Ethena Labs and the ADL Risk: How Market Protection Became Its Greatest Threat

Key Takeaways

- ADL defines Ethena’s true risk as the mechanism that can both protect and endanger its entire model under extreme market stress.

- Ethena operates as a sophisticated financial instrument with crypto-native yield, not as a traditional stablecoin.

- Strong backing from Arthur Hayes reinforces market confidence through proven experience and ongoing involvement.

- The 2025 roadmap targets $25 billion in growth and deeper integration with traditional finance, signaling aggressive expansion.

- The risk–reward balance remains attractive for investors who fully grasp the system’s mechanics and accept its volatility.

Ethena Labs and the ADL Risk: When Protection Turns Into Pressure

October 10, 2025 marked a breaking point for the market. In less than an hour, over $19 billion disappeared after Trump’s 100% tariff on Chinese imports sent traders into panic according to CoinGlass and Yahoo Finance. What was meant to protect against volatility instead triggered a wave of forced liquidations. Perpetual contracts, once seen as tools of precision, turned into engines of chaos.

Amid that turmoil stood Ethena Labs. Its synthetic-dollar system, built on delta-neutral hedging, collided with the raw force of ADL (Auto-Deleveraging) was created to keep markets stable, yet under extreme pressure it can strike the very systems it supports. For Ethena, this moment showed how innovation meets its hardest test. This article explores how Auto-Deleveraging, once a safety net, has become a defining challenge for Ethena, and for the future of stability in decentralized finance.

Ethena at a Glance

Ethena (ENA) trades around $0.44 to $0.47 with a market value near $3.3 billion. Its synthetic dollar, USDe, has expanded at record speed, reaching over $6 billion by the end of 2024 to become the world’s third-largest stablecoin after USDT and USDC.

Ethena reshapes the idea of stability. Instead of relying on fiat reserves, USDe anchors its value through delta-neutral strategies that pair crypto collateral with short perpetual positions. The model turns volatility into opportunity and transforms a stablecoin into a yield engine.

Auto-Deleveraging (ADL) remains its greatest risk. In extreme markets, ADL can unwind Ethena’s hedges and expose the system to sharp losses. The same mechanism built to protect liquidity can strike at the core of its structure. Even so, Ethena continues to expand with strong investor confidence and an ambitious 2025 roadmap. It stands as a bold experiment in DeFi, proving that innovation and risk now move on the same line.

The ADL Mechanism: From “Protection Shield” to “Fatal Blade”

