Inside MYX Finance’s 1,850% Rally and What’s Next

Executive Summary

September 2025 saw one of the most striking price movements in DeFi this year. MYX Finance (MYX) went from a quiet consolidation under one dollar to nearly nineteen dollars within weeks, catapulting itself into the global top 60 by market capitalization. The surge looked dramatic on charts, but beneath the surface it was more than a simple breakout. It was a complex interplay of narrative, tokenomics, and trading mechanics.

This report explores the drivers behind the rally and the controversies that followed. On one side, MYX has a credible technological roadmap, a clear value proposition in decentralized derivatives, and strong backing from investors and ecosystems. On the other hand, its price action carried hallmarks of speculative frenzy: artificially tight supply, reflexive short squeezes, insider selling around token unlocks, and valuations far ahead of fundamentals.

The result was a parabolic surge that rewarded some traders and created heavy risk for others. To understand this phenomenon, we have to look at both sides: the innovation that drew attention and the market dynamics that inflated prices. And our article will help investors distinguish between genuine progress and speculative noise.

Anatomical Analysis of the Parabolic Price Movement

To understand how a token can climb more than eighteen-fold in such a short span, we need to break the movement into its parts. Price action in crypto often looks chaotic, but when studied closely it follows recognizable patterns: a build-up of momentum, a tipping point where the crowd joins in, and finally the blow-off phase where valuations stretch far beyond fundamentals. MYX checked every box in this sequence.

