Crypto Whales Rise Fall: How Two Millionaires Lost Everything

Picture this: you’re sitting in a quiet café, and I begin to tell you two extraordinary stories from the world of Crypto Whales Rise Fall. Every cent, gone. No myth, no fiction, just the raw reality of the cryptocurrency world, a universe that glitters with promise yet hides an unsettling depth few truly understand.

These stories aren’t about money alone; they’re about the human mind: how triumph can quietly turn into ruin, how brilliance can blur into recklessness, and how even the most capable people can lose themselves in the very success they create. This article will take you inside their rise and collapse, uncovering the psychological traps, the hidden mechanisms of risk, and the lessons every investor should remember before stepping into the same storm.

Chapter One: The Man Who Never Stopped Chasing Waves

Setting the Stage: The Crypto World as a Giant Casino

Before we meet our first character, imagine the world he would one day dive into. The cryptocurrency market is like a casino that never sleeps. It’s open all day, every day. Every bet is visible to everyone, and the stakes can multiply beyond reason.

If you have one thousand dollars, you can trade as if you have fifty thousand. If the market moves in your favor, you win big. If it moves against you, you don’t just lose what you have: you owe much more. That’s the weapon called leverage, the force that creates millionaires overnight and destroys them just as fast.

Our First Protagonist: Huang Licheng, The Man of Trends

Next we will meet Huang Licheng, or as many call him, Brother Machi. Long before he touched crypto, Huang was chasing waves in an entirely different ocean. The year was 1991. Hip-hop was booming in the United States, but was almost unknown in Asia. Huang, a young Taiwanese-American living in California, saw what others didn’t. He believed hip-hop would spread to Taiwan and ignite a cultural movement.

He teamed up with his brother and cousin to form LA Boyz, one of the first groups to bring hip-hop to the Taiwanese audience. They weren’t the best singers, but they were pioneers. They got something new, something bold. From that early success, Huang learned his first rule of the game: timing is everything.

Think of it like opening a coffee shop. If you open the tenth café in a busy city block, competition will eat you alive. But if you open the first café in a small, growing town, you win before the race begins. Huang understood that truth earlier than most.

When Taiwan’s music scene later shifted toward soft ballads, he didn’t fight the current. He stepped aside and moved on. That became his second lesson: success is not only about knowing when to act, but also when to walk away.

Evolution of an Entrepreneur

In the 2000s, Huang reinvented himself once more, this time as a tech entrepreneur. He founded 17 Media and built a live streaming app called 17 Live. To grasp how visionary this was, remember the world back then: YouTube was still new, Facebook was for college students, and TikTok didn’t exist.

Huang understood the coming shift. In the digital age, attention would become the most valuable currency. People wouldn’t pay for things, they would pay for connection, for being seen, for the thrill of being noticed.

17 Live became a phenomenon. It grew fast, attracted top investors, and was valued at over a billion dollars. The company is prepared to go public. Then, in 2018, the IPO collapsed.

For Huang, it was the first hard fall. The lesson was brutal but clear: having a brilliant idea means nothing if you can’t execute it. Success, he realized, is never guaranteed, no matter how sharp your timing or how strong your instincts.

Chapter Two: Stepping Into the Crypto World

The First Adventure: Mithril

In 2017, the world was burning with crypto fever. Bitcoin dominated headlines, people were getting rich overnight, and every ambitious founder wanted to join the race. Huang Licheng refused to stay out. He saw the momentum and stepped right in.

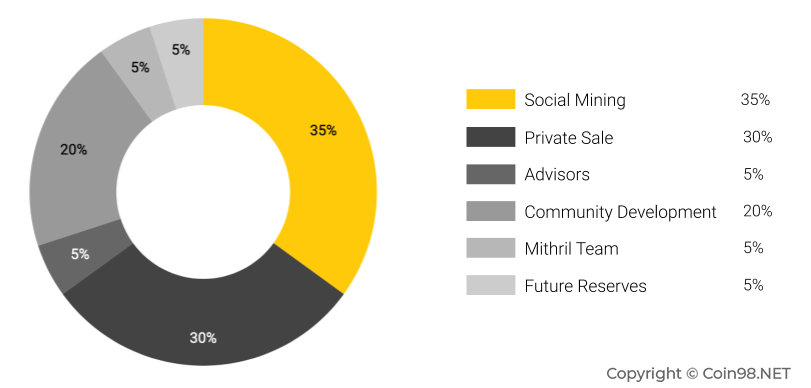

His new project was called Mithril, or MITH. The concept was bold: social mining. Users could earn tokens by posting photos, sharing videos, or creating any kind of online content. Every like, every comment, every share could become money. It sounded like the next evolution of social media, a system where creativity paid instantly.

