Lighter Airdrop Guide: a16z-Backed Perpetual DEX on Ethereum L2

After months of speculation, Lighter has confirmed an airdrop for users of its a16z-backed perpetual DEX on Ethereum Layer 2. The exchange is running an aggressive points campaign during its mainnet beta, rewarding traders for providing liquidity and using the platform while fees remain at zero. With Lighter already climbing to the top tier of perp DEX volumes, early participation in this phase could translate into meaningful token allocations once details go live.

This guide walks you through how Lighter works, why its airdrop matters, and the practical steps you can take to farm points as efficiently and safely as possible before the beta period ends.

Part 1: Lighter Overview

Lighter is a perpetual decentralized exchange on Ethereum Layer 2 built with zkLighter (zk-rollup) technology. The platform is currently in its mainnet beta and operates with a points-based rewards system designed to encourage early activity. Backed by Andreessen Horowitz (a16z) since May 2023, Lighter delivers CEX-level performance through transparent order matching, public liquidity pools, and zero trading fees during beta.

DeFiLlama data shows Lighter ranking second in trading volume among perpetual DEXs. Users can earn points by participating in futures trading, creating a strong position for potential token rewards as the beta phase draws to a close. While the team has not confirmed an airdrop, the structured points program and the success of similar DEX campaigns such as Avantis and Aster indicate a high chance of future distribution.

Part 2: How to join the Lighter Airdrop?

Prerequisites

To participate in Lighter’s points program, prepare the following:

- An EVM-compatible wallet (MetaMask, Rabby, Phantom, etc.) configured with Layer 2 networks including Base, Avalanche, and Arbitrum

- Minimum of 5 USDC for trading activities (amount can be adjusted based on individual capital and risk tolerance)

- Referral code (available in the project’s Discord community if needed)

