Investigation Links Hyperliquid Whale Controlling 100,000 BTC to Former BitForex CEO Garrett Jin

A new onchain investigation has reportedly linked the mysterious Hyperliquid whale, who controls more than 100,000 BTC, to Garrett Jin, the former CEO of the now-defunct exchange BitForex, which collapsed amid multiple fraud probes.

- On-chain data ties Hyperliquid whale wallets to Garrett Jin, ex-CEO of BitForex.

- The main wallet, ereignis.eth, connects to Jin’s verified @GarrettBullish account.

- The wallet activity mirrors BitForex-era transactions and Huobi-linked transfers.

- BitForex was accused of fake trading volumes and lost $57M before shutting down.

- Jin later launched several ventures, including XHash, now under scrutiny.

- Some analysts remain skeptical, calling the link “too convenient.”

A crypto investigation has drawn a direct line between one of the largest whales on the Hyperliquid trading platform and Garrett Jin, the former CEO of BitForex, a controversial exchange that shuttered in 2024 amid fraud allegations and missing customer funds.

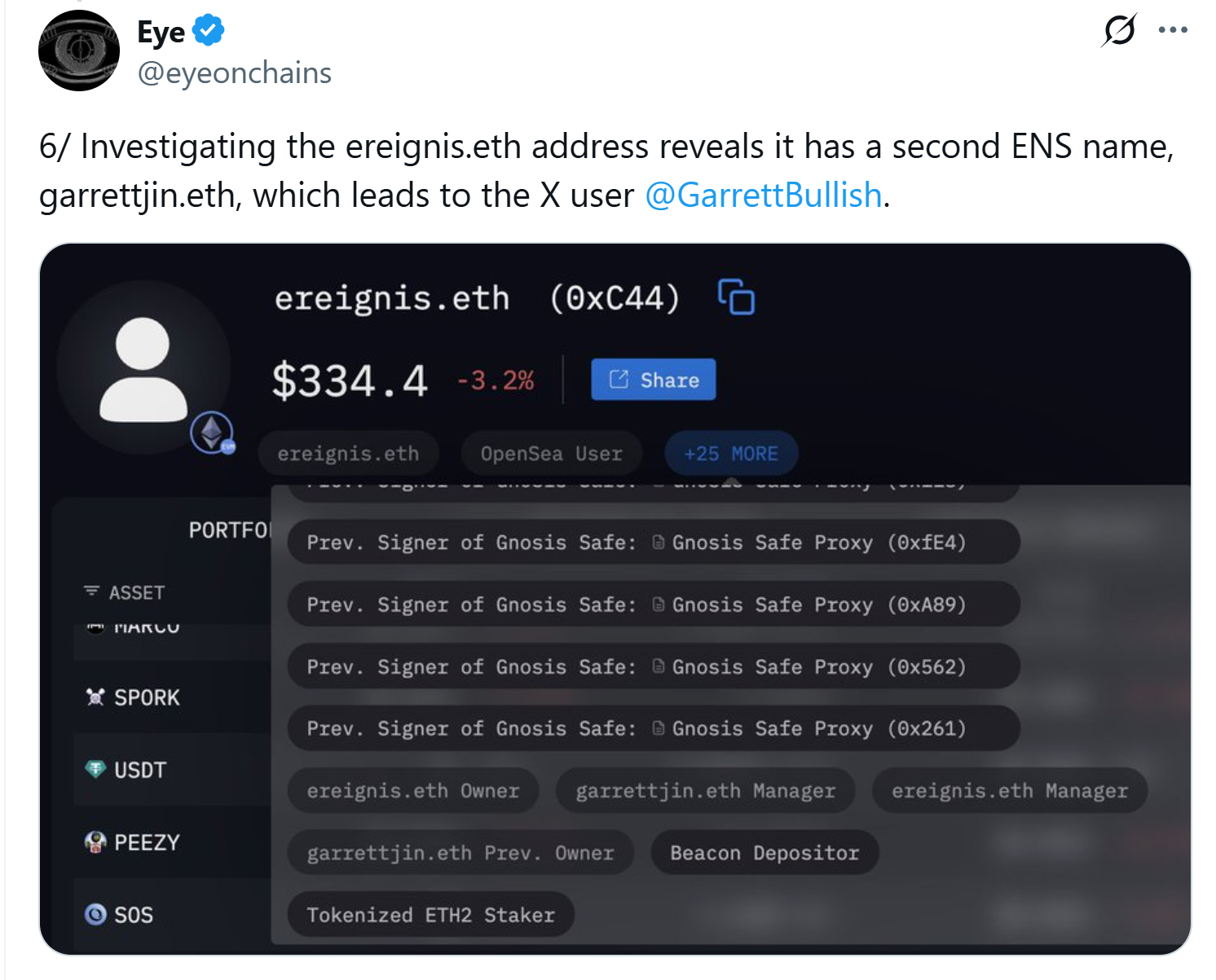

The investigation, led by onchain researcher Eye, found that the whale’s main wallet, ereignis.eth (“event” in German), is connected to another Ethereum Name Service (ENS) address, garrettjin.eth, which links directly to Jin’s verified X (Twitter) account, @GarrettBullish.

“The ENS name confirms his link to this wallet, identifying him as the actor behind the large-scale operations on Hyperliquid/Hyperunit,” Eye wrote. Blockchain records also show that the whale’s wallet interacted with multiple exchanges and addresses tied to Jin’s prior ventures — including Huobi (HTX) and former BitForex wallets.

Onchain data further revealed transfers between BitForex-associated addresses and the whale’s wallet, which later funded Binance deposits used to open a $735 million Bitcoin short position — one of the largest individual trades on record.

BitForex’s troubled history adds further intrigue to the findings. The exchange, led by Jin between 2017 and 2020, faced numerous accusations of inflating trading volumes and operating without a license in Japan. In early 2024, BitForex lost $57 million from its hot wallets, froze withdrawals, and abruptly shut down after its core team was detained in China. Hong Kong regulators later issued a fraud warning, and users reported millions in unrecovered funds.

Following BitForex’s collapse, Jin launched several ventures — including WaveLabs VC, TanglePay, IotaBee, and GroupFi — most of which have since gone inactive. In 2024, he introduced XHash.com, an institutional Ethereum staking platform. Investigators allege that XHash may have been used to move questionable funds. After these claims surfaced, Jin quietly removed XHash from his X bio, though references remain visible on his Telegram profile.

Despite mounting evidence, some analysts remain unconvinced. Crypto commentator Quinten François argued that the connection may be too obvious to be legitimate. “Why would someone link an .eth name tied to their public identity with wallets involved in potential manipulation?” he wrote. “It sounds way too simple to be true.”

Final Thought

The alleged link between Garrett Jin and the Hyperliquid whale raises new questions about how deeply old crypto scandals may intertwine with today’s major trading ecosystems. Whether the claims are accurate or a case of mistaken identity, the investigation underscores the growing transparency — and scrutiny — of onchain analytics in uncovering crypto’s hidden players.