Inside the Perpetual DEX War: Hyperliquid and Aster

Key Takeaways

- Hyperliquid defines precision and sustainability in Perpetual DEX design.

- Performance vs. Reach: Hyperliquid hits 0.2s latency, while Aster spans BNB, Arbitrum, Solana for instant access.

- Token Models: $HYPE is deflationary with 97% fee buybacks; $ASTER is growth-driven with 53.5% airdrops.

- Transparency Test: The DeFiLlama delisting exposed the trade-off between rapid growth and verifiable data.

- Market Outlook: Both can thrive—Hyperliquid as the precision-built engine, Aster as the scale-driven accelerator.

The rise of Perpetual DEX platforms marks a new era in on-chain trading. Among them, Hyperliquid and Aster stand at the forefront, redefining speed, transparency, and scale in decentralized derivatives. Their rivalry captures the essence of DeFi’s evolution — precision built versus growth unleashed.

This report offers a clear, deep analysis of both platforms across core architecture, execution performance, token design, user experience, governance, and recent disputes. It gives investors, traders, and builders a practical map to make confident decisions in one of the most consequential rivalries in DeFi today.

Chapter 1: The New Territory of Perpetual DEX and On-Chain Derivatives

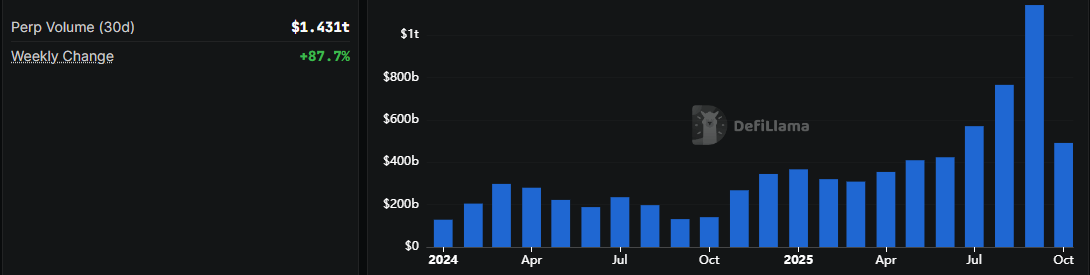

The crypto derivatives market is entering a trillion-dollar migration. Traders who once relied oncentralized exchanges are shifting to decentralized perpetual platforms. This movement marks a structural change, driven by self-custody, transparency, and open access. In September 2025, Perpetual DEX trading volume surpassed $1 trillion, rising 50% month-over-month. Their share of global derivatives trading has climbed from under 2% in 2022 to over 20%, a tenfold increase within three years.

At the heart of this transformation is the confrontation between Hyperliquid and Aster. It defines two paths that shape the future of decentralized finance.

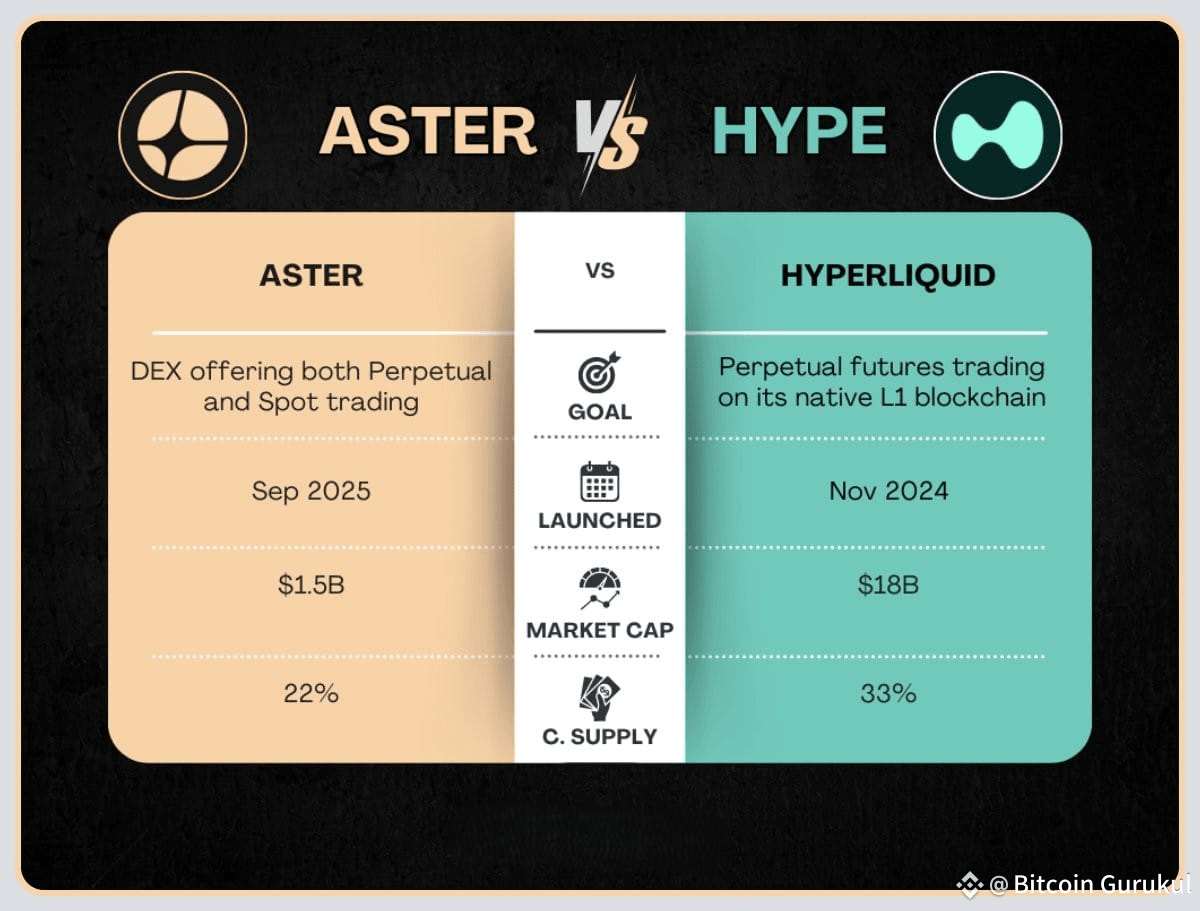

Hyperliquid represents an infrastructure-first philosophy. The team built a dedicated Layer-1 blockchain from the ground up, engineered to reach the performance of centralized exchanges. The project is entirely self-funded, with no venture capital influence, giving it full control over development and vision. Hyperliquid reflects the cypherpunk ideal where precision, transparency, and technology drive trust.