Getting Started

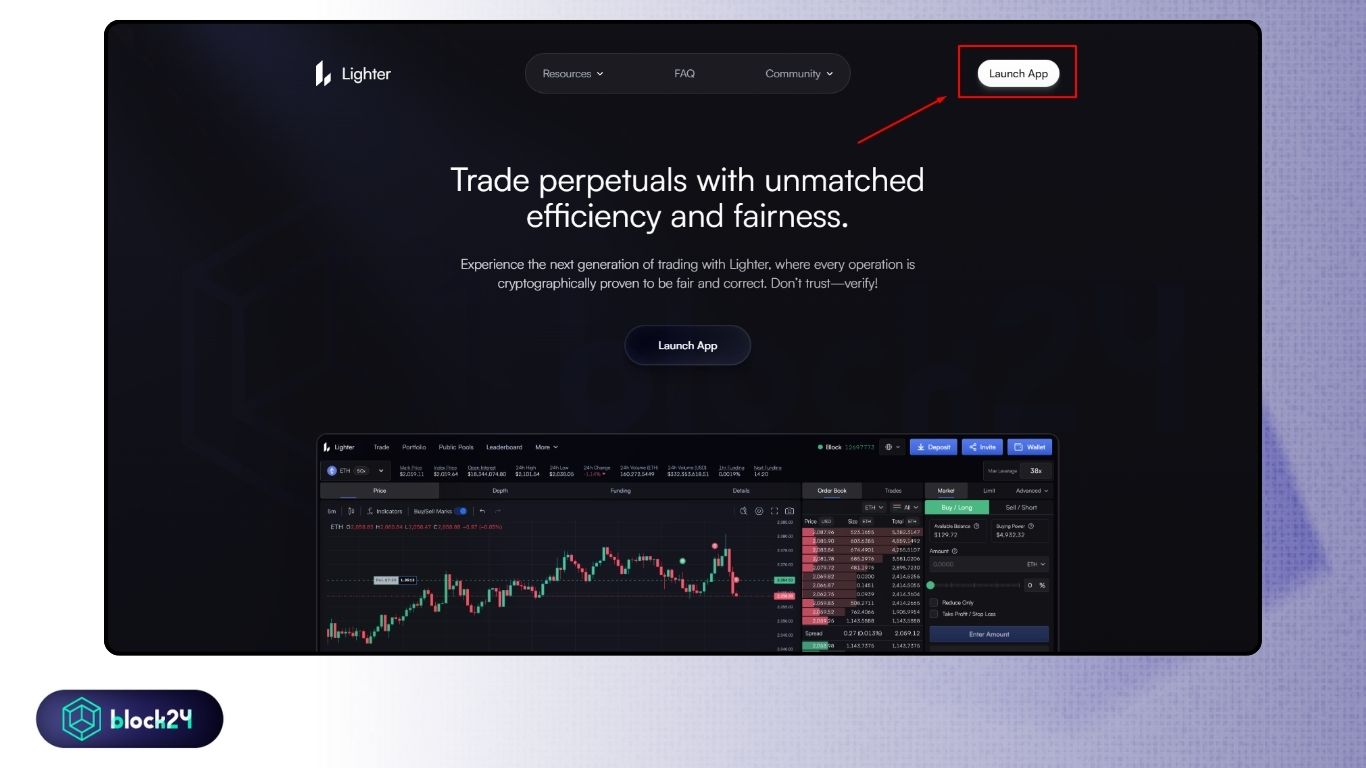

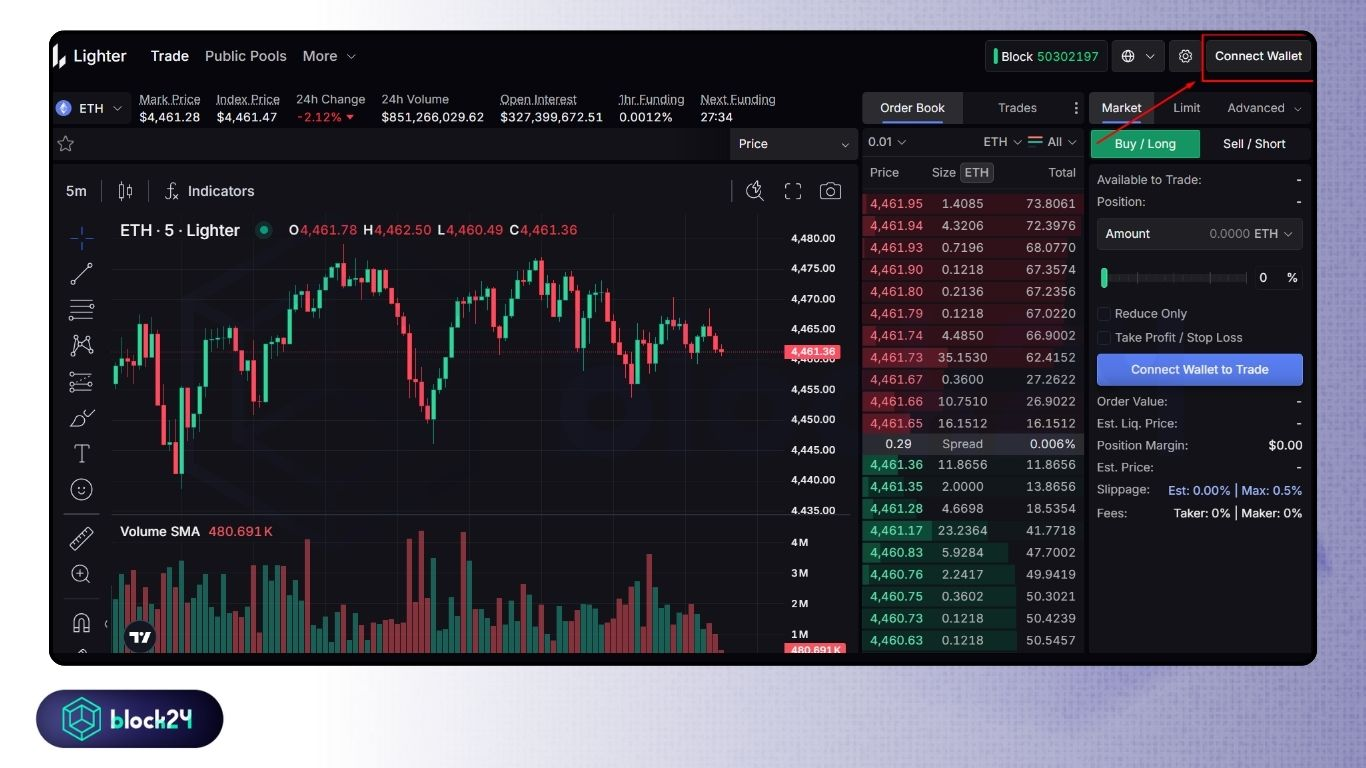

Step 1: Visit https://lighter.xyz/ and click “Launch App” to access the trading platform.

