Japanese Bitcoin Treasury Firm Metaplanet Raises $1.4B in International Offering

Tokyo-based Metaplanet (MTPLF) is scaling up its Bitcoin strategy, raising $1.4 billion through a massive international share sale to expand its treasury reserves.

- Majority of proceeds earmarked for Bitcoin purchases (~$1.2B).

- Metaplanet now holds 20,136 BTC, ranking as the sixth-largest public Bitcoin treasury.

- Company also earns revenue through Bitcoin options trading, with ~$13M in Q2 sales.

- Strategic pivot comes amid yen depreciation, debt concerns, and negative rates in Japan.

Metaplanet, the Japanese firm known for its aggressive Bitcoin treasury strategy, announced it will issue 385 million new shares in an international offering approved by its board in late August. The sale, priced at JPY 553 (~$3.75) per share, will raise approximately $1.4 billion, according to Tuesday’s filing.

Initially planning to issue only 180 million shares, the company upsized the round due to strong demand. The proceeds will be used primarily for Bitcoin accumulation ($1.2B) and expansion of its Bitcoin income generation business ($138M).

Since pivoting its treasury policy in May 2024, Metaplanet has aggressively stacked BTC, citing Japan’s mounting debt, prolonged negative real rates, and ongoing yen depreciation. As of Sept. 1, the company’s holdings topped 20,000 BTC, including a fresh $15M purchase disclosed this week.

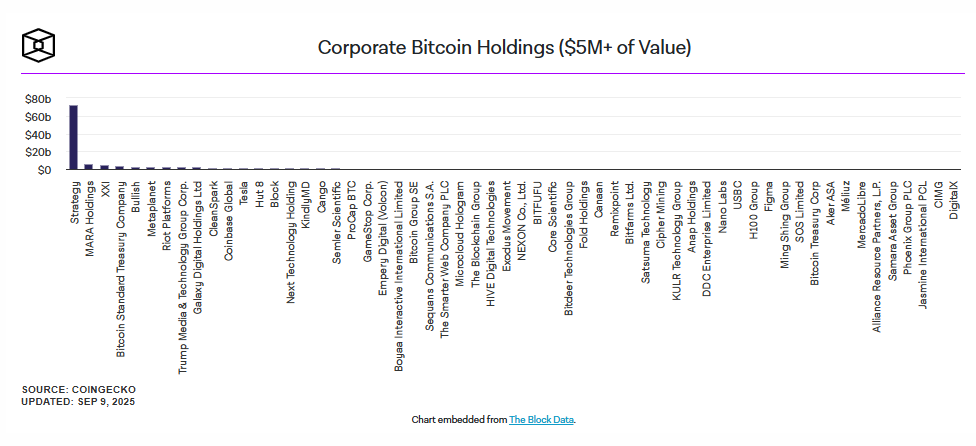

That makes Metaplanet the sixth-largest publicly traded Bitcoin treasury, sitting behind firms such as Strategy, Marathon Digital (MARA), XXI, Bitcoin Standard Treasury Co., and Bullish. In addition to direct holdings, the firm reported JPY 1.9B (~$13M) in Q2 revenue from trading Bitcoin options, further diversifying its BTC-linked income.

Metaplanet’s stock (MTPLF) closed down 2.8% at $4.49 on Tuesday, giving the firm a market cap of $3.6B.

Final Thought

Metaplanet’s $1.4B raise underscores how deeply it has embraced Bitcoin as its reserve currency — a bold play that could make it Asia’s MicroStrategy equivalent. With growing holdings and a global investor base, the firm is positioning itself as a long-term BTC powerhouse despite macroeconomic headwinds.