How to Find Hidden Gem Coins with 100x Potential

This guide provides a complete framework for how to find hidden gem coins before they explode. Discovering crypto with 100x potential requires more than just luck; it demands data, discipline, and a clear strategy. We will walk you through analyzing on-chain metrics, tokenomics, developer activity, and community sentiment to spot high-value projects and avoid common traps.

Understanding the Fundamentals of a Crypto Hidden Gem

To truly grasp how to find a hidden gem coin, we first need to understand the fundamental components of a Web3 protocol for assessing its viability & potential.

The very first key element you should pay attention to is the Whitepaper. This is the foundational document of any serious Web3 project. A robust protocol clearly articulates the problem it aims to solve, how its decentralized solution is superior to existing alternatives, and provides a detailed technical overview. You might want to avoid marketing buzzwords and look for a realistic roadmap with feasible tech solutions (the architecture, layers, or smart contracts, etc.)

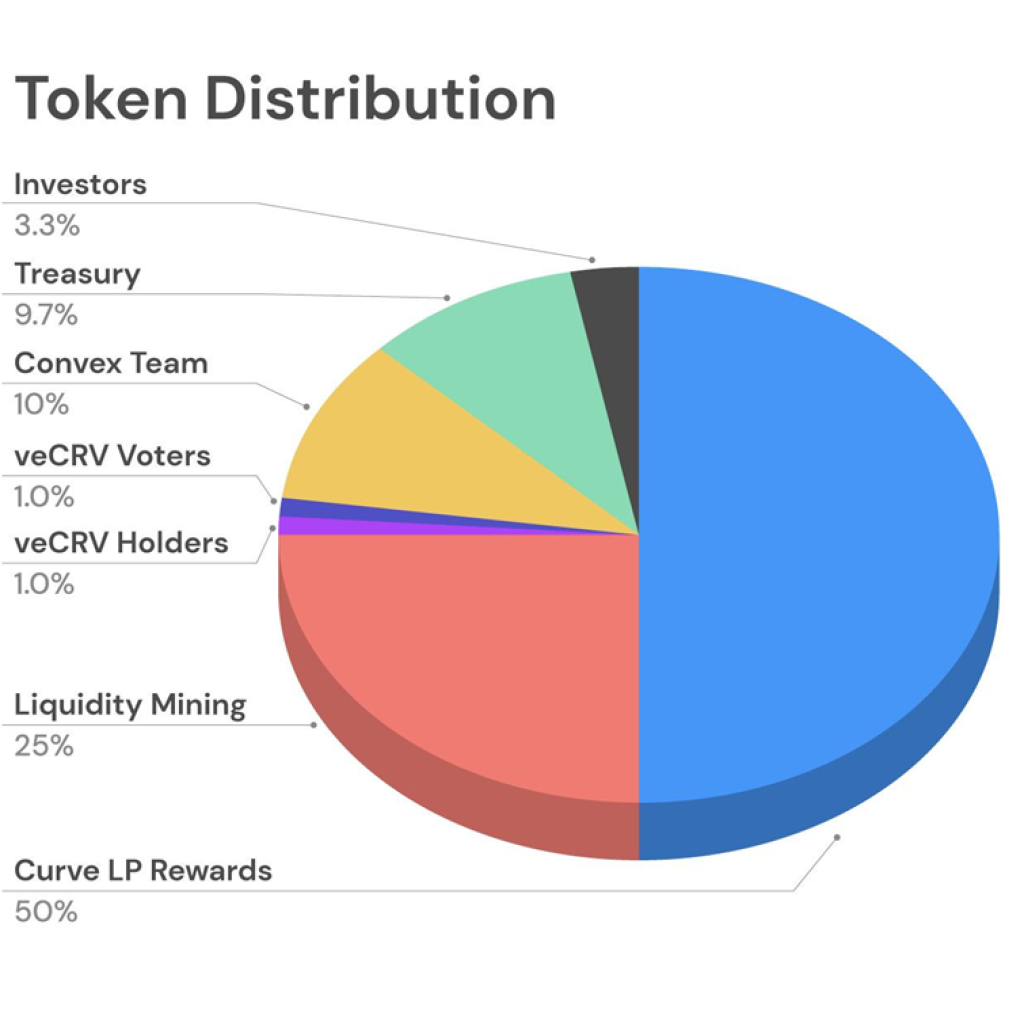

Secondly, because you’re discovering a cryptocurrency, you must understand its Token Utility & Tokenomics – the economic engine of the whole project. Tokenomics is the economic design (principles & mechanisms) that governs a cryptocurrency or a token. This factor is utterly important in deciding the entire ecosystem’s sustainability & growth. A well-designed tokenomics model carefully considers:

- Token Supply: The total number of tokens that can exist, how they are created (minted), and how they might be removed from circulation (burned). Will there be a fixed number of tokens, or will it be inflationary or deflationary?