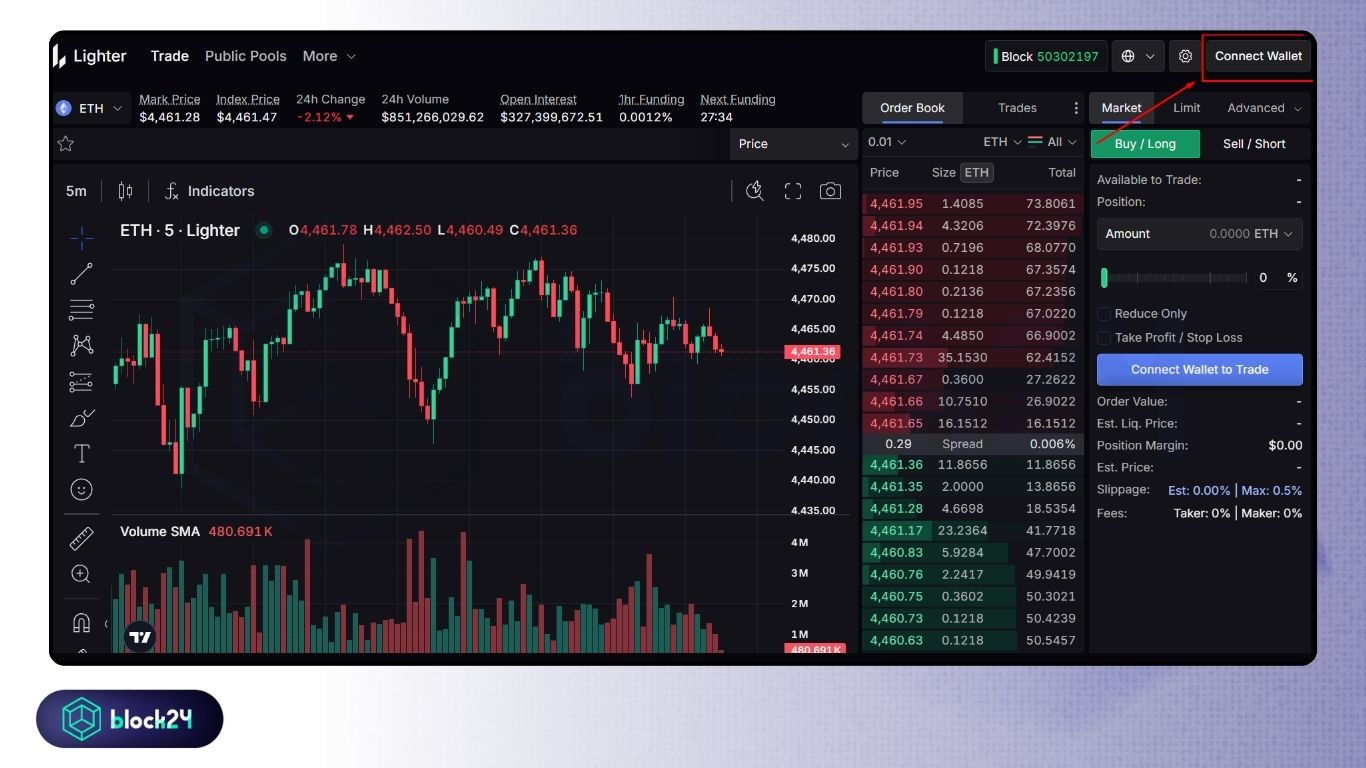

Step 2: Click “Connect Wallet” and link your EVM-compatible wallet to the platform.