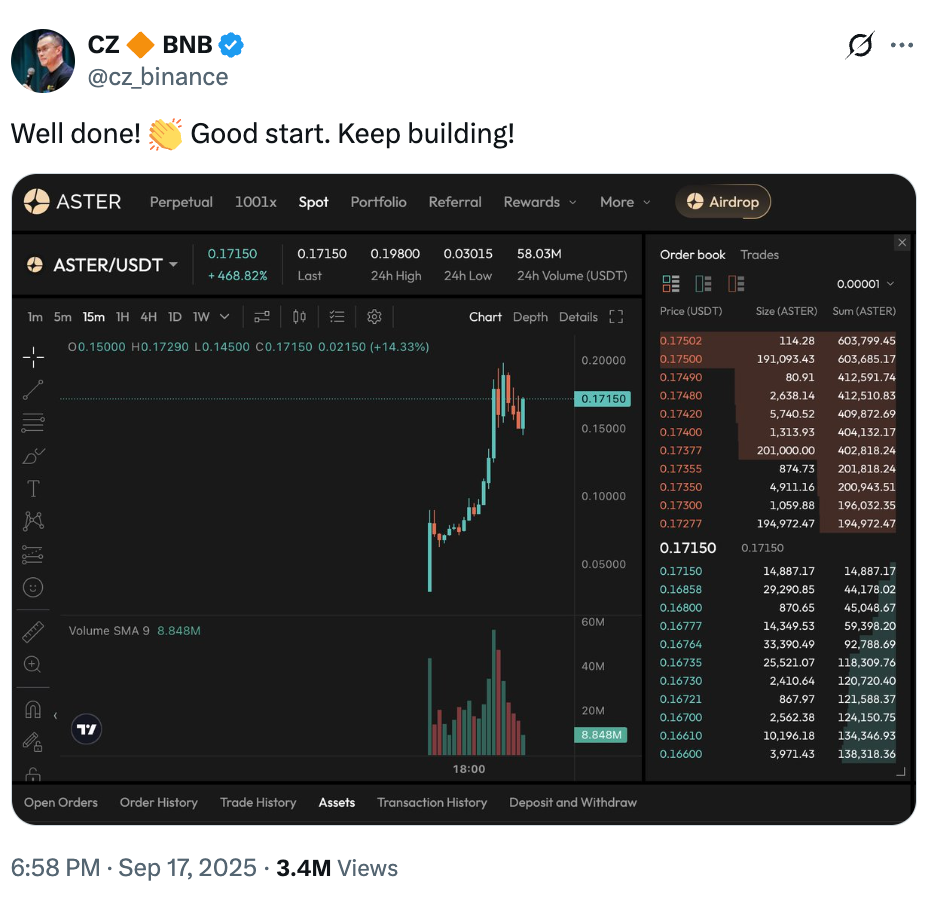

Aster follows a growth-first strategy. It expands rapidly by deploying across major blockchains such as BNB Chain, Solana, and Arbitrum. The platform leverages endorsements and powerful incentive programs, including 1001x leverage and large-scale airdrops, to accelerate user acquisition. With support from the “CZ effect,” Aster combines marketing scale and technical execution to dominate attention across ecosystems.

The rivalry intensified when Changpeng Zhao (CZ) appeared to support Aster, setting the stage for a battle between the patient builder and the fast-moving challenger. The entire market is now watching.

This competition reflects how far DeFi infrastructure has evolved. Earlier pioneers like dYdX and GMX validated the model but faced friction with liquidity, interface design, and execution speed. Hyperliquid’s custom-built appchain proved that on-chain trading can reach centralized performance levels. Aster, by contrast, utilizes the maturity of existing Layer-1 and Layer-2 ecosystems to deliver fast, accessible trading at scale. Their duel marks the industry’s arrival at a new threshold of efficiency and performance.

The difference between them lies in philosophy and execution. Hyperliquid grows organically, focusing on product strength and community trust. It launched a single major airdrop after building a base of committed traders. Aster takes an aggressive approach, allocating 53.5% of total token supply for community rewards and airdrops to ignite growth. Analysts debate whether this trading volume will sustain when incentives fade. Hyperliquid’s bet is that quality creates loyalty and long-term revenue. Aster’s bet is that scale and network effects will turn speed into dominance.

This confrontation is more than market rivalry. It is a live experiment that will define how decentralized exchanges evolve, through patient construction or explosive expansion.

Chapter 2: Hyperliquid – Infrastructure-First Leader in Perpetual DEX Innovation

Hyperliquid stands as one of the most technically ambitious and precisely engineered platforms in decentralized finance. Built on its own Layer-1 blockchain, it represents a complete financial ecosystem optimized for speed, transparency, and scalability. This design marks a decisive leap forward for on-chain derivatives trading and sets a new industry benchmark for performance.

