Mining Company MARA Loaned 7,377 BTC to Third Parties in 2024

MARA’s Bitcoin holdings are estimated to be worth $4.2 billion, based on a valuation of $93,354 per BTC.

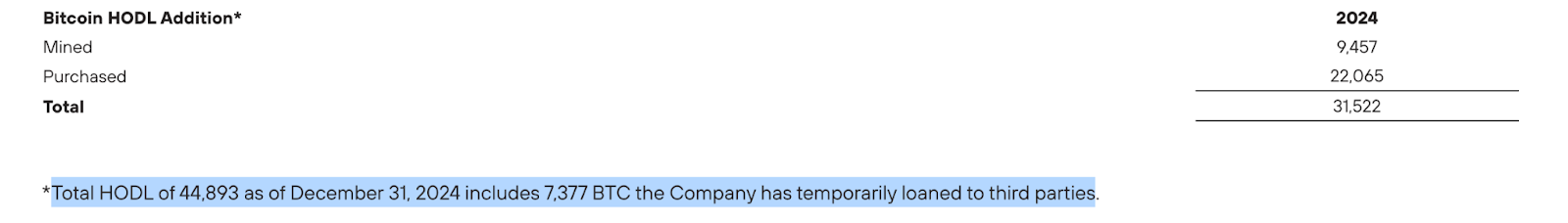

In 2024, MARA, previously known as Marathon Digital, lent 7,377 Bitcoin (BTC) to third parties, as confirmed in a January 3 announcement from the Bitcoin mining company.

Robert Samuels, MARA’s Vice President of Investor Relations, shared details about the company’s Bitcoin lending activities but refrained from disclosing exact figures.

Samuels explained that MARA’s Bitcoin lending initiative prioritizes short-term agreements with reputable third parties, offers a modest single-digit yield, and has been operational throughout 2024.

He added that as mining is a resource-intensive business, the lending program seeks to make enough money to pay for its operating expenses. Because block rewards are periodically reduced every four years during Bitcoin halving events, mining faces financial difficulties. In April 2024, the reward was cut in half again, to 3.125 Bitcoin every mined block.

An analysis of MARA’s Bitcoin holdings. (Source: MARA)

MARA Achieves 50 Exahashes Per Second and Expands Bitcoin Reserves

In December 2024, MARA became the first publicly traded mining company to achieve a computational power milestone of 50 exahashes per second (EH/s).

On January 3, the company announced it had surpassed the 50 EH/s mark, reaching an active hashrate of 53.2 EH/s.

Throughout 2024, MARA acquired 22,065 Bitcoin at an average price of $87,205 per coin and mined an additional 9,457 BTC, increasing its total Bitcoin holdings to 44,893 BTC.

To fund its operations, MARA raised $1.9 billion through two senior convertible note offerings in November and December 2024. These funds were used to purchase 15,574 BTC for the company’s corporate treasury. The first note offering will mature in 2030, while the second will mature in 2031, both featuring zero-interest coupons.

MARA’s strategy of accumulating Bitcoin as a treasury reserve asset has garnered attention and praise, notably from MicroStrategy co-founder Michael Saylor.

Saylor recently made the prediction that MARA might be the next Bitcoin-focused business to be included in the Nasdaq 100, a stock market index that includes the top 100 businesses listed on the Nasdaq exchange by market capitalization.