GameFi 2025: From Collapse to Comeback with AI and Tokenomics

Key Takeaways

- GameFi 1.0 collapsed, with 93% of projects dead and $43B lost.

- Survivors like Axie Infinity and The Sandbox rebuilt on stronger models.

- Layer 2, Ronin, and account abstraction removed cost and UX barriers.

- AI and new tokenomics drive sustainable, engaging economies.

- Traditional gaming giants and rising adoption signal GameFi’s comeback.

GameFi tells two stories. One is collapse: 93% of projects since 2021 are dead, wiping out $43B and leaving players with useless tokens. The other is rebirth: AI, better tokenomics, and big gaming studios are building a sector with real potential.

To see the truth, we need both sides: the crash of GameFi 1.0 and the fixes that define GameFi 2.0. It is a reinvention of how blockchain can power games instead of draining them.

The Spectacular Failure of GameFi 1.0

To see where GameFi is going, we first look at how massive the collapse was. The numbers show systemic failure rather than a simple market dip. ChainPlay reviewed 3,279 projects and found 93% classified as dead, with tokens losing over 90% of value or fewer than 100 daily users. Lifespans averaged only four months, compared with one year for memecoins and three years for typical crypto projects.

The fall was rapid. Market cap dropped 77%, from $55.3B in February 2022 to $12.8B today. Investment shrank 85%, from $5.56B in 2022 to $859M in 2024. During the 2022 bear market, the death rate exceeded new launches, as 742 older projects collapsed along with the newcomers.

Axie Infinity captures the picture best. At its January 2022 peak, it reached 2.7M daily players. Scholars in the Philippines earned $30–60 a day, above minimum wage. The play-to-earn model looked groundbreaking, with players receiving SLP tokens and selling them for cash. The design, however, carried Ponzi-like dynamics.

The system depended on constant inflows of new players buying starter teams priced between $250 and $1,300. When growth slowed, the spiral accelerated. Daily users fell to 350k, SLP declined from $0.40 to $0.02, and top players earned only $0.31 a day. The $620M Ronin Bridge hack pushed the decline further.

Common patterns ran across the sector: unlimited token emissions, weak burn mechanisms, gameplay aimed at income extraction over fun, and economies built on endless expansion. Cryptomines’ ETERNAL fell from $800 to $3. Hamster Kombat attracted 300M users in five months, then lost 86% within months once its token launch failed to sustain value.

The Economic Traps Behind GameFi 1.0’s Collapse

The real weakness of early GameFi lay in economics, not technology. These projects built what economists call extraction economies, value flowing out to players without enough value flowing back to sustain the system.

Traditional games earn revenue through purchases, subscriptions, or ads. It creates sustainable models. Early GameFi promised players income simply for playing, with revenue tied almost entirely to bringing in new players.

And this design triggered cascading failures. Player incentives shifted away from fun toward pure token farming, draining rather than enriching the ecosystem. The model attracted extractive players who wanted to take value out. Because the system relied on exponential growth, collapse became inevitable once growth slowed.

Scholar programs in Axie Infinity revealed the flaws clearly. Managers hired workers in developing countries to grind 8–10 hours daily for 50–70% of earnings. While profitable at first, these setups turned into digital sweatshops when tokens lost value. Scholars worked for cents while managers drained what was left, reinforcing rather than reducing inequality.

Tokenomics sealed the failure. Most projects used single-token models with unlimited emissions, creating inflation that demanded constant new demand. Burn mechanisms were weak and rarely balanced supply. Dual-token fixes often added complexity without solving the sustainability problem.

The Survivors: Lessons from GameFi Projects That Adapted

Amid the collapse, a small group of projects proved resilient. Their recovery shows that structural change, not temporary hype, defines lasting GameFi. These cases illustrate how the sector can mature into a sustainable model.