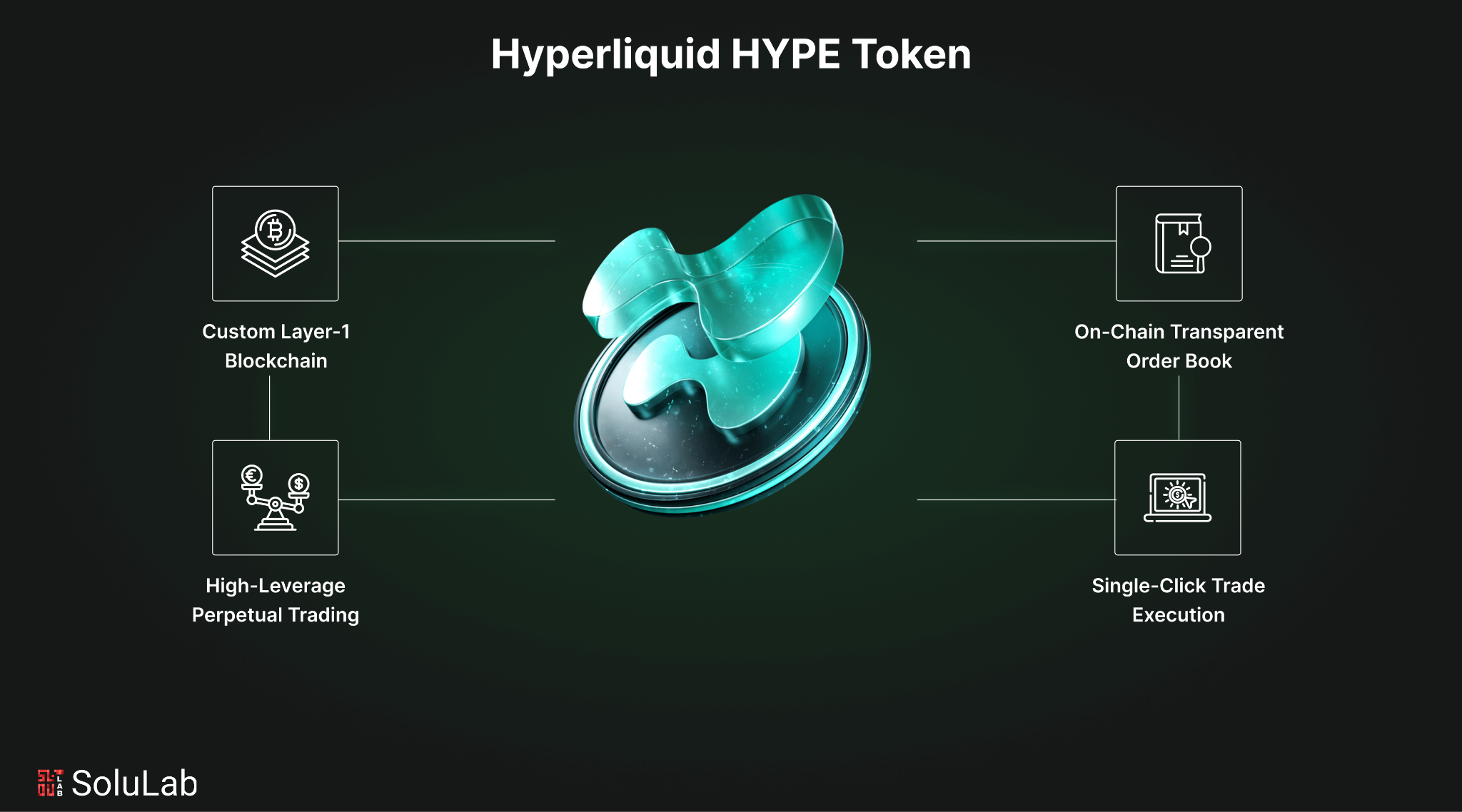

Proprietary Layer-1 Architecture for On-Chain Derivatives

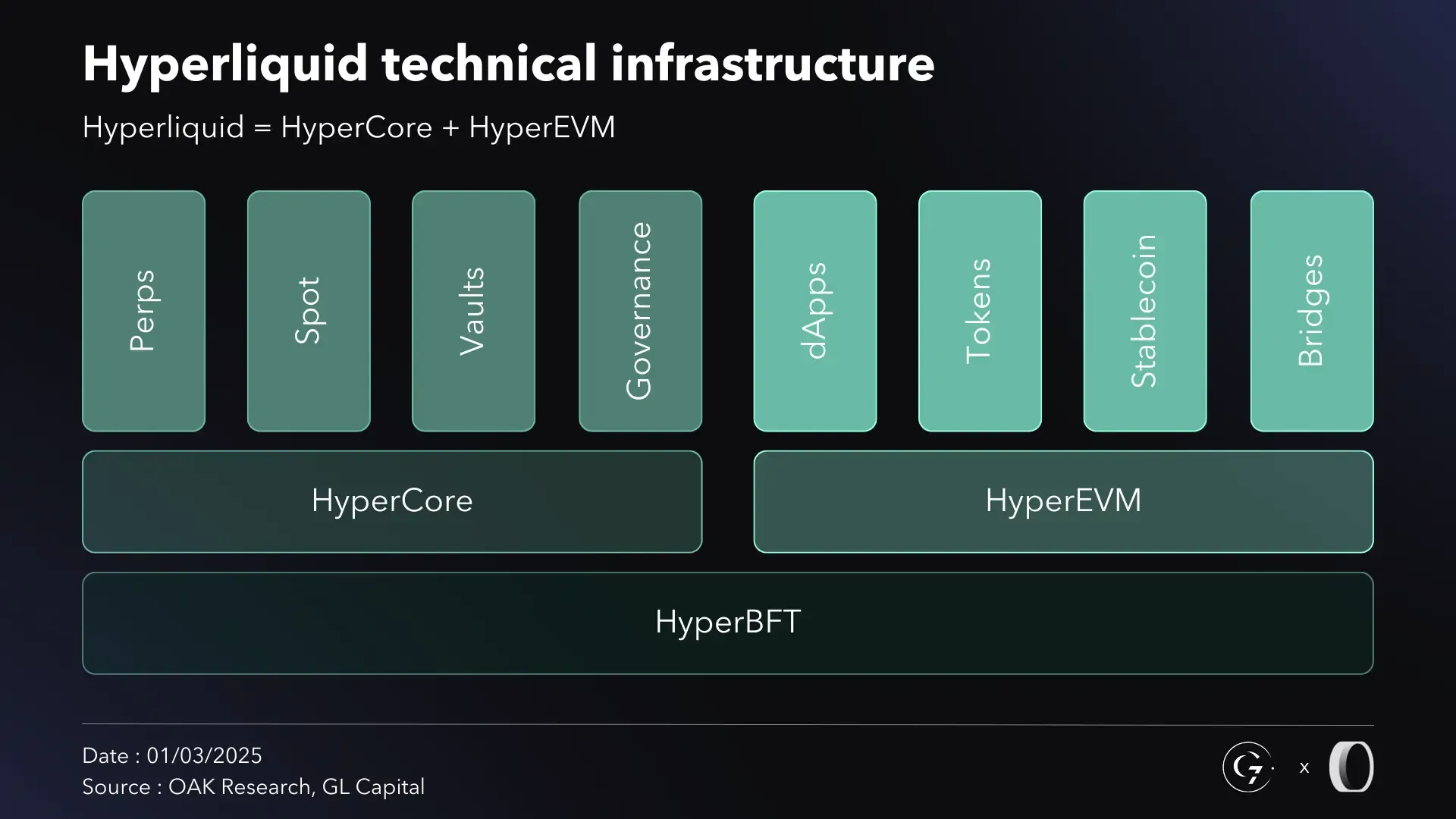

The foundation of Hyperliquid’s advantage lies in its architecture. The team chose to build a dedicated Layer-1 chain tailored specifically for high-frequency trading, enabling total control over throughput, latency, and execution. Every element in the stack is purpose-built for trading precision and security.

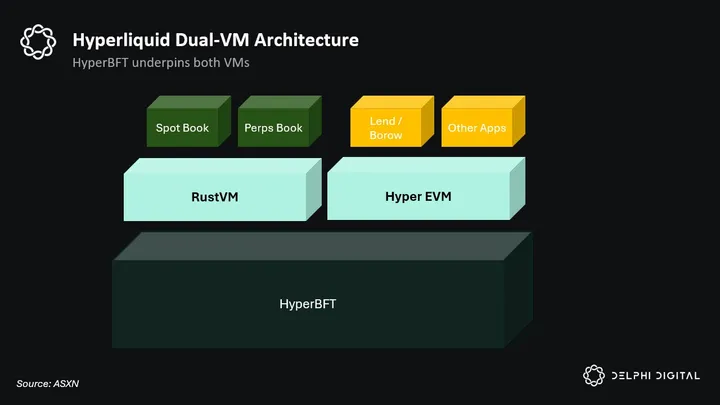

HyperCore operates as the on-chain order book engine, executing every order, cancellation, and liquidation with full transparency at lightning speed. In parallel, HyperEVM provides a fully Ethereum-compatible environment for deploying decentralized applications and smart contracts. These two components work seamlessly under a shared consensus, combining specialization in trading with open composability for developers.

This dual-layer structure gives Hyperliquid a rare balance: technical specialization for traders and flexibility for builders, both operating under a single, unified protocol.

Performance and Trading Experience in Perpetual DEX Markets

Hyperliquid achieves performance metrics that rival the fastest centralized exchanges. The system can process up to 200,000 orders per second, reaching block finality in under one second with an average latency of around 0.2 seconds.

This speed is made possible by HyperBFT, a consensus mechanism inspired by Hotstuff but refined for the unique demands of on-chain derivatives. It combines rapid block production with institutional-grade security, creating an environment where execution precision and reliability coexist.