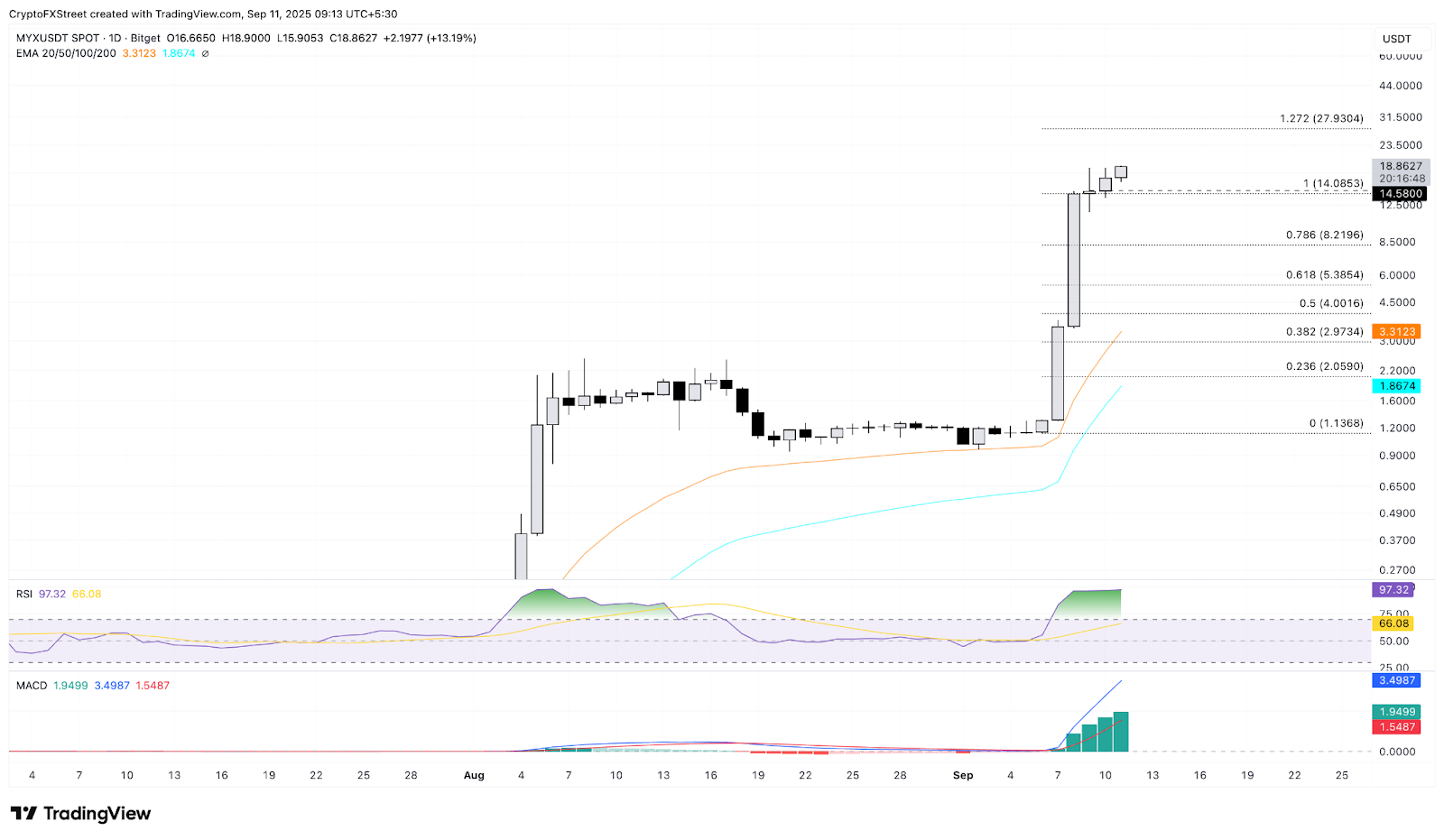

Timeline and Magnitude of the Surge

The rally began quietly. At the end of August, MYX traded around $0.95, showing little sign of what was to come. By September 7, momentum started to build, and a teaser about the long-awaited V2 upgrade quickly amplified interest. Within four days, the token climbed at breakneck speed, reaching $19.03 between September 9 and 11. Over that brief stretch, MYX delivered a 1,400% gain in just one week and more than 1,850% from its late August base.

Moves of this magnitude are rare even in crypto’s volatile history. The pace left little room for careful evaluation. Instead, traders chased momentum, driven by the promise of a breakthrough upgrade. MYX shifted almost overnight from an overlooked token to one of the most talked-about assets in global markets.

Volume and Market Capitalization Explosion

Price was only part of the story. Trading activity also surged, turning what had been modest volumes into a torrent of liquidity. During August, daily turnover stayed in the tens of millions. By the second week of September, volumes exceeded $550 million and, at times, pushed close to $780 million.

This wave of trading lifted market capitalization into the $2.6–3.3 billion range, while fully diluted valuation reached $17.7–17.8 billion. At those levels, MYX found itself compared with established DeFi leaders that had years of adoption behind them. The contrast was clear: while market value ballooned, Total Value Locked remained just $45 million. The picture suggested not steady growth but a speculative rush that turned price charts into near-vertical walls.

Market Structure Analysis

The structure of the surge reveals much about what really drove it. Price movements that stem from genuine adoption usually build gradually, reflecting the steady accumulation of users and value. MYX’s rally, however, shot upward almost vertically, a pattern more in line with speculative fervor than with organic growth.

How Myx works. Source: Bitrue

Trading volumes told the same story. Daily activity surged into the hundreds of millions of dollars, far beyond what the protocol’s modest TVL could justify. At the time, locked value was only around a few dozen million dollars, yet token turnover dwarfed that figure. Such imbalance makes clear that the frenzy was fueled by speculative trading of the token itself, not by real engagement with the underlying platform.

Foundational Narrative: Technology Promise and Ecosystem Integration

Every parabolic rally in crypto needs a compelling story, and MYX delivered one that captured the market’s imagination. Traders saw more than a rising chart, they saw the outline of a protocol with the ambition to reshape decentralized derivatives. The combination of a breakthrough upgrade, innovative technology, and ecosystem credibility gave investors confidence to project future growth far beyond current usage.

The V2 Upgrade as Primary Catalyst

The centerpiece of this story was the upcoming V2 upgrade. Marketed as a leap forward in decentralized trading, it introduced a Matching Pool Mechanism (MPM) for slippage-free execution, portfolio margin systems aimed at professionals, and cross-chain interoperability that emphasized Solana and other non-EVM networks.

Such promises struck at real pain points in DeFi. Slippage has long been a barrier for traders, and the idea of eliminating it created instant excitement. On September 8, when the team teased its “zero-slippage magic,” MYX spiked 135% in a single day, clear evidence of how powerfully the upgrade narrative moved the market.