- Distribution: How will tokens be allocated to the team, the community, and investors? How the distribution might change over time (e.g., through vesting schedules)

- Utility: What can the token be used for? Such as transaction fees, governance, voting, or as a store of value.

- Incentives: Tokenomics also outlines the incentives for users to hold or use the token, which can include staking rewards, discounts, or access to exclusive features.

- Market Dynamics: Factors like supply and demand, inflation or deflation, and how the token interacts with other economic processes are also considered

A 5-Step Framework for Finding Hidden Crypto Gems

Before you continue to read our methods for finding hidden gems in the crypto world, please note that this methodology is based on the research of our team and is recommended as a reference only. There is no guarantee of spotting the true “stars” among thousands of tokens, so due diligence is highly suggested.

Now, let’s find out how we do Web3 project analysis to distinguish the next “Solana or PEPE”?

1. Start with On-chain Metrics

The transparency of blockchain allows us to track every transaction, every token movement, and observes changes in user behaviors in real-time, so use that to examine these below crypto fundamental & on-chain metrics:

- Daily Active Wallets – This is the most important metric because it shows how many people are actually using the network. A project might have a high price but if daily active wallets are low, that could be a sign of manipulation.

- Transaction Volume – Don’t just look at total volume but analyze whether this volume is evenly distributed or concentrated in a few large wallets. Natural volume usually tends to grow steadily over time.

- Tokenholder Growth – The number of token holders increasing over time is a positive sign. What’s important is the rate of this growth – sudden growth might be a sign of airdrops or marketing events, while steady growth usually reflects real adoption.

- Liquidity on Decentralized Exchanges (DEXs) – High liquidity allows smoother trading and less slippage. This is especially important for new tokens.

- TVL (for DeFi projects) – Total Value Locked shows the level of user trust in the protocol. Steadily increasing TVL is usually a good sign.

Tools like Dune Analytics, Nansen, and DefiLlama can help you easily access on-chain data, though they may charge fees if you want to dive deep into it.

2. Evaluate their Tokenomics

Tokenomics represent the economics principles and systems behind a cryptocurrency. As noted, how to evaluate tokenomics is a crucial skill, and we’ve mentioned all components of a protocol’s tokenomics in the Fundamentals part.

Next, ask “Are there upcoming unlocks or vesting cliffs?” – Large unlocks can create strong selling pressure. Knowing this schedule in advance helps you prepare mentally and strategically. Find reasonable buy or sell points.

When investigating a project, you can first ask “What’s the total supply? How much is circulating?” This can help you determine, to some degree, about the growth potential & the stability of the tokens. Tokens with fixed supply are usually more price-stable than tokens that can be printed infinitely. You can also perceive whether the tokens are deflationary or inflationary.

When all the volumes are known, try to find out “Who holds tokens and what’s the concentration level of top wallets?” If most tokens are held by a few wallets, that’s a big risk. Fair distribution is usually better for long-term development.

The last thing we want to recommend to you is seeking any other function of the token in the ecosystem rather than a sole financial tool, since tokens with real utility usually have more long-term value.

Remember that tokens with limited total supply, smart incentives (like staking or burning mechanisms), and fair distribution models tend to perform better long-term.

3. Check Developer Activity

There are multiple ways you can use to track if the team is actually building, not just another crypto red flag. But we suggest you follow the 2 easiest tactics to identify ongoing projects (more tactics are better but these are the most essential ones).

The first step is checking the project’s on-chain and community activities. You can use explorers like [chain]-scan or Dune Analytics to monitor contract deployment and updates or analyze their usage metrics. Some may see that communities are hard to track but just look whether it is the dev team chatting, community testers giving real feedback, or even the team hiring more positions.

