Navigating the Crypto Space with Data Aggregators

The crypto market now boasts thousands of coins and tokens from several projects, and this can be a lucrative land for investors and crypto enthusiasts. However, keeping track of everything – from exchange rates and trading volumes to market capitalizations and emerging trends – requires significant time and effort and is not easy to do. This is where crypto aggregators emerge as indispensable tools, offering a centralized, data-rich hub to help you navigate the complex crypto universe.

What Is a Crypto Aggregator?

A crypto aggregator is a platform that consolidates data from various cryptocurrency exchanges, market sources, and other relevant data providers. As an exchange, an aggregator usually provides price charts where you can do your analysis with indicators and drawings, as well as latest news on the market.

However, the advantage of an aggregator is that you can get real-time price data and trading volume from different exchanges in just one place, as well as check information about which exchanges list a particular cryptocurrency, along with associated trading pairs instead of visiting dozens of websites.

Some data aggregators also offer various features, such as portfolio tracking, where you can monitor your holdings, track your profit/loss, and gain a clear understanding of your overall portfolio performance; or best price routing – a function that helps you to find the best prices for a specific token swap.

How to Use a Crypto Aggregator: A Hands-on Guide

There are numerous crypto aggregators on the market, each with unique features and tracking services. In this article, we’ll illustrate how to use a crypto data aggregator using CoinGecko – the leading platform recognized for its user-friendly interface, extensive data coverage, and robust features – though the fundamental principles apply to other popular aggregators such as CoinMarketCap, Nomics, and others.

