Germany’s AfD Calls on Government to Recognize Bitcoin as a Strategic Asset

- Germany’s main opposition party, AfD, wants the government to treat Bitcoin as a strategic national asset

- AfD says Bitcoin should not fall under the EU’s MiCA regulation

- The motion argues overregulation threatens innovation and financial freedom

- AfD suggests Bitcoin could serve as part of Germany’s currency reserves

- The party supports tax exemptions, VAT relief, and self-custody rights

- Germany ranks third in Europe for total crypto value received, according to Chainalysis

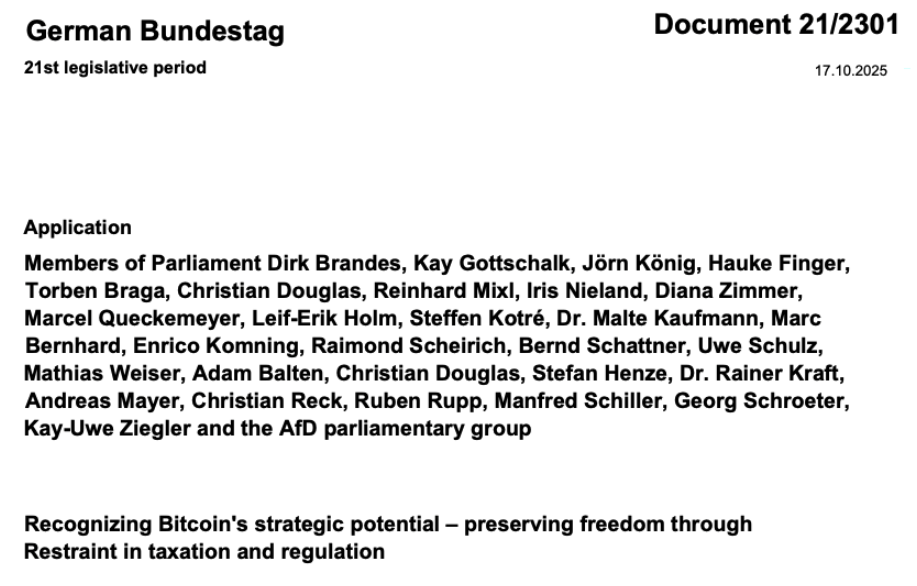

Germany’s main opposition party, Alternative for Germany (AfD), is calling on the government to recognize Bitcoin (BTC) as a strategic national asset and treat it differently from other cryptocurrencies. The motion, officially submitted to the Bundestag (German parliament), argues that Bitcoin’s decentralized nature makes it unique and deserving of a separate regulatory approach.

Filed on Thursday, the AfD’s proposal opposes what it calls the “overregulation” of Bitcoin under the European Union’s Markets in Crypto-Assets (MiCA) framework. The motion warns that too much regulation could harm Germany’s innovation, financial freedom, and digital sovereignty.

“Overregulation of Bitcoin service providers and users in the course of national MiCA implementation jeopardizes Germany’s innovative capacity, financial freedom, and digital sovereignty,” the motion states.

The AfD also highlighted that while Germany’s current tax rules for Bitcoin are relatively favorable, the lack of legal clarity discourages long-term investors. The party is pushing for clearer guidelines that support Bitcoin-friendly taxation and citizen rights in managing their crypto assets.

In its proposal, AfD urged lawmakers to recognize Bitcoin’s potential strategic role in the country’s financial system, especially as a hedge against monetary instability and as a tool for energy integration. The party believes Bitcoin could be treated as part of Germany’s national reserves, similar to how some countries are considering holding BTC as a reserve asset.

“The German government has so far failed to strategically recognize Bitcoin, for example as a technology for energy integration or, in times of increasing monetary instability, as an asset held within the framework of currency reserves,” the motion reads.

The AfD also proposed several key measures to strengthen Bitcoin adoption in Germany:

- Maintain the 12-month holding period for tax-exempt BTC gains

- Keep Bitcoin’s VAT exemption

- Protect the right to self-custody for individuals and businesses

This move places Germany among a growing number of European nations exploring Bitcoin as a strategic or reserve asset. Earlier in October, Éric Ciotti from France’s Union of the Right for the Republic also filed a motion urging softer MiCA regulations and support for stablecoins, while opposing central bank digital currencies (CBDCs).

However, not everyone agrees that MiCA is bad for crypto adoption. According to Chainalysis, the MiCA framework — fully implemented in late 2024 — has helped make Germany one of Europe’s top crypto-friendly destinations. The latest Chainalysis Europe Crypto Adoption Report ranked Germany third in Europe by total crypto value received, showing strong growth despite regulatory debates.

Final Thought

AfD’s motion shows that Bitcoin is becoming more than just an investment topic — it’s entering the political and economic discussion at a national level. As Germany debates Bitcoin’s role as a strategic asset, the country could set an important example for how major economies integrate decentralized digital money into their financial systems.