SEC Chair Atkins Calls for ‘Bringing Crypto Back’ as Companies Return to US

Cryptocurrency companies are beginning to return to the United States as senior officials signal a shift toward more favorable regulation and domestic growth initiatives.

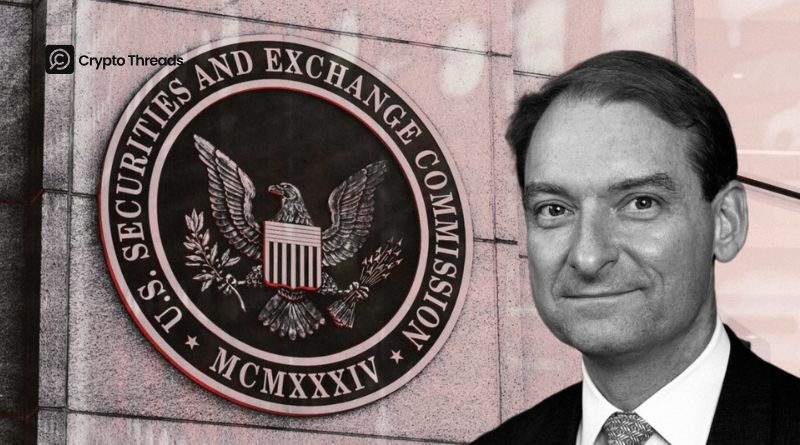

In a Thursday address at the America First Policy Institute, SEC Chair Paul Atkins called for the country to “bring back the crypto businesses that left,” reinforcing the broader effort by President Donald Trump’s administration to position the United States as a global hub for digital assets.

Treasury Secretary Scott Bessent stated on Friday that the United States has entered a “golden age of crypto” and issued a direct appeal to developers: “Start your business here. Deploy your protocol here. And hire your people here.”

Supported by clearer regulations and high-level political backing, cryptocurrency companies are beginning to respond. Several are shifting operations from overseas to the United States, while others, including Kraken and MoonPay, are expanding their domestic footprint in response to policy changes.

Global Crypto Companies Planning US Return

The combination of pro-crypto rhetoric, specific legislation, and a clearer regulatory environment under the Trump administration is beginning to yield results, with several global cryptocurrency companies expanding into the United States and bringing operations back to American soil.

Major crypto firms expanding US operations Source: Cryptopolitan

On April 28, Nexo, a Bulgaria-based crypto lending and yield platform, announced its return to the US market after years of absence, citing clearer regulations and a more constructive stance from federal agencies.

In early May, Deribit, a Netherlands-based derivatives exchange, was reportedly exploring entry into the US market. London-based algorithmic trading firm and market maker Wintermute opened a New York office during the same month.

In June, OKX, a centralized exchange registered in Seychelles, officially relaunched operations in the United States. The company established new headquarters in San Jose, California, after reaching a $500 million settlement with US regulators and refocusing on domestic growth.

In July, Beijing-based cryptocurrency mining company Bitmain announced plans to open its first US ASIC manufacturing facility in early 2026, according to Bloomberg reports. The company also indicated it would establish new headquarters in Texas or Florida by the end of the third quarter.

This announcement followed mid-June reports that Bitmain, Canaan, and MicroBT, companies that collectively hold a significant portion of the global Bitcoin ASIC market, were all shifting manufacturing operations to the United States.

US Companies Expanding Domestic Operations

Kraken and MoonPay, both US-based companies, are also expanding their domestic operations in response to the improved regulatory environment.

MoonPay’s modern NYC headquarters expansion Source: MoonPay

In June, Kraken relocated its global headquarters to Cheyenne, Wyoming, citing the state’s pro-cryptocurrency stance as a primary factor in the decision.

In April, MoonPay, originally headquartered in Miami, opened new headquarters in New York City. By June, the company announced it had obtained licenses to operate in all 50 states, significantly expanding its domestic reach.