Bitcoin Community Calls for JP Morgan Boycott After MSCI Moves to Exclude Crypto Treasury Companies

- Bitcoin supporters launch a boycott campaign against JP Morgan

- MSCI plans to exclude crypto treasury companies from major indexes in 2026

- Strategy and similar companies could face forced selling pressure

- Michael Saylor responds, saying Strategy is not a fund or holding company

- Concerns rise that the new rules could trigger negative impacts on crypto prices

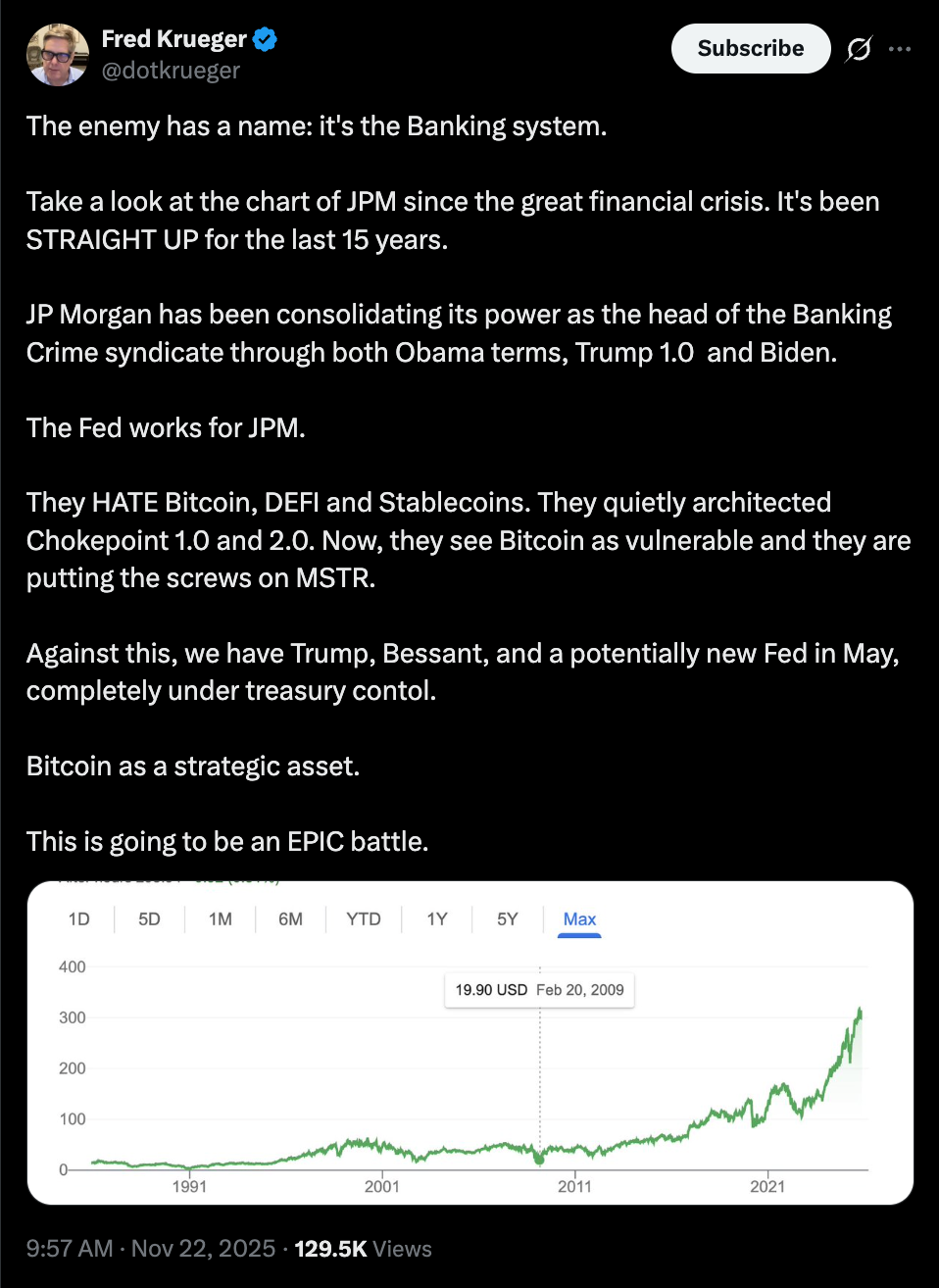

The Bitcoin community is pushing back strongly against JP Morgan after the bank circulated research showing that MSCI plans to exclude crypto treasury companies from major stock indexes starting January 2026. This move has triggered widespread frustration among Bitcoin supporters, as many believe the policy unfairly targets companies that hold large amounts of digital assets on their balance sheets. As the news spread, calls to “boycott” JP Morgan grew rapidly across social platforms, reflecting the community’s deep dissatisfaction.

The tension escalated when MSCI, a major index provider, revealed that firms with more than 50% of their balance sheet in crypto assets would no longer qualify for certain index listings. These indexes matter because they guide the investment decisions of funds, asset managers, and institutional portfolios that must follow strict inclusion rules. By excluding crypto treasury companies, MSCI could indirectly trigger a wave of forced selling, as funds holding these stocks would be required to offload them once the new criteria take effect.

JP Morgan amplified this news in its research note, which quickly reached major Bitcoin advocates. Some reacted with outrage. Investor and Bitcoin supporter Grant Cardone publicly announced that he withdrew $20 million from Chase and filed a lawsuit related to credit card issues. Max Keiser also urged people to stop using JP Morgan services while encouraging them to support Strategy and Bitcoin instead. Their responses helped fuel the momentum behind the boycott movement, which continues to spread online.

One of the biggest companies affected by MSCI’s proposal is Strategy, a major Bitcoin treasury company that joined the Nasdaq 100 in December 2024. Its inclusion in the index allowed it to benefit from passive capital flows as funds automatically purchased Nasdaq 100 components. With the proposed changes, those benefits could disappear entirely. The situation prompted Strategy founder Michael Saylor to address the issue publicly. He argued that Strategy should not be classified alongside funds or holding companies, explaining that the company creates and operates Bitcoin-backed structured financial products rather than simply holding assets passively.

If MSCI finalizes its new criteria, crypto treasury companies will face a difficult choice: either reduce their crypto exposure below the 50% threshold to maintain index inclusion or lose access to passive investor inflows. Many in the industry fear that this could lead to widespread selling pressure across the sector. Analysts warn that a sudden reduction in crypto holdings by these companies could push digital asset prices lower, potentially creating additional volatility during a sensitive period for the broader market.

The backlash against JP Morgan represents a broader frustration with traditional financial institutions perceived as hostile toward Bitcoin and the companies that support it. As the debate continues, the market is watching closely to see whether MSCI will proceed with the policy change — and how crypto treasury companies will respond if the new rules become official.

Final Thought

The growing boycott movement highlights a deeper divide between traditional finance and the Bitcoin ecosystem. With MSCI’s proposed changes threatening the stability of crypto treasury stocks, the coming months could play a major role in shaping how these companies operate in public markets. Whether MSCI adjusts its policy or crypto firms adapt to the new rules, the outcome will have lasting effects on both institutional participation and the broader digital asset landscape.