Axie Infinity stands as the clearest example. After its peak-to-trough fall, the game stabilized at 250,000 monthly active users and earned $4 million for its treasury in 2024. The turnaround came from a redesigned economy. The Bounty Board launch in April 2024 triggered a 691% surge in activity by tying rewards to meaningful engagement. New mechanics such as Part Evolution burned Axies to unlock crafting materials, creating real sinks. Net negative breeding now ensures more Axies leave circulation than enter, replacing the earlier inflationary spiral with a system of scarcity and value preservation.

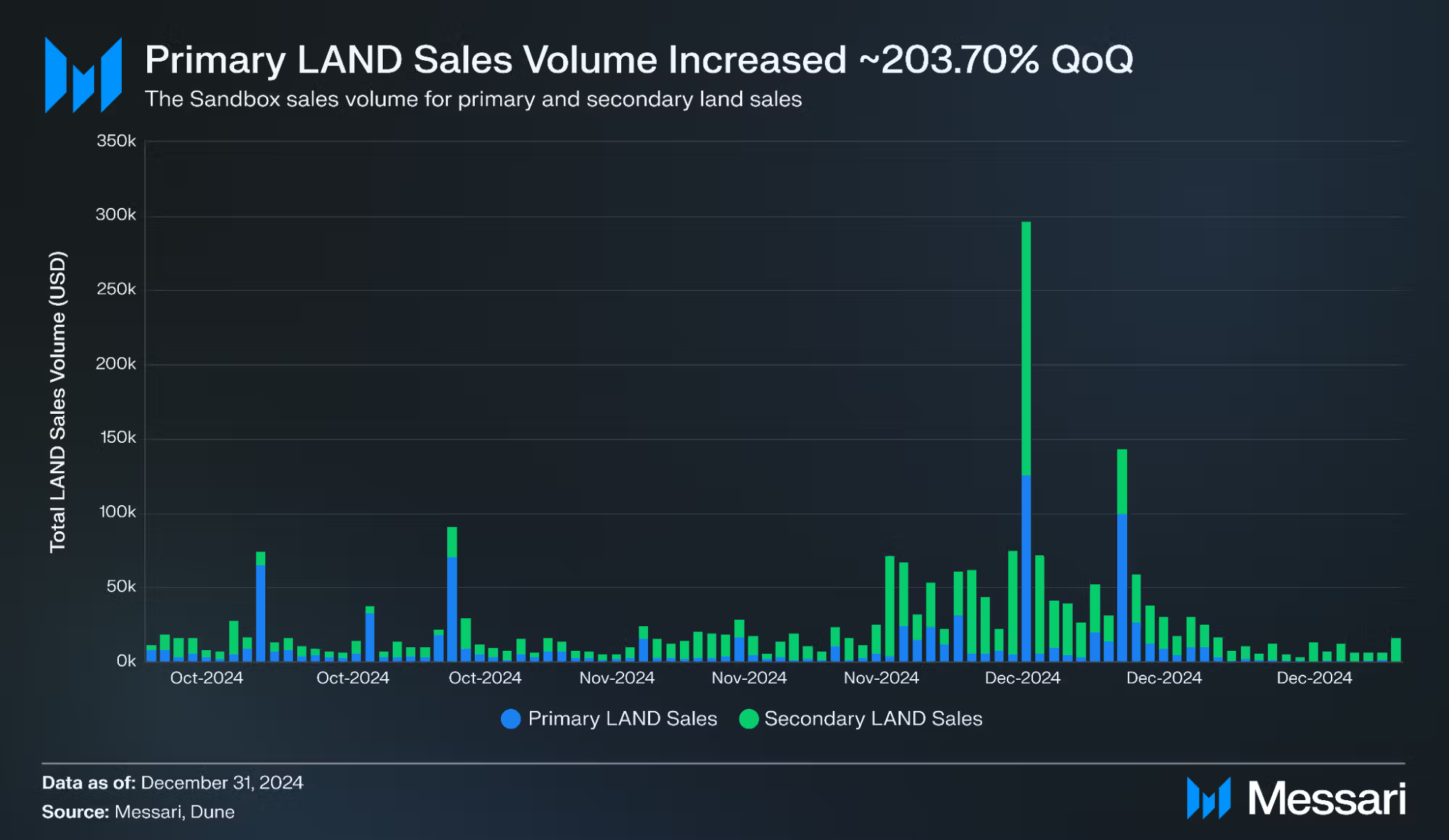

The Sandbox followed another path: building a creator economy around land and user-generated content. In Q4 2024, daily LAND buyers rose 94% quarter-over-quarter to 5,903, generating $2.43 million in sales. The community expanded to over 25,000 LAND owners and 62,000 avatar holders. Builder Challenges rewarded creators with more than 3 million SAND tokens, producing 600,000 visits and 220,000 hours of gameplay. By centering growth on creation rather than token price, The Sandbox transformed its users into the engine of activity and extended the platform’s lifecycle.

Together these survivors highlight essential principles. Sustainable projects integrate deflationary sinks and multiple revenue sources. They continue development even in bear markets, strengthen reach through partnerships with both crypto-native and mainstream brands, and deploy scalable infrastructure that removes transaction barriers. Most importantly, they place gameplay at the core, with blockchain elements serving as enhancements that deepen, rather than define, the experience.

The Infrastructure Revolution Enabling GameFi 2.0

GameFi’s revival rests on a new technical foundation far stronger than what powered the first boom. Early blockchain gaming suffered from high gas fees, clunky wallet setup, and weak scalability. These weaknesses have been replaced by infrastructure designed for mass adoption.