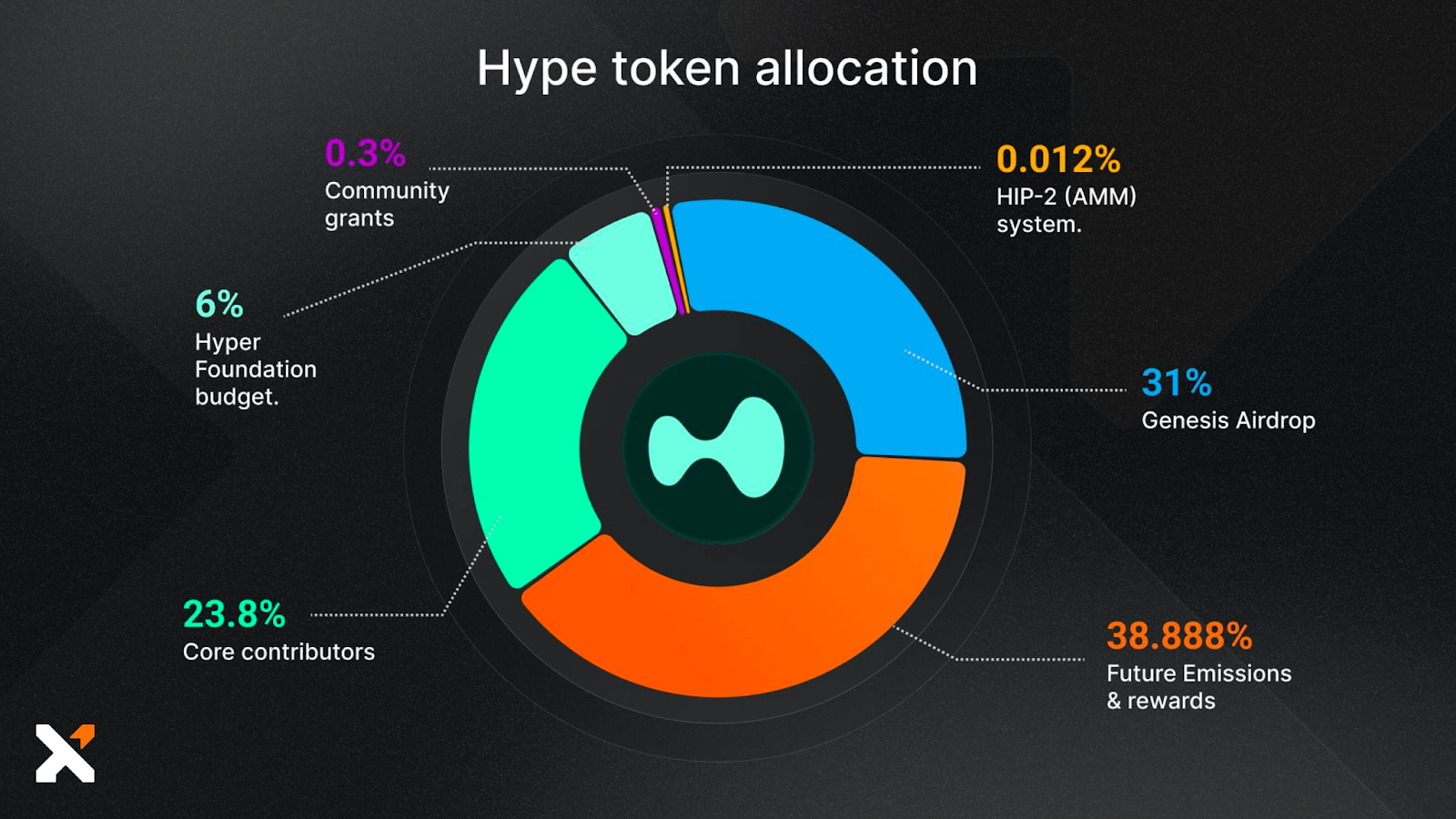

Deflationary Tokenomics and Long-Term Value Accrual

Hyperliquid’s growth story is rooted in craftsmanship and independence. Founded by Jeff Yan and a compact team of 11 members, many from leading technology firms and research institutions, the project reflects an engineering-driven culture. The team’s choice to remain self-funded keeps Hyperliquid fully aligned with its community and long-term vision.

Before Aster entered the scene, Hyperliquid had already achieved clear dominance in the perpetual DEX sector. It commanded 62% to 80% of total market share in trading volume and open interest, processing $319 billion in trading volume in July 2025 alone. These figures show both its scalability and deep user trust.

Owning a proprietary Layer-1 gives Hyperliquid a structural advantage. Its control over the full stack from consensus through execution, allows continuous optimization for performance and stability. The chain’s ~0.2s latency delivers speed levels that aggregation-based competitors cannot replicate.

This architecture also strengthens resistance against MEV extraction and front-running. Every order is processed on-chain under a validator-determined sequence, eliminating opportunities for manipulative reordering. Hyperliquid’s design integrates fairness and transparency directly into the base protocol, securing trust at the architectural level.

The HyperEVM Ecosystem Vision

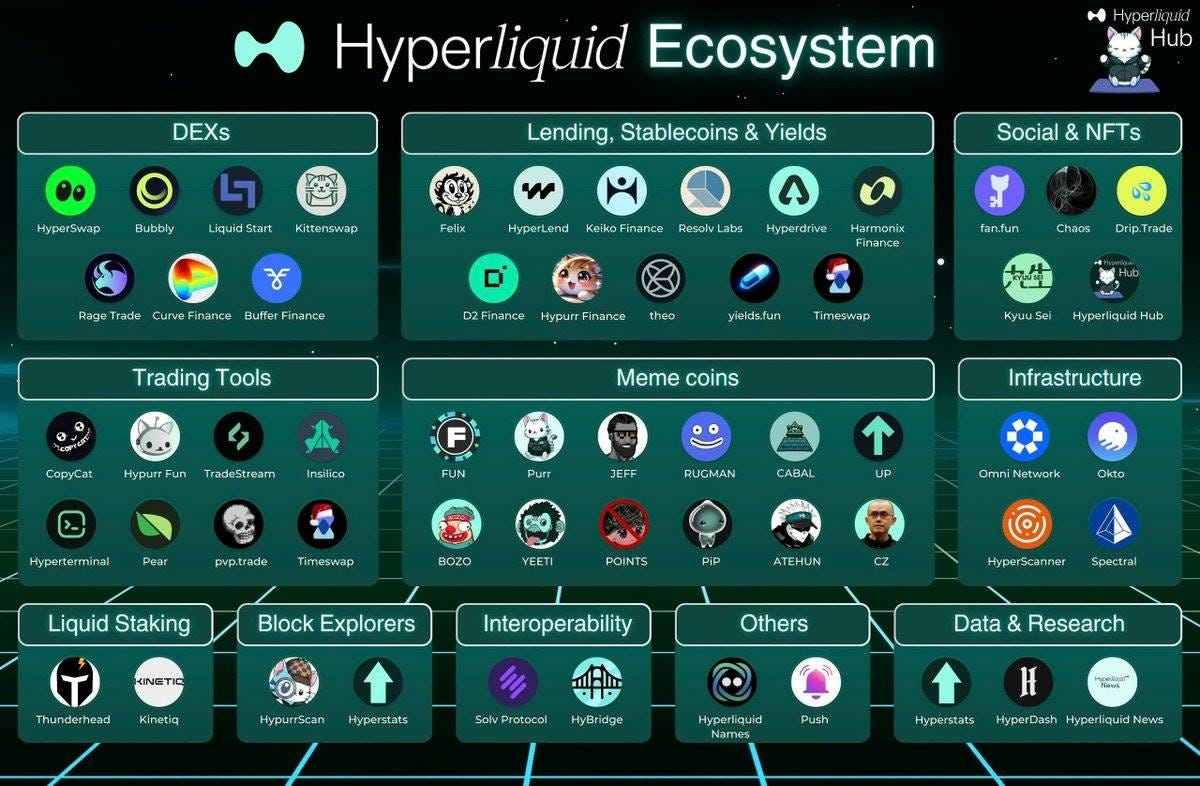

Hyperliquid’s vision extends beyond trading. The introduction of HyperEVM has turned the ecosystem into a vibrant developer platform. Over 100 protocols now operate within the network, including decentralized exchanges such as Hyperswap, lending platforms like Sentiment, liquid staking initiatives such as stakedhype, and real-world asset projects including Theo Network.

This growing ecosystem strengthens Hyperliquid’s position as not only a derivatives exchange but a foundation for DeFi innovation, linking capital markets with programmable finance.

$HYPE – A Deflationary Economic Engine

The $HYPE token serves as the economic backbone of the ecosystem. It grants holders governance rights, staking rewards averaging 2.27% APY, and trading fee reductions up to 40%.

The token’s most powerful feature is its buyback and burn mechanism. Between 93% and 97% of protocol fees are used to repurchase $HYPE from the market and permanently remove it from circulation. This creates consistent deflationary pressure and directly links platform activity to token value.

Hyperliquid’s independence enables this sustainable model. Without external investors demanding short-term gains, the project focuses entirely on long-term value creation. Each trade executed on the platform contributes to protocol revenue, which fuels buybacks, increases token scarcity, and rewards community participation.

This system forms a self-reinforcing loop: a high-performance product attracts volume, trading fees fund buybacks, $HYPE value rises, and community confidence deepens, driving even greater growth across the ecosystem.

Hyperliquid demonstrates what disciplined engineering and clear principles can achieve in decentralized finance. Its Layer-1 infrastructure, transparent execution, and deflationary token economy create a unified architecture built for endurance. The platform defines what “infrastructure-first” truly means, not a slogan, but a complete design philosophy that turns precision, independence, and user alignment into lasting competitive power.

