ETH/BTC Ratio Stays Below 0.05 Despite Ethereum’s Record Highs and Institutional Demand

Ethereum’s price has soared to new all-time highs and attracted major institutional interest, yet the ETH/BTC ratio continues to lag, signaling Bitcoin’s dominance remains intact.

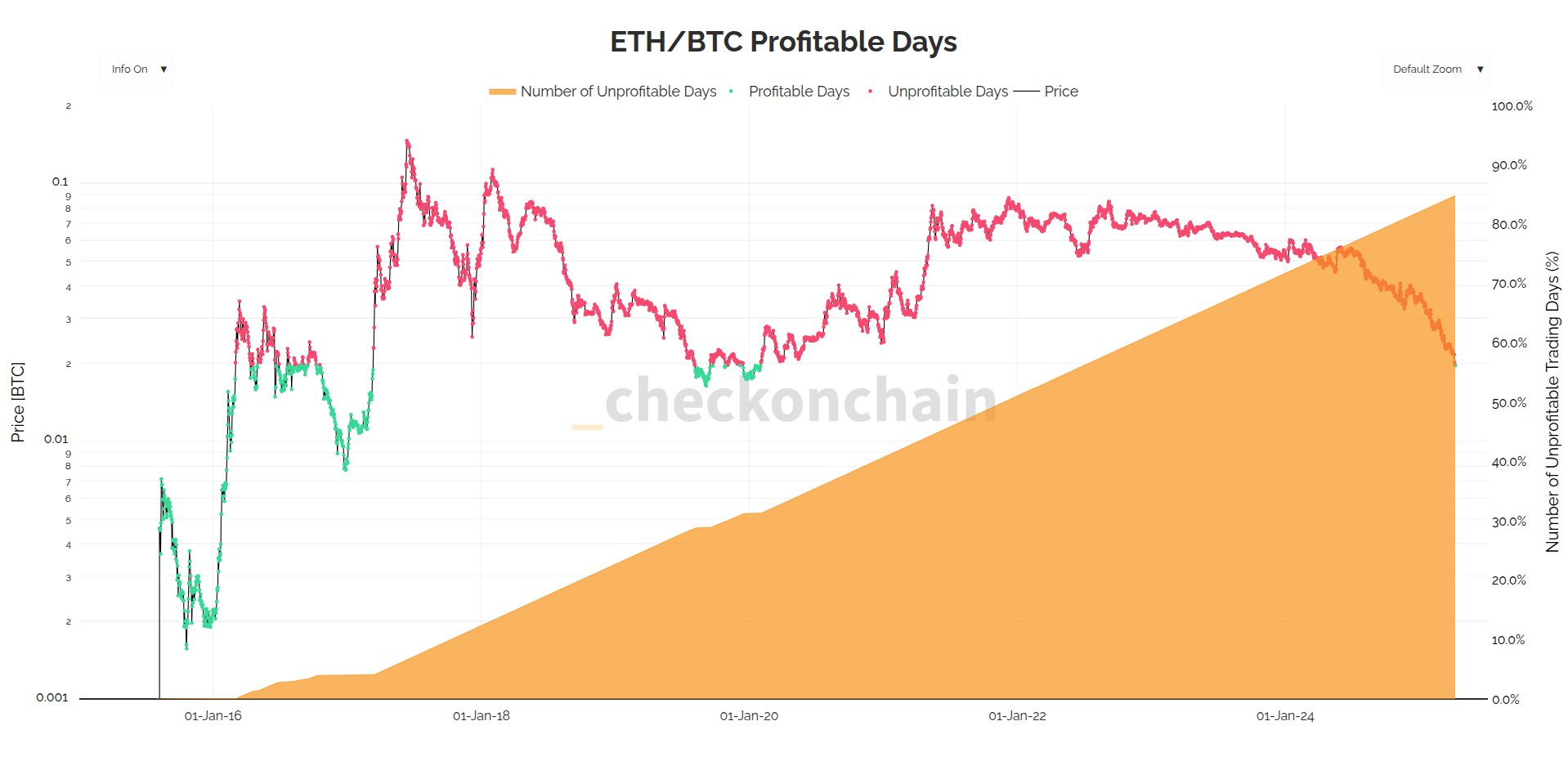

- ETH/BTC ratio sits at 0.039, failing to reclaim 0.05 despite Ethereum’s price surge and institutional adoption.

- The ratio hit an all-time high of 0.14 in 2017 but plunged to a five-year low of 0.02 in March 2025.

- Ether rallied 155% since July, peaking at $4,957 in August before a slight pullback.

- ETH has outperformed BTC only 15% of the time since 2015, with most gains occurring during the 2015–2017 ICO boom.

- Analysts expect consolidation before Ethereum attempts another all-time high above $5,000.

The ETH/BTC ratio, which tracks the price of Ether relative to Bitcoin, remains well below key levels even as Ethereum enjoys record-breaking demand. Currently hovering at 0.039, the ratio has been under 0.05 since July 2024, far from its 2017 peak of 0.14. Earlier this year, macroeconomic uncertainty and escalating global trade tensions drove the ratio to a five-year low of 0.02 in March. While both cryptocurrencies have since rebounded, Bitcoin continues to command greater relative strength.

Ether’s price performance tells a different story. Since July, ETH has rallied about 155%, reaching a new all-time high of $4,957 on August 24 before easing about 6.7% to around $4,627. This surge reflects growing institutional adoption: financial firms have begun adding Ether to their treasuries, while traditional equity investors have gained exposure through Ethereum ETFs. The Ethereum Foundation has also made notable efforts to market the network to Wall Street, further strengthening mainstream acceptance.

Despite these gains, Ether rarely outpaces Bitcoin over the long term. Market analyst James Check notes that ETH has only outperformed BTC 15% of the time since its 2015 debut, with most of those periods concentrated between 2015 and 2017 during Ethereum’s early growth and the ICO boom. Since 2020, BTC has consistently held the upper hand in price appreciation, maintaining its reputation as the dominant crypto asset.

Looking forward, analysts caution that Ethereum may need time to consolidate before making another run at the $5,000 mark. Jake Kennis of blockchain research firm Nansen told Cointelegraph that after such a rapid price climb, the market will likely pause for weeks or even months before Ethereum attempts new highs.

Final Thought

Ethereum’s impressive rally underscores its growing role in institutional portfolios, but the stagnant ETH/BTC ratio highlights Bitcoin’s continued dominance. Until Ethereum can sustain gains against BTC, the king of crypto remains firmly in the lead.