Layer 2 solutions transformed the economics of play. Immutable X, a ZK-rollup built on StarkWare, delivers zero-gas NFT minting and trading while keeping Ethereum-grade security. Since launching its zkEVM in early 2024, the network has processed nearly 150 million transactions, attracted 2.5 million monthly active users in just three months, and overtook Ronin in activity. Its ecosystem expanded to 4 million users and now supports 250 games across two networks, giving it close to 70% of the Web3 gaming infrastructure market.

Ronin also redefined itself. Originally the backbone for Axie Infinity, it grew into a gaming-focused Layer 1. Daily active users jumped from 16,000 in October 2023 to 1.37 million in May 2024, largely driven by the farming hit Pixels. The chain upgraded from Proof of Authority to Delegated Proof of Stake, now processes more than 14.4 million daily transactions, and maintains median fees at around $0.0001 on opBNB. Competitors show similar progress: Skale removes gas costs entirely for players, while Starknet offers fees as low as $0.002 with sub-two-second confirmation times.

Even more decisive is the rise of account abstraction, which attacks the greatest barrier to entry: wallet complexity. Traditional crypto wallets once required 17 steps to set up, compared to four for joining Facebook. In a 2024 survey by the Blockchain Game Alliance, 53.9% of industry professionals flagged poor UX and UI as the leading obstacle to onboarding, and another 11% pointed specifically to wallet setup.

Smart Contract Accounts provide the breakthrough. They allow social logins with Face ID, fingerprints, or Google accounts. Transactions can be gasless when subsidized by games. Recovery systems restore access without exposing private keys. Session keys keep players signed in for uninterrupted play. Adoption numbers highlight the shift: smart account deployments rose from 7.23 million in 2023 to 40.5 million in 2024. Immutable Passport alone passed 1 million sign-ups by May 2024, more than doubling from the previous month.

GameFi 2.0, built on this new infrastructure, now runs with massive scale, lower costs, and smooth access unmatched by the first wave.

Artificial Intelligence: The Game-Changing Technology Integration

The most powerful force shaping GameFi 2.0 is artificial intelligence. AI has moved far beyond a buzzword. It now drives mechanics to change how blockchain games function, scale, and connect with players.