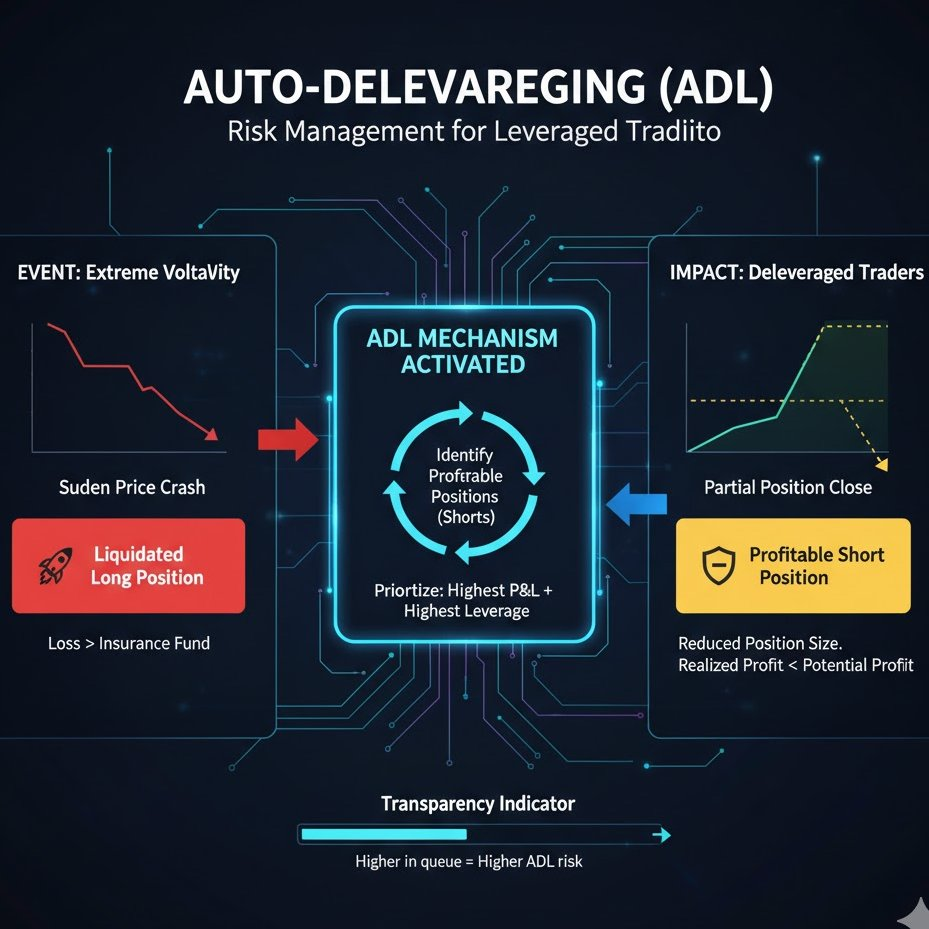

Auto-Deleveraging, or ADL, serves as the market’s last defense when volatility overwhelms normal systems. Once liquidations fail and insurance funds are empty, exchanges intervene to close profitable positions and cover the losses of bankrupt traders. On paper, it sounds protective. In practice, it punishes precision. To understand it, imagine a mechanism that targets traders with the highest profit and leverage: the better the trade, the higher the chance of being liquidated first. Binance’s ADL formula captures this logic clearly:

ADL Ranking = Profit/Loss Ratio × Effective Leverage.

For Ethena, this risk hits close to the core. The protocol relies on short futures to stay delta-neutral, yet strong performance pushes its hedges to the top of the ADL list. During the October 10 crash, the flaw became visible. A trader holding a $5 million hedge, long on BTC spot and short on futures, saw the short leg forcibly closed by ADL. The remaining leveraged long collapsed as prices fell, wiping out the entire position, according to Hyperliquid. On that day, it recorded over 35,000 ADL triggers and more than 6,000 liquidated wallets in a single day. This situation highlights how a system designed to maintain stability can paradoxically turn against the very structures it aimed to protect, posing a significant risk for Ethena.

Ethena and ADL Risk: An Existential Threat

Ethena’s Operating Model

Ethena’s stability relies on precision. The protocol keeps USDe balanced through cash-and-carry strategies, holding assets such as ETH, stETH, and BTC while opening short futures on centralized exchanges to stay delta-neutral. Revenue comes from three main streams: ETH staking yield of about 3.4%, funding rates from short perpetuals, and the basis spread between spot and futures. According to official data, ETH funding rates delivered around 16% in 2021, 0.6% in 2022, 9% in 2023, and 13% APY in 2024. These numbers reveal a profitable system built on leverage, speed, and precision, yet always one market shock away from exposure.

