Crypto Treasuries and Blockchain Transform Science Funding

Key Takeaways:

• Blockchain and crypto treasuries are helping biomedical firms fund research, highlighted by Portage Biotech’s move into a Toncoin treasury model.

• AlphaTON is exploring real-world asset tokenization to remove financial barriers in traditional scientific funding systems.

• Ideosphere aims to fund early-stage research using prediction markets, turning scientific hypotheses into tradable ideas.

• Bio Protocol secured $6.9 million from Animoca Brands and Maelstrom to build an AI-native, blockchain-powered research platform.

• Decentralized science models are emerging as a parallel infrastructure to accelerate drug discovery and early-stage innovation.

Blockchain Opens a New Frontier for Scientific Funding

A quiet revolution is forming at the intersection of biotechnology and blockchain. Biomedical firms and decentralized-science startups are increasingly turning to crypto treasury models and tokenized funding to accelerate research pipelines that often stall for decades under traditional capital structures.

Portage Biotech is one of the most striking examples of this shift. The company pivoted in September to become a Toncoin treasury business, generating operating revenue through network staking and investments across Telegram’s expanding ecosystem. From games to mini-apps, these assets generate yield that Portage plans to redirect into cancer research, AlphaTON CEO Brittany Kaiser told Cointelegraph.

For Kaiser, this model represents more than a revenue strategy. She sees blockchain as a mechanism to dismantle longstanding structural barriers in scientific development. The team is actively researching real-world asset tokenization to create alternative pathways for financing early-stage discoveries. Case studies under review include tokenizing intellectual property, equity in research-producing companies, and even tokenizing future profit streams tied to breakthrough therapies.

Kaiser and strategic advisor Anthony Scaramucci argue that combining a functioning biomedical vertical with a digital asset treasury is what makes the model fundamentally distinct. While many crypto treasury firms simply take over dormant shells, AlphaTON maintains a fully operational scientific arm with assets and research still intact.

As Scaramucci put it, retaining this operating business transforms the company into a hybrid structure: part blockchain-native capital engine, part biotech innovator.

