Grayscale: Chainlink Is the “Critical Connective Tissue” Driving Tokenized Finance

- Grayscale says Chainlink is core infrastructure for tokenization

- Report highlights LINK as essential middleware connecting blockchains to real-world data

- Chainlink now the largest non–layer-1 crypto asset by market cap (excluding stablecoins)

- Tokenized asset market grows from $5B to $35.6B since early 2023

- Chainlink involved in crosschain settlement tests with JPMorgan, Kinexys and Ondo Finance

Grayscale has declared that Chainlink will anchor the next major phase of blockchain adoption, calling it the “critical connective tissue” linking digital assets with traditional finance. In a new research report, the asset management firm explains that Chainlink’s expanding range of tools has positioned the project as essential infrastructure for tokenization, crosschain settlement and the movement of real-world assets onto blockchain networks. As institutions increasingly explore blockchain-based settlement, Grayscale says Chainlink is emerging as the technology stack at the center of this evolution.

According to the report, Chainlink has evolved into modular middleware that lets on-chain applications securely use off-chain data, communicate across multiple blockchains and meet advanced compliance requirements. This broader role has lifted LINK to become the largest non–layer-1 crypto asset by market capitalization, excluding stablecoins. Grayscale emphasizes that this gives LINK holders exposure to activity across many ecosystems, rather than a single blockchain environment.

The firm highlights tokenization as the clearest example of where Chainlink’s impact is most visible. Today, most financial assets — including securities, commodities and real estate — still exist on off-chain ledgers. For these assets to benefit from blockchain features such as programmability, automation and instant settlement, they must be tokenized and supported by reliable data feeds. Grayscale argues that Chainlink is positioned to coordinate this shift, backed by major partnerships with companies like S&P Global and FTSE Russell.

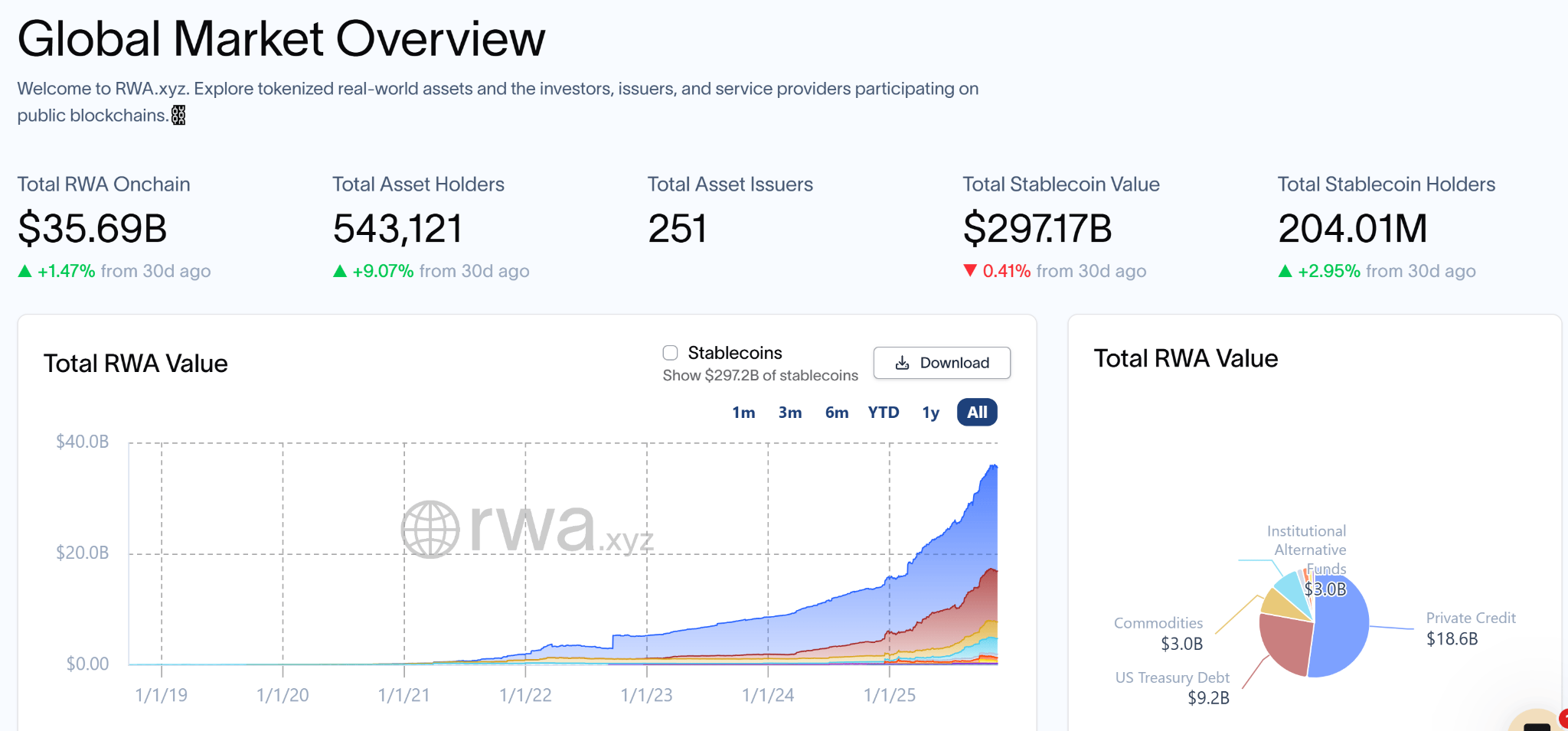

The tokenized asset market has expanded dramatically, rising from $5 billion in early 2023 to more than $35.6 billion today. Grayscale expects this growth to accelerate as institutions seek faster settlement, reduced operational risks and improved interoperability across financial systems. Chainlink’s suite of tools — including its oracles, crosschain protocol and security layers — is expected to power much of this transition.

One of the most significant real-world demonstrations of Chainlink’s role came in June, when the project helped facilitate a crosschain delivery-versus-payment (DvP) settlement test involving JPMorgan’s Kinexys network and Ondo Finance. The experiment connected Kinexys Digital Payments, a permissioned institutional payment system, with a public blockchain testnet used by Ondo Chain for tokenized U.S. Treasurys and other real-world assets. Chainlink’s Cross-Chain Interoperability Protocol and Runtime Environment enabled the exchange of Ondo’s tokenized Treasury fund (OUSG) for fiat payment without either asset leaving its native chain. Grayscale points to this as proof that Chainlink can bridge institutional infrastructure with public blockchain ecosystems.

Overall, the research report reinforces the view that Chainlink is becoming one of the most important layers of blockchain infrastructure. As tokenization gains momentum and financial institutions adopt blockchain rails for settlement and asset management, Grayscale argues that Chainlink will sit at the center of this global shift — making LINK a key asset in the emerging tokenized economy.

Final Thought

Grayscale’s analysis shows rapidly growing institutional confidence in Chainlink’s role as the connective layer of the tokenized finance ecosystem. With partnerships spanning major financial data providers and successful crosschain settlement pilots involving top banks, Chainlink appears set to remain a core part of blockchain’s next growth cycle.