Crypto Stocks IREN and NAKA Dip After Announcing Convertible Note Deals

Two major crypto-linked firms, IREN and Kindly MD (NAKA), saw their stock prices decline after unveiling multimillion-dollar convertible note deals. The news reflects growing investor caution amid slower venture capital inflows into the digital asset sector.

- IREN announced an $875 million convertible note offering, triggering a post-market drop.

- Kindly MD (NAKA) revealed a $250 million convertible note with Antalpha, worrying shareholders.

- Both companies’ deals raise concerns over shareholder dilution.

- Proceeds will fund corporate operations and Bitcoin purchases.

- VC funding in crypto has fallen by 59% quarter-over-quarter, per Galaxy Research.

Shares of Bitcoin mining firm IREN and crypto treasury company Kindly MD (NAKA) slipped this week as both announced large-scale convertible note offerings, sparking unease among investors.

IREN’s shares initially climbed 6.8% on Tuesday but dropped nearly 5% in after-hours trading after revealing plans to raise $875 million through a convertible senior note offering. The company said part of the proceeds will go toward general corporate purposes, working capital, and capped call transactions — a mechanism that helps limit dilution if debt holders convert their notes into shares.

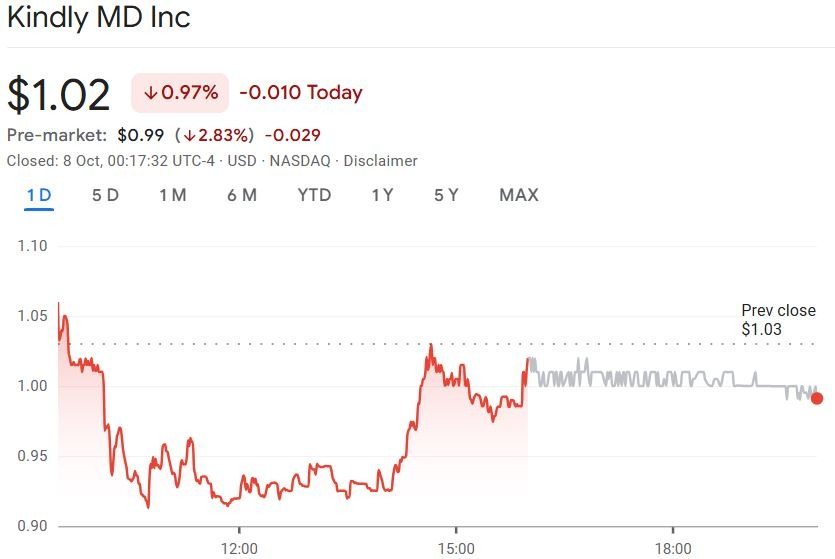

Similarly, Kindly MD — which merged with David Bailey’s Bitcoin firm Nakamoto — announced a $250 million five-year convertible note deal with fintech firm Antalpha. The stock fell 0.97% during the day and another 2.8% after hours, trading just below $1.00 per share.

Convertible note financing allows companies to borrow money that can later be converted into equity, but such deals often raise fears of shareholder dilution. IREN also offered an additional $125 million in notes for early purchasers, further amplifying investor concerns.

Meanwhile, Galaxy Research reported that venture capital funding for digital asset firms dropped 59% in available capital and 15% in deal count compared to the previous quarter, suggesting a tighter fundraising environment across the crypto industry.

Kindly MD stated that the financing aims to reduce dilution risk while using the proceeds to expand its Bitcoin holdings through the KindlyMD Bitcoin Treasury. The funds will also help refinance a $203 million Bitcoin-backed loan from Two Prime Lending. Pending completion, Antalpha will extend an interim Bitcoin-secured loan to Kindly MD.

Bailey called the partnership “a show of strength between Bitcoin companies,” adding that it “lays the foundation for financing structures tailored to Bitcoin treasury operations.”

Final Thought

While IREN and Kindly MD’s financing moves highlight efforts to strengthen liquidity and fund growth, investors remain cautious. The growing reliance on convertible notes underscores both the capital needs and the risks of equity dilution that crypto firms face in today’s uncertain funding climate.