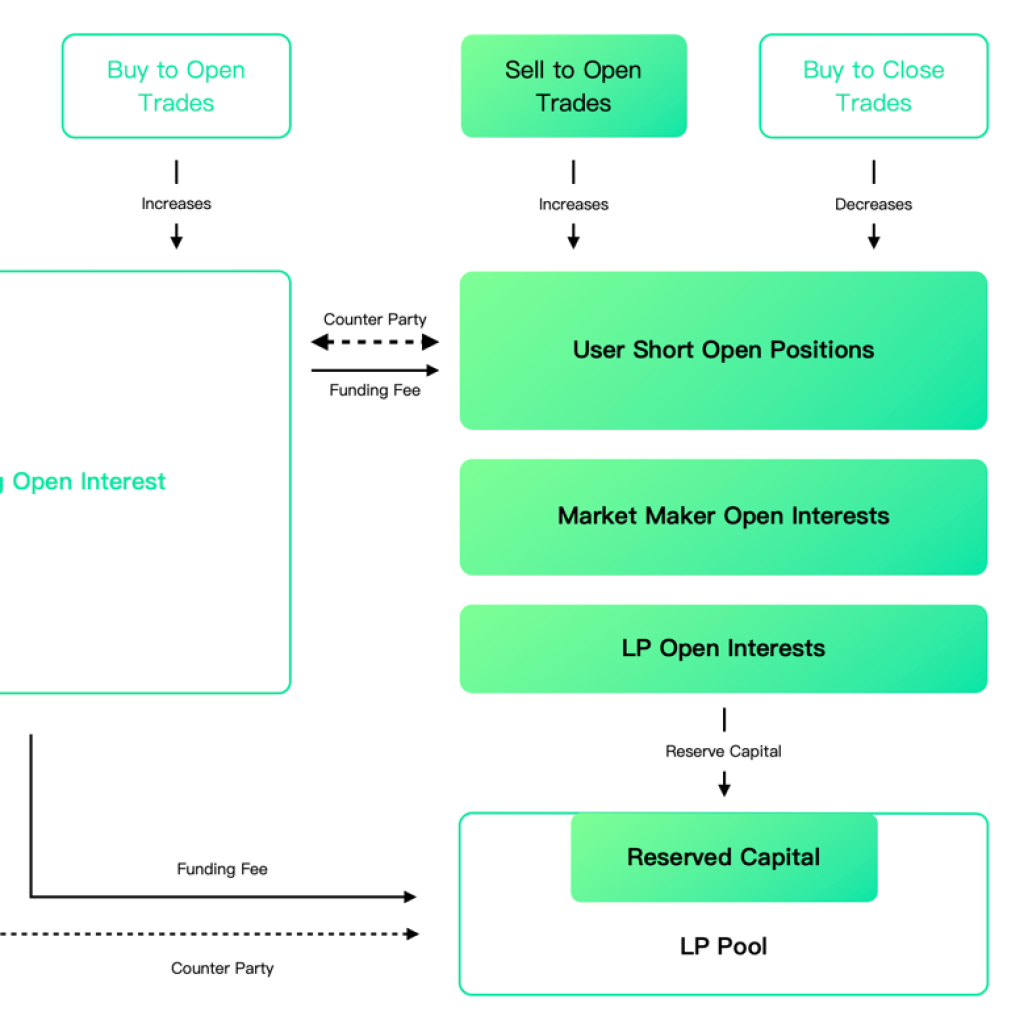

Core Technology: Matching Pool Mechanism

The MPM served as the backbone of V2’s vision. Instead of relying on traditional automated market makers, it allowed pools to act as counterparties and then internally matched trades, releasing liquidity and maximizing efficiency. This structure aimed to combine the speed of centralized exchanges with the transparency of on-chain systems.

Other features enhanced the appeal: leverage up to 50x, gasless relayer networks, and fees as low as 0.01%. Together, they positioned MYX as a platform attractive to both retail and institutional users, offering tools designed to meet the needs of high-frequency traders and casual participants alike.

Strategic Positioning and Ecosystem Support

MYX also benefited from its close alignment with the BNB Chain ecosystem. It won the “Volume Powerhouse” award, gained visibility through Binance Wallet during its Token Generation Event, and secured repeated exposure on Binance Alpha. These signals of recognition amplified the perception that MYX was a rising force.