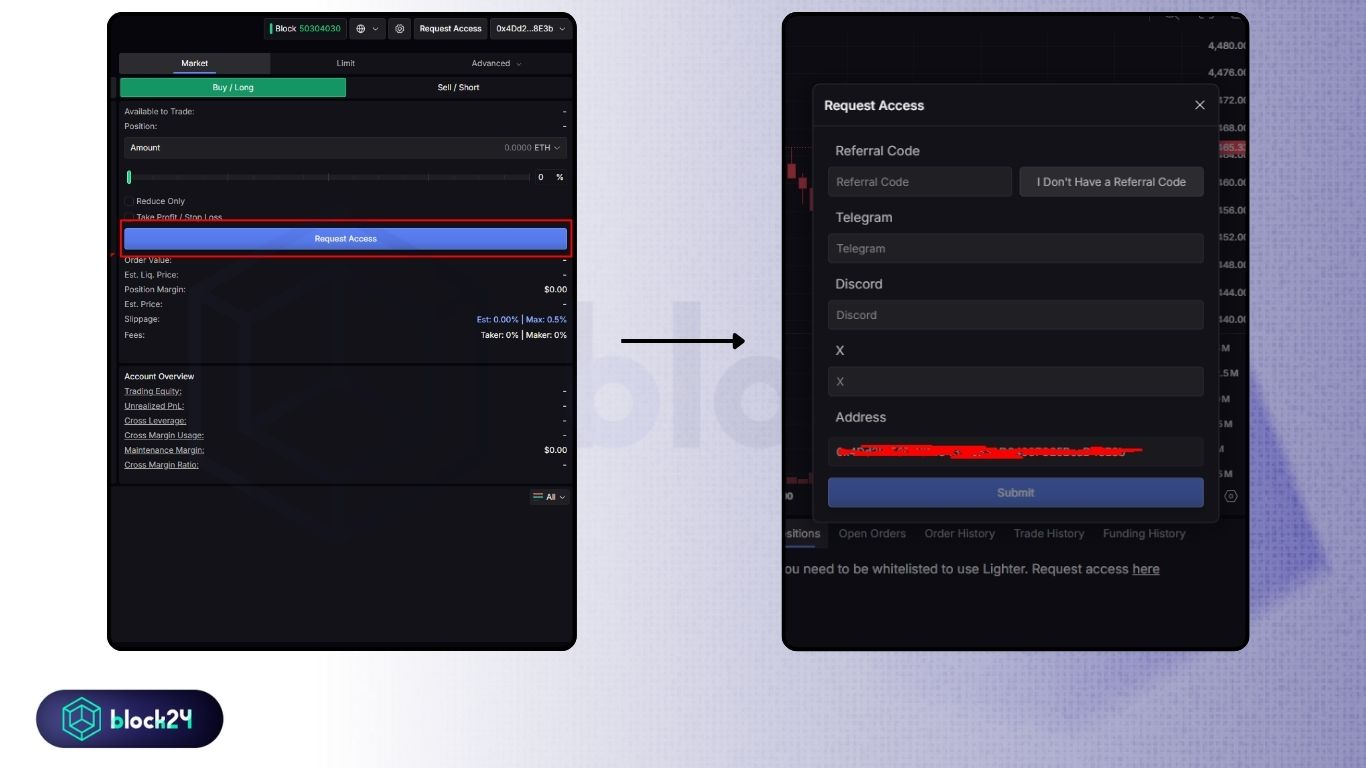

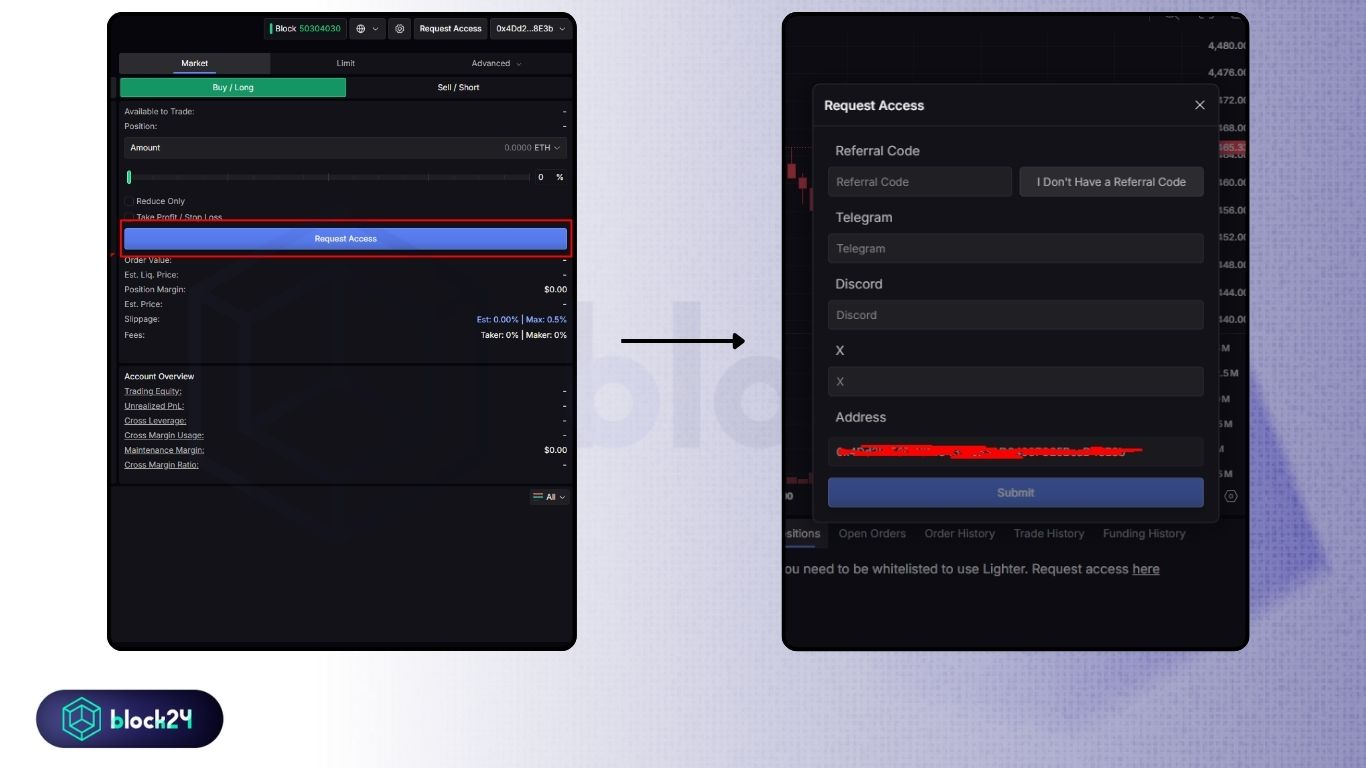

Step 3: Select “Request Access” and complete the registration form by providing:

