Jupiter and Ethena Labs unveil JupUSD: a Solana-based stablecoin for DeFi liquidity

Jupiter, Solana’s leading decentralized exchange aggregator, is teaming up with Ethena Labs to launch JupUSD, a new stablecoin designed to power liquidity, trading, and collateralization across the Solana DeFi ecosystem. The stablecoin, set to go live in mid–Q4 2025, will serve as the backbone of Jupiter’s growing suite of financial products.

- Jupiter and Ethena Labs will launch JupUSD on Solana in Q4 2025.

- JupUSD will be fully backed by Ethena’s USDtb and later USDe.

- The stablecoin will function across Jupiter’s perps, lending pools, and trading pairs.

- Built on Ethena’s white-label stablecoin-as-a-service stack.

- The launch highlights a growing trend of custom, ecosystem-backed stablecoins.

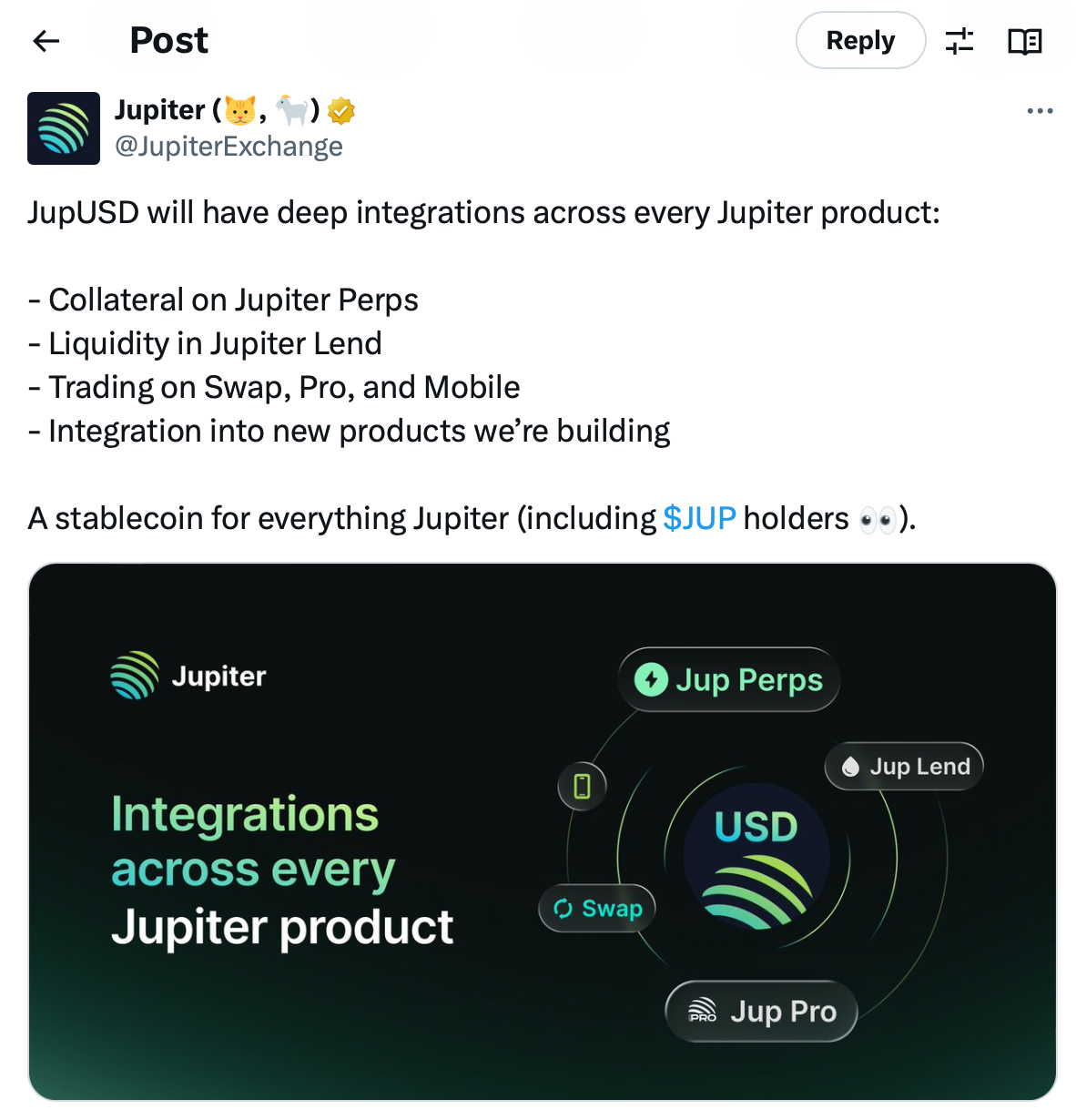

Solana’s DeFi ecosystem is about to get a major upgrade with the launch of JupUSD, a new stablecoin developed by Jupiter Exchange in partnership with Ethena Labs. The token will become the core liquidity and collateral asset across all of Jupiter’s products — including its perpetual futures exchange, lending pools, and decentralized trading platform.

According to Jupiter’s announcement, JupUSD will be 100% collateralized by USDtb, a dollar-pegged stablecoin backed by short-term U.S. Treasury bills issued by Ethena Labs. Over time, USDe, Ethena’s synthetic dollar, will be added as an additional collateral source to enhance yield and optimize liquidity management.

“JupUSD is not just another stablecoin—it’s the foundation for a more unified DeFi experience on Solana,” Jupiter’s team stated in its official X post. By standardizing liquidity under a single, protocol-native stablecoin, the exchange hopes to strengthen on-chain efficiency and reduce fragmentation across Solana’s DeFi ecosystem.

Ethena Labs confirmed that JupUSD is being built using its white-label stablecoin-as-a-service infrastructure, which allows any protocol, enterprise, or even government to issue custom-branded stablecoins using Ethena’s underlying systems. The framework manages collateralization, issuance, and redemption while ensuring full transparency and compliance.

Once launched, JupUSD will become the primary collateral asset for Jupiter Perps, gradually replacing roughly $750 million in existing stablecoins currently held in the protocol’s liquidity pools. This transition aims to consolidate market depth and simplify user experience across trading and lending activities.

The move comes as part of a broader trend of white-label and institutional-grade stablecoins reshaping global finance. Ethena Labs has recently partnered with the Sui Foundation to launch suiUSDe and USDi, Sui’s first native stablecoins. Meanwhile, Fiserv and the state of North Dakota are co-developing a state-backed stablecoin, Roughrider Coin, under a similar infrastructure model.

By enabling enterprises to issue their own stablecoins without requiring new licenses or technical overhead, Ethena’s model has positioned itself as a leading player in the race toward modular, interoperable stablecoin ecosystems. Other companies like Bastion and Stripe have also joined the field, offering similar infrastructure services.

For Solana, JupUSD could become a major liquidity anchor — aligning DeFi users, traders, and institutions under a single, yield-optimized stablecoin that benefits from real-world asset collateral and on-chain programmability.

Final Thought

JupUSD represents the next phase in stablecoin innovation — a fusion of on-chain efficiency, institutional-grade backing, and ecosystem alignment. With Jupiter and Ethena Labs leading the charge, Solana’s DeFi ecosystem could see a liquidity boost and become a testing ground for the future of programmable, collateral-backed stable assets.