“Black Swan” Scenario: ADL Could Erase Ethena Overnight

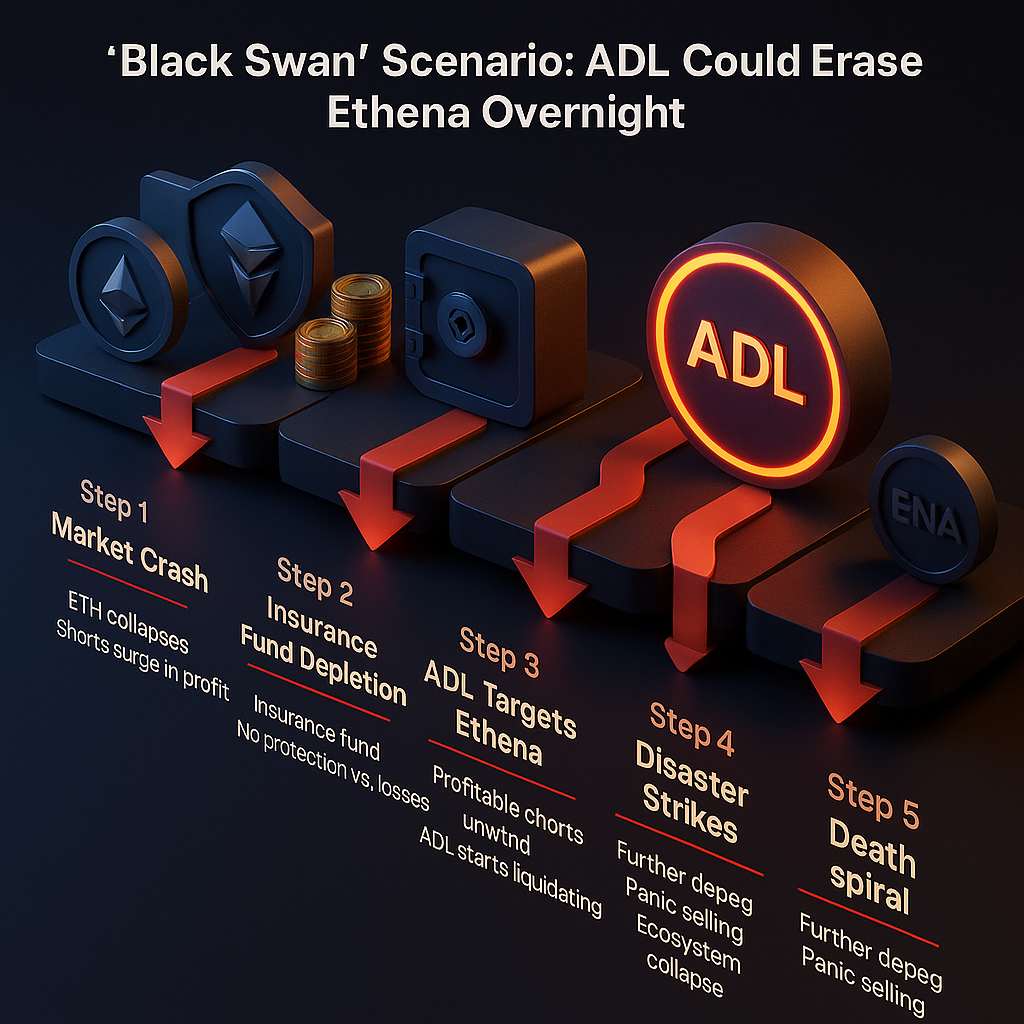

To see how fragile this balance truly is, imagine a single day when every safeguard begins to fail. Once volatility hits, one event leads to the next, each feeding the next wave of collapse. The chain starts with a crash, drains insurance reserves, and ends with forced liquidations that strip away Ethena’s protection. In moments like these, the Auto-Deleveraging (ADL) mechanism reveals its true nature: an automatic response built to protect the system, even if it means sacrificing its strongest players first.

- Step 1: Market Crash

ETH collapses. Ethena’s short positions surge in profit while long traders across exchanges begin to fall into liquidation. - Step 2: Insurance Fund Depletion

Liquidation volume overwhelms exchange reserves. Insurance funds dry up, leaving no protection against cascading losses. - Step 3: ADL Targets Ethena

With Ethena representing roughly 14% of total ETH open interest and about 5% on BTC, its profitable short positions rise to the top of the ADL queue. Exchanges begin to unwind those trades to protect the system. - Step 4: Disaster Strikes

Forced closures erase Ethena’s hedge positions. The delta-neutral shield disappears, leaving exposed collateral as prices fall. USDe starts slipping from its peg as redemption pressure mounts. - Step 5: Death Spiral

The peg breaks deeper. Users rush to exit. Collateral value drops below total USDe supply, sparking a liquidity collapse. Panic spreads, confidence vanishes, and the ecosystem implodes. In this chain reaction, USDe turns worthless and ENA heads toward zero.