- Referral Code (obtain from Discord community if unavailable)

- Telegram handle

- Discord username

- X (Twitter) account

This information activates your trading account and links social profiles for verification purposes.

Depositing Funds

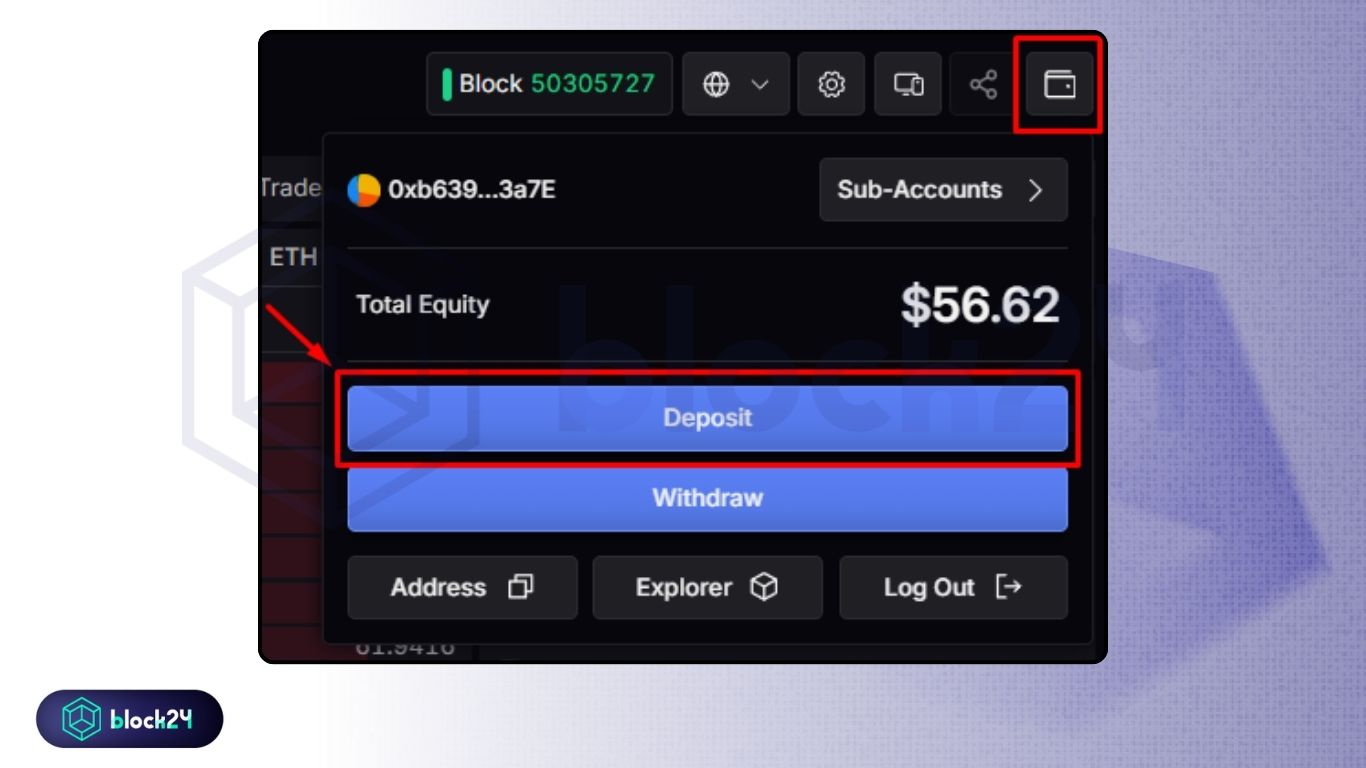

Step 4: Click the wallet icon in the top right corner and select “Deposit” to begin funding your account with USDC.

Step 5: Choose one of two deposit methods:

Option A – Wallet Deposit: Transfer minimum 5 USDC from Ethereum Layer 2 networks including Base and Arbitrum directly from your connected wallet.

Option B – CEX Deposit: Withdraw USDC directly from centralized exchanges to your Lighter account via supported networks including Base, Arbitrum, and Solana.