Chapter 3: Aster – Rapid Expansion in the Perpetual DEX Market

If Hyperliquid represents engineering precision and discipline, Aster is a campaign of speed and scale: a strategic blitz designed to seize market dominance through momentum, incentives, and reach. Aster’sgrowth-first philosophy has turned it into one of the fastest-growing forces in decentralized derivatives, proving how aggressive expansion can rival years of infrastructure building.

The Blitzscaling Scenario

Aster approaches expansion as a market takeover, not a gradual rollout. The platform entered the scene with a complete ecosystem ready to operate across multiple chains, achieving what would normally take years within a few months. Every part of its design focuses on capturing users, volume, and attention at maximum velocity.

Multi-Chain Aggregation

Aster selected a pragmatic path by deploying simultaneously on BNB Chain,Ethereum, Solana, and Arbitrum. This strategy sacrifices single-chain optimization to access the largest liquidity pools and user bases available. Traders can connect directly from their preferred networks, eliminating bridging friction and reducing entry barriers.

By leveraging existing blockchain infrastructure, Aster shortened its time-to-market from years to months. This allowed it to build liquidity fast and reach users where they already trade, creating an instant network effect across ecosystems.

The Strategic Merger Story

Aster’s rise began with the2024 merger of two DeFi projects: Astherus, known for liquid staking and yield generation, and APX Finance, a derivatives protocol with advanced perpetual trading technology. Backed by YZi Labs (formerly Binance Labs), the merger combined deep technical knowledge with proven market infrastructure.

The result was a platform born with a working product, established liquidity, and access to Binance’s vast network of users and partners. This foundation positioned Aster to enter the perpetual DEX market with speed and credibility.

Features Designed to Create a Storm

Aster’s product suite is engineered for virality, accessibility, and scale. Each feature serves a clear purpose: expanding reach, boosting engagement, and amplifying trading activity.

- Dual-Mode Trading: The platform caters to two audiences. Pro Mode offers a full-featured CLOB (Central Limit Order Book) system tailored for professional traders. Simple Mode delivers one-click trading, MEV protection, and up to 1001x leverage, opening the market to retail users and newcomers. This dual structure widens adoption and allows both experience levels to coexist on one platform.

- 1001x Leverage: This extreme leverage option functions as both a trading tool and a marketing weapon. It attracts high-risk traders and generates attention, positioning Aster as a frontier for bold speculation.

- Superior Capital Efficiency: The Trade & Earn mechanism allows users to employ yield-bearing assets such as asBNB (BNB liquid staking token) and the proprietary USDF stablecoin as collateral. Trader capital continues to earn yield even while being used as margin for leveraged positions, creating a layer of passive income within active trading.

- Security Enhancements: Features like Hidden Orders and Dark Pools enhance protection against MEV attacks and front-running. These systems conceal trade intent from public mempools and safeguard large-volume traders from predatory algorithms. The concept echoes ideas previously discussed by CZ, reinforcing speculation about close strategic alignment.

Security Features and the CZ Effect in Perpetual DEX Ecosystem

Support from Changpeng Zhao (CZ) and YZi Labs serves as the cornerstone of Aster’s rise. CZ’s endorsement transformed Aster from a new entrant into a global phenomenon. The Binance connection provided instant brand trust, access to institutional liquidity, and powerful promotional leverage.

Market observers view Aster as part of a broader move to bring Binance’s derivatives leadership fully on-chain. The combination of capital, infrastructure, and community backing created a launch environment few competitors could match.

Strategic Response to Hyperliquid

Aster’s strategy functions as a direct counter to Hyperliquid’s dominance. Hyperliquid’s strength lies in its dedicated Layer-1 and unmatched execution speed, but its reach is limited to users willing to bridge assets. Aster’smulti-chain aggregation removes that friction entirely, meeting users directly within major ecosystems such as BNB Chain and Solana.

Hyperliquid built its reputation on professional-grade trading. Aster mirrors those capabilities in Pro Mode while amplifying accessibility through Simple Mode, designed to appeal to mass retail audiences. Hyperliquid’s expansion is deliberate and product-driven; Aster’s growth is explosive, driven by incentives, social momentum, and the influence of the Binance network.

This duality defines the competition: precision versus scale, independence versus acceleration.

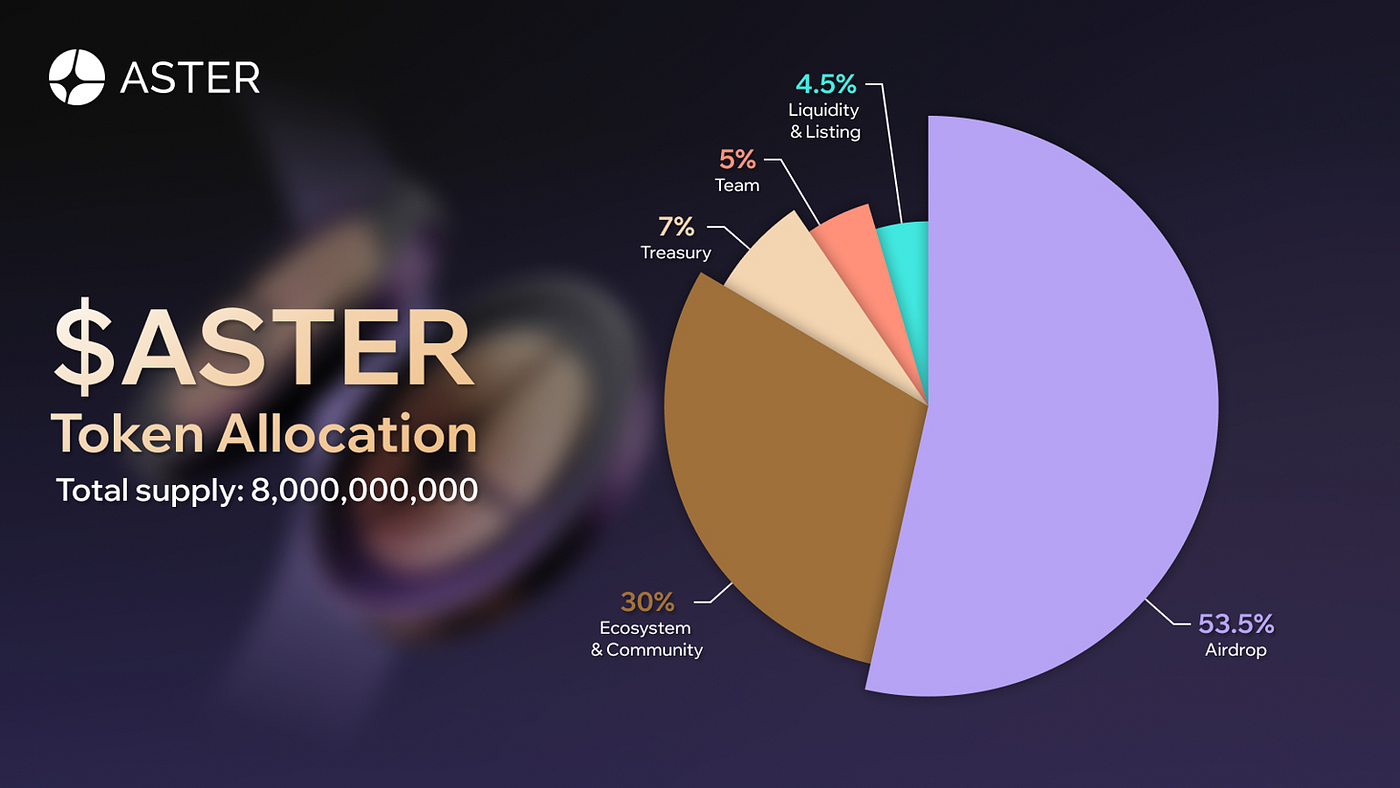

$ASTER Token: The Incentive Flywheel

The $ASTER token lies at the center of Aster’s growth model. Its structure transforms incentives into motion and motion into narrative.