Investors rushed in. Within weeks, Huang raised more than 51 million dollars, the kind of funding used for a Hollywood blockbuster. He once again proved his power in shaping narratives. Huang didn’t just build projects; he built belief.

Then everything changed. Only three months after MITH launched, his team sold almost 90% of the total token supply. For investors, it felt like betrayal. The price collapsed by 99%, wiping out nearly everyone who trusted the vision of social mining.

For Huang, it was the first harsh lesson of the crypto world. Innovation and exploitation can look identical, and the difference lies only in timing and perception.

Lessons from DeFi: Cream Finance

Three years later, in 2020, a new movement took over the market. It was called DeFi Summer, the golden era of decentralized finance. This time, the dream was bigger: rebuilding the banking system without banks. Huang saw the opening and founded Cream Finance.

Cream worked like a digital bank. Users could deposit crypto to earn interest or borrow funds by locking their assets as collateral. No bankers, no offices, just code running everything automatically.

The project grew at breakneck speed. Within months, Cream Finance held over 1 billion dollars in total deposits, similar to a mid-sized financial institution. But success came faster than security. The team was focused on innovation, not protection, and hackers quickly noticed.

In 2021, Cream Finance was hacked five times, losing a total of 200 million dollars. Each time, Huang’s team repaired the code and carried on, but the damage was already done. Trust vanished, and in crypto, trust is everything. In the end, Huang handed control of the project to Andre Cronje, a respected developer in the DeFi space.

It was another bitter lesson. In crypto, moving fast can make you rich, but it can also destroy everything you’ve built overnight.

The NFT Era: From Pioneer to Victim

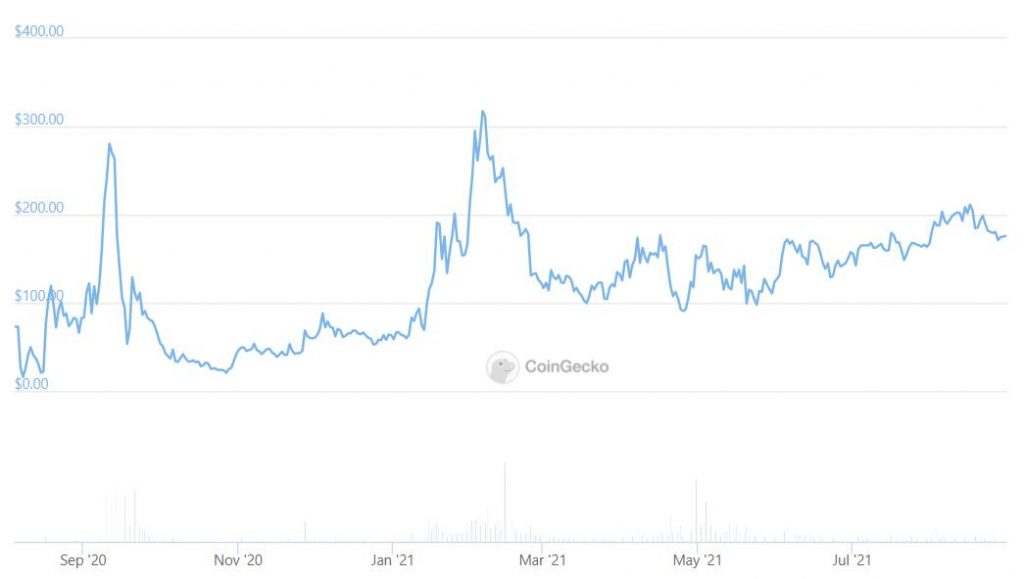

By 2021, a new craze had taken over the industry. The world was talking about NFTs, unique digital assets that could represent ownership of art, music, or anything online. Once again, Huang moved early.

He began collecting top-tier NFTs such as Bored Ape Yacht Club when prices were only 0.08 ETH, about 200 dollars. Within a year, their value soared above 100 ETH, more than 200,000 dollars. It was a stunning success. Huang became one of the biggest NFT whales, holding hundreds of pieces worth millions.

