Daily Crypto Liquidations Triple as Leverage Overheats, Says Glassnode

- Daily crypto liquidations nearly tripled compared with the previous cycle.

- Futures markets saw one of the sharpest deleveraging events in Bitcoin’s history on Oct. 10.

- Open interest hit a record $67.9B, with perpetual futures dominating activity.

- Spot volume also doubled, with ETFs shifting price discovery back to the cash market.

- Bitcoin now processes more settlement volume than Visa and Mastercard.

- Institutional players hold 6.7 million BTC, showing a major market shift.

The latest report from Glassnode and Fasanara shows that crypto markets are now operating with far higher leverage than in previous cycles. Daily liquidations have almost tripled, reflecting how much larger and more active the derivatives market has become.

During the last cycle, average daily liquidations totaled around $28 million in long positions and $15 million in short positions. In the current cycle, these numbers have climbed sharply to $68 million in longs and $45 million in shorts. This shows that traders are taking on more leverage, and markets are becoming more sensitive to quick price movements.

A clear example appeared on Oct. 10, the event that researchers described as “Early Black Friday.” Bitcoin dropped from $121,000 to $102,000, triggering more than $640 million per hour in long liquidations. Open interest fell by 22% in less than 12 hours, dropping from $49.5 billion to $38.8 billion. Glassnode noted that this was one of Bitcoin’s strongest deleveraging events ever recorded.

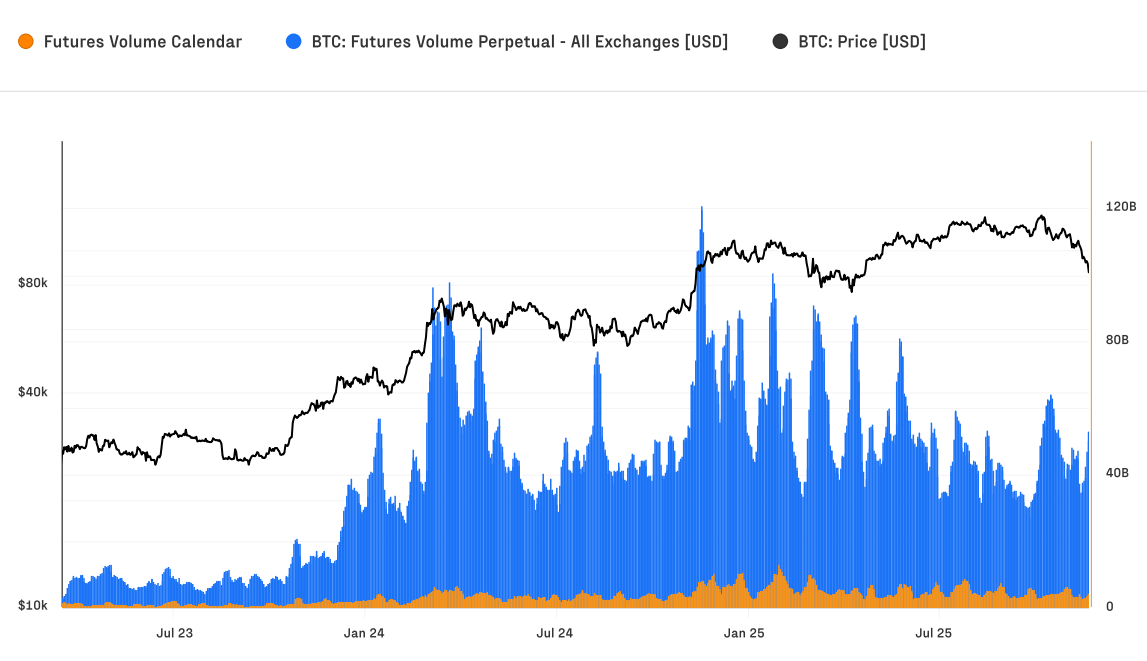

Futures activity has grown alongside this trend. Open interest recently reached an all-time high of $67.9 billion, and daily trading volumes in October climbed as high as $68.9 billion. More than 90% of this activity came from perpetual futures, a product widely used by speculative traders.

Alongside futures, Bitcoin’s spot market has also expanded. Daily spot trading volume has doubled compared with the previous cycle, ranging between $8 billion and $22 billion. During the Oct. 10 sell-off, hourly spot volume reached $7.3 billion — more than triple recent levels. This shows that instead of leaving the market, many traders used the opportunity to buy the dip.

One of the biggest structural changes in this cycle came from the launch of U.S. spot Bitcoin ETFs in early 2024. Glassnode notes that price discovery has shifted toward the spot market, while leverage continues to accumulate in futures. This has brought more capital into Bitcoin and pushed its market dominance from 38.7% in late 2022 to 58.3% today.

Capital inflows support this trend. Monthly inflows into Bitcoin have ranged from $40 billion to $190 billion, lifting its realized capitalization to a record $1.1 trillion. Since the 2022 low, more than $732 billion has entered the Bitcoin network — more than all previous cycles combined. Glassnode said this highlights a more mature, institutionally driven market environment.

The report also highlights Bitcoin’s growing role as a global settlement system. Over the last 90 days, Bitcoin processed $6.9 trillion in settlement volume, surpassing the amounts handled by major networks like Visa and Mastercard. This trend strengthens Bitcoin’s position as a large-scale financial infrastructure.

Another major shift is the movement of supply into institutional hands. A total of 6.7 million BTC is now held by ETFs, corporations, and various treasuries. Since the start of 2024, ETFs alone have acquired around 1.5 million BTC, while balances on centralized exchanges continue to fall. This suggests that long-term holders and institutions are accumulating more supply and removing liquidity from exchanges.

Overall, the report shows a market that is more leveraged, more active, and more institutionally controlled than ever before.

Final Thought

Crypto markets are entering a new phase where leverage, institutional demand, and ETF-driven liquidity now shape each major move. With futures activity rising and more Bitcoin shifting into long-term, institutional storage, volatility spikes like the Oct. 10 event may become more common as leverage continues to build.