Prediction Markets Push the Next Phase of Decentralized Science

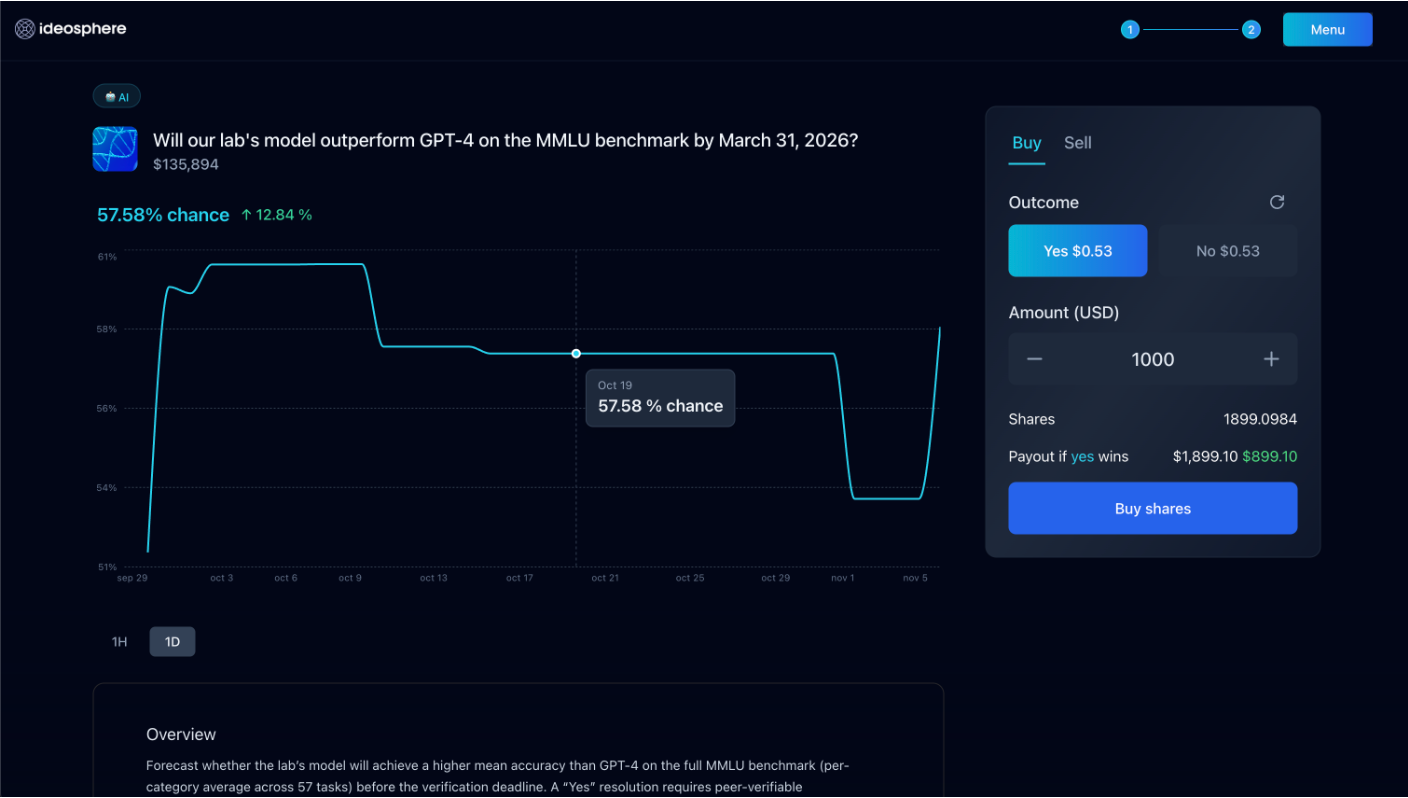

While treasury-driven science funding gains momentum, a different approach is emerging from Ideosphere, a decentralized science startup aiming to route capital through prediction markets.

Prediction markets aggregate crowd intelligence by letting participants place speculative trades on outcomes. Ideosphere believes this mechanism can be repurposed to accelerate scientific innovation.

“If you can create prediction markets around early-stage research, you can make those markets a marketplace of ideas that will actually bring the money in,” Ideosphere co-founder and head of technology Rei Jarram told Cointelegraph. Researchers would publish hypotheses, traders would speculate on their viability, and the trading spread would flow directly back to the scientists.

This transforms research from a slow, grant-dependent process into a dynamic, market-driven competition of ideas. Instead of institutional committees determining which proposals receive funding, financial incentives and open-market participation determine which hypotheses gain traction.

If successful, Ideosphere’s model could radically expand the funding options available to small labs, independent researchers, and interdisciplinary teams that struggle to navigate traditional grant systems.

AI-Native Research Platforms Attract Venture-Backed Support

Investor interest in decentralized science continues to strengthen. In September, Bio Protocol, a platform combining blockchain, artificial intelligence, and community-powered research, secured $6.9 million in funding from Animoca Brands and the Maelstrom fund.

Bio Protocol aims to become an “AI-native research market,” Maelstrom founder Arthur Hayes said, drawing parallels to how blockchain restructured financial coordination and how AI restructured data processing.

The platform integrates community governance, token-based incentives, and AI-driven discovery tools to streamline drug development. By merging decentralized participation with machine learning, Bio Protocol hopes to eliminate bottlenecks in the early phases of pharmaceutical innovation, an area historically plagued by cost, complexity, and slow feedback loops.

Hayes argues that this next-generation model could reshape not just how data is analyzed, but how research agendas are set and funded. If adopted widely, decentralized science networks could evolve into open, global research engines where financial incentives and community intelligence work alongside AI to accelerate discovery.

