Inside Aster DEX: 1,500% Surge After Launch

Aster DEX has quickly risen to prominence in the decentralized derivatives market, drawing attention from both traders and analysts after its high-profile launch in September 2025. As perpetual trading becomes the focal point of DeFi growth, established players like dYdX, GMX, and Hyperliquid are now facing a formidable new competitor.

This article explores how Aster’s unique design, market performance, and strategic backing position it within the broader DeFi ecosystem. By examining its origins, technological innovations, tokenomics, and risks, we aim to provide a comprehensive view of whether Aster represents the next major shift in decentralized finance.

Executive Summary

Aster DEX has quickly become one of the most disruptive forces in decentralized finance after its Token Generation Event (TGE) in September 2025. Within days, the ASTER token soared over 1,500%, capturing market attention and signaling the arrival of a new generation of perpetual derivatives platforms.

The project’s momentum is built on structural innovation rather than short-term speculation. Its “Trade & Earn” model allows users to employ yield-bearing assets as collateral for derivatives trading, a breakthrough that improves capital efficiency and integrates yield generation with high-leverage markets. Native multi-chain support, advanced tools such as hidden orders, and open endorsement from Binance’s former CEO Changpeng Zhao further reinforce its competitive edge.

With daily volumes already surpassing several incumbents and TVL approaching $1 billion, Aster is establishing itself as a credible rival to Hyperliquid, dYdX, and GMX. While concentration of token supply and regulatory uncertainties remain key challenges, the platform’s early growth highlights its potential to reshape the structure and dynamics of the DeFi derivatives market.

Formation Context and Market Positioning

Aster DEX was created in late 2024 through the merger of Astherus, a yield and liquidity protocol, and APX Finance, a derivatives exchange. This move solved a long-standing problem in DeFi: yield strategies and derivatives trading existed in separate silos. By combining them, Aster introduced a seamless ecosystem where capital works harder on both fronts.

At the center of this design is the “Trade & Earn” model. Traders can use yield-bearing assets as collateral, turning passive holdings into productive margin. This approach raises capital efficiency and gives Aster a clear edge over platforms that still rely on static, non-yielding collateral.

When the ASTER token launched in September 2025, the perpetual DEX market was largely controlled by Hyperliquid, dYdX, and GMX. Yet Aster’s rapid adoption, multi-chain support, and Binance ecosystem ties pushed it into the same league almost overnight. The result is a new competitive landscape where Aster is no longer an outsider, but a direct challenger to the market leaders.

| Protocol | Daily Volume (24h) | TVL (est.) | Core Technology | Key Strengths | Key Risks / Weaknesses |

| Aster DEX | ~$25.7B | ~$1B | Multi-chain CLOB, Hidden Orders, 1001x leverage | Trade & Earn model, Binance backing, fast growth | Token supply concentration, regulatory risk |

| Hyperliquid | ~$10B | ~$600M | Proprietary CLOB | Deep liquidity, consistent trader base | Slower innovation, no yield collateral |

| dYdX v4 | ~$2–3B | ~$450M | Cosmos SDK + off-chain orderbook | Institutional credibility, refined UX | Declining share vs new entrants |

| GMX v2 | ~$1.5B | ~$550M | GLP liquidity pool + oracles | Low fees, strong community, DeFi-native | Oracle reliance, fragmented liquidity |

