Mysterious Hyperliquid Whale Doubles Down on Bitcoin Short with $496M Bet

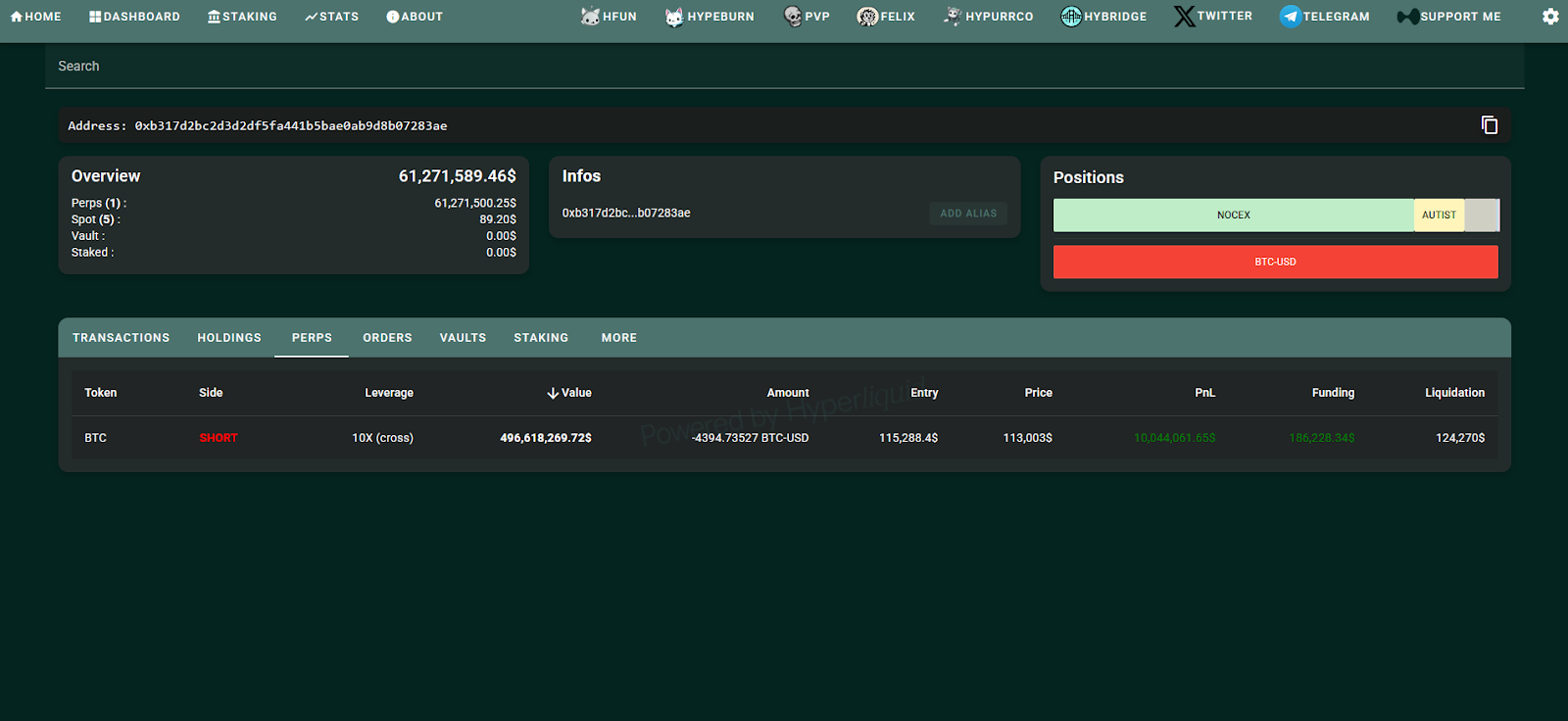

A mysterious Hyperliquid whale has increased their Bitcoin short position to nearly $496 million, doubling down on a bet against the crypto market. Despite the whale’s success in profiting from the recent market downturn, the identity of the trader remains shrouded in mystery.

- Hyperliquid whale adds $333 million to their Bitcoin short, bringing total to $496 million.

- The trader is using 10x leverage, with a liquidation price at $124,270.

- Whale’s short position was opened before Trump’s tariff announcement, which led to a massive market crash.

- Blockchain sleuths point to Garrett Jin, former BitForex CEO, as a potential suspect behind the whale.

- $192 million profit from the whale’s previous short position during the recent market crash.

- Identity remains unclear, but Jin’s social media posts fuel speculation.

The Hyperliquid whale has made waves again, doubling down on their aggressive market stance by adding $333 million to their existing Bitcoin short position, which now totals approximately $496 million. This massive bet was made with 10x leverage, and the trader’s liquidation price is set at $124,270, making this one of the largest positions in recent weeks.

Blockchain data from Hypurrscan, Hyperliquid’s block explorer, revealed that the whale’s short bet came shortly after the initial $163 million position opened just a day earlier. This quick escalation has caught the attention of market watchers, especially considering the strange timing of the short position opening just hours before US President Donald Trump’s tariff announcement, which sent the crypto market into a freefall.

The whale first made headlines when they held $11 billion in BTC, sparking widespread speculation. Last week, they made headlines again with $900 million worth of shorts on Bitcoin and Ether. The timing of the whale’s moves has led many to label them the “insider whale”, with several users speculating that the trader may have inside knowledge of Trump’s tariff moves.

The market’s interest in this whale’s moves has led to deeper investigation. Blockchain sleuth Eye pointed to Garrett Jin, the former CEO of BitForex, a now-defunct exchange, as a possible suspect behind the whale’s wallet. While Binance CEO Changpeng Zhao (CZ) shared the thread on X, ZachXBT later speculated that the wallet might belong to one of Jin’s associates rather than Jin himself.

Jin himself addressed the allegations in a series of posts on X, where he clarified that he had no connection to Trump or his family, insisting that the funds behind the whale were “client funds”.

Despite Jin’s denials, the whale’s actions have fueled continued speculation. With a liquidation price just above $124,000, the whale’s position may have significant repercussions if the Bitcoin market faces further downward pressure. The increased short position and the timing of the moves continue to raise questions, especially as market participants remain cautious amid geopolitical and market volatility.

Final Thought

The Hyperliquid whale’s position exemplifies how major players are betting on Bitcoin’s price movement, and its actions are likely to continue impacting the market in the coming days. While the identity behind the whale remains a mystery, analysts will be watching closely to see if this bet pays off or if the market rebounds.