By 2024, half of new GameFi titles had integrated AI in some form. NPCs gained memory and planning, responding to player choices instead of repeating scripted lines. Quest systems adapted to player skill levels, creating challenges that evolve with progress. Procedural engines generated personalized content, so no two players saw the same world. AI-driven economies adjusted in real time, tuning prices and rewards based on supply, demand, and player behavior. The result: static designs gave way to living systems, responsive to every action.

Robbie Ferguson, co-founder of Immutable, reported that AI cut Web3 development cycles by 65% over the past year. With $12 billion of capital invested in Web3 gaming since 2020, this acceleration means 2025 is set to deliver more AAA blockchain titles than any previous cycle. The gains come from AI producing art assets, drafting code frameworks, designing quest narratives, and balancing complex in-game economies—tasks that once consumed months of manual work.

Some projects push further. AI agents enter economies as autonomous traders, analyzing markets and behavior at superhuman scale. Instead of bots with fixed scripts, games now feature economies that move like real ones. NPCs with memory hold evolving conversations, recall past encounters, and adapt to each player’s story. Players describe stronger emotional bonds and higher replay value.

AI also reinforces economic stability. Smart contracts powered by AI adjust reward pools when conditions change. Security models flag abnormal patterns before exploits spread. Anti-cheat systems scan thousands of sessions at once, preserving fairness in competitive play. Data from 2024 shows projects using these tools keep 30–40% more players than those that ignore them.

The fusion of AI and blockchain is opening a new frontier. Personalization tailors every journey. Fraud prevention protects digital economies. Automated content creation lowers costs for small studios, letting them compete with giants. Together, these advances push GameFi beyond speculation into immersive, scalable, and secure gaming.

The New Tokenomics: Building Sustainable Game Economies

The evolution of tokenomics is the single most decisive shift shaping GameFi’s long-term survival. The implosions of 2021–2022 exposed weak foundations: unchecked emissions, Ponzi-like reward loops, and models that relied on endless new entrants. From this wreckage, teams have pivoted toward designs that can sustain value, engagement, and growth.

Most new projects employ dual or multi-token systems. Governance tokens now serve as instruments for decision-making, treasury allocation, and ecosystem direction. Gameplay tokens cover in-game spending and rewards. This separation shields the core economy from inflation while letting developers and communities retain a stake in the ecosystem’s long-term vision.

But the number of tokens alone does not define sustainability. The real breakthrough lies in distribution models and utility design. Unlimited emissions have been replaced by fixed reward pools tied to player activity. “Play-to-airdrop” mechanics add scarcity and competition: rewards flow to the most active or skilled players rather than being automatically issued to everyone. The result is a healthier balance between player effort and ecosystem resilience.

Staking has also become more strategic. Instead of serving only as a passive yield tool, it now shapes behavior. Players who lock tokens gain enhanced rewards, governance rights, or access to exclusive features. Lockups pull circulating supply off the market, creating natural deflationary pressure, while simultaneously reinforcing loyalty and long-term participation.

A new generation of projects is pushing innovation further. Tapzi, for instance, has introduced skill-based competitive pools. Players stake tokens and compete directly, with outcomes determined by ability rather than grinding or inflationary rewards. With a fixed supply of 5 billion tokens, this model ties value to performance and community activity rather than constant minting.

At the frontier, dynamic adjustment mechanisms bring real-time balance to game economies. Algorithms monitor player activity, token circulation, and overall ecosystem health. Difficulty levels also shift to keep gameplay competitive and engaging. These adaptive systems act like economic stabilizers, maintaining equilibrium without requiring constant developer intervention.

Together, these innovations move beyond quick fixes. They outline a framework where digital economies balance creation and extraction, where player skill drives contribution, and where ecosystems evolve with stability. Tokenomics now acts as the structural core of GameFi’s revival, shaping it into a durable and mature sector.

Traditional Gaming’s Strategic Entry into Blockchain

The involvement of traditional publishers marks a decisive turning point for GameFi. What was once speculation is evolving into real technological development, backed by studios with proven track records, global IPs, and vast resources. Their presence gives the sector both credibility and expertise.

