Crypto Ownership in America 2025: 55 Million Users Reshape Market Demographics

The cryptocurrency landscape in America has undergone a dramatic transformation, shattering stereotypes about who owns digital assets. According to the National Cryptocurrency Association’s groundbreaking “2025 State of Crypto” report, one in five American adults now owns cryptocurrency, representing a seismic shift from the early days of blockchain technology.

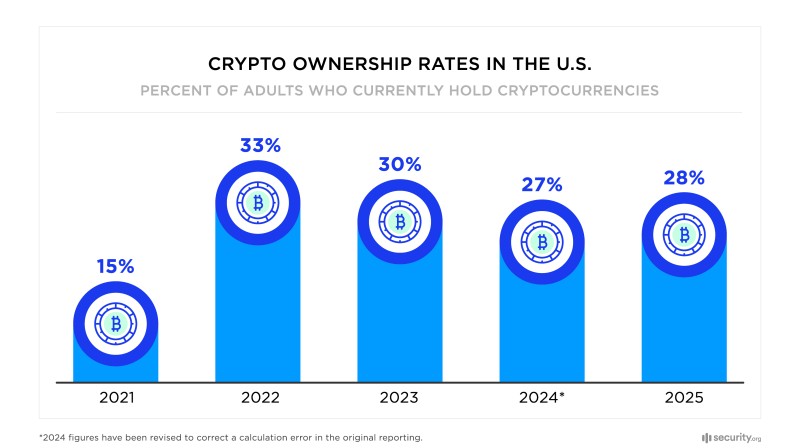

US crypto ownership rates by demographic ( Security.org )

The New Face of American Crypto Owners

Gone are the days when cryptocurrency ownership was synonymous with tech bros in Silicon Valley or Wall Street traders chasing quick profits. The latest data reveals a surprisingly diverse ecosystem of 55 million Americans who have embraced digital assets for practical, everyday purposes.

“Crypto is for everyone,” Ali Tager, vice president of communications at the NCA, emphasized during Bitcoin 2025 in Las Vegas. This statement reflects a fundamental shift in how Americans view and use cryptocurrency in 2025.

Crypto ownership by generation ( Electro IQ )

Breaking Down the Demographics

The Harris Poll’s comprehensive survey of 54,000 adults reveals striking diversity in crypto ownership:

- Gender Distribution: While 67% of holders are men, 31% are women (nearly 17 million American women)

- Age Breakdown: 67% of owners are under 45, but 9 million are over 55

- Geographic Spread: From construction workers in Oklahoma to artists in Chicago

- Income Levels: 70% of holders possess less than $10,000 in crypto

Real-World Crypto Usage Patterns

Practical crypto applications ( Chainalysis )

Everyday Financial Activities

The survey reveals that crypto has moved beyond speculation into practical financial applications:

- 39% use crypto for purchases – goods and services transactions

- 96% shop with crypto at least annually, 22% weekly

- 31% send crypto to family as remittance alternative

- 60% entered crypto primarily for investment purposes

Motivation Beyond Investment

While investment remains the primary driver, other motivations demonstrate crypto’s expanding utility:

- 50% driven by blockchain curiosity

- 27% attracted to online shopping capabilities

- 45% view crypto as financial inclusion tool

- 38% recognize technological innovation potential

Market outlook for 2025 ( Security.org )

Security Challenges and Education Needs

Despite widespread adoption, security concerns persist among American crypto owners:

- 75% worry about scams and security

- Only 3% report personal fraud experience

- 81% want to learn more about digital assets

- Focus areas: investment strategies, blockchain basics, tax implications

This disconnect between perception and reality suggests that while crypto crime exists globally (estimated at $51.3 billion in 2024), most everyday users operate in relatively safe environments.

Regulatory Sentiment and Policy Expectations

Global crypto adoption trends ( Chainalysis )

American crypto owners demonstrate nuanced views on regulation:

- 64% support government regulation

- 73% want US global crypto leadership

- 67% fear heavy-handed restrictions

- 44% see crypto enhancing financial system transparency

This balanced perspective reflects mature market thinking, where users recognize regulation’s legitimizing potential while protecting innovation.

Industry Validation and Future Outlook

The NCA findings align with broader industry research from Chainalysis, Messari, and a16zcrypto, confirming directional trends toward mainstream adoption. However, methodological differences highlight the need for continued research to refine demographic understanding.

President Trump’s second presidency and Treasury Secretary Scott Bessent’s pro-crypto stance signal favorable policy winds. With senators proposing Bitcoin Strategic Reserve Bills and general governmental support, domestic crypto growth appears positioned for acceleration.

Investor demographics by age ( Vestinda )

Implications for the Future

The transformation from niche technology to mainstream financial tool represents more than demographic expansion. It signals crypto’s evolution into infrastructure that serves diverse American communities, from cattle ranchers tracking beef provenance to single mothers building financial independence.

“We were surprised ourselves,” Tager admitted, “but it makes sense; crypto’s low barriers to entry make it accessible in places where traditional finance has failed.”

This democratization suggests that cryptocurrency’s next chapter will be written not by institutional adoption alone, but by millions of everyday Americans integrating digital assets into their financial lives.

As crypto ownership continues expanding across traditional demographic boundaries, the industry faces the challenge of building infrastructure, education, and regulatory frameworks that serve this diverse, growing community of 55 million American users.