Institutional backers added another layer of confidence. With support from ConsenSys, Hack VC, OKX Ventures, and HongShan (formerly Sequoia China), MYX carried the weight of respected names in both venture capital and crypto infrastructure. In a market where reputation accelerates momentum, this blend of technology and endorsement created a strong foundation for speculative enthusiasm.

Broader Market Themes

MYX’s narrative also connected with wider currents in 2025. Decentralized perpetual exchanges were gaining attention as traders sought alternatives to centralized platforms. By branding itself as a “CEX-killer” and highlighting interoperability with Solana, MYX positioned itself at the heart of two of the year’s hottest narratives. These themes resonated deeply with both retail traders and institutions, turning the token into a focal point of market speculation.

Market Mechanism Analysis: Driving Forces Behind the Surge

The rise of MYX was shaped by more than headlines and hype. Behind the scenes, trading mechanics, supply design, and retail psychology all worked together to create the conditions for a parabolic move. When these forces aligned, momentum built on itself until the price curve turned vertical.

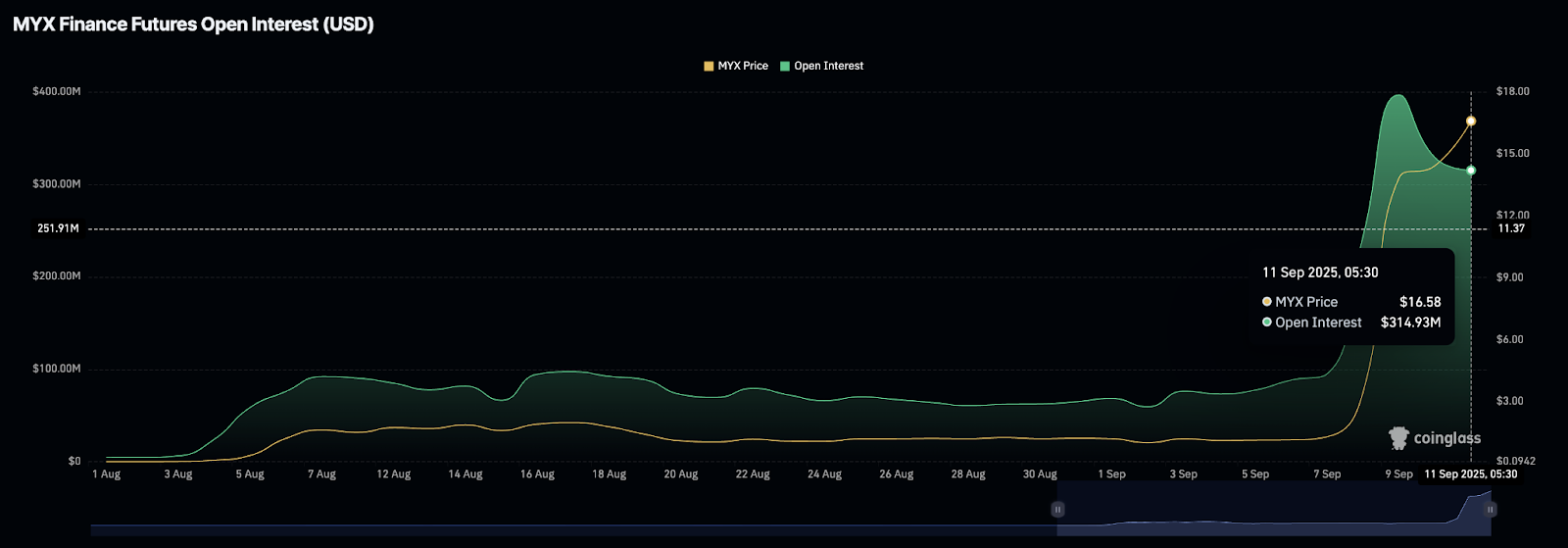

Short Squeeze Effect: Primary Driver

One of the strongest accelerators was the short squeeze. Between September 6 and 10, liquidations reached $89.5 million in short positions compared with $23.5 million in longs. On September 10 alone, up to $53 million in shorts were forced out of the market. This imbalance showed how heavily traders had bet against MYX and how quickly those positions unraveled.