Ubisoft set the tone. With Champions Tactics on Oasys and Captain Laserhawk on Arbitrum, the company tested how Web3 utilities can deepen gameplay. These titles carry the polish of Ubisoft’s mainline productions while experimenting with player ownership, tradeable assets, and decentralized governance.

Square Enix brought a different angle. Known for narrative-driven blockbusters, it introduced Symbiogenesis on Arbitrum, minting 1,500 NFT characters in May 2024. Here the emphasis is not speculation but emotional investment—building attachment through character ownership and cross-game interoperability.

Japan’s industry has gone further, embedding blockchain into its regulatory and technical frameworks. Sega revealed Rent-A-Hero for Web3, while Bandai Namco and Konami joined Oasys as validators. Their role within the Japan Cryptoasset Business Association shows a deliberate, long-term approach rather than opportunism.

Regionally, Asia-Pacific has become the engine of Web3 gaming, home to nearly 40% of developers. Nexon is testing Maple Story N. Gameloft collaborates with Claynosaurz. Krafton develops Overdare. Netmarble builds a multi-game roadmap anchored by zkEVM architecture. Together, these moves demonstrate a systematic strategy rather than isolated trials.

The strongest signal came from Epic Games. By listing 85 Web3 titles in 2024, its store gave blockchain gaming mainstream distribution previously blocked by Apple and Google. As the creator of Unreal Engine and Fortnite, Epic’s endorsement shifts perceptions: blockchain games are no longer fringe experiments but part of the broader gaming future.

Cross-Chain Interoperability: Breaking Down Gaming Silos

Among the breakthroughs shaping GameFi 2.0, cross-chain interoperability stands out as the most transformative. It moves beyond simple asset transfers and builds systems where achievements, skills, reputation, and even game states travel seamlessly across ecosystems. The result is a gaming metaverse connected rather than fragmented.

Giulio Xiloyannis of Pixelmon highlights its real potential: a creature captured in an RPG can reappear as a card in a trading game, tradeable across platforms. This shift overturns the walled-garden model that defined both traditional and early blockchain gaming.

Protocols like LayerZero now allow digital assets to move freely between networks without losing rarity, attributes, or functional value. A sword forged in one game can be carried into another with its properties intact. Such portability dismantles the barriers that once locked investments within isolated titles.

Building this vision requires robust standards. Projects are creating universal metadata frameworks, cross-chain communication protocols, and identity systems that track achievements and ownership across multiple environments. A single player profile may soon anchor identity, assets, and reputation across all games, regardless of chain or publisher.

For players, this solves one of gaming’s deepest frustrations: losing years of time and money whenever they shift to a new title. Interoperability preserves and transfers that value, turning sunk costs into portable equity. The incentive to stay engaged no longer ends with a single game but extends across entire ecosystems, strengthening loyalty and expanding the very idea of what gaming economies can be.

From Collapse to Recovery: GameFi’s Market Shift

GameFi is climbing back from collapse with clearer signs of stability. The rebound rests on improved design, disciplined tokenomics, and more selective capital rather than a rush of speculation.

Player activity is strengthening. Daily active users now range between 4.5 and 5.5 million, a 15.7% month-over-month increase from October to November 2024. This growth aligns with better game quality and healthier economics, showing that engagement is tied to play rather than short-term profit.

On-chain data highlights the same momentum. Web3 gaming records more than 7 million unique active wallets daily, equal to 29% of blockchain activity and only slightly behind DeFi. At this pace, gaming could soon emerge as the leading sector, a sharp turnaround from the lows of 2022–2023.

Investment patterns also reflect maturity. Although overall capital inflows have contracted, the number of funding rounds rose 44% year-over-year. Q1 2025 alone brought $4.8 billion in crypto fundraising, the strongest quarter since Q3 2022, with a significant share directed at gaming infrastructure. Major players are doubling down: Andreessen Horowitz launched a $600 million GameFi fund, and Animoca Brands completed over 100 deals in 2024, building a portfolio valued at $35.6 billion.