Why ADL Is So Dangerous to Ethena’s Survival

ADL strikes at the worst possible moment. It activates when markets crash, exactly when Ethena depends on its hedges to stay balanced. Instead of shielding the protocol, it removes the protection that keeps USDe stable. The system built for defense turns against its operator, exposing Ethena’s entire structure to market chaos.

This mechanism also tears apart Ethena’s core identity. The protocol was created as a tokenized hedge fund built on delta-neutral precision. Once ADL closes its short positions, that balance disappears. Ethena no longer operates as a hedged system; it becomes a naked long trapped in a bear market.

From there, the chain reaction begins. Losing hedges means collateral starts to fall without control. As asset values sink below the total USDe supply, the protocol edges toward insolvency. The peg breaks, users rush to redeem, and the ecosystem spirals into collapse.

The danger lies in its permanence. When ADL triggers during a full-blown market storm, recovery becomes nearly impossible. Rebuilding hedge positions under extreme volatility is no longer an option. In a single event, Ethena’s entire model can unravel, proof that in DeFi, the line between protection and destruction is razor-thin.

Ethena vs Luna: Two Sides of Financial Risk

Overall Comparison Table

Both Ethena and Luna were built with the ambition to redefine stable value in crypto, yet they represent two completely different types of risk. Ethena faces a different kind of threat, a technical one born from the same systems built to preserve stability. While Luna collapsed through flawed economics, Ethena’s risk comes from precision pushed to its limits. ADL and liquidation mechanisms designed to protect the market can turn against the protocol in moments of extreme volatility.

The table below shows how the two models differ in structure, operation, and failure dynamics.

| Criteria | Ethena | Luna |

| Model | Decentralized protocol | Blockchain with algorithmic stablecoin |

| Primary Risk Type | ADL, Smart contract, Oracle | Algorithmic peg, Death spiral, Governance |

| Transparency | Public code, regular audits | Transparent but complex model |

| Asset Control | Smart contract + CEX custody | On-chain protocol |

| Failure Mechanism | Technical (ADL, oracle) | Economic (depeg, death spiral) |

Fundamental Risk Differences

Luna’s risk is economic. Its system relied on an algorithmic peg between UST and LUNA, a loop that collapsed once the market lost confidence. When UST slipped below one dollar, the protocol minted more LUNA to restore balance, flooding supply and crushing its price. Each decline fueled the next, and within days, both tokens collapsed. The Terra ecosystem disappeared almost overnight, a clear example of how economic design can turn into a self-destructive cycle.

Ethena’s risk is technical. The protocol depends on automated systems such as Auto-Deleveraging and liquidation engines that react instantly to volatility. The danger lies in forced hedge closures, oracle delays, or smart contract failures. When ADL triggers, Ethena’s delta-neutral balance vanishes, leaving its collateral exposed to sharp price swings. USDe may slip from its peg, yet the underlying assets remain on-chain, creating structural damage instead of total loss.

In the end, Luna fell because of flawed economics, while Ethena’s challenge comes from mechanical precision. Both reveal the same truth: stability in crypto always carries a cost, and the line between innovation and collapse is razor-thin.

Arthur Hayes and Ethena: The Strategist Behind the ADL Challenge

Arthur Hayes has become one of Ethena’s strongest supporters, shaping both its vision and its resilience against the ADL threat. He sees Ethena as a calculated step forward for DeFi, not a gamble. Through his Maelstrom fund, he placed 5% of assets into sUSDe to hedge against U.S. election volatility, earning about 13% in returns. This move proved his belief that Ethena’s model can withstand market pressure.