Then came the turn. The NFT marketplace Blur introduced a points system that rewarded heavy trading. The more you traded, the more points you earned, and those points could later convert into valuable tokens. Huang jumped in aggressively, trading hundreds of NFTs every day to maximize rewards.

For a while, the strategy worked. But when the market cooled, prices began to fall fast. Liquidity dried up, and Huang’s vast NFT holdings turned into a trap. To cover losses, he had to sell more than 1,000 NFTs at heavy discounts. The total loss reached at least 5,000 ETH, worth millions of dollars at the time.

Once again, Huang found himself caught in the same cycle. Every triumph brought a higher wave, and every fall hit harder than the last. You can see the man who once built his fortune by spotting trends had become trapped inside the very waves he chased.

Chapter Three: James Wayne – The Digital Trading Generation

Now comes the second figure in our story, James Wayne. If Huang Licheng represented the pioneers who carried entrepreneurial ambition into crypto, then James stood for something new: the digital native trader, born and raised inside the internet.

The Difference in Mindset

James grew up in an age where success stories spread faster than truth. He watched teenagers turn small accounts into fortunes and saw headlines about traders becoming millionaires in months. To him, trading wasn’t a dangerous game or a profession built on patience. It was freedom. It was proof that anyone with skill, speed, and confidence could escape the ordinary.

The difference between James and Huang was in how they saw risk. Huang, molded by years of business and failure, knew that every venture moves in cycles. There are times to win, times to lose, and the real goal is to survive long enough to play again.

James thought differently. For him, a loss wasn’t part of the process. It was proof of weakness. He believed that anyone truly talented would never fall behind, never doubt, and never stop. In his mind, discipline was secondary to momentum.

Hyperliquid: The Stage of Tragedy

James made his name on a platform called Hyperliquid. Imagine a financial arena that never closes, where trades happen every second, where you can use up to 50x leverage, and where every move is public. Hyperliquid turned trading into a spectacle. It wasn’t just about making money; it was about putting on a show.

Here, traders weren’t anonymous investors. They were performers, building fame and influence through every bold position and every dramatic win.

James rose fast. His record was perfect: trade after trade, profit after profit. For months, his win rate stayed at 100%. In a world obsessed with instant results, that made him a legend. He turned a few thousand dollars into more than 43 million and became an icon for young traders who dreamed of doing the same.

But the higher the pedestal, the greater the pressure. When thousands of people watch your every move, losing feels like humiliation. Admitting defeat feels impossible. Every trade becomes a performance, and every hesitation looks like weakness.

Chapter Four: The Great Disaster on Hyperliquid

Huang Licheng: From $45 Million to Zero in 47 Days

By late 2024, Huang Licheng stepped into Hyperliquid with confidence built on decades of experience. His reputation as a trend chaser followed him, and soon he became one of the biggest whales on the platform. At first, everything seemed effortless. His trades on the HYPE token were sharp, timed perfectly, and his unrealized profit in June surpassed 6.5 million dollars. Three months later, by September, it had soared to nearly 45 million dollars.

To put this in perspective, 45 million dollars equals the transfer budget of a top European football club for an entire season. Huang stood at the summit of his career, admired by traders who saw him as proof that mastery could defy risk.

Then the tide turned. At the end of September, the crypto market was hit by extreme volatility. Prices of ETH, HYPE, and other major tokens began to plunge. Within days, Huang’s 45 million profit started to vanish. What happened next exposed the difference between a professional trader and a gambler.

A disciplined trader would have taken the loss early, accepted reality, and waited for the next opportunity. Huang, however, couldn’t let go. Each time the market moved against him, he added more margin to keep his position alive. When prices continued to fall, he opened new trades to win back what was lost. The deeper he went, the harder it became to stop.

This pattern repeated more than 10 times through October. Each trade carried the same hope and ended in the same pain. The desire to recover overwhelmed reason. The more he fought, the more the market punished him. By early November, the damage was irreversible.

On November 3, his final position using 25x leverage was completely liquidated, erasing 15 million dollars in one blow. His account balance dropped to just 16,771 dollars. Still unable to quit, Huang used the remaining funds to open a new 100 ETH position with the same leverage. Twenty-four hours later, it was gone. His account showed only 1,718 dollars.