Impressive Market Performance

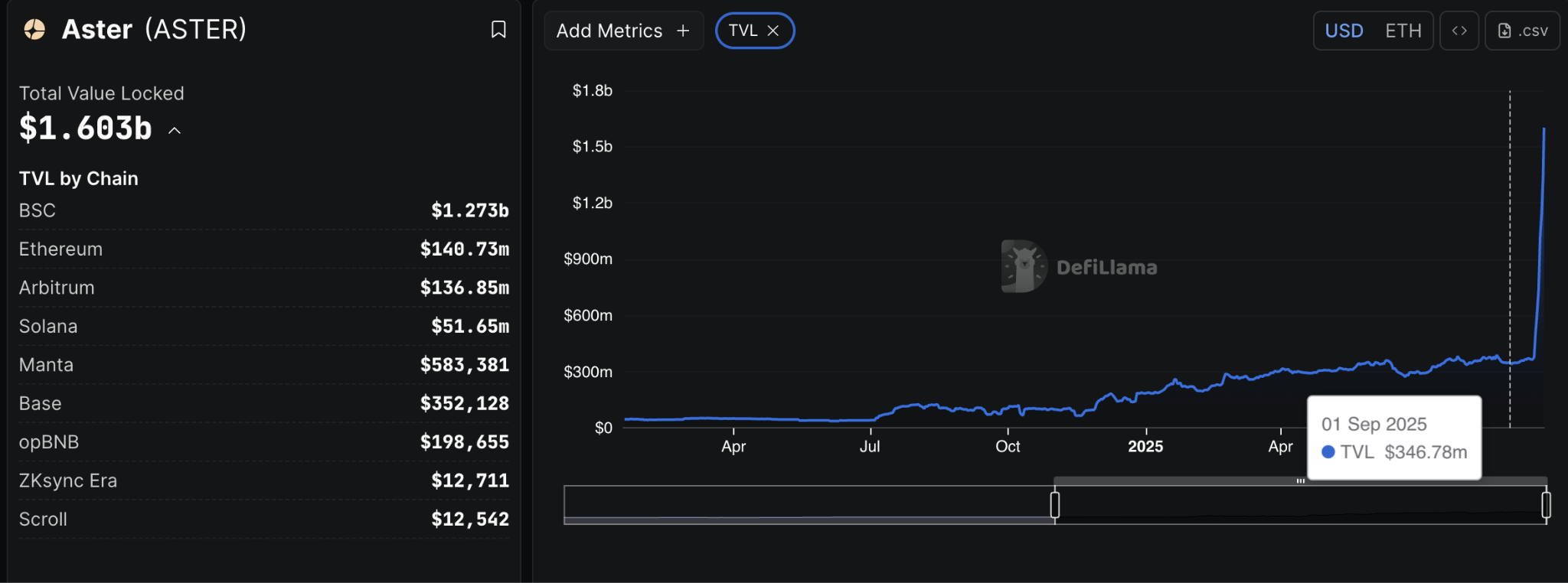

Since its Token Generation Event in September 2025, Aster DEX has posted some of the fastest growth metrics in DeFi. Total Value Locked (TVL) climbed to nearly $1 billion, while cumulative trading volume crossed $500 billion within weeks. Daily activity now averages in the hundreds of millions, placing Aster firmly in the top tier of decentralized exchanges.

The rivalry with Hyperliquid has become one of the most closely watched stories in perpetual trading. On a recent 24-hour snapshot, Aster recorded $25.7 billion in volume compared to Hyperliquid’s $10.1 billion, giving it the largest single-day share of the perp DEX market. Over longer horizons, Hyperliquid still leads with $66 billion in weekly and almost $300 billion in monthly volume, proving its depth and consistency.

According to DeFiLlama, perpetual DEXs together processed more than $52 billion in daily volume in mid-September. Aster captured almost half of that flow, while also surpassing Hyperliquid in open interest with $260 million outstanding. With 2 million users onboarded and trading volumes rivaling established CEX players, Aster has moved beyond being a new entrant; it is now shaping the competitive balance of the entire market.

| Protocol | Daily Volume (24h) | Weekly Volume | Monthly Volume | TVL (est.) | Open Interest | Users (est.) |

| Aster DEX | ~$25.7B | ~$50B+ | ~$150B+ | ~$1B | ~$260M | ~2M |

| Hyperliquid | ~$10.1B | ~$66B | ~$300B | ~$600M | ~$200M+ | n/a |

| dYdX v4 | ~$2–3B | ~$15B | ~$60B | ~$450M | ~$100M | ~1.2M |

| GMX v2 | ~$1.5B | ~$10B | ~$35B | ~$550M | ~$80M | ~800K |

Notable Technology Innovations

Aster DEX is gaining momentum thanks to more than market activity, its unique technical design is redefining how perpetual trading works.

Former Binance CEO Changpeng Zhao underscored this in a public statement: “Aster is not just a proprietary derivatives exchange on the BNB Chain. It supports multiple chains natively and also supports hidden orders. Different from other derivatives exchange designs.” His comments reflect the platform’s ambition to set itself apart through both design and functionality.

One of Aster’s standout features is its native multi-chain execution. While many perpetual DEXs operate on a single network, Aster integrates trading across Ethereum, Solana, and BNB Chain. This structure expands liquidity, gives users more choice of collateral, and reduces reliance on a single ecosystem.

Equally important is the introduction of hidden orders. In traditional on-chain order books, every trade is visible, exposing traders to front-running bots and MEV (Maximum Extractable Value) attacks. Aster’s hidden order system conceals order size and intent until execution, protecting strategies and improving execution quality. This innovation addresses one of the biggest weaknesses of decentralized trading and appeals strongly to professional traders.