Adoption channels are expanding. Telegram Mini-Apps, through titles like Notcoin and Hamster Kombat, attracted millions of new users with lightweight interfaces and seamless payment integration via ApplePay and PayPal. These games remain simple, but they prove how streamlined onboarding can open the door to mainstream adoption.

Regional Dynamics and Regulatory Pressures

GameFi adoption has unfolded unevenly across the globe, shaped by culture, income, and law. Southeast Asia and Africa led the first wave. Western markets remain cautious, and East Asia presents both opportunities and barriers.

Southeast Asia became the poster child. In the Philippines, Axie Infinity allowed thousands to earn income during lockdowns, proving both the potential and the fragility of play-to-earn models. Similar trends appeared in Indonesia and Vietnam, where mobile-first culture and lower wages made crypto earnings attractive. Yet these systems often funneled most rewards to managers abroad, exposing design flaws that drained local players rather than empowering them.

Africa showed comparable adoption drivers. Growing mobile penetration and unstable currencies amplified the appeal of token-based rewards, helping P2E titles spread quickly despite limited gameplay sophistication.

Western markets remain more skeptical. Cultural resistance to new earning models and stronger regulatory scrutiny have slowed adoption. As Yat Siu of Animoca Brands noted, overcoming distrust in these markets is essential if GameFi is to scale globally.

East Asia reflects how regulation can reshape strategy.

- South Korea banned P2E mechanics outright. Developers there must build games around entertainment first, which could raise long-term quality even as monetization options narrow.

- Japan permits blockchain experiments but its gambling laws complicate game design. Studios like Sega, Bandai Namco, and Konami have responded by working through industry associations and setting regulatory standards.

- China enforces a full prohibition on crypto gaming domestically, but its studios continue to build blockchain titles for international markets, exporting technical strength and production scale to global GameFi.

Beyond individual cases, broader regulatory frameworks are starting to take shape. The U.S., under Trump’s administration, signals a friendlier stance toward blockchain innovation, though the SEC’s uncertainty over token classification still clouds fundraising. The EU’s MiCA regulation offers a clearer path for tokenized games, while Singapore has crafted guidelines balancing innovation with consumer protection. Canada is reviewing tax treatment to make the space more developer-friendly.

In short, these patterns highlight a dual reality. In some regions, cultural adoption fuels growth but loose regulation risks instability. In others, strict rules force developers to prioritize quality and compliance. For GameFi to achieve global scale, projects must tailor strategies to local conditions while preparing for the gradual convergence of regulatory standards worldwide.

| Region / Country | Adoption Drivers | Regulatory Landscape | Outlook |

| Southeast Asia (PH, VN, ID) | Mobile-first culture, lower wages, crypto as extra income | Generally permissive but fragmented rules | Strong adoption base, but needs models that share value fairly |

| Africa | Rising mobile use, currency instability, income gap | Light oversight in many markets | Fast adoption despite simple games; potential for leapfrog growth |

| Western markets | High income, mature gaming culture | Strict oversight, user skepticism, SEC uncertainty | Adoption slow; success hinges on trust and compliance clarity |

| South Korea | Advanced gaming ecosystem, strong domestic spend | Ban on P2E mechanics | Forces focus on gameplay-first design; potential quality boost |

| Japan | Deep gaming culture, tech-savvy audience | Gambling laws complicate blockchain mechanics | Big studios involved; industry associations pushing standards |

| China | Huge gaming industry, strong dev talent | Total ban on crypto gaming domestically | Developers build for export; influence global markets |

| United States | Large capital base, strong VC ecosystem | Pro-blockchain government stance, SEC ambiguity | Potential growth hub if securities rules stabilize |

| European Union | Integrated market, institutional capital | MiCA regulation creating unified rulebook | Clearer compliance path; foundation for sustainable expansion |

| Singapore | Regional financial hub, innovation-friendly culture | Guidelines balancing innovation and consumer safety | Attractive hub for developers and publishers |

| Canada | Strong dev talent, moderate adoption | Exploring favorable tax frameworks | Could become niche hub if tax clarity improves |

GameFi’s Next Infrastructure Test

GameFi’s infrastructure has advanced, yet major technical hurdles remain. Scalability, user experience, security, and integration continue to define the sector’s path forward.

