Crypto Sentiment Slips into Fear as Traders Turn to Major Assets

The crypto market is cooling off as traders shy away from obscure altcoins, with sentiment dipping into Fear. Analysts point to a stronger focus on Bitcoin, Ether, and XRP as investors weigh the next major move.

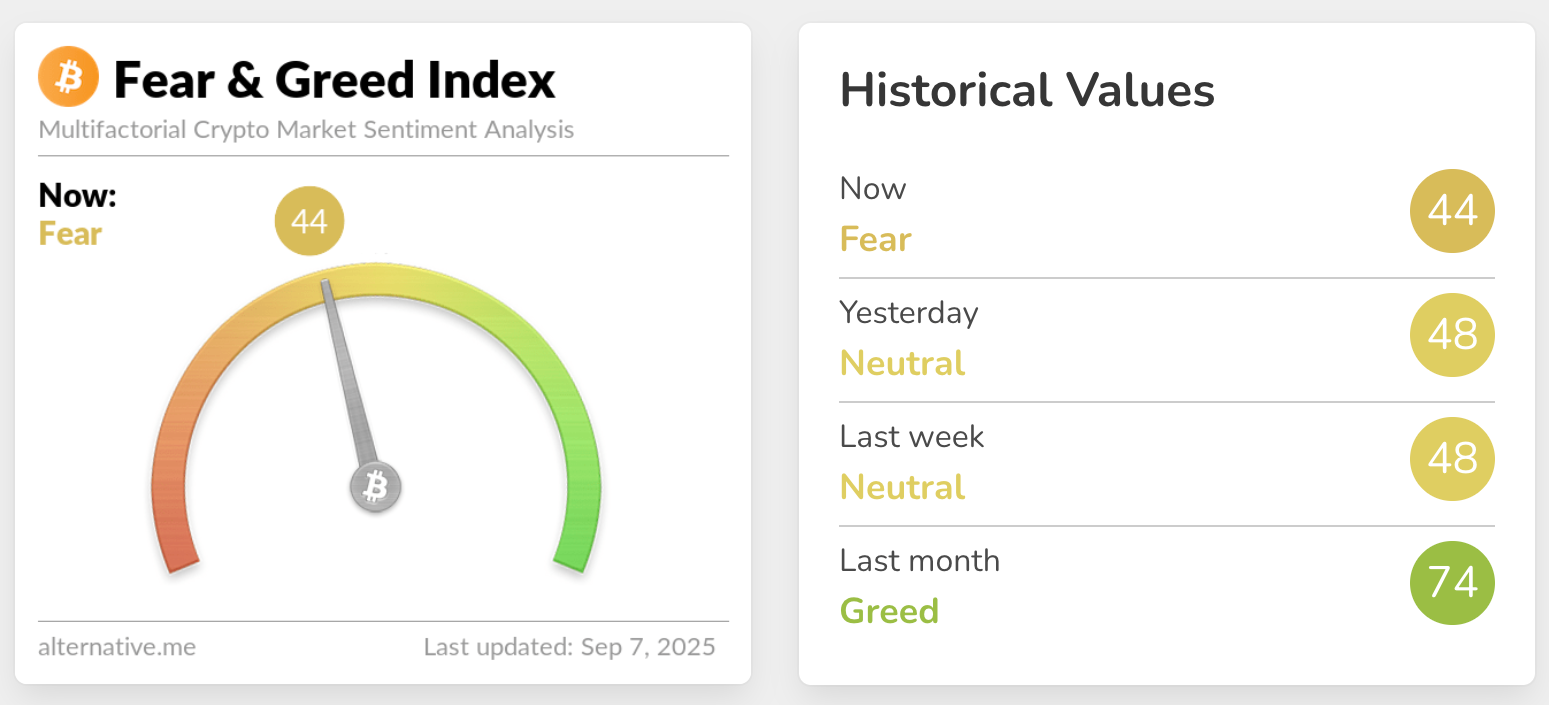

- Market sentiment has shifted into “Fear,” according to the Crypto Fear & Greed Index (score: 44).

- Traders are shifting their focus away from smaller altcoins and toward large-cap assets, such as Bitcoin, Ether, and XRP.

- Bitcoin’s price remains indecisive, fueling uncertainty about short-term market direction.

- Analysts suggest altcoins may be facing a “final shakeout” despite being seen as undervalued.

- The debate continues over whether the altcoin season will return soon or be delayed until the ETF launches.

The latest sentiment data reveals a cooling risk appetite across the crypto market. Santiment noted that traders are showing less interest in obscure altcoins and are instead debating which major asset could lead the next breakout. The focus has shifted toward Bitcoin, Ether, and XRP — a sign of risk-off behavior where investors prioritize stability over speculative plays.

Bitcoin’s price action remains uncertain. Some traders, like Daan Crypto Trades, expect a possible sweep of monthly lows, potentially triggering panic around the $100K level. Over the past month, Bitcoin has slipped by 5.38%, while Ether has managed to climb 9.44%. This divergence reflects ongoing uncertainty about which asset class will take the lead.