47 days earlier, he had been worth 45 million. Now, he had almost nothing.

The fall wasn’t caused by a lack of knowledge or skill. It came from something deeper: the illusion of control. Success had made him believe he could outlast the storm. Instead, he became its victim.

James Wayne: The Endless Cycle of Addiction

While Huang was losing everything, James Wayne was facing his own storm. His account once reached a peak of 43 million dollars and later plunged into a loss of 30 million. By the end, only about 570,000 dollars remained.

Numbers alone could not capture what unfolded within him. The true collapse began in his thoughts. Instead of retreating to rebuild, James transformed his downfall into a performance. He became a trading influencer, using commissions and sponsorships as fuel for his next series of trades. Every setback felt temporary, every loss seemed like a prelude to another comeback.

The pattern soon revealed itself. He kept raising the stakes to chase the same thrill. Every trade grew larger, faster, and riskier than the last. When he stepped away from the screen, unease followed, urging him back to the market. Charts, graphs, and the endless movement filled his days with a sense of purpose no ordinary life could match.

Trading evolved into something deeper than work. It became his source of excitement, his center of gravity, his way to exist. Each decision, each fluctuation, each flash of green or red on the screen bound him tighter to the rhythm of the market.

By early 2025, both Huang and James reached the same ending. One was a seasoned entrepreneur who had spent years mastering timing, the other a digital-era prodigy who thrived on speed. Yet their paths converged in the same truth: success without control turns into obsession, and the chase for risk becomes the only way to feel alive.

Chapter Five: Psychological Analysis – Why Couldn’t They Stop?

The Neurochemistry of High-Risk Trading

To understand why both Huang and James kept trading, we need to look inside the mind. High-risk trading triggers a powerful reaction in the brain. Every bold position triggers a dopamine rush in the brain. The strongest surge comes just before the outcome, when uncertainty feels most alive. Heartbeats quicken, focus narrows, and the wait becomes the reward.

Dopamine works through expectation. The strongest sensation appears before the outcome, during the waiting period when possibility feels most alive. The heartbeat quickens, attention sharpens, and every second feels charged with potential.

Consider the act of scratching a lottery ticket. The most thrilling instant arrives as the final numbers are revealed, before the result becomes clear. That fleeting anticipation creates the impulse to try again.

Huang and James were driven by the same chemistry. The tension before each market move kept their minds engaged and alert. Every trade, win or lose, carried the same emotional intensity. The process itself became rewarding, and the anticipation replaced the need for rest or reflection.

Sunk Cost Fallacy in Action

Another force kept them locked in the cycle. Once time, energy, and reputation are deeply invested, turning away feels unbearable. The human mind values what has already been given more than what might be gained, and this bias often leads people further into loss.

Imagine paying 10 dollars for a movie. After 30 minutes, the story drags and interest fades. Yet most people remain until the end because leaving feels like surrender. Continuing allows them to believe the choice still holds value.

Huang faced the same pattern on a far greater scale. Years of experience, countless hours of study, and enormous capital built his confidence as a trader. Every new position represented proof of that identity. Exiting would erase the meaning of everything he had built. Each trade, therefore, became an effort to preserve his image of mastery, a belief that the next turn of the market could redeem the past.

Social Pressure and Performance Anxiety

Both Huang and James operated within the glare of public attention. Every position appeared on-screen, followed by thousands of traders who watched, praised, and criticized. The market transformed from a private pursuit into a public contest.

Such visibility reshapes behavior. Under observation, decisions grow more emotional, and pride becomes a driving force. The wish to appear strong replaces the instinct to act carefully. Studies in behavioral psychology show that performance pressure encourages greater risk-taking, as individuals attempt to meet the expectations of an audience.

Picture a poker player sitting alone. Folding a weak hand feels natural and strategic. Now imagine the same player streamed live to 1,000 viewers. Each decision carries judgment. Folding now seems like weakness, and the temptation to push forward grows stronger.

This same tension surrounded Huang and James. Each trade became a test of courage before their audience. Success brought admiration, while loss invited ridicule. The weight of those eyes shaped their judgment and tied their self-worth to the next result.

Trading ceased to function as analysis or calculation. It evolved into performance and validation. Every move became proof of identity, every risk an act of defiance. The market no longer served as a tool for profit; it became the stage where both men measured their worth against the gaze of the crowd.

