Crypto Traders Eye Friday’s US Inflation Report as Market Braces for Impact

- September’s US inflation report (CPI) is delayed due to the government shutdown, now in its 24th day.

- Economists expect 3.1% annual inflation, the highest in 2025 so far.

- CPI results could influence the Federal Reserve’s upcoming rate cuts.

- A reading below 3.1% could boost Bitcoin and crypto prices.

- Despite rising inflation, the Fed is still expected to cut rates next week.

Crypto traders and analysts are closely watching the delayed US inflation report for September, set to be released this Friday, as it could trigger short-term volatility across the crypto and broader financial markets.

The Consumer Price Index (CPI) report, published by the US Bureau of Labor Statistics, was delayed by the ongoing government shutdown, now stretching into its 24th day. This CPI print will be the first major US economic data release since the shutdown began.

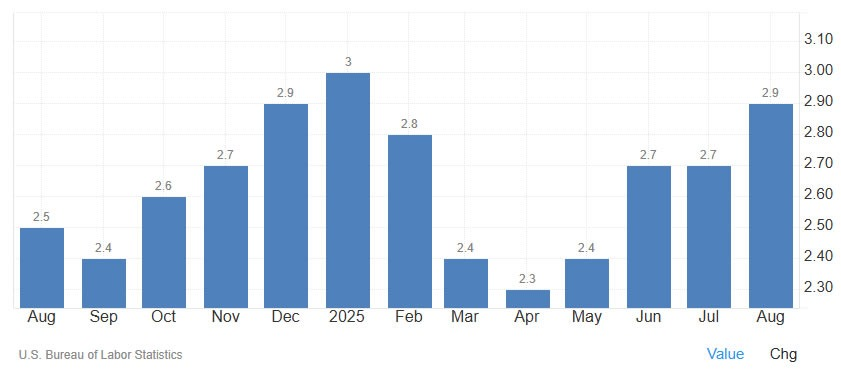

Economists predict that September inflation rose 0.4% month-over-month and 3.1% year-over-year, according to data from Trading Economics.

If confirmed, this would mark the first time in 2025 that headline CPI exceeds 3%, signaling a slight uptick in consumer prices amid a still-weak economic backdrop.

Potential Impact on Crypto and Rates

Market analysts are divided on how this CPI reading might affect crypto and rate-cut expectations.

Investor Ted Pillows noted that if CPI exceeds 3.1%, the odds of an immediate Fed rate cut could fall. However, if inflation comes in at or below 3%, it could be bullish for markets, signaling easing price pressure.

Crypto analyst Ash Crypto agreed, saying that a CPI below 3.1% would be a “perfect scenario for risk-on assets” like Bitcoin and Ethereum:

“Rate cuts will happen, and the monthly increase in CPI will likely stay around 0.1%. That could push liquidity back into risk-on assets,” he said.

Meanwhile, Matt Maley, chief market strategist at Miller Tabak, told Bloomberg that the CPI report still matters:

“The Fed says it’s focused on employment, but if tomorrow’s CPI data is far from expectations, it could still affect their thinking and move markets.”

Fed Expected to Stay on Track With Rate Cuts

Despite fears of hotter inflation, analysts at Barron’s believe that the Federal Reserve will not change course.

The labor market remains the Fed’s primary concern, and futures data from CME’s FedWatch Tool show a 98.3% probability of a rate cut next Wednesday.

Another rate cut is also expected during the December Fed meeting, though the government shutdown could complicate economic data collection and forecasts ahead of that decision.

Crypto Market Reaction

Crypto markets have remained relatively stable in the lead-up to the CPI report.

The global crypto market cap rose 1.8% over the past 24 hours, reaching $3.8 trillion, according to CoinGecko.

Bitcoin (BTC) briefly surged above $111,000 late Thursday before pulling back to around $110,500 at press time. The move reflects cautious optimism among traders ahead of Friday’s data.

Analysts suggest that a CPI reading near or below expectations could trigger short-term bullish momentum in crypto, as lower inflation supports Fed easing and improves risk sentiment.

However, a hotter-than-expected print could temporarily weigh on Bitcoin, Ethereum, and altcoins, as investors reprice expectations for rate cuts.

Either way, Friday’s inflation data is set to shape the next major move in crypto markets — marking another critical moment in the ongoing crypto-macro correlation story.