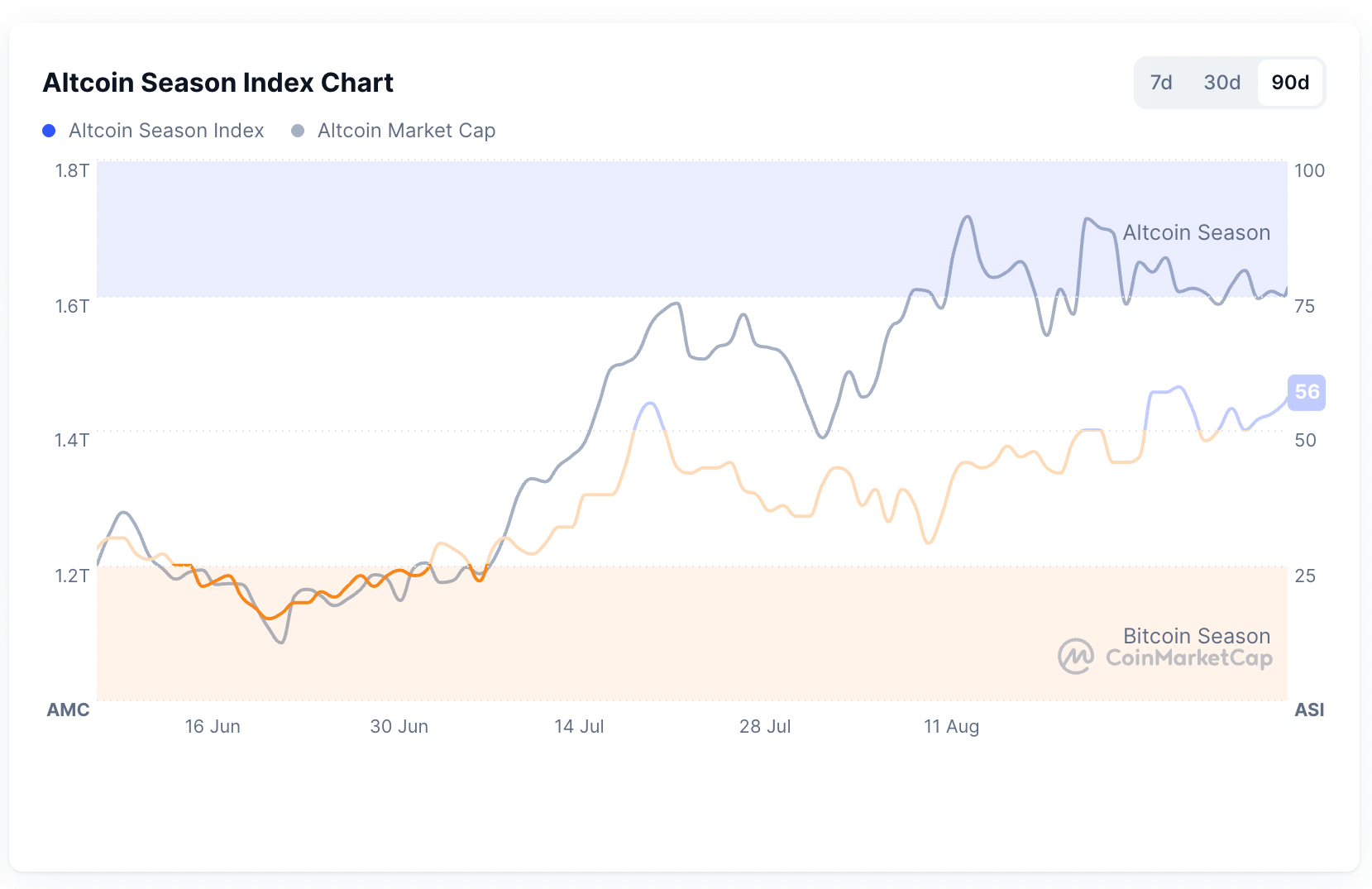

The Crypto Fear & Greed Index echoed this cautious mood, falling into “Fear” territory with a score of 44, after holding at “Neutral” for the previous two days. Meanwhile, the Altcoin Season Index from CoinMarketCap sits at 56, suggesting lingering strength in altcoins despite the pullback.

Some analysts believe this could mark the “final shakeout” for smaller tokens. Rekt Fencer sees it as a last wave of fear before recovery, while Michael van de Poppe argues altcoins are “extremely undervalued” at current levels. Others, like analyst PlanC, caution against over-relying on historical halving cycle patterns, suggesting that this market cycle may not unfold like previous ones.

Final Thought

Crypto sentiment has clearly cooled, with traders consolidating around major assets and shying away from high-risk plays. Whether this signals a temporary pause or the beginning of a deeper shakeout will depend on Bitcoin’s next decisive move — and whether altcoins can prove resilient in the weeks ahead.