FTX Recovery Trust Confirms $1.6B September Distribution

Key Takeaways

- Third distribution confirmed: $1.6B payout scheduled for Sept. 30, with funds reaching creditors within three business days.

- Different claim types covered: Dotcom customers get 6%, US Customer Entitlement Claims 40%, General Unsecured 24%, Convenience Claims 120%.

- Recovery fund scope: Trust has up to $16.5B earmarked for creditors, following $1.2B (Feb) and $5B (May) disbursements.

- Market implications: Investors eye payouts for potential impacts on crypto liquidity and sentiment.

- SBF legal battle continues: Founder appeals 25-year sentence, arguing trial unfairness and FTX solvency.

FTX Recovery Trust Greenlights $1.6B Distribution

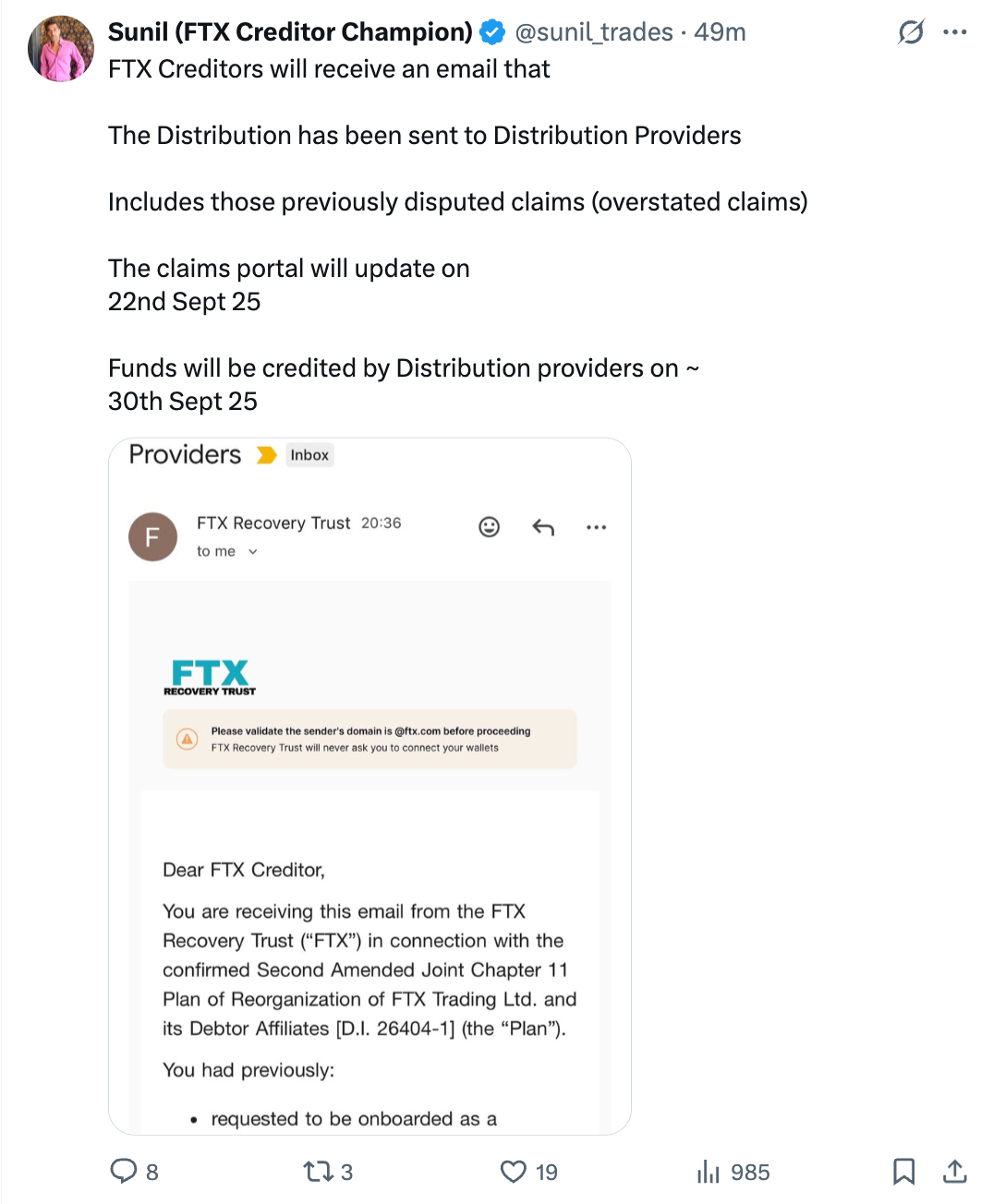

The FTX Recovery Trust, responsible for unwinding one of the most infamous collapses in crypto history, announced it will release $1.6 billion in creditor distributions on September 30. The funds are expected to land in creditor accounts within three business days, according to Friday’s announcement.

This marks the third tranche of repayments to FTX’s former customers and creditors, following a $1.2 billion payout in February and a $5 billion disbursement in May. With up to $16.5 billion set aside for recovery, the trust has now released nearly half of the earmarked funds.

Breakdown of September’s Payout

The latest disbursement includes tailored recovery percentages across different claim categories:

- Dotcom Customer Claims: 6% payout

- US Customer Entitlement Claims: 40% payout

- General Unsecured & Digital Asset Loan Claims: 24% payout

- Convenience Claims: 120% reimbursement

This diversified structure reflects the complexity of the bankruptcy case, which involves customers from multiple jurisdictions and various claim classifications. For many, the September tranche represents both a relief and a reminder of the billions still locked in recovery proceedings.

FTX Collapse: A Shadow Still Looms

FTX’s downfall in November 2022 shook the foundations of the crypto industry, intensifying the bear market and triggering regulatory crackdowns worldwide. The exchange’s bankruptcy remains one of the largest financial failures in the sector’s history, with ripple effects still visible across markets and policymaking.

The Recovery Trust’s methodical repayments have become closely watched events. Analysts warn that large-scale creditor distributions could impact crypto liquidity as recipients may liquidate recovered assets, though others suggest the orderly, phased structure will limit shocks.

Sam Bankman-Fried’s Legal Fight

Meanwhile, former CEO Sam “SBF” Bankman-Fried, who was convicted in November 2023 on seven counts including wire fraud, securities fraud, and money laundering conspiracy, continues his legal battle. Sentenced to 25 years in March 2024, SBF’s attorneys are preparing an appeal for November 2025.

The defense maintains that Bankman-Fried did not receive a fair trial and argues that FTX was “never insolvent,” claiming the exchange always held enough assets to cover obligations. Judge Lewis Kaplan, however, described SBF’s crimes as “serious” and deserving of decades in prison.

What’s Next for Creditors and Markets

With $6.2 billion already distributed and another $1.6 billion imminent, the FTX Recovery Trust still holds billions more to unwind. Each disbursement not only compensates victims of the collapse but also shapes sentiment in the broader crypto market.

For creditors, the process offers hope of restitution after years of uncertainty. For the industry, it serves as a stark reminder of crypto’s fragility, and a test of resilience as new capital enters while old scars slowly heal.