Mega Matrix Files $2B Shelf Registration for Ethena Bet

Key Takeaways

- Mega Matrix filed a $2 billion shelf registration with the SEC to fund an Ethena-focused treasury strategy

- The company plans to accumulate ENA governance tokens rather than holding USDe stablecoin directly

- Strategy aims to capture yield from Ethena’s synthetic stablecoin USDe through the protocol’s fee-switch mechanism

- USDe has grown to become the world’s third-largest stablecoin with $12.5 billion market cap

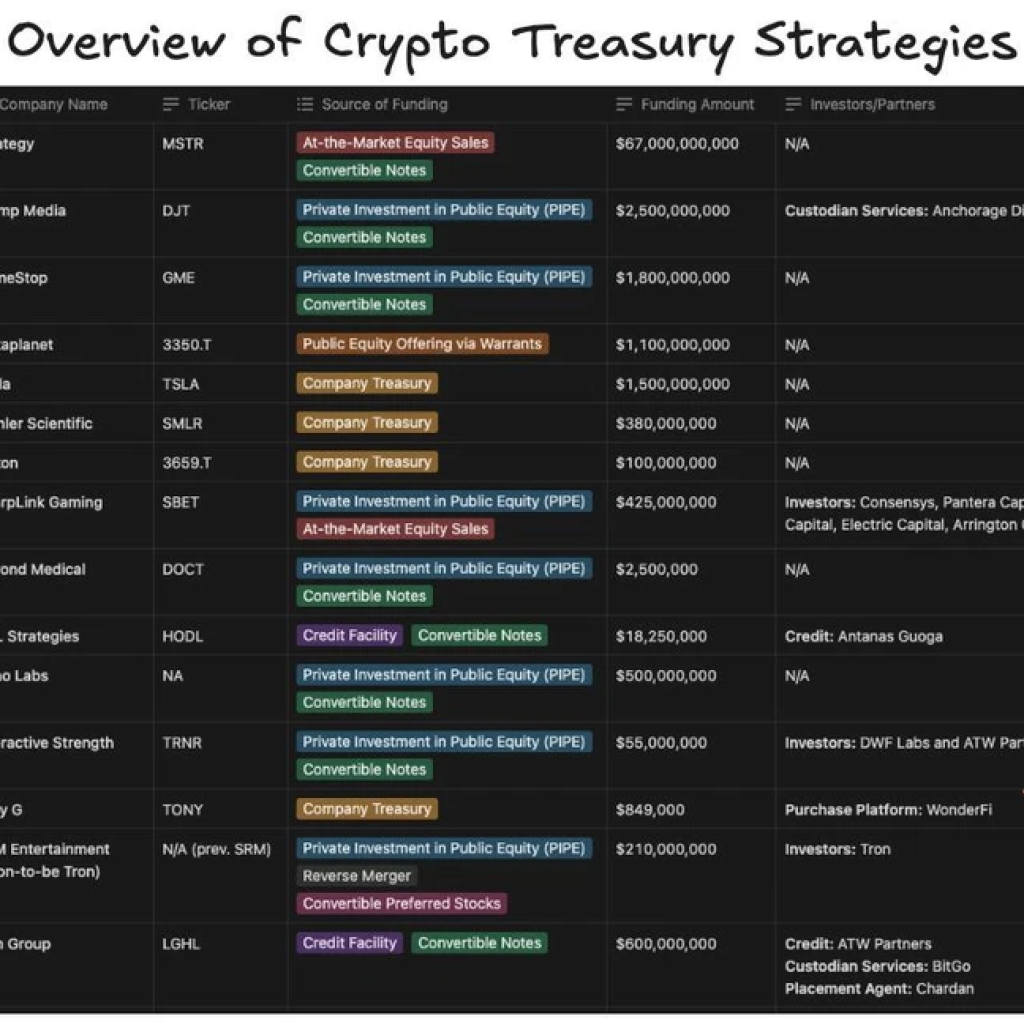

- The move reflects broader trend of companies adopting digital asset treasury strategies

Company Strategy and Filing Details

Mega Matrix, a publicly traded holding company that has transitioned into digital assets, has filed a $2 billion shelf registration with the US Securities and Exchange Commission. This regulatory filing allows the company to register securities for future issuance, enabling them to sell portions of stock over time rather than in a single offering.

The funding strategy focuses exclusively on the Ethena stablecoin ecosystem, with proceeds directed toward accumulating the protocol’s ENA governance token. This approach is designed to provide exposure to revenue generated by Ethena’s synthetic stablecoin, USDe, while securing governance influence over the protocol.

The company has emphasized that this strategy concentrates “exclusively on ENA, focusing influence and yield in a single digital asset.”

Ethena Protocol and Yield Mechanism

Rather than holding USDe directly, Mega Matrix plans to build a significant position in ENA tokens. This strategy could benefit from Ethena’s “fee-switch” mechanism, an on-chain feature that, once activated, will distribute a portion of protocol revenues to ENA token holders.

Ethena’s USDe operates differently from traditional fiat-backed stablecoins like USDC or USDT. As a synthetic stablecoin, USDe maintains its dollar peg through a combination of collateral hedged with perpetual futures contracts. This structure enables the protocol to generate yield from funding rates in derivatives markets.

The protocol has demonstrated impressive growth, with Ethena Labs reporting cumulative gross interest revenue exceeding $500 million. USDe has subsequently climbed to become the world’s third-largest stablecoin, achieving a market capitalization of $12.5 billion.

Regulatory Environment and Market Drivers

The company cited several factors driving its Ethena-focused strategy, including the rapid growth of major stablecoin issuers and the rise of digital asset treasury strategies. A significant regulatory factor is the US GENIUS Act, which prohibits stablecoin issuers from paying yield directly to holders.

This restriction has paradoxically increased demand for synthetic, yield-bearing alternatives like Ethena’s USDe. As explained by industry analysts, investors are turning to yield-bearing or staked stablecoins to generate returns, precisely because traditional stablecoin issuers cannot provide yield directly.

Company Background and Financial Position

Mega Matrix currently maintains a market capitalization of approximately $113 million. The company’s first-quarter financial results showed revenue of $7.74 million and net losses of $2.48 million. Its primary business operation remains FlexTV, a short-form streaming platform.

The company’s pivot toward digital assets began earlier with a $1.27 million Bitcoin purchase. The current $2 billion shelf registration represents an unusually large filing relative to the company’s size, indicating a significant strategic shift toward digital asset treasury management.

Industry Trend and Risk Considerations

Mega Matrix joins a growing number of companies adopting digital asset treasury strategies. Recent examples include ETHZilla, a former biotechnology company that has accumulated hundreds of millions of dollars in Ether, and other firms like BitMine Immersion Technologies, SharpLink Gaming, and Bit Digital pursuing similar approaches.

However, digital asset treasury strategies carry substantial risks. Industry experts have drawn comparisons to complex financial products that contributed to previous financial crises, noting concerns about engineered financial products where investors may be uncertain about their actual exposure.

The strategy represents a significant bet on the continued growth and adoption of synthetic stablecoins and the yield-generating capabilities of the Ethena protocol specifically.