Trading and Earning Points

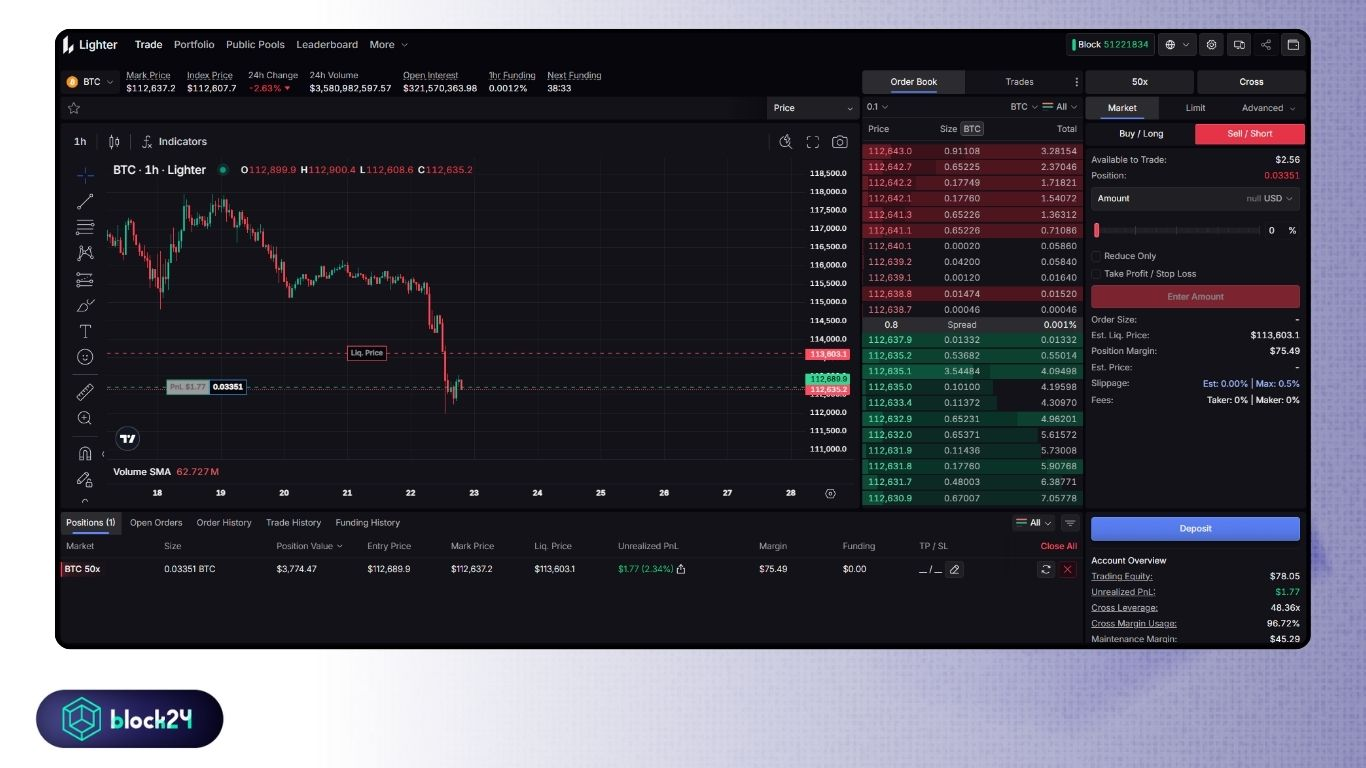

Step 6: Navigate to the “Trade” section to execute futures positions. All trading activity contributes to points accumulation and volume generation.