In his essay Dust on Crust Part Deux, Hayes wrote that Ethena could eventually surpass Tether in size and influence. He described Tether as dominant but limited by its dependence on traditional finance, while Ethena operates entirely on-chain with delta-neutral hedging and yield sourced from real market activity.

Hayes often emphasizes three key strengths. Ethena’s yield comes from ETH staking and perpetual funding, not from token inflation. Its code and operations are transparent on-chain. Its structure remains capital-efficient, avoiding the heavy over-collateralization seen in other stablecoins.

Recently, Hayes called Ethena “severely undervalued” when ENA traded near $0.35. He believes once global interest rates fall and liquidity returns, Ethena will look far more attractive to institutions.

Ethena Labs Expansion and the ADL-Driven 2025 Roadmap

Team Expansion

Ethena Labs is entering a phase of rapid growth. To strengthen its foundation and improve how it manages ADL risk, the team is expanding for the first time since launch. Around ten new members will join in the coming months, increasing the current headcount of 10 to 15 people by nearly half.

Recruitment focuses on critical roles such as Head of Security, Senior Backend Engineer, and specialists in DeFi, trading, and blockchain safety. New positions in business development and product design will help Ethena combine technical depth with broader market reach.

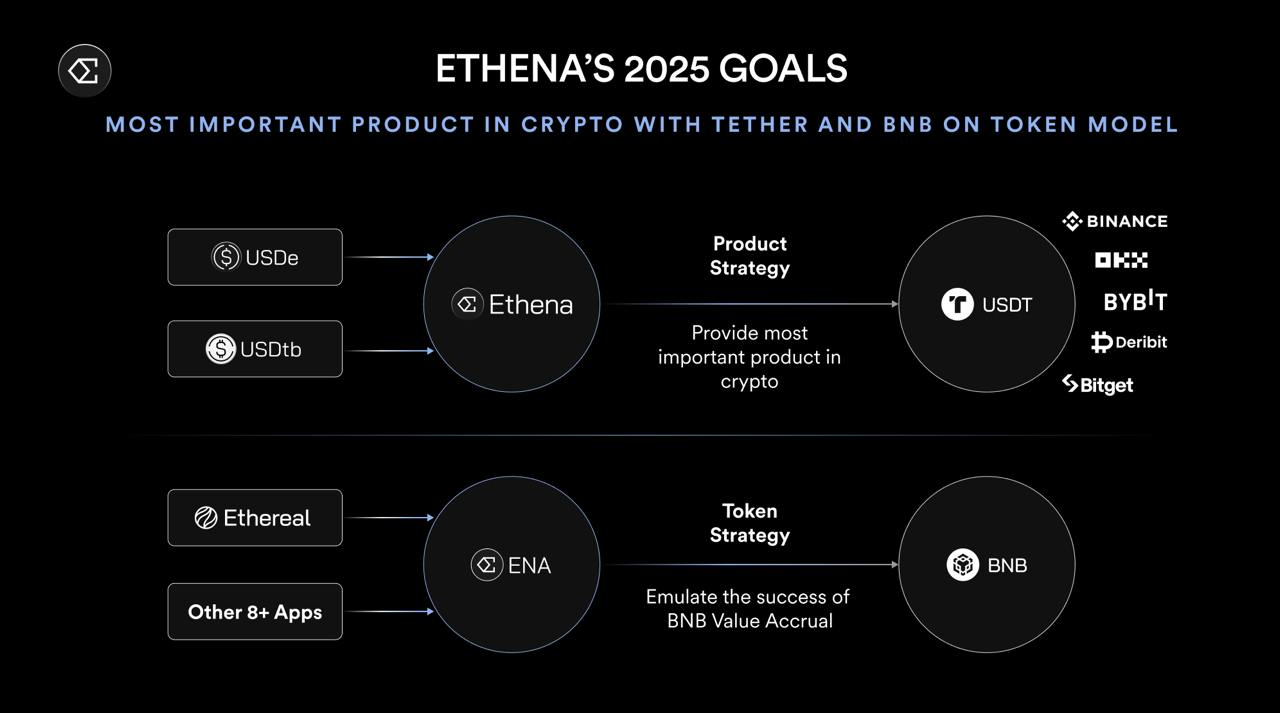

2025 Vision Under ADL Pressure

Ethena’s 2025 plan aims to scale from $6 billion to $25 billion in market cap while proving its ability to handle the ADL challenge. Growth and stability must move together, especially when market conditions turn extreme.