The unwind created powerful feedback. As shorts closed, they were forced to buy MYX at rising prices, which pushed the market even higher. Each wave of liquidations attracted new speculators who saw an unstoppable trend. The squeeze became a chain reaction, with forced demand and opportunistic buying feeding each other.

“Binance Alpha” Effect and Retail FOMO Psychology

Alongside derivatives activity, retail psychology added another layer of fuel. Binance Alpha highlighted MYX as one of the most profitable airdrops of the year. Early participants turned small allocations into more than $9,000, and those stories spread quickly across social media.

Visibility turned into action once major exchanges such as Gate.io and Bitget listed MYX. Traders around the world suddenly had access, and retail inflows surged. The combination of recognition on Binance Alpha and easier trading channels created a broad wave of participation that amplified every move upward.

Artificially Constrained Supply: Critical Role of Low Circulating Supply

MYX’s token design added further intensity. Roughly 20% of the total one billion supply was in circulation, while the rest remained locked. This tight float meant that liquidity was thin and prices could respond sharply to bursts of demand.

When retail inflows and short covering hit at the same time, the low float magnified the effect. Even moderate buying pressure translated into dramatic price swings. Instead of acting as a stabilizer, supply mechanics turned into an amplifier, making every spike more pronounced.

External Catalyst: WLFI Listing

A final spark came from outside the core protocol. On September 5, MYX announced the listing of WLFI, a politically linked meme token. The news drew attention from speculative traders who might not otherwise have noticed MYX.

This listing served as a bridge. It created a fresh pool of traders already focused on the platform just as the V2 narrative took off. Although WLFI was not the main driver of the rally, it expanded the audience and set the stage for momentum to snowball once MYX itself began to climb.

Risk Assessment and Warning Indicators

The parabolic surge of MYX dazzled traders, but beneath the surface several warning signs raised serious questions. Distribution irregularities, suspicious unlocks, insider activity, and valuation extremes all appeared during the rally. Taken together, these signals suggest that the September breakout was less a natural wave of adoption and more a carefully timed liquidity event.

The $170 Million Airdrop Controversy: Sybil Attack Allegations

One of the most striking red flags came from blockchain analytics firm Bubblemaps. Their investigation pointed to almost 100 wallets funded through OKX in mid-April that acted in concert to harvest MYX’s airdrop allocations. Collectively, these wallets captured 9.8 million tokens. At the September peak, that trove was worth around $170 million — an unprecedented concentration for what was marketed as a community-driven distribution. Bubblemaps labeled it the largest Sybil farming attack ever recorded.

The project team responded quickly, asserting that MYX had anti-Sybil protections in place and that these wallets belonged to legitimate high-volume users. Yet the rebuttal lacked specifics, leaving observers unconvinced. For critics, the issue wasn’t just the size of the allocation but the appearance of coordinated accumulation by a small cluster of entities. Such concentration created the risk that a meaningful share of unlocked supply was in the hands of actors motivated to time an exit during peak hype.

On-Chain Analysis: Suspicious Token Unlocks and Insider Selling

Another layer of concern emerged from token unlocks. A release of 39 million MYX tokens, equal to about 20 percent of circulating supply at the time, landed right as the rally reached its steepest climb. Unlocks are a normal part of vesting schedules, but the timing here drew immediate attention.

On-chain data added fuel to the debate. Addresses linked to Hack VC sold $2.15 million worth of MYX shortly after the unlock. Commentators in Web3 circles flagged other patterns: wallets moving in sync, unusually high trading activity in derivatives (estimated at $6–9 billion daily), and sharp swings that coincided with whale-sized orders. For many, these were classic signatures of a market engineered to provide liquidity for large holders seeking to exit.

Valuation Versus Reality: Clear Fundamental Disconnect

Valuation metrics told their own story. At the September peak, MYX carried a fully diluted valuation of $17.7 billion. Meanwhile, Total Value Locked was about $45 million, a gap so wide that it placed MYX in a league of its own in terms of speculative premium. Market cap to TVL ratios reached ~47x, while FDV to TVL soared beyond 240x. By comparison, leading DeFi protocols usually sit in the 1–10x range.

