Bitcoin Whale Owen Gunden Sells Entire $1.3B BTC Stack as Institutions Buy More

- Early Bitcoin whale Owen Gunden has sold all his BTC holdings worth $1.3 billion.

- His last transfer of 2,499 BTC went to Kraken, signaling a full exit from Bitcoin.

- The market is extremely bearish, with CryptoQuant’s Bull Score dropping to 20/100.

- Gunden’s net worth now stands at around $561 million after selling.

- Institutional ownership of U.S. Bitcoin ETFs has surged to 40%.

- Institutions continue buying while retail investors panic and sell.

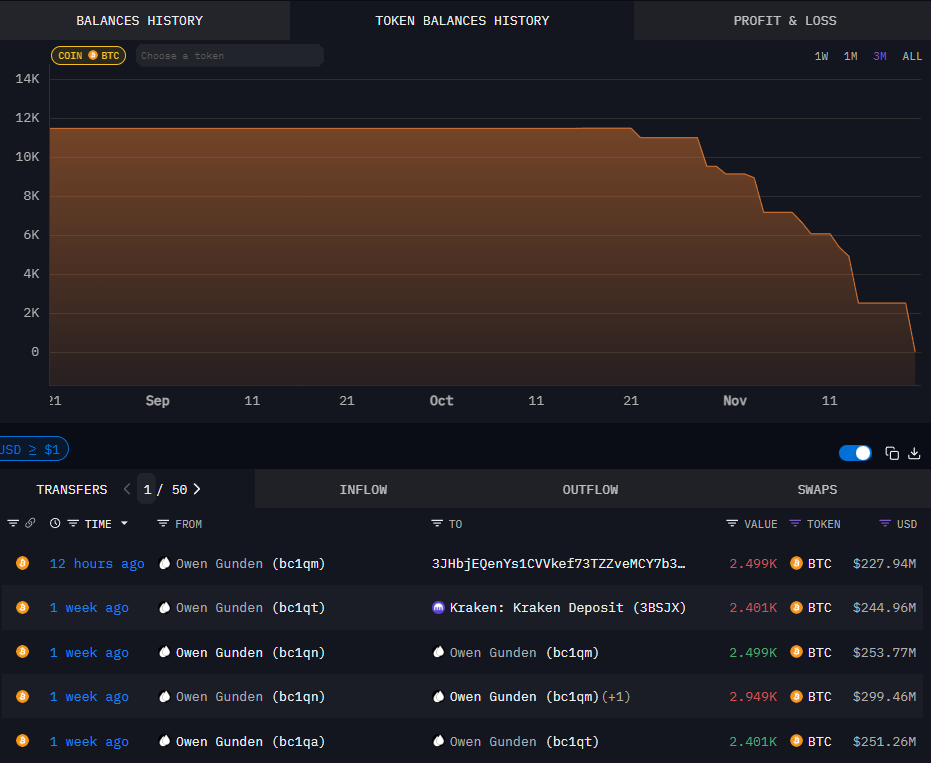

Early Bitcoin whale and long-time crypto trader Owen Gunden has completely exited his Bitcoin position, selling a total of 11,000 BTC worth around $1.3 billion. His final move came on Thursday when his wallet transferred 2,499 BTC, valued at $228 million, to cryptocurrency exchange Kraken. The wallet, identified by Arkham, now holds zero Bitcoin.

These sales come at a time when fear is rising in the market. Bitcoin conditions have hit their most bearish level of the current cycle. CryptoQuant’s Bull Score Index has dropped to 20 out of 100, signaling extreme bearish sentiment across the industry. Many retail investors are panicking, expecting the bull market to be over.

Owen Gunden has been a well-known figure in the crypto world. According to Arkham’s ranking, he is the eighth-richest person in crypto, with a net worth of about $561 million. His wealth dates back to the early days of Bitcoin, when he traded large amounts of BTC on platforms like Tradehill and Mt. Gox, long before their collapse. During that period, he reportedly traded tens of thousands of Bitcoin, helping him build a massive on-chain fortune over time.

Institutions Are Going the Opposite Direction

While retail investors and some whales like Gunden are selling, institutional investors are increasing their exposure to Bitcoin through U.S. spot Bitcoin ETFs. According to Bitcoin analyst Root, institutional ownership in these ETFs reached 40% as of Wednesday. This is a major jump from 27% in Q2 2024, when 1,119 institutional firms held Bitcoin ETF positions.

These figures are based on 13-F filings submitted to the U.S. Securities and Exchange Commission. Only institutions managing over $100 million are required to report these holdings, meaning the actual level of institutional participation could be even higher.

The data suggests that institutions are holding onto their ETF shares despite heavy selling by retail investors. U.S. spot Bitcoin ETFs have seen around $2.8 billion in outflows so far in November, according to Farside Investors. Yet institutional buyers continue to grow their share of ownership, tightening their grip on the Bitcoin supply.

This widening gap—whales exiting, retail panicking, and institutions buying—reflects a deeper shift in market structure. Institutions appear to be positioning for long-term accumulation, while short-term traders react to fear and negative sentiment.

Final Thought

Owen Gunden’s full exit from Bitcoin marks a major moment, especially as the market turns bearish. But at the same time, institutions are quietly increasing their share of Bitcoin ETFs, signaling long-term confidence. This growing divide between retail fear and institutional accumulation may shape the next phase of Bitcoin’s market cycle.