The first major release will be iUSDe, an institutional version of USDe designed for fixed-income portfolios. It includes transfer restrictions and targets around 20% APY, offering an alternative for investors seeking steady returns as global bond yields decline.

Next, Ethena will introduce a Telegram Mini App to bring yield-bearing dollars to everyday users. Integrated with Apple Pay, it will let people send, spend, and save directly inside Telegram, opening access to nearly one billion potential users.

To expand beyond DeFi, Ethena plans to build stronger links with traditional finance. Partnerships with asset managers, private credit funds, prime brokers, and structured investment platforms will position USDe as a bridge between on-chain liquidity and institutional capital.

The 2025 roadmap reflects more than growth goals. It represents Ethena’s effort to balance expansion with defense, turning ADL risk into a real-world test of the system’s strength and adaptability.

ADL and Performance Metrics: Ethena’s Growth Under Pressure

USDe has recorded one of the fastest growth trajectories in crypto history. Since launching publicly in February 2024, its market cap has surged past $6 billion, overtaking both DAI and FDUSD to become the third-largest stablecoin in the world. The speed of this rise underscores strong adoption and investor confidence despite the ongoing challenges tied to ADL risk.

Ethena’s revenue performance also stands out. The protocol reached $100 million in revenue faster than any other DeFi project, second only to Solana’s meme coin platform, pump.fun. By the third quarter of 2025, Ethena generated $123 million in fees, up sharply from $45 million in the previous quarter. By December 2024, the project was operating at an annualized revenue rate of over $1.2 billion, placing it among the most profitable names in decentralized finance.

Its Total Value Locked (TVL) tells a similar story. In only three weeks, TVL jumped from $5.8 billion to $9.6 billion, pushing Ethena to the seventh position among the largest DeFi protocols. This explosive expansion shows how quickly the ecosystem is scaling, even as the team works to balance growth with the technical risks that come from ADL exposure..

Risk Analysis: Threats to Monitor

Funding Rate Pressure

Funding rates remain a major internal challenge for Ethena. When markets turn bearish, these rates can flip negative, cutting into USDe’s yield. This risk alone is manageable, but when combined with an ADL event, it could create the perfect storm. Since June 2024, market conditions have often been unfavorable for positive funding returns, yet the protocol has held steady. The danger lies in a prolonged period of negative rates coinciding with forced deleveraging, a scenario that could push Ethena to its limits.

Liquidity Weakness

Liquidity for sUSDe has declined sharply in recent months. On secondary markets, the token now trades at a slight discount, with the liquidity-to-supply ratio falling below 1%. Total sUSDe liquidity has dropped under $10 million, marking the weakest level since April 2024. This thin liquidity increases volatility and reduces flexibility during market stress, especially if ADL activity spikes.

ADL: The Existential Risk

Auto-Deleveraging remains the single greatest threat to Ethena’s survival. As explored earlier, ADL is not a routine risk but a mechanism that can erase Ethena’s entire model in extreme conditions. It functions as a single point of failure, once triggered at scale, the damage spreads fast and recovery becomes nearly impossible. Managing this risk is less about elimination and more about mitigation through speed, liquidity depth, and coordination with exchanges.