To serve a broad user base, Aster has also developed two distinct trading modes:

- Simple Mode – Designed for speed and accessibility, this mode offers one-click trading, MEV-free execution, and leverage up to 1001x. It targets retail traders who prioritize simplicity and fast order fulfillment.

- Pro Mode – Built for advanced users, this mode leverages a full Central Limit Order Book (CLOB) structure, similar to Hyperliquid. It provides granular order book depth, hidden orders, and sophisticated risk management tools, enabling professional traders to execute more complex strategies.

Together, these elements create a dual-layered experience that lowers the entry barrier for newcomers while giving professionals the tools they demand. By combining multi-chain infrastructure, innovative order types, and differentiated user experiences, Aster DEX signals a new standard in decentralized derivatives design.

Support from Binance Ecosystem and Expert Opinions

Aster DEX has gained powerful momentum through its ties to the Binance ecosystem. The project is backed by Yzi Labs (formerly Binance Labs) and publicly endorsed by Binance’s former CEO Changpeng “CZ” Zhao. His endorsement triggered a surge of interest across the crypto community, driving the ASTER token to rally more than 1,500% within a single week. The connection is significant: Binance regularly clears over $2.1 billion in daily Bitcoin spot volume, a figure that dwarfs competitors such as Bybit and Coinbase. This scale highlights the market influence Aster can leverage through its ecosystem alignment.

Market analysts have also reinforced the bullish sentiment. Michael van de Poppe, a widely followed trader with over 750,000 social media followers and professional experience on the Amsterdam Stock Exchange, described ASTER’s trading environment as “pure paradise.” In his view, the combination of high volatility and heavy trading activity makes Aster a magnet for traders seeking opportunities. His perspective carries weight, as it blends both technical and fundamental analysis.

Confidence in Aster’s trajectory is further illustrated by professional traders. James Wynn, known for profiting from HYPE token trades, recently shifted his strategy by going long on ASTER while shorting HYPE. After earning over $8,000 in referral fees, Wynn positioned himself to capture the differential performance between the two tokens—a move that underscores growing belief in Aster’s upside potential.

Forecasts and Technical Analysis

Analysts see room for ASTER to rally far beyond current levels. If the token matches HYPE’s peak valuation, the price could climb to $9.69, a 4.8x move from today. The comparison is compelling: Aster already outpaces HYPE in daily trading volume and revenue, even without a Binance Spot listing. A future listing is widely viewed as a potential catalyst that could ignite the next leg higher.

On the charts, momentum is building. Traders highlight a developing Cup and Handle pattern on the 1-hour timeframe, with the $2.10 zone acting as the key breakout level. A confirmed push above this resistance would flip the pattern bullish and could trigger rapid upside acceleration. Short-term speculators are tracking this level closely, while long-term investors see it as a technical validation of the more aggressive price targets ahead.

Assessment from Reputable Organizations

Independent research groups and major exchanges have started to recognize Aster DEX’s rapid ascent.

At Datawallet, analyst Jed interprets Aster as part of CZ’s broader effort to revive BNB Chain. He points out that the platform’s signature 1001x leverage engine was not an isolated breakthrough but the continuation of trials previously run on PancakeSwap. This suggests that Aster’s launch is tied to coordinated ecosystem planning rather than a standalone project.

Financial metrics back up this view. CoinGecko ranks Aster third among all DEXs by daily revenue, reporting figures more than 2.5 times higher than Hyperliquid. Such performance has pushed Aster into the same league as the largest protocols in space.

Exchanges are adapting quickly. KuCoin highlights Aster as a “multi-chain DEX for Spot and Perpetual trading, with MEV-free execution, stock perpetuals, Hidden Orders, and grid trading.” Meanwhile, DBA Asset Management has proposed cutting HYPE’s token supply by 45%, a move that reflects growing pressure from Aster’s expanding market share.

Taken together, these assessments underline a clear shift: Aster is no longer just competing; it is setting the pace for the entire perpetual DEX market.