After trying that tactic, you can delve deeper with the team’s Testnet/Devnet progress and GitHub updates. In fact, GitHub is a goldmine of information. The GitHub code needs to be public with a clear README. Look at how frequently code is pushed, how many contributors are active, and whether the repo looks alive. Though it can be more complicated, if you’re familiar with coding, pay close attention to meaningful code changes and open issues being resolved. No updates for months? That’s a warning sign.

A good project will have:

- Regular commits (at least a few times per week)

- Multiple different contributors

- Clear and updated documentation

- Issue tracking and community involvement in development

4. Look for Ecosystem in Web3 Project Analysis

When assessing a crypto with 100x potential, real traction shows up when other developers start building on or integrating the protocol. Ecosystem growth is very hard to fake, and it’s usually the strongest early indicator that a project has legs.

You can go straight to the project’s website and check if there are independent teams launching DApps, tools, or games on top of the protocol? Have they formed any integration with bridges like Wormhole or LayerZero, Wallets like MetaMask, Alchemy Pay, or unique scaling solutions like Metis or GOAT Network. For example, when you research about IOTeX, you can spot the protocol has been supporting & integrating with 230+ different projects:

5. Follow the Community

X (Twitter), Discord, Telegram, Reddit – yes, it’s noisy. However, since in Web3, the strength of a project’s community often precedes price movement of its token, we still recommend joining all possible channels you can find about the project to help determine a true Hidden Gem.

One thing to note is that if you stay long enough in this crypto world, you get familiar with the concept of shilling/seeding. So make sure the communities’ members chat, not chatter. Beyond price conversation, you can ask:

- Are people actually using the product?

- Do devs answer questions?

- Is the tone constructive or just hype?

- Are KOLs actually talking about it, or just soullessly promoting it?

Use LunarCrush or Santiment to track social momentum, but always double-check it with on-chain data.

Furthermore, when you decide to listen to a KOL/builder, don’t fool yourself with their pros-cons tricks. Push your brain to work – who are they? Builders, researchers, or just meme influencers? Do they actually use the products and are respected accounts in crypto X engaging in their threads, analysis, or building tools?

*Please note that all the tactics you use can only point out 1 or more bullish signs. The market is intrinsically speculative, and even experts can guarantee nothing. So take our methods as a reference only.

Analyzing Crypto Trends in 2025

The markets have seen several fluctuations of bullish & bearish periods in 2025. Analysts and investors have their own strategies to determine and evaluate hidden gem coins in crypto trends. However, not everyone has enough knowledge and experience to craft an effective plan in finding the stars. A coin might be flying, but is it because people are actually using it or just talking about it? We’ve outlined some points to help distinguish the difference can save you from bad investments.

Signs of Real Traction

| Sign of Quality | Description |

| Steady User and TVL Growth | If users appear before the token pumps – and numbers continue rising week over week – that’s usually a sign of quality. You often see this in DeFi protocols or layer 2s gaining trust gradually, not overnight. |

| Code Commits and Product Updates | A lively GitHub with regular commits, active devs, and visible progress means the team is building. This shows momentum and long-term focus – not just a marketing push. |

| Tokenholder Distribution | When new holders join steadily – and supply isn’t locked up by the top 5 wallets – that’s a healthier setup. Distributed ownership reduces rug pull risk or organized dumps. |

| New Integrations and Ecosystem Activity | If other apps are integrating the token or building on the protocol, it usually means the tech is solid and useful. This type of network effect compounds quickly and often precedes a breakout. |

| Gradual Liquidity Building | Gradual increases in liquidity and trading volume tend to reflect real interest. If liquidity sticks (instead of disappearing after a pump), it’s usually organic. |

Signs of Fake Hype

| Red Flag | Description |

| Sudden Spikes Without News | If a project appears everywhere on social media overnight, but there are no product updates, launches, or roadmap changes, be skeptical. It might be organized shilling. |

| Influencer Spam | When you see multiple anonymous influencers posting the same meme or catchphrase, that’s a signal someone is trying to manufacture buzz. |

| No Dev Activity or Roadmap | If there’s no GitHub, no changelog, and the team isn’t shipping anything, it might just be a hype machine. |

| Anonymous Team, Excessive Promises | Combine a mysterious team with claims like “100x guaranteed,” and you might be looking at a cash grab. Real builders let the work speak. |

| Rule of Thumb | If price is moving and everything else – users, devs, integrations – is standing still, you’re looking at hype. Don’t let fake pumps get you excited, as these might be traps for inexperienced investors. |

Dangerous Signals & Crypto Red Flags to Avoid

Some projects look great on the surface – shiny websites, trending hashtags, fast-moving charts – but collapse under the hood. Here are some other red flags to watch for:

- High holder concentration: If most tokens are sitting in a few wallets, it doesn’t take much to have a price crash. Whales often buy early and dump them on retail.