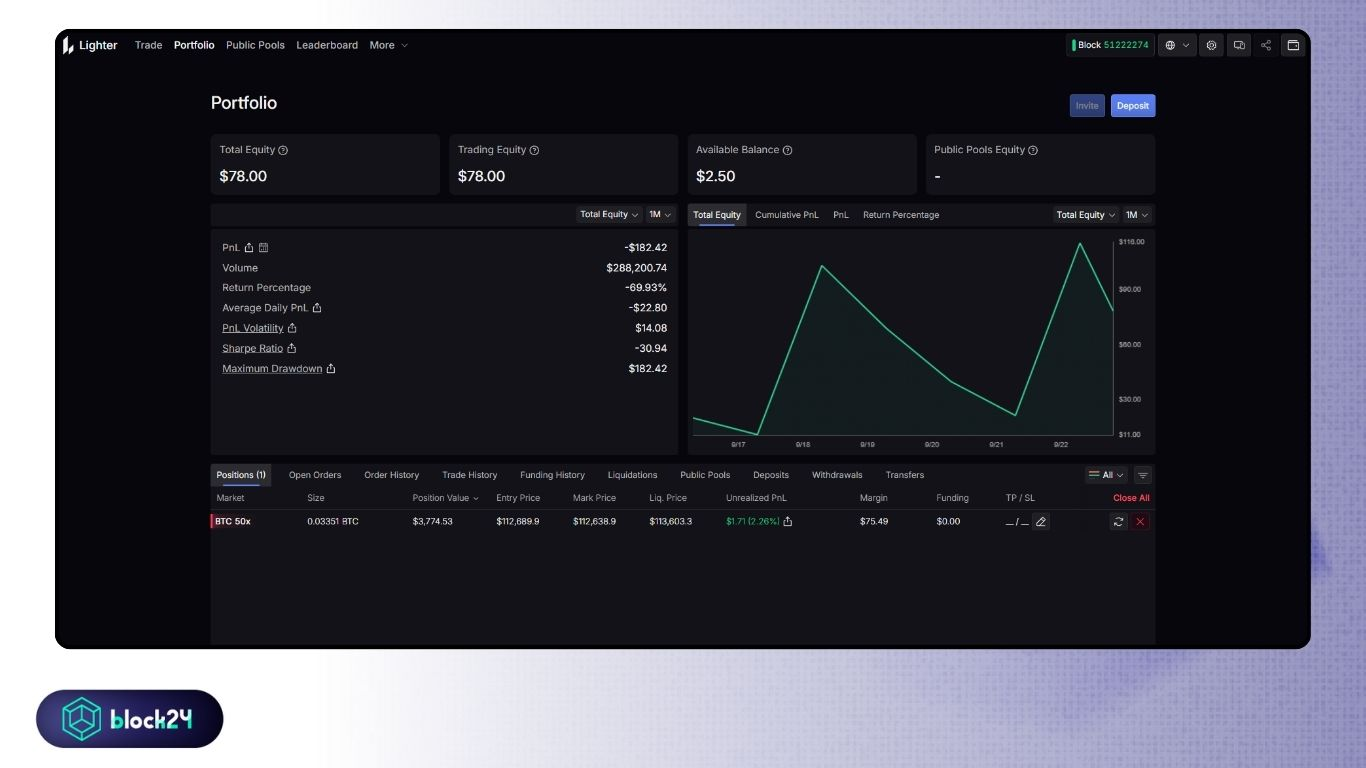

Step 7: Monitor your trading performance by accessing the “Portfolio” section, which displays:

- Total trading volume

- Profit and Loss (PNL)