Tokenomics and Investment Performance

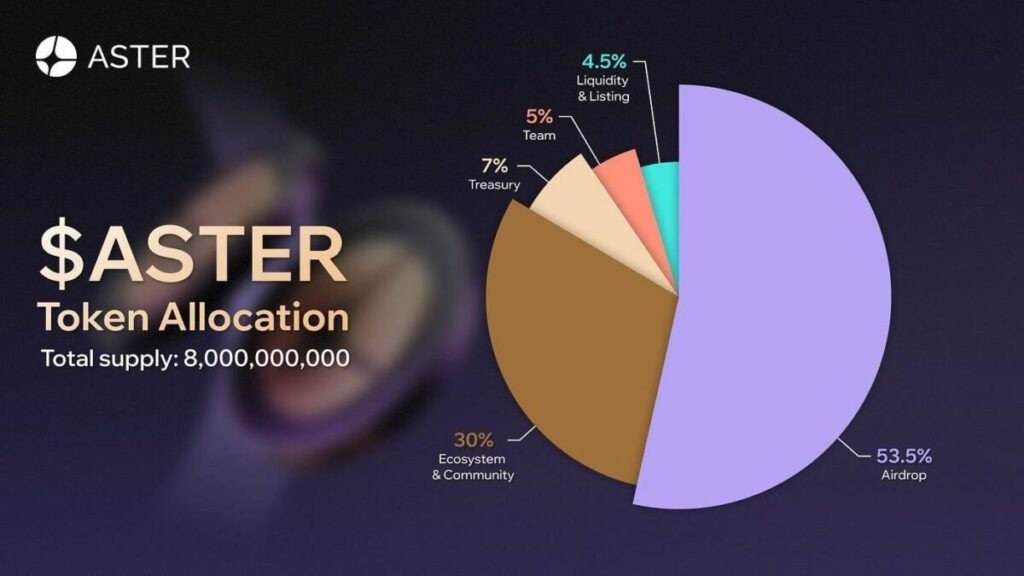

The ASTER token is designed with a community-first allocation model that aims to drive adoption and long-term growth. Out of a total supply of 8 billion tokens, more than half has been distributed directly to users, while the remainder supports ecosystem expansion and treasury reserves.