Centralization Exposure

Ethena still depends heavily on centralized exchanges to execute its hedging strategies. This reliance creates a potential weakness. A technical failure or security breach on a major exchange, such as Binance, could disrupt hedging operations, endanger collateral, and shake user confidence. Building deeper on-chain execution and decentralized hedging pathways will be essential to reducing this exposure.

Ethena’s growth has been impressive, but its long-term success depends on mastering these risks, especially the ADL mechanism that defines both its strength and its most fragile point.

Competitive Landscape: Ethena’s Position

USDe has climbed to the third spot among global stablecoins, standing just behind USDT and USDC. Surpassing DAI and FDUSD in only ten months is a remarkable achievement that shows how quickly the market has embraced Ethena’s model, even with the constant pressure of ADL risk.

| Category | Ethena (USDe) | Key Insight |

| Market Rank | 3rd largest stablecoin | Reached top three in less than a year |

| Average Yield | Around 8.8% APY | Driven by ETH staking and perpetual funding |

| System Design | Crypto-native, synthetic dollar | Operates fully on-chain without banks |

| Scalability | High | No over-collateralization required |

| Innovation | New synthetic dollar model | Combines DeFi yield with stability |

Ethena’s strengths are clear: high yield, strong scalability, and a design that stays independent from the banking system. Yet growth brings new challenges. The protocol carries a higher risk profile than fiat-backed stablecoins, making it more sensitive to market stress and ADL volatility. Its structure remains complex for casual users, and regulatory clarity is still uncertain.

Even so, Ethena stands apart as a pioneer in synthetic stability. Its future will depend on how well it can grow without losing control of the ADL risk that now defines both its power and its biggest test.

Institutional Adoption and Future Catalysts

Ethena’s position in the institutional landscape is gaining strength as top trading firms, exchanges, and funds back its expansion. The project has attracted support from Binance Labs, Dragonfly, GSR, BitMEX, Deribit, OKX, Bybit, Huobi, Gemini, Wintermute, BlockTower Capital, Nascent, Finality Capital Partners, and Delphi Digital. This level of institutional trust gives Ethena both liquidity depth and strategic reach, especially as it continues to refine its model against ADL-related volatility.

The next growth phase will depend on several catalysts set to shape Ethena’s path through 2025 and beyond. Each development strengthens its foundation while testing how well the protocol can balance expansion with risk control.

| Catalyst | Description | Potential Impact |

| Coinbase Listing | ENA is under review for listing on Coinbase | Could unlock new investor access and expand liquidity across U.S. markets |

| Basel III Implementation | Global banking standards coming into effect in 2026 | May push institutions to adopt on-chain assets like USDe for compliant yield exposure |

| Institutional iUSDe | A new product designed for institutional clients with transfer limits and steady yield | Positions Ethena for integration into traditional fixed-income portfolios |

| Cross-chain Expansion (TON) | Integration with TON through LayerZero protocol | Extends USDe’s reach across multiple blockchains and reduces network concentration risk |

Together, these catalysts highlight Ethena’s evolution from a synthetic stablecoin project into a full-scale financial platform. The challenge now lies in execution: scaling adoption, maintaining liquidity, and managing ADL pressure as institutional participation deepens.

Conclusion: Navigating The Synthetic Dollar Revolution

Ethena reshapes the meaning of stability in digital finance. It builds strength through precision and control, turning volatility into momentum. The October 11 crash revealed how quickly balance can shift, transforming protection into exposure in an instant.

The protocol moves on the fine line between creation and collapse. Its future depends on how it handles ADL, a force that sustains markets in calm periods yet tests every system under stress. Each swing becomes a trial of speed, structure, and will.

Ethena speaks to those who act with conviction. It rewards clear judgment and resilience in the face of pressure. In the world shaped by ADL, power belongs to those who endure the storm and keep moving forward.

Disclaimer: This article is for informational and analytical purposes only, not investment advice. Investing in Ethena is high-stakes with existential risks. Success or failure can occur within hours when black swan events happen. Past performance does not guarantee future results, and in Ethena’s case – survival is not guaranteed.