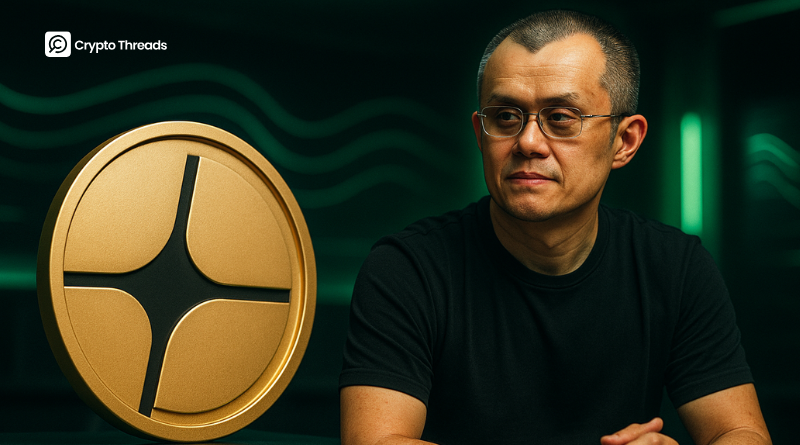

CZ’s $2.5M Buy Sends Aster Token Soaring 30%

Key Takeaways

• CZ’s $2.5M personal investment in Aster sparked a 30% price surge and renewed market interest.

• Trading volume surged from $224 million to over $2 billion in 24 hours.

• Whales are already shorting Aster, betting the rally won’t last.

• CZ’s family office, YZi Labs, previously backed Aster’s predecessor, Astherus.

CZ’s Post Sparks Aster Frenzy

The price of Aster (ASTER), the native token of the decentralized exchange protocol, surged more than 30% on Sunday after Binance co-founder Changpeng “CZ” Zhao revealed his personal stake in the project.

CZ shared a screenshot of his wallet on X, showing he had purchased over 2 million ASTER tokens, worth around $2.5 million at the time. “I am not a trader. I buy and hold,” he wrote, emphasizing that the purchase was made with his own funds through Binance.

The post immediately ignited a wave of buying activity, sending Aster’s price from $0.91 to $1.26, according to CoinGecko data. It later stabilized around $1.22.

This isn’t the first time the crypto market has reacted strongly to a high-profile endorsement. Just last week, Zcash (ZEC) spiked nearly 30% after Arthur Hayes, the co-founder of BitMEX, predicted it could one day hit $10,000.

Traders Follow CZ’s Move

Rare public disclosure had a domino effect. According to DefiLlama, Aster’s trading volume exploded from $224 million to more than $2 billion within a day, while its market cap climbed from $1.8 billion to $2.5 billion.

Crypto traders on X quickly jumped on the hype. One trader known as “Gold” announced opening a position in Aster, calling it a “no-brainer” move: “CZ, the most influential figure in crypto, just bought ASTER with personal funds. That’s it. Don’t overthink it.”

Later, CZ joked about the rally, saying he “was hoping to buy more at lower prices” and noted he doesn’t invest often, the last time being his BNB purchase eight years ago, which he still holds.

Whales Start Shorting the Hype

While retail traders rushed to follow CZ, some large players took the opposite bet. Blockchain analytics platform Lookonchain reported that two whales opened significant short positions against Aster following the spike.

One whale built a short worth $52.8 million, equal to 42.97 million ASTER tokens, with a liquidation price of $2. Another trader bet $19.1 million against the token with liquidation at $2.1.

These moves suggest skepticism about the sustainability of the rally and could set the stage for heightened volatility in the coming days.

CZ’s Connection to Aster Runs Deeper

Though CZ described his purchase as a personal investment, his ties to the project go back further. In September, he publicly congratulated Aster’s developers on X, encouraging them to “keep building.”

Aster emerged in late 2024 from a merger between Astherus and APX Finance, a decentralized perpetual protocol. CZ’s family office, YZi Labs, formerly known as Binance Labs, had previously invested in Astherus.

A spokesperson from BNB Chain later confirmed that both BNB Chain and YZi Labs supported Aster but declined to specify whether CZ had any direct involvement.

Outlook

The endorsement has undoubtedly injected new momentum into Aster’s ecosystem, but it’s also fueled speculation and short-term volatility. While some see this as a long-term validation from one of crypto’s most influential figures, others warn the market may cool quickly once the initial hype fades.

For now, Aster’s fate seems tightly linked to CZ’s influence and to whether retail enthusiasm can outweigh the whales betting against it.