KuCoin Challenges $14M Fine from Canadian Regulator Over Alleged AML Violations

Crypto exchange KuCoin is pushing back against a hefty $14.1 million fine imposed by Canada’s financial intelligence regulator, FINTRAC, for alleged breaches of anti-money laundering (AML) laws. The exchange insists it has complied with Canadian regulations and is appealing the ruling in court.

- Allegations include failure to register as a foreign money services business and missing required transaction reports.

- KuCoin disputes both the findings and the size of the penalty, calling it “excessive and punitive.”

- The exchange has filed an appeal with the Federal Court of Canada.

- KuCoin’s native token (KCS) dropped 0.7% following the news.

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) recently announced a C$19.5 million ($14.1 million) administrative penalty against crypto exchange KuCoin for allegedly failing to meet Canada’s anti-money laundering and anti-terrorist financing obligations. According to FINTRAC, KuCoin’s operator, Peken Global Ltd., did not register as a foreign money services business, failed to report cryptocurrency transactions exceeding C$10,000, and neglected to file suspicious activity reports as required by Canadian law.

In response, KuCoin swiftly contested the ruling, stating that it had lodged an appeal with the Federal Court of Canada. The exchange emphasized that it “respects the decision-making process” and remains “committed to compliance and transparency.” However, KuCoin firmly rejected FINTRAC’s characterization of its operations, arguing that the regulator’s findings were both factually and procedurally flawed.

KuCoin CEO BC Wong reinforced this stance in a post on X (formerly Twitter), asserting that the company “disagrees with this decision on both substantive and procedural grounds” and that the appeal aims to ensure “a fair outcome for KuCoin.” The exchange described the fine as “excessive and punitive,” maintaining that it continues to cooperate with authorities while defending its position through proper legal channels.

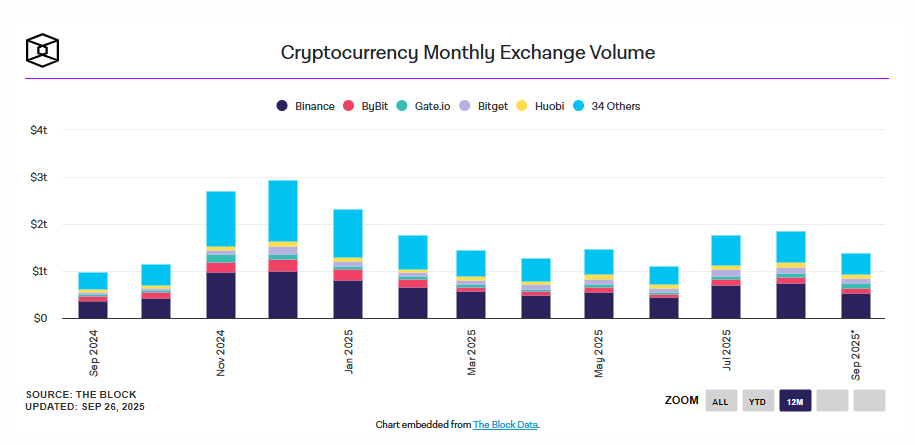

Following the announcement, KuCoin’s native token, KCS, dipped 0.7% to $15.12, with a market capitalization of $1.9 billion as of early Friday. Despite the controversy, KuCoin remains one of the largest global exchanges, reporting a trading volume of $53.6 billion in August—though that figure still trails behind major competitors like Binance and Bybit.

Final Thought

KuCoin’s appeal against FINTRAC’s $14 million fine highlights the growing tension between global crypto exchanges and national regulators over AML compliance. As governments tighten their oversight of digital asset platforms, KuCoin’s case may set an important precedent for how foreign exchanges navigate Canada’s increasingly strict financial landscape.