Ethereum Foundation Converts $4.5M ETH Into Stablecoins

Key Takeaways

- Strategic Conversion: EF converted 1,000 ETH (~$4.5M) into stablecoins via CoW Swap to finance grants, research, and donations.

- Treasury Focus: The move aligns with EF’s policy of balancing returns with ecosystem stewardship.

- Operational Shifts: The conversion follows leadership restructuring and a pause on new grant submissions.

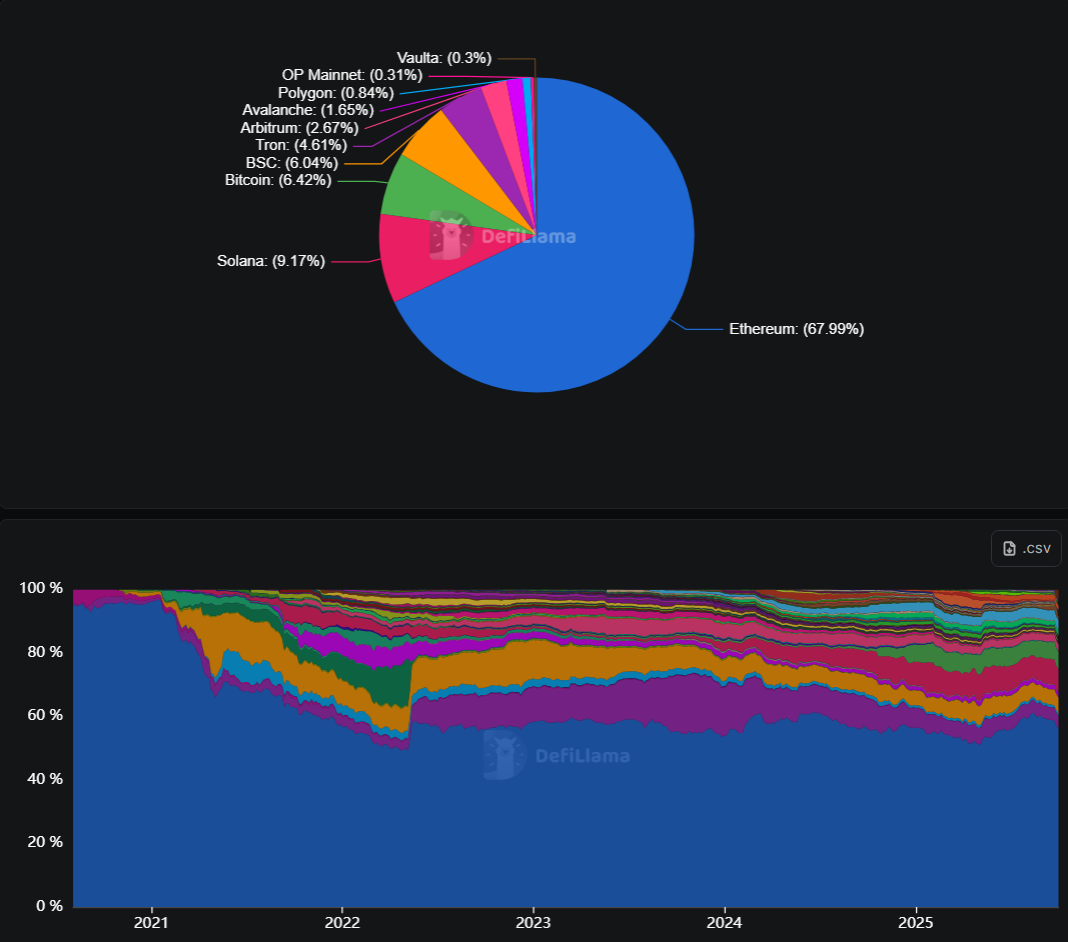

- Ethereum’s DeFi Role: Ethereum still leads with ~68% of DeFi TVL despite growing competition.

- Vitalik’s Vision: Buterin underlined “low-risk” DeFi as a sustainable revenue base for Ethereum.

Ethereum Foundation’s Stablecoin Strategy

The Ethereum Foundation (EF) has carried out a strategic conversion of 1,000 Ether, valued at approximately $4.5 million, into stablecoins. The transaction was executed using CoW Swap, a decentralized protocol that aggregates liquidity across exchanges to deliver competitive prices without relying on centralized intermediaries.

According to EF’s announcement, the conversion is part of its broader treasury strategy and is intended to provide stable resources for research, grants, and ecosystem donations. While the foundation did not disclose which stablecoins it received in return, the move highlights EF’s increasing reliance on stable assets to manage volatility and secure funding for long-term initiatives.

This step comes after EF revealed in September that it would convert 10,000 ETH into stablecoins over several weeks. Friday’s 1,000 ETH conversion appears to be a separate transaction, notable for its use of a decentralized protocol rather than centralized exchanges.

The decision reflects EF’s treasury policy, which emphasizes balancing returns above a benchmark rate with its role as a steward of the Ethereum ecosystem. Stablecoins give EF predictable liquidity to deploy toward grants, R&D, and DeFi funding without being overly exposed to ETH price swings.

The timing also matters. EF has temporarily paused open grant submissions due to a surge of applications, shifting focus toward the ecosystem’s most pressing needs. The new conversion ensures that funds are available to support protocol development, scalability research, and critical DeFi initiatives.

Impact on Ethereum’s Ecosystem and DeFi Leadership

The conversion takes place alongside broader organizational changes. In April, EF appointed Hsiao-Wei Wang and Tomasz K. Stańczak as co-executive directors to streamline leadership. By June, EF restructured its core development teams and reduced staff, signaling a tighter focus on efficiency and strategic funding.

Ethereum itself remains the backbone of decentralized finance. Despite competition from other blockchain platforms, Ethereum still accounts for around 68% of total value locked (TVL) in DeFi, according to DefiLlama. While this is lower than its peak share in 2021, it underscores Ethereum’s continued dominance in the sector.

Vitalik Buterin, Ethereum’s co-founder, has stressed the importance of “low-risk” DeFi applications for long-term sustainability. He compared their role to Google Search within Google’s business model: a reliable anchor generating stable revenue. Buterin pointed to basic payment tools, savings mechanisms, synthetic assets, and fully collateralized lending as essential elements of this foundation.

By converting ETH into stablecoins, EF reinforces this vision. The move strengthens financial stability while keeping liquidity available for projects that aim to deliver sustainable growth. For developers and researchers, it ensures predictable funding. For the broader DeFi sector, it signals that Ethereum intends to remain its core infrastructure, even as rivals gain traction.