- Distribution: Out of 8 billion total tokens, 53.5% are allocated to community rewards and airdrops. This large allocation powers Aster’s adoption flywheel, fueling engagement and trading activity across multiple networks.

- Utility: $ASTER serves as the governance token, offers trading fee discounts when used for payments, and unlocks premium features on the platform.

- Value Accrual: Platform expansion and user participation are designed to create value for token holders. The model relies on growth-driven demand and governance utility rather than direct buyback mechanisms. Its high emission rate in the early phases feeds continuous market activity and participation.

Aster’s approach draws on the principle of reflexivity, where activity and perception reinforce one another. High trading volumes drive visibility, which brings new users and liquidity, reinforcing the cycle. The project’s Rh points system encourages traders to generate volume for airdrop eligibility, pushing reported daily trading volumes to $87 billion.

These massive figures, amplified by CZ’s presence and Binance’s ecosystem, sustain the narrative of Aster as the “next Hyperliquid.” The story itself becomes a growth engine, drawing media coverage, investor interest, and social momentum. The power of this reflexive loop lies in its ability to turn incentives into perception and perception into sustained expansion: a cycle that defines Aster’s lightning growth strategy.

Chapter 4: Perpetual DEX Battle – Hyperliquid vs Aster Comparison

Understanding the rivalry between Hyperliquid and Aster requires more than a look at performance numbers. It is a direct comparison between two strategic doctrines: one built on engineering sovereignty, the other powered by growth momentum. Each represents a distinct school of thought within DeFi, and their competition defines the current evolution of on-chain derivatives.

This chapter examines their differences across four dimensions: technological architecture, trading experience, token economics, and ecosystem development.

Architecture and Performance: App-Chain vs Aggregation Platform

The most fundamental difference between the two platforms lies in their blockchain architecture.

Hyperliquid chose the vertical integration path, building a proprietary Layer-1 (HyperCore/HyperEVM) optimized for a single application: trading. This approach delivers superior performance benefits: latency around 0.2 seconds, throughput up to 200,000 transactions per second, and order settlement performed entirely on-chain deterministically, providing a CEX-like trading feel.

Aster pursues a horizontal integration strategy, operating as a liquidity aggregation layer across multiple different blockchains. The benefit of this model is immediate access to users and liquidity across major ecosystems like BNB Chain, Arbitrum, and Solana without requiring users to perform complex asset bridging operations. However, the trade-off is that Aster's performance depends on and is limited by the host chains it operates on. Notably, Aster's roadmap includes plans to launch a proprietary Layer-1 based on ZK technology in the future, called "Aster Chain," showing their ultimate ambition to achieve a performance model similar to Hyperliquid.

Trader Experience: Features, MEV Protection, and Capital Efficiency

User experience is where philosophy turns into tangible impact. Hyperliquid emphasizes technical reliability and professional control, while Aster emphasizes accessibility and financial creativity.

Interface & Onboarding: Hyperliquid requires deposits through the Arbitrum network, providing a focused and consistent environment for traders. The interface is widely recognized for its clarity, precision, and near-instant withdrawal capability. Aster enables direct deposits from multiple chains, delivering an open and frictionless onboarding process for users across ecosystems.

Trading Features: Both exchanges offer CLOB (Central Limit Order Book) systems, derivatives, and spot trading. Hyperliquid maintains a professional, performance-driven setup with up to 50x leverage. Aster differentiates itself with Simple Mode, offering 1001x leverage and 24/7 stock perpetuals, expanding into hybrid asset classes that bridge traditional finance and DeFi.

MEV Protection Capability: This is an important battleground.

- Aster provides MEV protection in Simple Mode through "a private mempool or specialized matching system" and in Pro Mode through "Hidden Orders."

- Hyperliquid addresses MEV at the architectural level. The fully on-chain orderbook and deterministic order settlement by Layer-1 validators inherently prevents common front-running and sandwich attacks on other chains.

Capital Efficiency: Aster advances this field with its Trade & Earn system, which allows the use of asBNB (BNB liquid staking token) and USDF as collateral. Traders can maintain exposure and yield simultaneously, improving capital utilization. Hyperliquid, while focusing on execution speed and transparency, has yet to integrate yield-generating collateral within its framework.

Tokenomics and Value Accrual Models in Perpetual DEX Design

Token design reflects each project’s philosophy toward sustainability and value creation. Hyperliquid uses scarcity to build lasting value, while Aster uses incentives to accelerate participation.

Hyperliquid ($HYPE): The $HYPE model is built for endurance. 97% of all protocol fees are used to buy back and burn tokens, directly linking trading activity with long-term value growth. The deflationary structure rewards holders and reflects real platform performance. Revenue flows naturally into the token, turning utility into value through sustained trading volume.

Aster ($ASTER): The $ASTER token fuels growth through scale. 53.5% of the total 8 billion supply is allocated for airdrops and community rewards. The design focuses on rapid market capture through incentives, encouraging traders to engage, earn points, and contribute to the ecosystem. While the system expands token distribution quickly, it relies on continuous activity to maintain momentum.

Ecosystem & Decentralization: Organic Growth vs. Centralized Push

The ecosystem dimension reveals how each platform scales its influence beyond trading.

Hyperliquid grows from within. The network hosts over 100 protocols on HyperEVM, including Hyperswap, Sentiment, and Theo Network. Its community-led structure and absence of venture capital funding allow developers and traders to co-own the narrative. The expansion follows a natural cycle where innovation arises from real usage and collaboration.

Aster grows from alignment. Backed by YZi Labs and CZ, it leverages institutional resources, marketing infrastructure, and global recognition. Token distribution remains concentrated, with reports showing 6 wallets controlling 96% of supply — most of which is reserved for community incentives and ecosystem programs. The model channels top-down coordination to accelerate visibility and adoption across chains.

Core Architecture and Feature Comparison

The following table highlights the technical and functional distinctions that define the performance and structure of each platform.

| Criteria | Hyperliquid | Aster |

| Blockchain Architecture | Proprietary Layer-1 (HyperCore/HyperEVM) | Multi-chain aggregation layer (BNB, Arbitrum, SOL, etc.) |

| Consensus Mechanism | HyperBFT (custom) | Dependent on host chains |

| Performance (TPS/Latency) | 200,000 TPS / ~0.2s | Dependent on host chains |

| Trading Model | Fully on-chain CLOB orderbook | CLOB orderbook (Pro) & AMM (Simple) |

| Maximum Leverage | Up to 50x | Up to 1001x |

| MEV Protection | Inherent architecture (deterministic settlement) | Dedicated features (Hidden Orders, private mempool) |

| Unique Features | CEX-level performance, no gas fees | 1001x leverage, stock perpetuals, yield-bearing collateral |

| Fee Structure | Maker: 0.01% / Taker: 0.035% (reducible) | Maker: 0.01% / Taker: 0.035% (reducible) |

Table 2: Token Economics and Value Accrual Comparison

The next table provides a clear view of how token design and value distribution align with each project’s strategy.

| Criteria | Hyperliquid ($HYPE) | Aster ($ASTER) |

| Total Supply | 1,000,000,000 | 8,000,000,000 |

| Community Allocation | ~70% (including airdrop and incentives) | ~83.5% (53.5% airdrop + 30% ecosystem) |

| Core Utility | Governance, Staking, Fee discounts | Governance, Fee discounts, Feature access |

| Value Accrual Mechanism | 97% protocol fees for Buyback & Burn | Platform growth, governance rights |

| Economic Model | Deflationary | Inflationary/Incentive-driven |

Hyperliquid and Aster stand at two ends of the same spectrum. Hyperliquid channels precision, engineering, and deflationary value to build endurance. Aster channels scale, incentives, and distribution power to expand fast and dominate mindshare.

