CZ Denies Financial Times Report on YZi Labs Seeking Outside Investors

Binance founder Changpeng “CZ” Zhao has shot down claims that his $10B investment fund YZi Labs is courting external investors or U.S. regulators, calling a recent Financial Times report “completely false”.

- FT claimed the U.S. SEC requested a private demo of YZi’s portfolio, signaling friendlier crypto oversight.

- FT alleged YZi accepted about $300M in outside money in 2022 but later returned part of it.

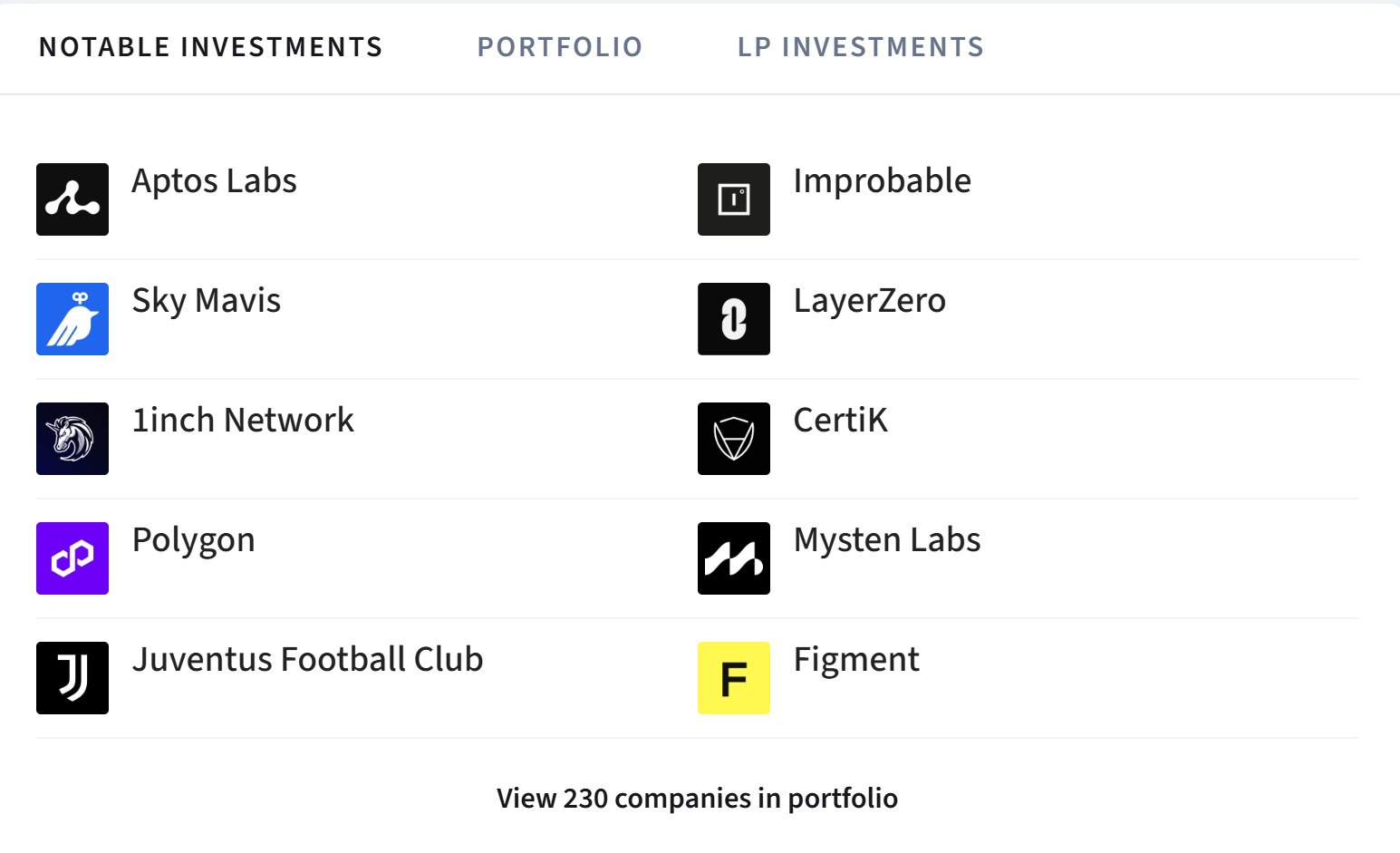

- YZi Labs backs over 230 crypto & Web3 firms, including Aptos Labs, Polygon, 1inch, Sky Mavis, LayerZero, Mysten Labs, and CertiK.

- CZ resigned from Binance in 2024 after pleading guilty to AML violations, served a 4-month sentence, and is now seeking a pardon from U.S. President Trump.

Crypto billionaire Changpeng Zhao (CZ) publicly refuted a Financial Times report claiming his $10 billion investment arm, YZi Labs, is preparing to raise external capital. In a Tuesday social post, CZ called the story “completely false,” stressing that YZi has not pitched investors, crafted a fundraising deck, or arranged any demo with regulators.

Earlier the same day, the FT reported that YZi Labs—an investment firm managing CZ’s personal wealth and capital from early Binance insiders—was considering opening to outside investors and had recently drawn interest from the U.S. Securities and Exchange Commission (SEC). The report even alleged that YZi once accepted about $300 million in external funding in 2022 but later returned a portion due to the fund’s massive capital base.

The FT cited YZi Labs head Ella Zhang, who reportedly said, “There’s always a lot of external investors interested… We will eventually consider turning it into an external-facing fund. We just think it’s not there yet.” The article also claimed the SEC requested a private demo of YZi-backed companies after missing the fund’s New York Stock Exchange demo day, a move portrayed as evidence of a more crypto-friendly regulatory climate under the current U.S. administration.

YZi Labs is a heavyweight in the crypto investment space, with a portfolio of over 230 companies spanning infrastructure, security, and Web3 innovation. Its notable investments include Aptos Labs, Polygon, 1inch Network, Sky Mavis, LayerZero, Mysten Labs, and CertiK, according to Dealroom data.

Despite stepping down as Binance CEO in 2024 after pleading guilty to failing to implement proper Anti-Money Laundering (AML) controls, CZ remains Binance’s largest shareholder. He served a four-month prison sentence and is currently seeking a presidential pardon from Donald Trump.

While the FT’s report sparked speculation of an upcoming capital raise, CZ’s swift denial signals that YZi Labs remains a closed fund—for now—focused on deploying its existing multibillion-dollar war chest rather than courting outside money.

Final Thought

With CZ labeling the FT report “false,” YZi Labs appears committed to operating as a private fund, leaving investors watching for any future sign of a pivot toward external capital.