- Unverified token contract: An unverified token on Etherscan or BscScan might hide functions allowing minting, wallet blocking, or draining liquidity. Always check the contract or look for audits.

- No liquidity lock or audit: If devs control all liquidity provider tokens and there’s no lock or time-locked contract, they can pull the rug anytime. Similarly, no third-party audit? That’s a gamble.

- Large token unlocks coming: Big unlocks for insiders or early investors can trigger massive sell-offs. If you’re holding during a major vesting event, you might exit liquidity. Know the schedule.

*Important tip: Before you click buy, ask yourself: Do you have enough information about it? What’s your buying plan? How will you allocate capital? What are the risk mitigation plans?

If you can’t really answer these questions, you’re still just prey, not a gem hunter.

Success Stories

Solana – A Lesson in the Breakthrough Technology

When Solana launched in 2020, few people outside the developer community knew about it. But it had a major advantage: speed. And this is what made Solana a true hidden gem at that time. Solana’s proof-of-history technology made it one of the fastest blockchains, and it quickly became a magnet attracting builders, especially in DeFi and NFT fields.

Those seeking investment opportunities who noticed on-chain growth like wallet activity and DEX volume could see something was happening. Solana rose from under $1 to over $50 in less than a year. The key here was observing technical metrics and actual adoption, not just rumors or hype.

Arbitrum – The Power of Infrastructure

Arbitrum was launched in 2021 as an Ethereum layer 2 with low fees, high speed, and compatibility with Ethereum. Currently, Arbitrum is in the top 100 crypto projects by market capitalization with over 1000 protocols in 5 main categories – DeFi, Bridges and On-ramps, Gaming, NFTs, and Infrastructure & Tools.

However, the project’s popularity truly exploded in March 2023 following the launch of the ARB token airdrop. Arbitrum continued to explode in December 2024 when its Total Value Locked (TVL) surged to a four-year high of $3.054 billion. While this figure has since decreased, its TVL remains substantial at over $1 billion.

Gem hunters had been following the project even before there was a token, the signs were there: user activity, increasing liquidity, and growing application adoption. When ARB was airdropped, the pump was sustainable because the foundation was real.

Chainlink – Long-term Utility Value

Chainlink is a classic example of a project focused on long-term utility. It didn’t have flashy branding or meme power, it just focused on doing one thing extremely well: providing real-world data to smart contracts.

By 2024, it had become the backbone of most DeFi, gaming, and even tokenized real-world assets. If you paid close attention in 2019-2020, you would see LINK being integrated everywhere. And that was a good signal for smart money to flow into LINK.

PEPE Coin – Meme Phenomenon and Crowd Psychology

You might not like meme coins because you think they have no intrinsic value, but don’t think memes aren’t important. Pepe launched in 2023 with no roadmap, no utility, and no VC support. But it touched a type of culture, and the entire internet ran after it. The coin reached a billion-dollar market cap within weeks.

That type of run is rare – and risky. But for traders monitoring social sentiment, wallet distribution, and community activity, the early signals were all there. PEPE promised nothing, but it delivered profits by becoming a viral moment.

“Emotion has no price, but it’s priceless” – Meme Trader.

Conclusion: Becoming a Gem Hunter, Not Prey

After reading this article, we hope you clearly perceive that finding the next 100x crypto is not a lottery; it’s a discipline. Our process of how to find hidden gem coins relies on a repeatable framework, which includes performing rigorous crypto fundamental analysis, evaluating tokenomics, tracking on-chain metrics and developer activity, and spotting crypto red flags. However, remember that the market is speculative, and no method guarantees success. But by applying this structured approach, you can form the ground to move from being prey to hype and manipulation to becoming a calculated gem hunter.