Scalability is the first pressure point. Layer 2 networks already process millions of transactions daily, but AAA games with tens of millions of players demand far greater throughput and lower latency. Developers are exploring game-specific blockchains, advanced state channels for real-time play, and hybrid designs that keep heavy logic off-chain while securing assets on-chain.

User experience has improved with account abstraction, reducing wallet friction. Still, players struggle with asset custody, cross-chain movement, and crypto concepts. The next step is full abstraction: a seamless experience where Web3 operates in the background and gameplay comes first.

Security risk remains high. With valuable assets in play, a single contract flaw can drain economies. Teams now use multi-signature treasuries, formal verification, insurance mechanisms, and rapid-response protocols to protect players.

Integration poses another challenge. Developers must juggle blockchain tech and traditional game design, while players manage multiple wallets and standards. Industry-wide efforts on shared frameworks, common interfaces, and universal identity systems aim to simplify this landscape and unlock true scale.

GameFi’s Future

GameFi’s trajectory lies between extremes. It is unlikely to mirror the explosive surge of 2021–2022, and equally unlikely to vanish entirely. The sector now points toward conditional success, driven by genuine entertainment value enhanced with blockchain utilities rather than speculation disguised as play.

Market projections frame this path. By 2026–2027, capitalization could stabilize in the $30–50 billion range if quality improvements continue. With proven AAA titles and sustainable economies at scale, the market could expand further to $80–150 billion by 2030, capturing 10–15% of the global gaming industry.

Challenges remain sharp. Retention rates lag badly: more than 60% of Web3 players drop off within 30 days, while successful free-to-play games hold 80–90% on Day 7. The quality gap with traditional titles is still wide. Token volatility disrupts economic planning. And 52% of potential players report they do not understand blockchain gaming at all, underscoring the scale of education and marketing still required.

Clearer success criteria are emerging. Winning projects must deliver gameplay that entertains even without tokens, pair it with sustainable tokenomics built on multiple revenue streams and deflationary pressure, guarantee real ownership and cross-game interoperability, keep communities engaged through market cycles, and secure partnerships that pull new audiences into Web3.

The next 12–24 months will serve as a stress test. AAA releases in 2025 will reveal whether blockchain enhances gameplay or only adds friction. Account abstraction will prove if seamless wallets can finally remove onboarding barriers. New economic models will determine whether retention improves or whether players gravitate back to the free-to-play systems they know.

The coming phase will decide if GameFi matures into a permanent force in global gaming, or fades again into speculative excess.

Conclusion: GameFi’s Next Chapter

GameFi has reached a turning point. The failures that erased 93% of early projects forced hard lessons in design, economics, and technology. The new wave is built on stronger foundations: streamlined infrastructure, tokenomics designed for sustainability, AI-driven experiences will make games dynamic and engaging rather than extractive.

The shift in focus is clear: entertainment comes first, with blockchain as an enhancer rather than the core pitch. Ownership, interoperability, and player-driven economies add depth instead of replacing fun. Traditional gaming giants like Ubisoft, Square Enix, and Epic Games now bring credibility and production expertise, pushing quality standards far beyond the speculative models of GameFi 1.0.

The road ahead still demands discipline. Gameplay must stay central, economies must hold against inflationary pressure, and user experience must be frictionless. If GameFi avoids repeating past mistakes and delivers lasting entertainment, it can grow into a permanent force within global gaming. We will see if 2025 marks either the year GameFi collapsed for good, or the year it finally came of age.