Nasdaq to Invest $50M in Winklevoss-Led Gemini Ahead of IPO

Gemini has locked in Nasdaq as a strategic backer, with the exchange committing $50 million in a private placement tied to Gemini’s upcoming IPO.

- Deal links Gemini’s custody & staking services with Nasdaq’s Calypso collateral platform.

- Gemini targets raising over $300M through IPO at $17–$19/share.

- IPO would make Gemini the third publicly traded U.S. crypto exchange after Coinbase and Bullish.

- Despite growing losses, Gemini pushes ahead as crypto IPO momentum builds.

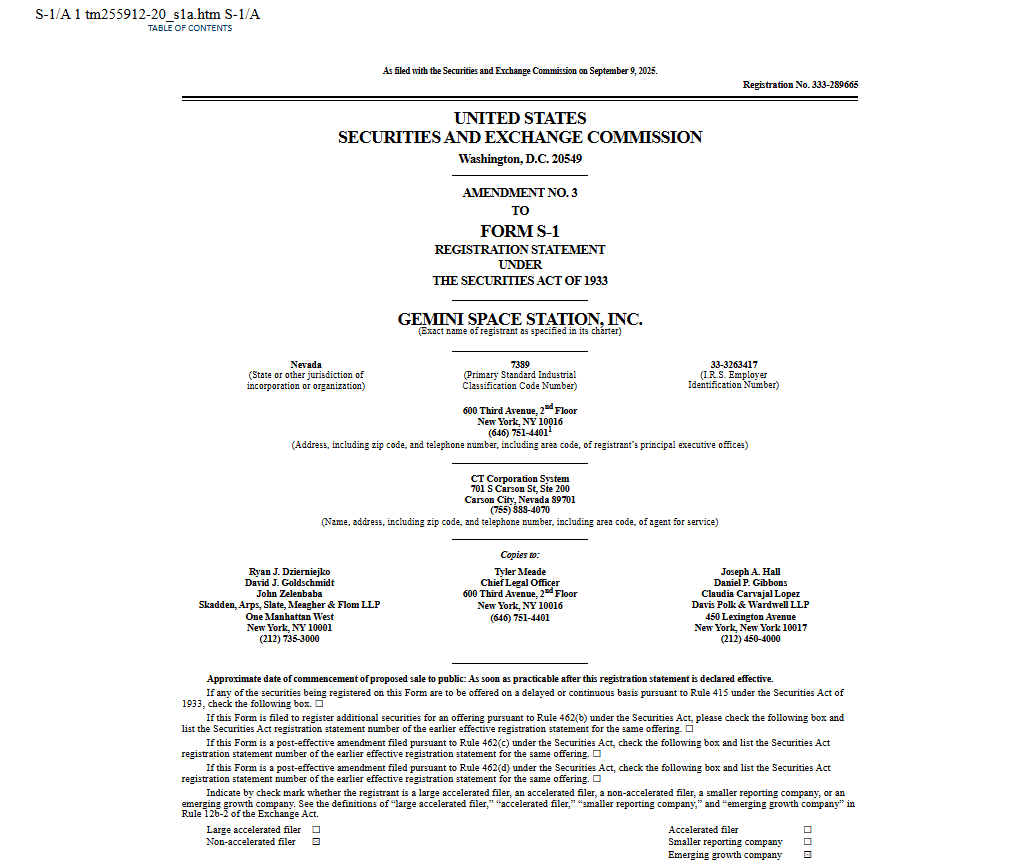

Crypto exchange Gemini, founded by Cameron and Tyler Winklevoss, has secured Nasdaq as a key strategic investor ahead of its planned IPO. According to an updated SEC filing, Nasdaq will purchase $50 million worth of Gemini Class A common stock at the IPO price, excluding underwriting discounts and commissions.

The partnership is expected to give Nasdaq clients access to Gemini’s custody and staking services, while Gemini’s institutional users will tap into Nasdaq’s Calypso platform for managing and tracking trading collateral. However, sources cautioned plans could shift depending on market conditions.

Gemini is seeking to raise over $300 million through its IPO, offering 16.7 million shares at $17–$19 per share, with underwriters granted an option to purchase additional stock. Trading is expected to begin Friday on Nasdaq under the ticker GEMI.

The exchange would join Coinbase and Bullish as the third U.S.-listed crypto exchange. Other crypto firms, including Grayscale, Kraken, Figure, and BitGo, are also eyeing public listings. Earlier this year, Circle staged a blockbuster IPO, while Bullish stock surged 150% on its NYSE debut.

Financials, however, paint a challenging picture. Gemini posted a $282.5M net loss in H1 2025, compared to $41.4M the year before. Adjusted EBITDA swung from +$32M to a $113.5M loss. For 2024, Gemini reported a net loss of $158.5M on $142.2M in revenue.

Final Thought

With Nasdaq’s backing, Gemini gains both credibility and institutional reach — but its mounting losses underscore the pressure to prove sustainable growth once it goes public. The IPO could mark a pivotal test of market appetite for crypto exchanges in a shaky macro environment.