Both redefine the landscape of decentralized perpetual trading: one through discipline, the other through momentum. The balance between these two philosophies will determine how DeFi’s next era of competition unfolds.

Chapter 5: Perpetual DEX Transparency – The Aster Volume Controversy

Aster’s rapid ascent brought admiration, momentum, and controversy. On October 6, 2025, the market reached a turning point when DeFiLlama, one of the most trusted data aggregators in decentralized finance, announced the temporary removal of Aster’s derivatives volume from its dashboard. The decision sent a shock through the DeFi community and opened a global conversation on transparency, accuracy, and data integrity within on-chain trading.

This chapter examines the event through four perspectives: the allegations, the data, the reactions, and the broader implications for DeFi.

Allegations and Evidence

At the center of the storm stood concerns about wash trading, a technique that artificially amplifies trading activity to create the illusion of liquidity and investor demand.

0xngmi, co-founder of DeFiLlama, presented the key evidence. He highlighted a near 1:1 correlation between Aster’s trading volume on pairs such as XRP/USDT and ETH/USDT and the same pairs on Binance Derivatives. The correlation suggested that Aster’s reported data might have mirrored Binance’s market movements instead of reflecting purely organic transactions.

Aster did not publish detailed on-chain data identifying makers and takers, which left external analysts unable to fully trace the source of trading activity.

On-Chain Analysis and Contradictions

To evaluate the validity of the numbers, on-chain researchers examined the relationship betweentrading volume, Total Value Locked (TVL), and Open Interest (OI). Consistent growth across these metrics typically indicates genuine user engagement. In Aster’s case, the ratios displayed extraordinary disparities, prompting deeper analysis.

The following table highlights the comparative data that drew attention from analysts across the DeFi ecosystem.

| Metric | Aster | Hyperliquid | Observation |

| Volume-to-TVL Ratio | 38:1 | 0.09:1 | Very high turnover relative to locked capital |

| Volume-to-OI Ratio | Significantly higher | Low and stable | Activity driven by short contract cycles |

| Transactions with Wash Trading Traits | ~2.02% by count / ~1.7% by value | N/A | Indicates selective manipulation rather than full-volume fabrication |

The data revealed an imbalance between reported volume and actual liquidity depth. The 38:1 volume-to-TVL ratio showed that trading was occurring at speeds far beyond the capital base, indicating intense cycling of contracts. At the same time, deeper research found that only 2.02% of trades by count and 1.7% by value showed clear wash trading characteristics. This layered view suggested that the system’s metrics were amplified by design rather than entirely simulated.

Consequences and Reactions

DeFiLlama’s announcement immediately impacted sentiment. Within hours,$ASTER dropped 15%, falling from $2 to $1.57. Traders responded with caution, and social channels lit up with debate about data accuracy and transparency.

Momentum shifted quickly when Binance confirmed the spot listing of $ASTER, sparking a rebound and restoring short-term market confidence. The event underscored how much Aster’s market identity relies on ecosystem influence and strategic positioning.

The temporary decline followed by a swift recovery reflected both the volatility of investor psychology and the strength of Aster’s network alliances.

Aster’s Reaction and Analyst Assessments

The Aster development team referred to the issue as “data discrepancies” within their airdrop dashboard. Analysts viewed the event through a structural lens, emphasizing how Aster’s incentive framework created a fertile environment for inflated metrics.

Aster’s Rh points system rewards participants based on trading activity. With 53.5% of total supply allocated to community rewards and airdrops, traders had a strong reason to increase turnover aggressively. Many wallets executed high-frequency transactions to maximize points, producing headline-making volume of $87 billion per day.

This structure turned trading itself into a promotional engine. The system achieved its intended goal of visibility, liquidity movement, and viral marketing. It also illustrated the delicate balance between financial innovation and transparency in incentive-driven models.

Broader Implications for DeFi Transparency

The DeFiLlama delisting represented more than a single protocol controversy. It highlighted the challenges of maintaining reliable, verifiable data in a world built on decentralization.

Key takeaways from the incident include:

- Data Authority: Aggregation platforms like DeFiLlama have become powerful arbiters of market credibility. Their decisions shape perception, liquidity flows, and investor confidence.

- Incentive Design: Reward systems that link points or yield directly to trading volume require robust monitoring to ensure sustainable behavior.

- Verification Standards: On-chain does not automatically mean transparent. Effective auditing depends on the visibility of transactional and liquidity data.

- Market Psychology: Ecosystem alignment and strategic partnerships can restore confidence even when trust is temporarily strained.

The event served as a reminder that in modern DeFi, transparency is a competitive advantage as much as a compliance standard.

Community Reaction

Public opinion surrounding the delisting revealed deep division within the community.

Supporters framed the incident as a byproduct of Aster’s scale and speed, arguing that DeFiLlama’s move disrupted market neutrality. They saw the platform’s explosive metrics as evidence of its marketing success.

Critics emphasized the importance of data integrity. They praised DeFiLlama for setting a precedent that quality of information matters more than growth figures. Many saw the moment as a turning point where projects must prove transparency through verifiable data rather than reputation.

Despite differing opinions, the community recognized the broader significance of the event. It marked a milestone in how decentralized markets define credibility and trust.

The DeFiLlama delisting incident became a defining chapter in Aster’s journey and a test of DeFi’s maturity. The data revealed extraordinary growth patterns, fueled by incentives and amplified through reflexive market behavior. The price reaction, rapid recovery, and global attention positioned Aster at the center of DeFi’s transparency debate.

The chapter demonstrated the strength of Aster’s network influence and the evolving expectations for data accountability. In the expanding world of decentralized derivatives, credibility is now measured not only by scale and speed but by the clarity of what happens on-chain.

Chapter 6: Voices from the Community: Expert Commentary and Market Sentiment

The story of Hyperliquid and Aster extends beyond charts and numbers. Expert opinions, on-chain investigations, and community discussions reveal how perception shapes the market. The following perspectives capture the emotional, analytical, and reputational layers of this rivalry, reflecting how two philosophies collide in the minds of traders and investors.

Commentary from Expert Analysts

Patrick Scott remains one of the most influential voices in the debate. He describesHyperliquid as “the best positioned Perp DEX” and “the most investable” platform in the market. His analysis emphasizes a strong foundation built on product performance, long-term vision, and user loyalty.

According to Scott, Open Interest provides a truer measure of liquidity than raw trading volume. Hyperliquid currently holds 62% of Open Interest among perpetual DEX platforms, showing consistent capital engagement and trader confidence. He views this as the clearest signal of real usage and sustainable business growth.

Other analysts share a similar view, calling Hyperliquid “the Uniswap of perpetual markets.” They highlight the platform’s role in setting new standards for execution, transparency, and product-led growth.

Perspectives from On-Chain Investigators

ZachXBT, one of the most respected on-chain analysts, has delivered strong criticism toward the Aster community. He pointed to associations with known bad actors and warned that normalizing wash trading behavior damages market credibility. His remarks extended beyond data, touching on governance, integrity, and brand risk.

The investigator’s commentary shaped how many in the industry view Aster’s growth narrative. By connecting behavioral patterns with governance choices, his insights added a reputational layer to what had been a largely technical debate.

Community Sentiment (Reddit & X)

Discussions on social media platforms show deep polarization.

About Hyperliquid: Users consistently praise its speed, ease of use, and trading experience that mirrors centralized exchanges. The interface earns recognition for being intuitive, while near-instant deposits and withdrawals reinforce the perception of professional-grade execution. Some traders express caution over its small validator group and the tight control behind its Layer-1 design, but overall sentiment leans positive. Many users describe Hyperliquid as the platform that finally made on-chain trading feel seamless.