- Position history

- Account balance

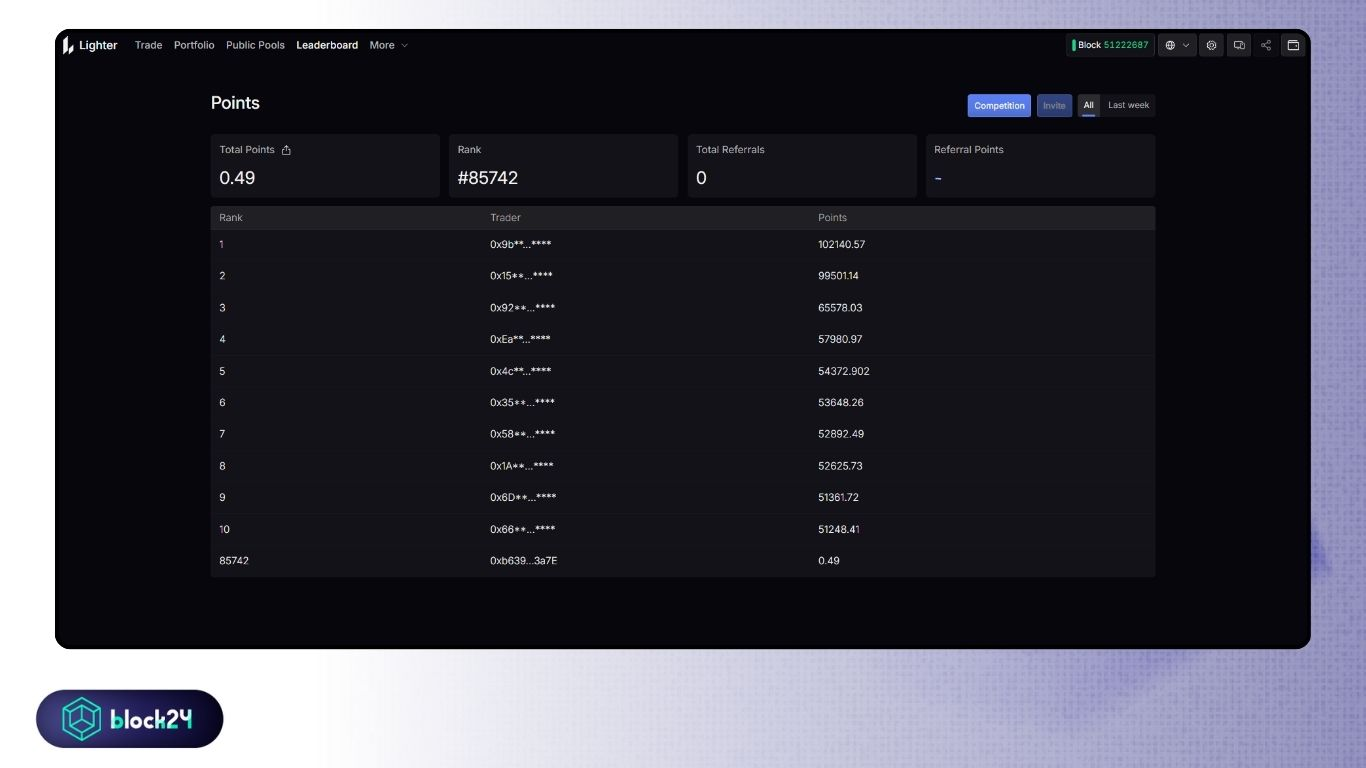

Step 8: Track accumulated points and leaderboard ranking in the “Leaderboard” section to assess your relative position among participants.

Points Optimization Strategies

To optimize your points on Lighter, apply the strategies below:

Use Limit Orders Over Market Orders

Limit orders let you set exact entry and exit prices. They reflect natural trading behavior, unlike market orders often used for wash trading. Using limit orders can help the system identify you as a genuine trader and reward you more fairly.

Trade Altcoins Instead of BTC and ETH

Altcoins usually move more sharply than BTC and ETH. Lighter assigns lower multipliers to BTC and ETH volumes and higher multipliers to altcoin trades to encourage liquidity. Focusing on altcoins typically results in better point returns.

Maintain Positive PNL

Accounts with consistent profits earn significantly more points than those generating volume with losses. Lighter rewards real traders, so maintaining a positive PNL increases total point accumulation.

Trade Newly Listed Tokens

New listings often show sharp price swings and heavy activity. Lighter provides bonus multipliers for early trading on new pairs. Follow announcements on X or Discord and enter within the first 24–48 hours to maximize rewards.

Implement Hedging Strategy

If you prefer low-risk farming, open hedged positions (one long and one short) at the same size and leverage. You can do this by combining Lighter with another futures exchange. This approach generates points regardless of price direction while protecting your capital.

Leverage Referral Program

Inviting active traders via your referral link gives you 10% of their earned points. It’s a simple, passive method to boost your total points.

Provide Liquidity to Public Pools

Adding small amounts of liquidity shows you are a real user, not a wash trader. Liquidity providers earn extra points and are often prioritized in reward allocations.

Why Participate in the Lighter Airdrop?

Growing Perpetual DEX Trend:

Recent successful airdrops from platforms like Avantis and Aster have pushed perp DEX projects into the spotlight. Lighter is positioned as one of the strongest candidates for meaningful token rewards.

High Trading Volume:

DeFiLlama data places Lighter as the second-largest perpetual DEX by 30-day trading volume, showing strong user demand and consistent activity.

Reputable Backing:

Lighter secured investment from Andreessen Horowitz (a16z) in May 2023, indicating solid institutional confidence in the project’s technology and long-term direction.

Part 3: Conclusion

Lighter’s mainnet beta gives users the chance to explore a high-performance perpetual DEX while earning points through real trading activity. Its position as the second-largest perpetual DEX by trading volume, combined with a16z backing and zero trading fees during the beta phase, creates a strong environment for users aiming to build early participation advantages.

Although trading fees are waived, leveraged futures trading still involves meaningful capital risk, especially when using high leverage. The points model is designed to reward authentic usage, with higher emphasis on limit orders, altcoin trading, profitable execution, and early engagement with newly listed markets.

The team has not officially announced an airdrop, but the structured points system and the success of similar perpetual DEX campaigns indicate a reasonable possibility of future token rewards. Users should approach the program responsibly, allocate only the capital they can tolerate losing, and avoid taking unnecessary risks purely for the sake of point farming.

—————————————————-

Disclaimer: The content published on Cryptothreads does not constitute financial, investment, legal, or tax advice. We are not financial advisors, and any opinions, analysis, or recommendations provided are purely informational. Cryptocurrency markets are highly volatile, and investing in digital assets carries substantial risk. Always conduct your own research and consult with a professional financial advisor before making any investment decisions. Cryptothreads is not liable for any financial losses or damages resulting from actions taken based on our content.