

- Analysts have lowered price forecasts as SOL struggles to reclaim key levels.

Filing Withdrawn After Deal Falls Through

CoinShares has withdrawn its SEC registration for a staked Solana ETF, according to a filing submitted Friday. The firm stated that the transaction supporting the structure of the proposed fund “was ultimately not effectuated,” adding that no shares were or will be sold under the abandoned registration. The withdrawal comes months after the first staked Solana ETFs entered the U.S. market.

REX-Osprey launched the first staked SOL ETF in June, followed by Bitwise in October. Bitwise’s debut was especially notable, opening with nearly $223 million in assets on its first day, roughly half the size of the REX-Osprey fund, despite its later start. ETF analyst Eric Balchunas highlighted the rapid uptake as a sign of strong institutional interest in yield-bearing Solana products.

However, SOL’s market performance has not reflected the enthusiasm shown by ETF flows. After reaching highs above $250 in September, Solana has trended downward, weighed by broader market volatility and shifting risk appetite.

Strong ETF Inflows Clash With Weak Price Momentum

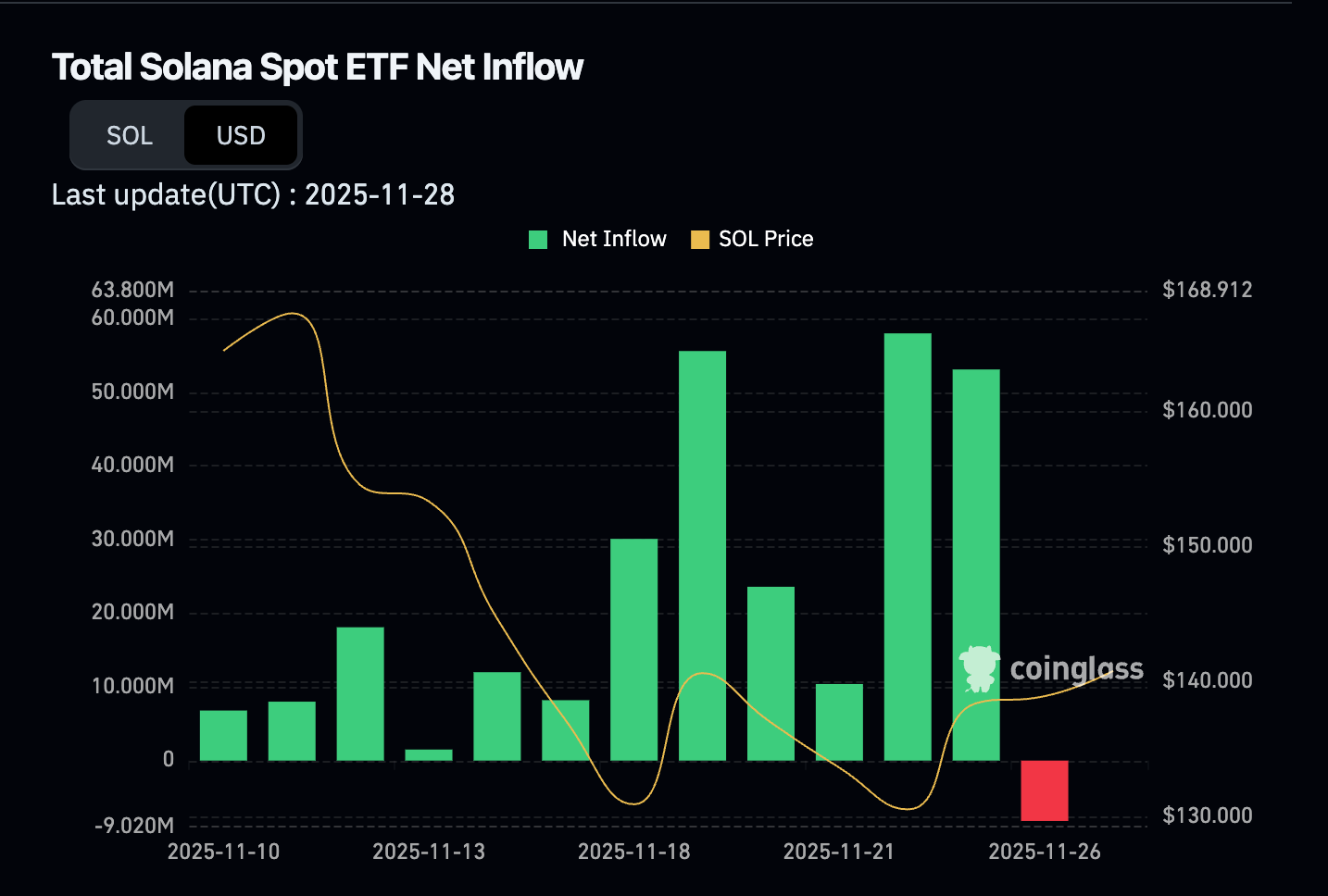

Despite its price decline, Solana has attracted some of the strongest capital inflows of any digital-asset ETF category this quarter. In November alone, SOL investment vehicles saw more than $369 million in net inflows, driven by demand for 5–7% staking yields embedded in the ETF structures.

These products continued to absorb capital even as Bitcoin and Ether ETFs experienced record outflows across October and November. Analysts initially projected that sustained inflows could help push SOL toward $400, but sentiment has cooled significantly. Revised forecasts now suggest the token may struggle to reclaim levels near $150.

SOL reached a five-month low of around $120 in November, nearly 60% below its January 2025 all-time high of roughly $295. The explosive rally in January was largely attributed to the launch of the Official Trump memecoin, which triggered a surge of activity across Solana-based memecoins.

With CoinShares stepping back from launching its own product and price momentum fading, Solana enters year-end with conflicting signals: strong ETF demand on one side and persistent market headwinds on the other.