About Aster: The tone around Aster is far more polarized. Supporters celebrate the massive airdrop campaigns, record revenue numbers, and the influence of CZ’s backing as proof of scale and credibility. For them, Aster represents the next frontier of exchange innovation, a platform that grows by merging community energy with institutional power.

Core Debate: A Reddit comment perfectly summarized this debate: ASTER's price might surpass $HYPE thanks to "CZ, supply control, incentives and narrative," but it's not a "real disruptor" because the product isn't 10x better and would need years to build what Hyperliquid has already done.

The table below summarizes these two contrasting approaches that currently drive sentiment around $HYPE and $ASTER.

| Investor Group | Focus | Representative Metrics | Outlook |

| Analysts & Long-Term Builders | Product strength and verifiable on-chain fundamentals | Open Interest, platform revenue, fee retention, developer activity | Favor Hyperliquid for stability and sustainable growth |

| Retail Traders & Airdrop Hunters | Narrative, rewards, and market excitement | Rh points, airdrop potential ($570 million), CZ endorsement, trading volume | Favor Aster for short-term opportunity and momentum |

This contrast captures the essence of the rivalry. Hyperliquid attracts those who prioritize structure and measurable results. Aster energizes a crowd driven by speed, incentives, and the power of narrative.

Chapter 7: Security, Risk, and Legal Outlook in Perpetual DEX Platforms

Every financial platform, centralized or decentralized, must manage layers of risk. Security, sustainability, governance, and regulatory compliance all determine long-term survival. For Hyperliquid and Aster, these challenges define how each model withstands stress under real market conditions.

This chapter explores three key dimensions: smart contract security, platform-specific risks, and legal exposure in the evolving global framework for decentralized derivatives.

Smart Contract Security and Audits

Security is the backbone of credibility. Both projects have undergone audits, yet each faces unique structural risks tied to their design philosophy.

Hyperliquid: The platform completed audits by Zellic, focusing on bridge contracts between Hyperliquid Layer-1 and Arbitrum. The audit found no major vulnerabilities within its assessment scope. However, the documentation outlines areas requiring close monitoring: Layer-1 stability, oracle integrity, and bridge security.

The Jelly token delisting in 2025 highlighted how a liquidity imbalance can escalate into systemic risk if not managed proactively. The incident underscored Hyperliquid’s focus on safeguarding solvency and platform reliability as the network expands.

Aster: The Kryll X-Ray audit rated Aster’s overall security as “B”, noting solid contract construction but identifying weaknesses in email configurations (susceptible to spoofing) and high token centralization. The asBNB token, central to Aster’s yield and collateral system, also underwent an independent review by Cyberscope, ensuring code consistency across multiple chains.

The comparison between both projects shows two different security philosophies—Hyperliquid focuses on chain-level robustness, while Aster emphasizes operational adaptability across ecosystems.

Platform-Specific Risks

Each platform faces its own structural risks that arise from its growth model and governance design.

Hyperliquid: The main risk relates to validator centralization. With a validator set of around 16–24 nodes, the network achieves high performance and fast block finality. This architecture prioritizes speed but relies on tight coordination between validators, requiring rigorous monitoring and transparent governance to maintain trust.

Aster: This platform faces three main types of risks:

- Sustainability Risk: The platform’s growth model depends heavily on inflationary token incentives. The key question is whether traders will stay once airdrop rewards and community bonuses decrease.

- Centralization Risk: Around 96% of the total token supply resides in six wallets, a structure that allows rapid coordination but concentrates governance power. A large portion remains reserved for community programs, yet control remains in the hands of a few entities.

- Reputational Risk: Allegations of wash trading and opaque data reporting have influenced how investors and users view Aster’s governance standards. Maintaining credibility becomes essential for retaining high-value traders and institutional partners.

The table below summarizes the primary risks observed in each platform.

| Risk Type | Hyperliquid | Aster |

| Core Structural Risk | Small validator set | Token concentration (96% in 6 wallets) |

| Operational Risk | Bridge or oracle manipulation | Incentive exhaustion post-airdrop |

| Reputational Risk | Limited transparency on validator operations | Allegations of wash trading |

| Resilience Mechanism | Custom Layer-1 performance and on-chain settlement | Ecosystem marketing power and liquidity aggregation |

Both networks embody two clear philosophies in handling trade-offs. Hyperliquid prioritizes engineering mastery and performance optimization, reflecting a technical path built on precision and control. Aster advances through coordinated execution and rapid expansion, representing a strategic path centered on scale and momentum. One perfects the machine; the other commands the battlefield.

Challenges from Legal Environment

Legal uncertainty represents a shared challenge for allperpetual DEXs. Platforms that allow leveraged trading without Know Your Customer (KYC) verification operate within a shifting regulatory landscape.

Regulatory agencies such as the U.S. SEC and CFTC continue tightening oversight on derivatives trading and non-compliant exchanges. Potential outcomes include restricted access for U.S. residents, exchange delistings from app stores, or targeted enforcement actions.

For Hyperliquid, its self-contained Layer-1 and user-driven architecture provide a degree of protection, though it still must ensure transparency for cross-chain bridges and stablecoin integrations.

Aster, in contrast, draws greater attention from regulators due to its aggressive marketing and multi-chain visibility. The project publicly states that U.S. users can access its services without VPN, a detail that increases exposure to legal scrutiny. The situation places Aster at the intersection of innovation and jurisdictional oversight, making compliance strategy a defining factor for its long-term expansion.

Chapter 8: The Future of Perpetual DEX – Cypherpunk Dream vs Crypto Reality

After extensive analysis of architecture, strategy, and execution, the confrontation between Hyperliquid and Aster emerges as a battle between two financial ideologies. Hyperliquid represents the cypherpunk dream, a vision built on engineering precision, performance excellence, and independence from external influence. Aster captures the crypto reality, a modern landscape where scale, marketing influence, and strategic alliances often define success faster than pure technical mastery.

This chapter brings both worlds into focus: one built through deliberate craftsmanship, the other through rapid mobilization of momentum and market narrative.

Assessing Long-Term Sustainability

Hyperliquid: Hyperliquid's model appears more economically sustainable. The deflationary token economics model, directly tied to actual revenue from trading fees, creates a long-term economic engine. The organically developing developer ecosystem shows a sustainable network effect based on utility rather than just short-term incentives.

Aster: Long-term sustainability is the biggest question for Aster. Can this platform convert the massive user base, attracted by incentives, into a loyal community that stays after airdrops end? Can they successfully transition to their own Layer-1 and address transparency concerns that have damaged their reputation?

Recommendations Based on User Profile

There is no single answer to the question "which platform is better." The optimal choice depends on individual goals and risk tolerance.

For Professional/High-Frequency Traders: Hyperliquid is probably the superior choice currently. Unmatched speed, low latency, and CEX-like order execution experience on a proven and stable platform are factors optimized for performance-sensitive strategies.

For Airdrop Hunters/Risk-Taking Speculators: Aster offers a higher-risk but potentially higher-reward opportunity. Large token allocation for airdrops and momentum from big-name backing create significant speculative potential. The strategy here is to "farm" reward points through trading volume and bet on the market narrative.

For Long-Term DeFi Investors: Hyperliquid's $HYPE token presents a more attractive long-term investment thesis based on fundamentals. The direct link between platform revenue and token value through buybacks provides a clear and sustainable value accrual mechanism. Investing in $ASTER is like betting on the development team's ability to execute their ambitious roadmap and overcome current reputational challenges.

Conclusion

The market remains wide enough for both platforms to grow. The race for leadership in perpetual DEX trading is still in its early phase, with each side building its foundation in a different way. The outcome will depend on how well Hyperliquid expands its ecosystem and attracts developers, and how effectively Aster turns its rapid rise into lasting trust and user commitment. In the long run, the market itself will decide which vision prevails, and it may reward both.