NYSE Approves Grayscale DOGE and XRP ETFs, Launch Set for Monday

- NYSE Arca approves Grayscale’s Dogecoin (GDOG) and XRP (GXRP) ETFs

- Trading for both ETFs begins Monday

- Chainlink ETF from Grayscale expected to follow next week

- New ETFs add to the wave of crypto ETF launches in the U.S.

- XRP ETF competition grows as multiple issuers enter the market

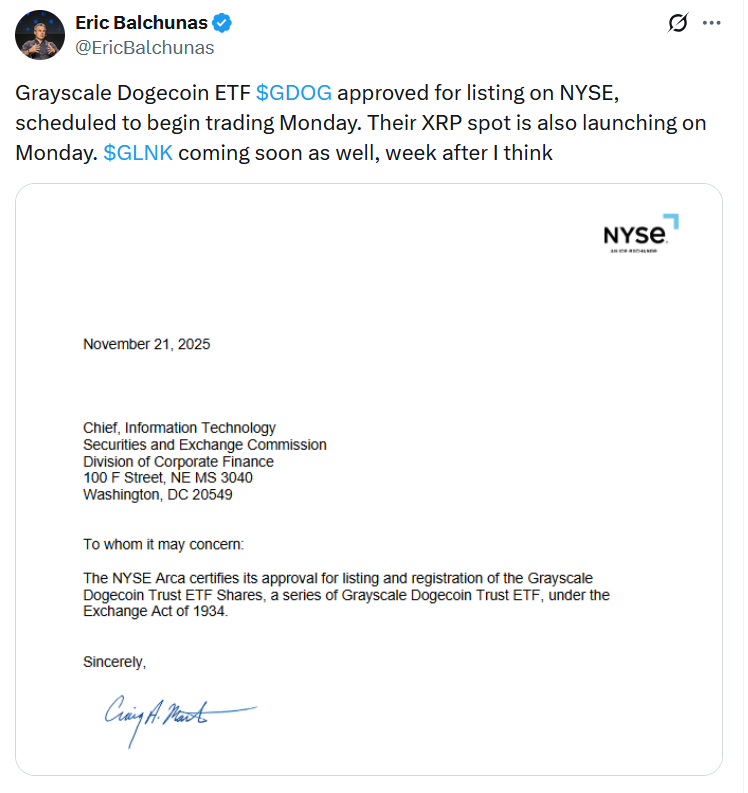

The New York Stock Exchange has officially approved the listing of Grayscale’s Dogecoin and XRP ETFs, setting both products up to begin trading this Monday. This approval comes through NYSE Arca, a subsidiary of the exchange, which submitted the final required filings to the Securities and Exchange Commission. With this certification complete, Grayscale can now move forward with launching the Grayscale Dogecoin Trust ETF (GDOG) and the Grayscale XRP Trust ETF (GXRP) on schedule.

Bloomberg ETF analyst Eric Balchunas shared the approval documents on social media, noting that Grayscale’s Chainlink ETF is also nearing launch and may arrive the following week. According to Balchunas, both the DOGE and XRP ETFs are expected to debut on Monday and could draw strong early trading interest. He also predicted that Grayscale’s Dogecoin ETF could see around $11 million in trading volume on its first day.

The Dogecoin ETF is a conversion of Grayscale’s existing DOGE trust into a fully tradable exchange-traded fund that tracks the spot price of Dogecoin. This move brings Dogecoin closer to mainstream financial markets and adds another speculative cryptocurrency to the growing list of spot ETFs approved in recent weeks. The approval highlights the increasing appetite from asset managers to offer crypto-related investment products as market demand continues to rise.

XRP is also seeing rapid growth in ETF availability. Grayscale’s XRP ETF will launch at the same time as Franklin Templeton’s competing XRP fund, while an ETF from WisdomTree is still waiting for its official start date. The U.S. market saw its first spot XRP ETF earlier in November when Canary Capital launched its XRPC fund. That ETF started strong, drawing more than $250 million in inflows on its first day of trading, signaling strong investor interest in XRP-based products.

In addition to Grayscale and Canary Capital, firms like Bitwise, 21Shares, and CoinShares have also introduced XRP ETFs this month. These launches accelerated after the U.S. government shutdown ended and the SEC eased its restrictions around crypto ETF approvals, opening the door for a wave of new investment vehicles.

Even with the excitement around ETFs, XRP’s price has struggled, falling around 18% since the beginning of November based on data from CoinGecko. Market analysts note that ETF launches do not always lead to immediate price increases, especially when multiple similar products enter the market at the same time.

Overall, the approval of Grayscale’s DOGE and XRP ETFs marks another major step in integrating popular cryptocurrencies into traditional investment markets. With more crypto ETFs launching every week, the U.S. market is rapidly expanding, giving investors more access and more ways to gain exposure to digital assets.

Final Thought

The launch of Grayscale’s Dogecoin and XRP ETFs adds momentum to the growing wave of crypto investment products hitting U.S. markets. As more issuers join the competition, investors now have more choices than ever, although the impact on asset prices remains unpredictable. Monday’s launches will be a key moment to watch as DOGE and XRP make deeper inroads into mainstream finance.