Morpho Protocol: Open Infrastructure for Onchain Loans

Supported by changes for new tangled benefit enhancements, a lending solution called Morpho Protocol has become one of the most transformative for on-chain loans as a decentralized open-infrastructure lending solution. The Morpho Protocol, as one of the best lending solutions for institutional-grade projects, is ultra-efficient, secure, and offers flexible loan-lending options. It aims to open the doors to decentralized finance for fintech companies, sustainable DeFi projects, and institutional capital sources who need an efficient, compliance-centering secured solution.

Morpho Protocol

Features and Services Offered by Morpho Protocol

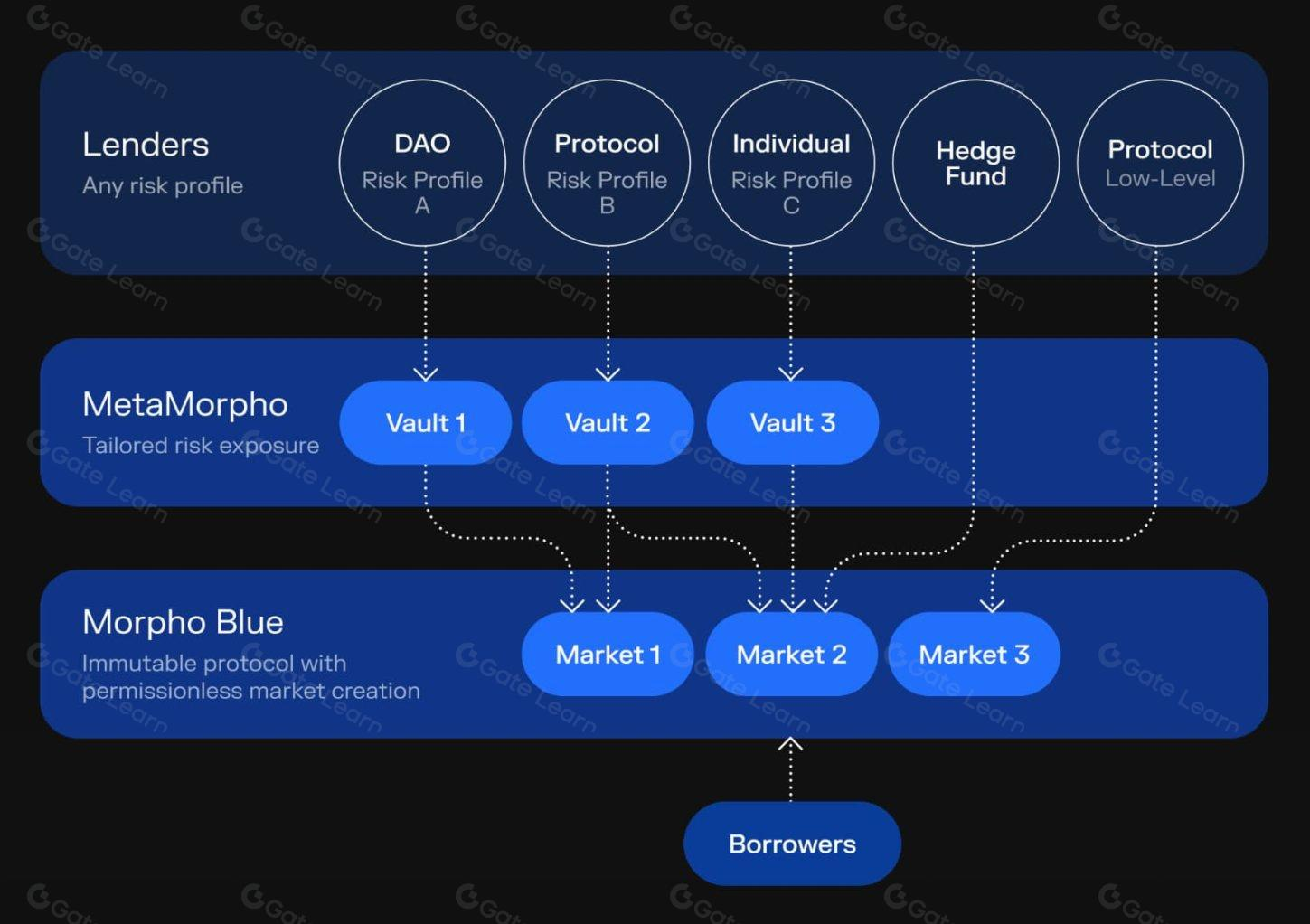

Ultimately, Morpho is an open infrastructure for on-chain loans. The project exists within two ecosystems: the Morpho Protocol and Morpho Vaults. The protocol is responsible for establishing the market and earning interest. Furthermore, it’s a decentralized and permissionless initiative—in layman’s terms, anyone can establish a lending market on Morpho. Lending markets are established at the user’s discretion and based on three factors: a) a collateral asset, b) a loan asset, and c) risk parameters. Therefore, there are no restrictions as to what markets can be established.