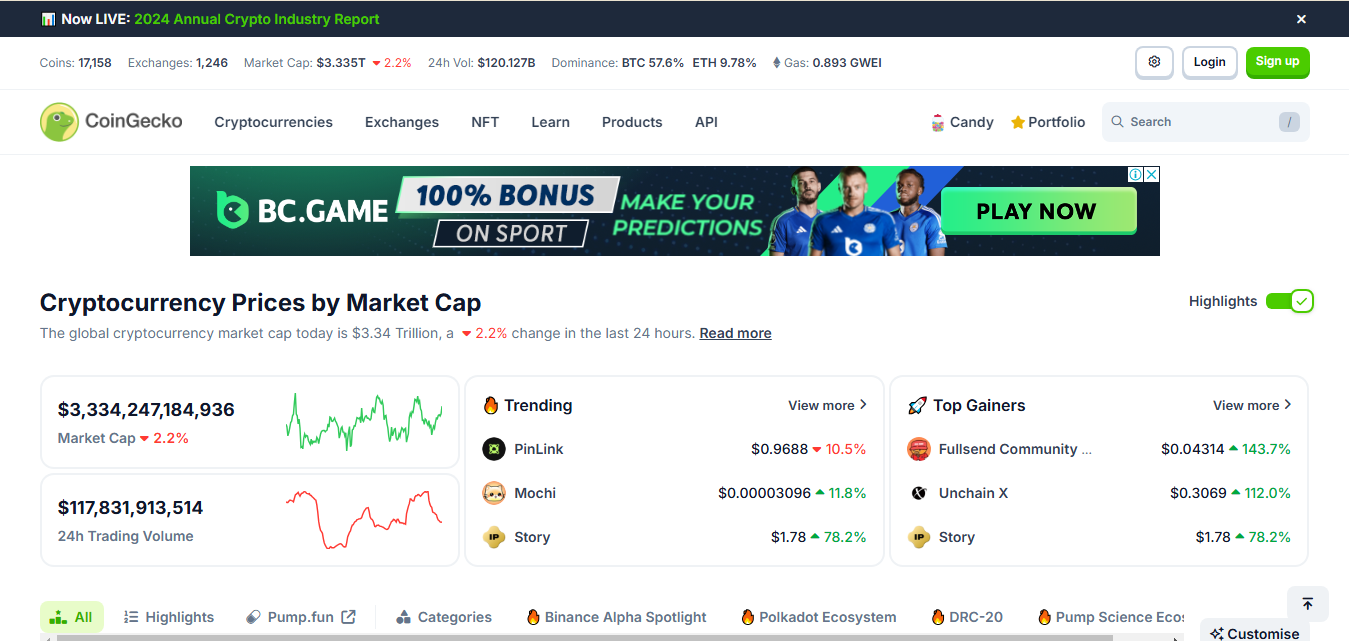

Step 1: Getting Started – Navigating the CoinGecko Interface

CoinGecko homepage. Source: coingecko.com

Step 2: Delving into Individual Cryptocurrencies

Step 3: Harnessing the Power of CoinGecko for Trading Strategies

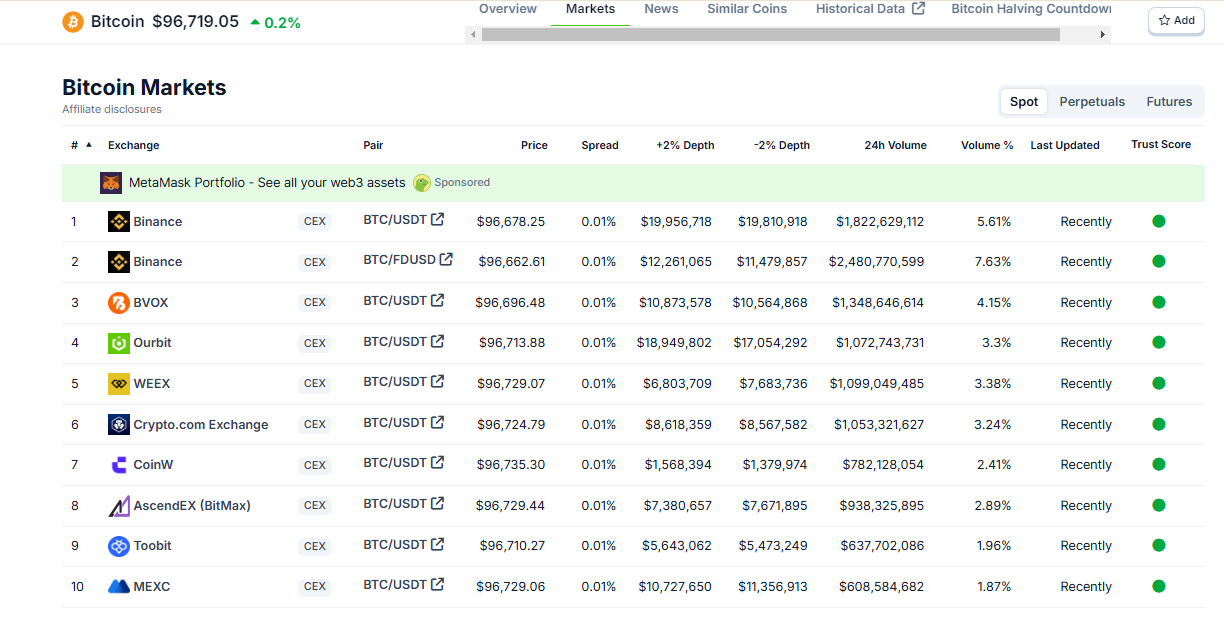

Bitcoin price on all exchanges. Source: CoinGecko

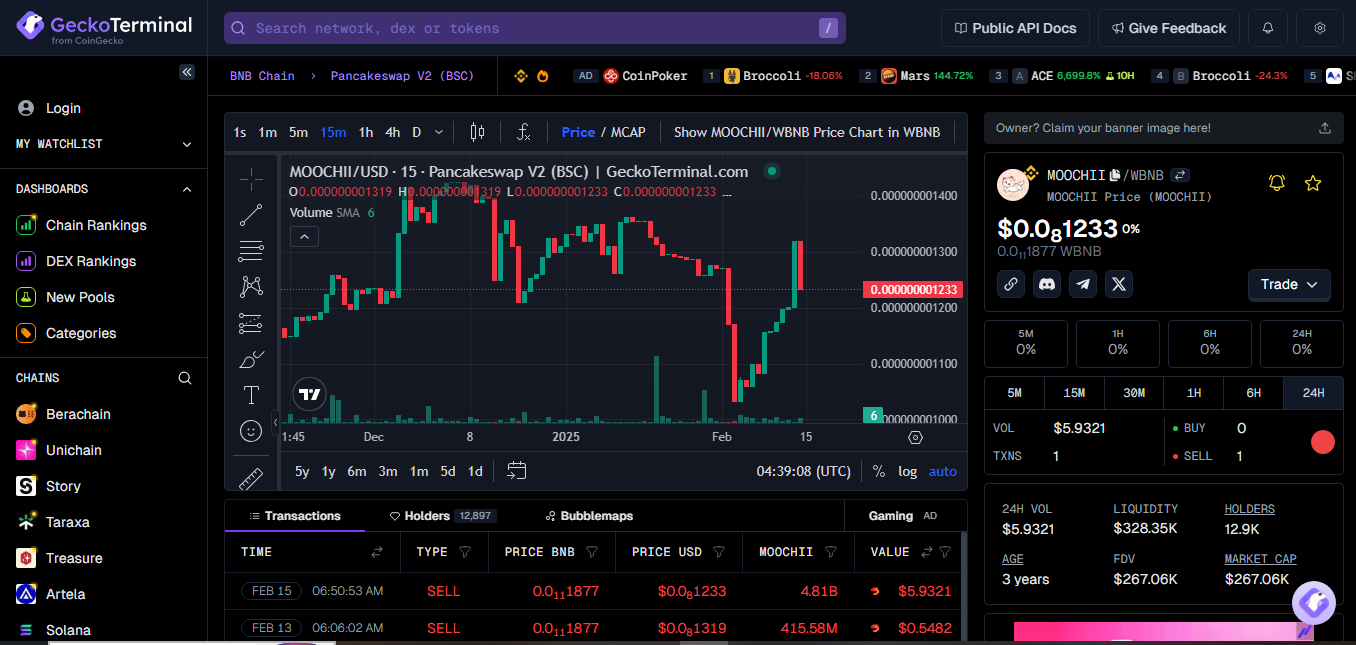

Analyze Charts: Leverage price charts with diverse timeframes (e.g., hourly, daily, weekly) to spot trends, identify support and resistance levels, and pinpoint potential entry and exit points. Click on Live Chart mode and you will be directed to Gecko Terminal, a CoinGecko platform with live charts, indicators and drawing tools.

Assess Price Changes: Pay close attention to the 24-hour, 7-day, and 1-month price change percentages, to get a grasp of recent momentum and longer-term performance.

The live chart on Gecko Terminal for Moochi. Source: geckoterminal.com

Gecko offers Tradingview for BTC instead. Source: coingecko.com

Beyond CoinGecko: Exploring Aggregator Variations and Their Strengths

While CoinGecko serves as a strong foundation, various other crypto aggregators offer unique functionalities:

Crypto aggregators are indispensable tools for anyone involved in the cryptocurrency market. They offer a central, efficient, and data-rich platform for navigating the often-complex world of digital assets. By understanding the different types of aggregators, their features, and how to use them effectively, you can unlock the power of information, make more informed decisions, and enhance your success in the crypto market. Remember to always do your own research (DYOR), manage your risks, and adapt your strategy as the market evolves.