Ethereum Developer Warns Corporate Influence Could Undermine the Network’s Core Values

- Ethereum core developer Federico Carrone warns that venture capital influence, particularly from Paradigm, could pose a “tail risk” to Ethereum’s decentralized ethos.

- Carrone argues corporate motives may lead to misalignment with Ethereum’s philosophical foundations.

- Paradigm has been hiring key Ethereum researchers and funding critical open-source projects.

- The firm is also incubating a new blockchain, Tempo, in partnership with Stripe, Visa, and Deutsche Bank.

- Concerns are growing that centralized control could shift Ethereum’s priorities away from community-driven innovation.

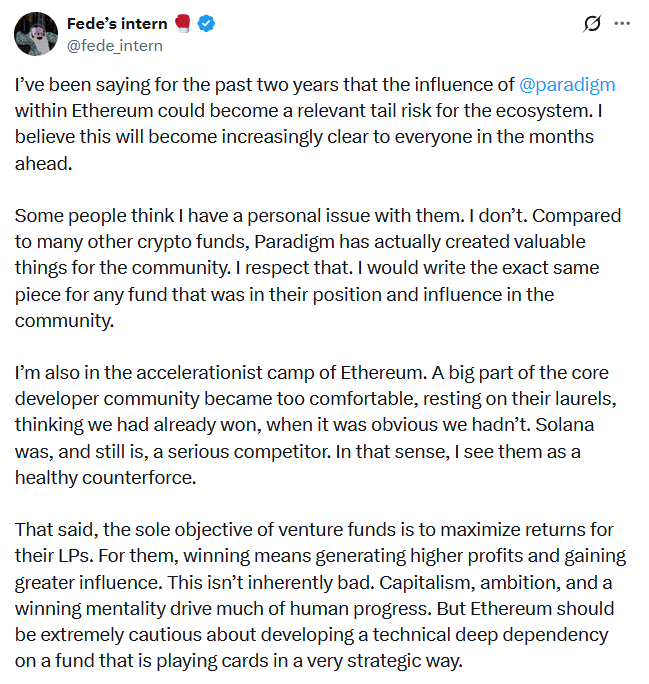

Ethereum developer Federico Carrone, known online as Fede’s intern, has raised fresh concerns about the growing influence of major venture capital firms — particularly Paradigm — on the Ethereum ecosystem. In a post on X (formerly Twitter), Carrone described this influence as a potential “tail risk” for Ethereum’s long-term health and decentralization.

“I’ve been saying for the past two years that the influence of @paradigm within Ethereum could become a relevant tail risk for the ecosystem. I believe this will become increasingly clear to everyone in the months ahead,” Carrone wrote.

Carrone acknowledged that Paradigm has made meaningful contributions to Ethereum, including funding open-source projects and employing top researchers. However, he cautioned that these contributions might come with hidden costs if corporate motivations start shaping the network’s direction. “When corporations gain too much legibility and influence over open source projects, priorities start to drift away from the community’s long-term vision and toward corporate incentives,” he warned.

Paradigm, a leading crypto and AI investment firm founded in 2018 by Matt Huang (former Sequoia Capital partner) and Fred Ehrsam (Coinbase co-founder), has been an active force in Ethereum’s development. Its portfolio spans DeFi, NFTs, blockchain infrastructure, and security initiatives. Among its recent ventures is Reth, an Ethereum development toolkit written in Rust, and Tempo, a new Layer-1 blockchain incubated in partnership with Stripe, Visa, Deutsche Bank, and Shopify.

Tempo aims to focus on stablecoin and payments infrastructure, but its corporate-heavy partnerships have sparked debate over centralization. The project’s design — involving major traditional finance players — contrasts sharply with Ethereum’s open, community-led ethos. Although Tempo claims it will transition toward decentralization with “an independent and diverse validator set,” Carrone remains skeptical.

He argues that Ethereum must be “extremely cautious about developing a technical deep dependency on a fund that is playing cards in a very strategic way.” For Carrone, the core danger lies in allowing venture-backed entities to influence critical protocol decisions or dominate essential infrastructure components.

Carrone’s remarks highlight a broader tension within the crypto industry: the push-and-pull between decentralization and the capital needed to sustain development. While venture funding accelerates innovation, it can also introduce hierarchical control structures that contradict the egalitarian ideals of decentralized networks.

Paradigm has defended its role as a builder and backer of open innovation, stating that its approach combines investing, building, and researching to advance crypto technology. Beyond pure investment, the firm has also shown support for the wider crypto community — filing an amicus brief defending Tornado Cash co-founder Roman Storm and bringing on blockchain investigator ZachXBT as an adviser to promote transparency and security.

Still, Carrone’s comments serve as a timely reminder of Ethereum’s original vision: a decentralized platform driven by community consensus rather than corporate influence. As Ethereum continues to evolve, balancing openness with institutional participation will be crucial to preserving its philosophical and technical integrity.

Final Thought

The debate over Paradigm’s influence captures a defining challenge for Ethereum’s future — maintaining its decentralized ethos while embracing large-scale innovation and funding. As corporate players deepen their involvement in the ecosystem, the community faces a delicate balancing act: welcoming resources and expertise without compromising the fundamental ideals that made Ethereum revolutionary.