On the other hand, Morpho Vaults serve as an additional layer for risk management and liquidity optimization. These smart contracts distribute the liquidity of lenders across various Morpho markets based on predefined risk parameters. By optimizing yield generation and minimizing risk exposure, the vaults offer users a chance to earn passive income. Risk managers usually oversee the curation of these vaults, guaranteeing that funds are distributed to markets aligning with the desired risk-return profile. By separating accounting from risk management, a highly efficient system is created, enabling fintech companies and DeFi protocols to provide lending products that offer maximum security and flexibility.

Key Features of Morpho Protocol

1. Permissioned Markets for Compliance

Morpho facilitates KYC-gated markets and exclusively permits participation to verified users. This innovation allows fintech companies for KYC/AML compliance, without losing efficiency and liquidity from DeFi. For example, a company can open a lending market where only KYC-verified users can borrow USDC with a KYC-wrapped token as collateral.

An Overview of the Morpho Lending Protocol (Source: Gate.io)

2. Noncustodial Lending for Full Asset Control

Morpho is entirely noncustodial, meaning users own their assets, unlike on custodial platforms. Morpho leverages immutable smart contracts and minimal governance to eliminate reliance on intermediaries. A notable example is Coinbase’s integration of crypto-backed loans, allowing for permissionless lending.

3. Strong Security and Immutable Smart Contracts

It puts security first, having been audited by Spearbit and OpenZeppelin, with an accompanying $2.5 million bug bounty. Its immutable architecture and governance attack prevention maintain a dependable lending experience for fintechs and institutional players.

Morpho’s Achievements and Industry Impact

Morpho has already made significant strides in the DeFi space, with one of its most Morpho has already achieved a number of major milestones in the DeFi space, with the most notable being its integration with Coinbase for crypto-backed loans. This partnership enables millions of Coinbase users to take out borrowings in USDC by using their Bitcoin as collateral — all using the infrastructure behind Morpho lending, which is highly efficient. We are excited to see this integration, and a huge leap forward to bridge these two worlds, bringing onchain lending even more to the retail ends of the crypto space.

Morpho has also garnered popularity among various DeFi protocols and fintech companies seeking to optimize lending solutions on top of Coinbase. Its innovative model that separates interest accounting from risk management has become a model of choice for institutions looking for more granulation and flexibility. Furthermore, the protocol’s capacity to aggregate liquidity from multiple sources guarantees users the best borrowing and lending rates available onchain. These highlight has made Morpho the fastest solution for institutional DeFi users, allowing a large cohort of the enterprise to access DeFi without the perils of security and compliance.

Roadmap and Future Developments

Looking ahead, Morpho aims to expand its ecosystem by fostering deeper integrations with leading fintech platforms, banks, and DeFi protocols. The roadmap includes the development of more sophisticated risk management tools, enhancing the capabilities of Morpho Vaults to cater to diverse risk profiles. Additionally, Morpho is exploring partnerships with real-world asset (RWA) providers to create more use cases for institutional lending, further strengthening its position as a key player in the financial industry.

The Roadmap of Morpho Protocol (Source: KuCoin)

Another major focus is on scalability. As DeFi adoption continues to grow, Morpho is working on optimizing its infrastructure to support higher transaction volumes while maintaining efficiency. Future developments may also include support for additional blockchain networks beyond Ethereum, increasing accessibility for users across different ecosystems. By continuously improving its infrastructure, Morpho is committed to setting new standards for decentralized lending, making DeFi more accessible, secure, and compliant for global financial institutions.

Ultimately, Morpho Protocol is a giant leap for on-chain lending and is attractive to fintechs and institutions but still welcomes DeFi users of all kinds into this new secure, efficient, trustworthy, and flexible environment. Built on an open-source on-chain lending protocol yet with tremendous security features, all the more appealing to those interested in peer-to-peer lending and borrowing; the ability to create permissioned markets allows the lending potential to become regulated and regulatory approved while non-custodial means that users never have to relinquish access to their assets should they choose not to. In addition, early success stories of integration—Coinbase and its cryptocurrency-backed loans—and ongoing collaboration through a large, detailed roadmap champions Morpho as the institutional level DeFi lending standard.

As the demand for decentralized financial solutions continues to rise, Morpho stands as a beacon of innovation, proving that DeFi can be both secure and compliant. Institutions looking to harness the power of open financial infrastructure can confidently build on Morpho, unlocking new opportunities in digital asset lending. For those interested in integrating Morpho into their financial services, now is the time to explore the vast possibilities that this revolutionary protocol has to offer.