Revenue numbers underscored the imbalance. According to DefiLlama, even during the busiest weeks, annualized fee revenue stayed in the low hundreds of thousands of dollars. Projects valued in the tens of billions generally produce fee streams measured in millions or even billions. MYX’s market value was therefore anchored more in anticipation than in realized performance.

The Bigger Picture

When these elements are viewed together, a pattern emerges. Airdrop allocations clustered in a few hands, token unlocks that aligned with peak excitement, and insider sales all point toward a coordinated effort to create liquidity. At the same time, Binance Alpha exposure and the powerful V2 narrative ensured that retail demand flooded in at the right moment. The short squeeze added a final accelerant, turning a calculated setup into a parabolic price move.

This synthesis paints a clear picture: the September surge looked less like the organic reflection of adoption and more like a liquidity event designed to benefit early holders. Whether intentional or simply opportunistic, the result was the same — insiders had the perfect stage to realize profits while retail traders shouldered the risks of inflated prices.

Summary and Forward-Looking Analysis

The September rally of MYX Finance was more than just another volatile episode in crypto. It brought together innovation, speculation, and opportunism in a way that revealed both the promise and the risk of modern DeFi markets. Looking back, the surge can be understood as the product of a perfect storm, while looking forward, the project faces a set of challenges that will test whether hype can turn into durable adoption.

The Perfect Storm Synthesis

MYX’s surge stands as a textbook example of how multiple forces can converge to push a token far beyond its fundamentals. A credible technology roadmap provided the base narrative. A short squeeze served as the engine. Constrained supply amplified every move. Media attention and exchange visibility added fuel. When insiders and early holders stepped in to capitalize on the frenzy, the parabolic rally was complete.

The episode shows how legitimate innovation can coexist with highly speculative trading. A strong story gave traders confidence, but it was the mechanics of leverage and liquidity that shaped the rally’s vertical form. In the end, MYX’s ascent was both a showcase of ambition and a reminder of the fragility behind such rapid moves.

Sustainability Assessment and Future Risks

The greatest challenge for MYX lies ahead. Roughly 80% of the token supply remains locked, and every scheduled unlock adds fresh selling pressure. A precedent already exists: in August 2024, a major release triggered a 58% decline. Unless adoption expands quickly enough to absorb this supply, the market will struggle to sustain September’s valuation levels.

Execution of the V2 upgrade will be decisive. If MYX delivers on its promises, slippage-free trading, deep liquidity pools, and institutional-grade features, it could justify part of its valuation. If usage growth lags, selling pressure from unlocks may outweigh demand. Technical signals also add caution: the Relative Strength Index spiked above 90 during the rally, a level that often precedes corrections of 70–85%. Analysts already highlight a potential retreat into the $2.7–5.1 range if momentum fades.

Key Metrics for Future Monitoring

The September surge proved how quickly momentum can outpace fundamentals. For investors looking ahead, the focus now shifts to hard data that will reveal whether MYX can translate hype into sustained adoption. Watching a few critical indicators will make it easier to separate short-term noise from long-term progress.

- On-Chain Activity: Growth in TVL and protocol fee revenue will indicate whether adoption is real.

- Token Unlock Schedule: Each release should be tracked, along with flows from large wallets to exchanges.

- Derivatives Market Data: Open interest and funding rates will reveal whether traders are building positions for another squeeze or stepping aside.

- V2 Adoption Metrics: User counts, DEX trading volumes, and realized slippage will show if the technology works in practice.

The MYX phenomenon serves as a compelling case study in modern cryptocurrency market dynamics, demonstrating how legitimate technological development can become overshadowed by speculative excess and potential market manipulation. While the underlying protocol may possess genuine merit, investors must carefully distinguish between technological potential and current market valuation sustainability when making investment decisions.

Conclusion

The MYX phenomenon illustrates the dual nature of today’s crypto markets. On one side, it reflects genuine progress in DeFi innovation, with technology that aims to solve long-standing challenges. On the other, it exposes how narratives, liquidity design, and trading mechanics can drive prices to extremes detached from fundamentals.

For the project, the next phase will determine whether MYX becomes a true contender in decentralized derivatives or remains a cautionary tale of market exuberance. For investors, the lesson is broader: every parabolic rally carries both opportunity and danger, and success depends on distinguishing sustainable growth from short-lived liquidity storms.