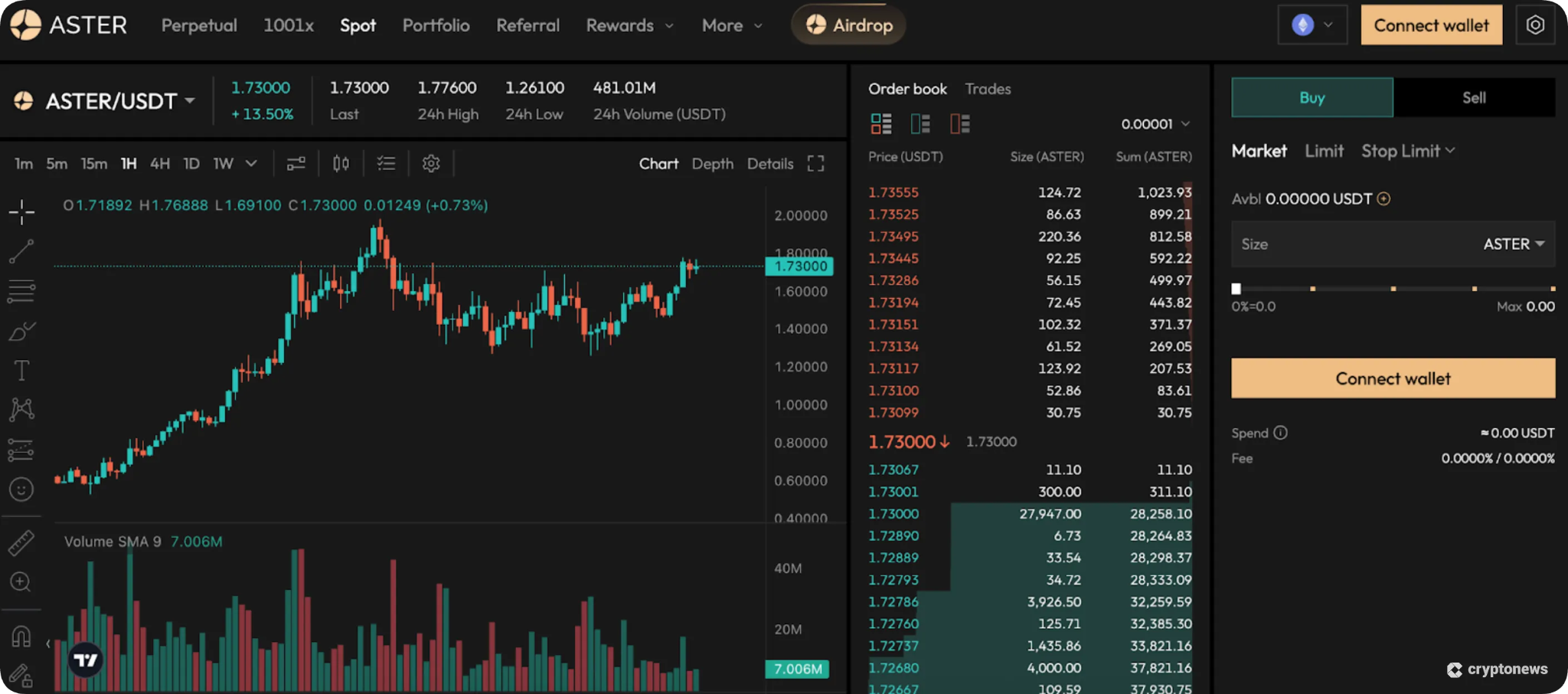

In terms of market performance, ASTER has traded with high volatility since launch. The token climbed to a new all-time high of $2.12 before consolidating near $2.34, supported by 24-hour trading volumes above $2.7 billion. Intraday swings of 15–20% have become common, creating both risks and opportunities for active traders.

Such volatility reflects strong demand but also exposes concentration risk. More than 93% of supply is currently held by six wallets, raising the possibility of large sell-offs that could pressure price action. Even so, trading activity and liquidity levels suggest that ASTER has already become one of the most actively traded altcoin tokens in the DeFi sector.

Risk Warnings and Challenges

While Aster DEX shows strong momentum, several risks remain. The most pressing is token concentration. According to Coinpedia, more than 93% of ASTER supply is controlled by six wallets, creating the possibility of sharpvolatility if any of these holders exit positions.

Another vulnerability comes from ecosystem dependence. Aster’s USDF mechanism is closely tied to Binance’s operations, meaning the protocol carries counterparty risk if the exchange faces disruptions. This reliance undercuts the fully decentralized image that many DeFi investors expect.

Competition is equally intense. Giants such as Hyperliquid and dYdX continue to command liquidity, user trust, and brand recognition. To maintain its trajectory, Aster will need significant resources for incentives, product development, and trader retention.

Finally, the regulatory landscape poses a structural threat. High-leverage perpetual products remain under scrutiny in both the U.S. and Europe. A crackdown on decentralized derivatives could directly challenge Aster’s business model, particularly its extreme leverage offerings.

Future Development Roadmap

To counter these risks and push growth further, Aster has laid out an ambitious roadmap. The centerpiece is the launch ofAster Chain, a dedicated Layer 1 blockchain designed specifically for derivatives trading. It will integrate zero-knowledge proofs to enable private yet verifiable transactions, combining speed with confidentiality.

The roadmap for 2025–2026 is divided into four key phases:

- Aster Chain Launch (Q4 2025): Introduce the new Layer 1 infrastructure focused on high-performance trading.

- TGE Completion (Q4 2025): Finalize token distribution and incentive alignment.

- Mobile UX Redesign (Q4 2025): Deliver a simplified, mobile-first trading experience to capture retail users.

- Intent-Based Trading (2026): Roll out intent-driven order execution, allowing users to specify outcomes rather than inputs—bringing a new paradigm to DeFi trading.

Rather than focusing only on trading growth today, Aster’s roadmap makes clear its ambition to shape the infrastructure and user experience that will define the future of perpetual DEXs.

Overall Assessment

Aster DEX is quickly turning into one of the most serious contenders in perpetual trading. Analyst Amit Chahar believes it could grow into the market’s largest perp DEX, though it still has to prove it can match Hyperliquid and other strong rivals.

Trader behavior adds weight to this view. James Wynn has shifted from HYPE into ASTER, while Michael van de Poppe calls its market conditions a paradise for active traders. Both moves signal growing confidence in Aster’s upside.

The battle between Aster and Hyperliquid marks a turning point for DeFi. With Binance’s backing, fast revenue growth, and features like multi-chain support and hidden orders, Aster has positioned itself as more than a newcomer, it’s a challenger to the current order.

The risks are real: token supply is highly concentrated, and dependence on Binance leaves the protocol exposed. Balancing those risks with its rapid growth will decide whether Aster becomes the next dominant force in decentralized derivatives.

This analysis was compiled based on data from authoritative sources including CoinGecko, DeFiLlama, BeInCrypto, Cointelegraph, CoinMarketCap, and leading industry experts as of September 2025.

Disclaimer: The content published on Cryptothreads does not constitute financial, investment, legal, or tax advice. We are not financial advisors, and any opinions, analysis, or recommendations provided are purely informational. Cryptocurrency markets are highly volatile, and investing in digital assets carries substantial risk. Always conduct your own research and consult with a professional financial advisor before making any investment decisions. Cryptothreads is not liable for any financial losses or damages resulting from actions taken based on our content.