Crypto Investment Funds See Second Week of Outflows as Altcoins Show Strength

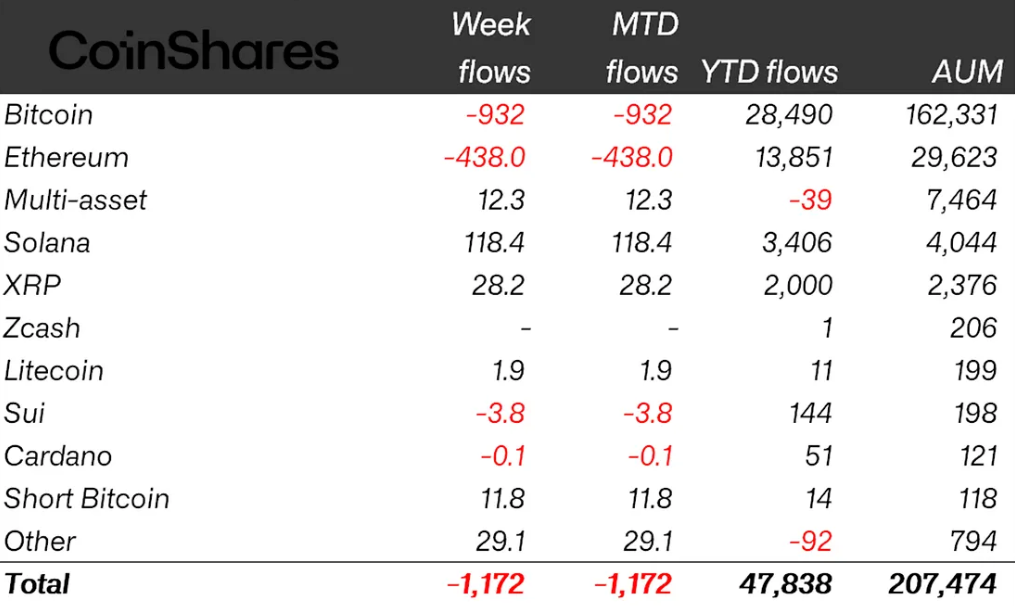

- Crypto exchange-traded products (ETPs) recorded $1.17 billion in outflows last week.

- Total crypto ETP AUM dropped to $207.5 billion, the lowest level since mid-July.

- Bitcoin and Ether ETPs led withdrawals, with $932M and $438M in outflows respectively.

- Meanwhile, Solana, XRP, Hedera, and Hyperliquid attracted inflows despite the broader market downturn.

- Market uncertainty tied to recent price volatility and expectations for U.S. interest rate policy is driving selling pressure.

Cryptocurrency investment funds continued to face heavy selling pressure last week, marking the second consecutive week of significant outflows. According to new data from CoinShares, crypto exchange-traded products saw a combined $1.17 billion withdrawn, which represents a notable increase from the $360 million in outflows recorded the week prior. The trend follows mounting market uncertainty and lingering caution among investors.

James Butterfill, head of research at CoinShares, linked the continued outflows to a broader negative trend that emerged after the sharp market drop on October 10. He also noted that uncertainty surrounding a potential U.S. interest rate cut later in the year has contributed to the cautious sentiment across digital asset markets.

Trading activity, however, remained elevated, with weekly ETP volume reaching $43 billion. A temporary uplift occurred mid-week on optimism that the U.S. government would avoid a shutdown, but as concerns resurfaced, outflows resumed swiftly by Friday.

Bitcoin products once again led the withdrawals, with $932 million exiting Bitcoin ETPs last week, only slightly less than the previous week’s figure. Ether funds also saw outflows return, with $438 million withdrawn after experiencing inflows the week prior. Short Bitcoin products recorded $11.8 million in inflows last week, reflecting increased bearish positioning.

Despite the broader drawdown, several altcoins stood out by attracting new capital. Solana investment products led all altcoins with $118 million in inflows, continuing a growing trend that has seen Solana ETPs receive $2.1 billion over the past nine weeks. XRP, Hedera, and Hyperliquid also posted inflows, signaling selective investor confidence in alternative ecosystem development even as sentiment across blue-chip cryptocurrencies remains cautious.

With the latest moves, total assets under management in crypto ETPs have fallen to $207.5 billion. This is the lowest level since mid-July and significantly below the early October peak of more than $254 billion.

Final Thought

The continued outflows highlight the fragility of market confidence, particularly around Bitcoin and Ether. However, persistent inflows into select altcoins signal evolving investor interest and diversification within the digital asset sector. The coming weeks may hinge on macroeconomic clarity and market reactions to risk sentiment.