Chapter Six: Expensive Lessons

Every rise carries a cost, and every victory hides its price. The journeys of Huang and James reveal more than fortune gained or lost. They expose how ambition, confidence, and risk intertwine when the chase for wealth becomes a test of human endurance. Each turning point in their story holds a lesson shaped by experience, measured in time, and paid for with millions.

Lesson 1: Leverage is a Double-Edged Sword

The first lesson centers on leverage, a force capable of building wealth and wiping it away with the same intensity. Warren Buffett once said, “Leverage can make you rich, but it can also make you broke.” The idea stays simple yet merciless, and nowhere does it strike faster than in the world of crypto.

Imagine buying a house worth 200,000 dollars. You borrow 180,000 from the bank and invest 20,000 of your own. When the price rises by 10% to 220,000, your profit doubles from 20,000 to 40,000, a 100% return. When the price falls by 10% to 180,000, the entire 20,000 vanishes while the debt remains unchanged. The same mechanism that drives opportunity also carries destruction.

Huang traded using 25x leverage. Under those conditions, a move of 4% in the wrong direction clears the account completely. Crypto markets move in seconds, creating a level of volatility far beyond traditional finance. Seasoned traders often stay within 3x to 5x leverage, preferring precision to excitement.

Leverage rewards control and exposes arrogance. It amplifies both judgment and mistakes. Over time, endurance belongs to those who act with patience and restraint.

Lesson 2: Success Pattern Recognition Can Be Misleading

Repeated victories can create a dangerous belief in control. Huang’s achievements across industries built the image of a man who always chose the right moment. James’s flawless trading record strengthened his conviction in a personal formula for success. Confidence grew from repetition until both began to see predictability where chance played the larger role.

The mind naturally seeks order. When success arrives again and again, it feels like evidence of mastery. Yet many outcomes depend more on timing, momentum, and circumstance than on skill. Markets reward precision for a while, then shift without warning.

Imagine flipping a coin and landing on heads ten times in a row. The sequence feels extraordinary, yet the odds remain the same each time. What looks like consistency may simply be probability at work.

True awareness begins with perspective. Each victory calls for reflection, each gain for renewed caution. Knowledge fades quickly in environments that change every day, and the past provides little protection when the next wave arrives.

Lesson 3: Diversification Isn’t Just About Assets

The third lesson reaches beyond money or portfolio balance. Both Huang and James devoted nearly all their energy to trading, placing every goal, every plan, and every measure of success inside a single arena. True diversification extends far wider than holding multiple coins or assets. It involves building different sources of growth, different timelines for reward, and different levels of risk.

Huang, after years of success in business, directed all focus toward active trading and lost the stability that came from long-term ventures. James relied on trading as both income and identity, allowing market movements to shape his confidence and self-worth.

Resilient wealth comes from variety. It flows from several channels: some fast, some slow, some safe, some daring. Balance protects perspective, while diversity builds endurance. No single pursuit, however rewarding, should hold complete power over one’s life or fortune.

Conclusion: Sisyphus and The Eternal Return

The original article compared these traders to Sisyphus, a figure from Greek mythology doomed to roll a heavy stone up a mountain again and again, only to see it fall each time. The image feels powerful because it reflects the nature of addiction itself.

Addiction continues through repetition. People stay trapped in it not for the result, but for the sensation that comes before the result. Huang and James were no longer chasing wealth. They were chasing the thrill, the rush that came from the possibility of winning.

The crypto market moves in the same rhythm. Each cycle introduces a new group of traders who rise with confidence, convinced they have mastered the game. For a brief moment, they shine. Then the market shifts, and the same pattern returns under new names.

This endless repetition reveals a larger truth. The story of each trader matters less than the system that keeps producing them. The structure of the market rewards risk, celebrates success, and tempts those who believe they can escape its pull.

After losing everything, Huang said a single line that captured the feeling perfectly: “It was fun while it lasted.” Behind those words lies the essence of the crypto world. The real addiction comes not from money but from the sense of being alive while risking everything.

That emotion, sharp and consuming, becomes the most dangerous prize of all. Every market cycle creates both triumph and tragedy. In the end, each person must decide which side to stand on, and what price they are willing to pay for the experience.