A New Funding Infrastructure for Scientific Breakthroughs

From crypto treasuries that reinvest staking rewards into cancer research, to prediction markets that turn hypotheses into tradable instruments, to AI-native research platforms backed by major Web3 investors, the decentralized science movement is rapidly evolving into a viable parallel infrastructure for global research.

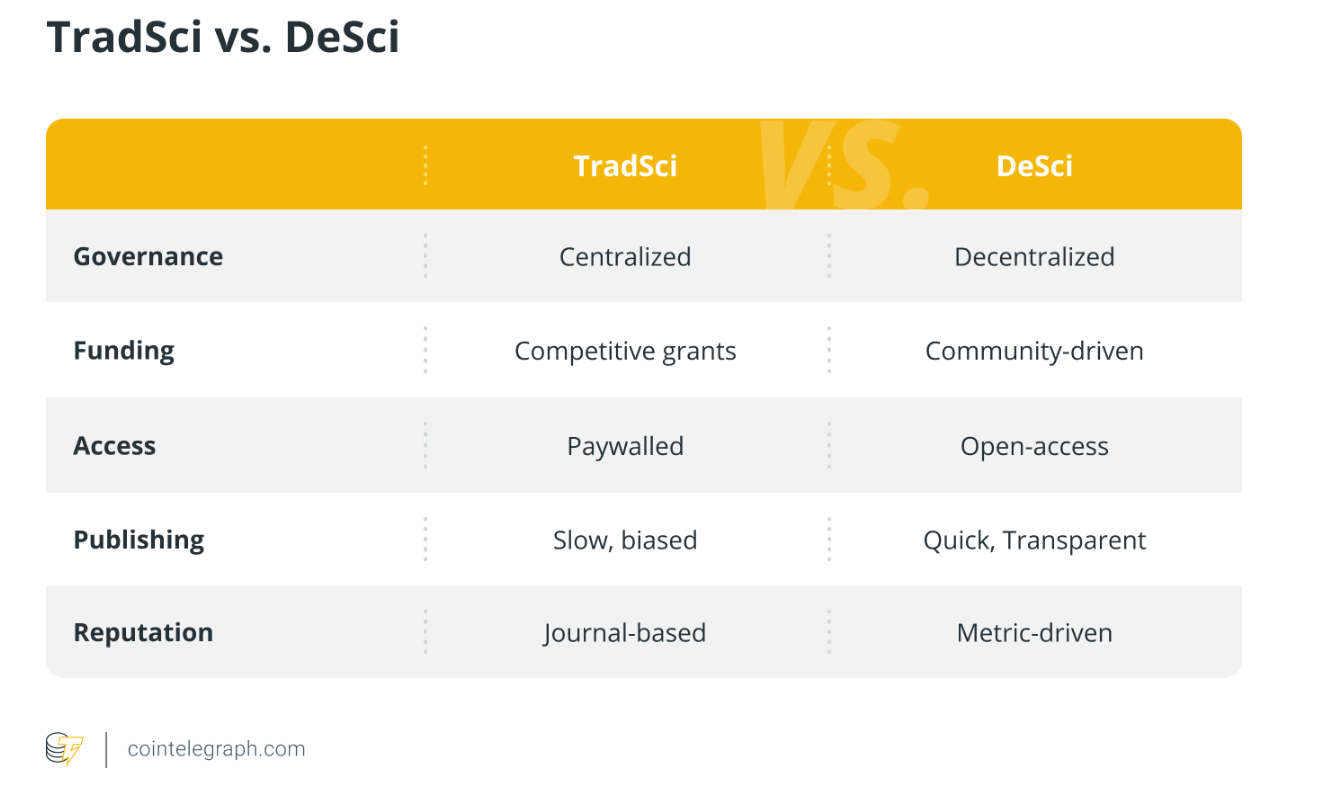

This emerging model shifts power from slow-moving institutions toward transparent, market-driven, and community-supported frameworks. For startups, early-stage labs, and researchers working outside legacy systems, blockchain-enabled science may become not just an alternative but a superior path to funding and discovery.