Smart Cross Margin Trading: How It Works and Why Traders Use It

Margin trading offers investors an opportunity to amplify potential profits and earn extra returns through strategic efforts. With a diversified portfolio, traders can use cross margin trading to lower the risk of liquidation and potentially achieve larger gains. This guide explains the basic concepts of margin trading and how to deploy smart cross margin strategies to diversify your portfolio and control risk amidst market volatility.

Understanding Margin Trading

In finance, margin is the collateral investors must deposit with their broker or exchange to cover credit risk. Margin trading involves using borrowed funds to make trades. Below are the key components:

What is Cross Margin in Crypto Trading?

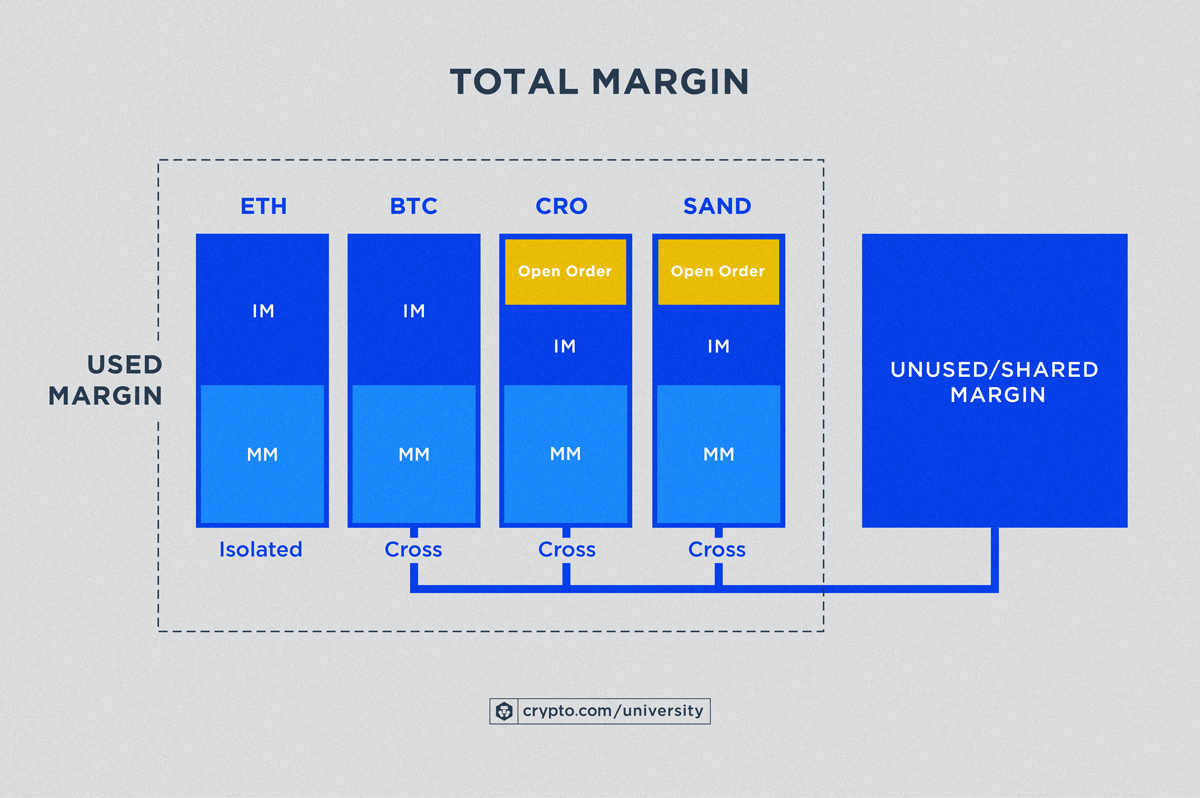

Margin trading can use two main strategies: isolated margin and cross margin. While isolated margin applies to single positions, cross margin shares collateral across multiple positions.

Isolated Margin

Isolated margin assigns specific collateral to a single position, protecting other positions in a portfolio. If this position’s margin falls below the maintenance threshold, liquidation occurs without affecting other positions.

Cross Margin

Cross margin allows traders to share collateral across multiple positions. Gains from one position can offset margin deficiencies in others, potentially preventing liquidation.

Isolated vs. cross margin trading in cryptocurrency.

Example: Isolated vs. Cross Margin

Suppose Investor Q opens four positions:

If both ETH and BTC experience losses:

Advantages of Smart Cross Margin

Smart cross margin offers several benefits:

Positions in Opposite Directions

A long position gains when prices rise, while a short position profits when prices drop. Cross margin allows gains from one to cover losses in the other.

Smart cross-margin strategy balancing long and short positions

Different Product Types

Traders can use cross margin across various instruments:

When to Use Smart Cross Margin

Smart cross margin is ideal for traders managing complex portfolios with:

For example, a trader with a short BTC futures position to hedge a long BTC spot position can avoid liquidation through balanced collateral.

Conclusion

Smart cross margin trading offers a flexible, efficient way to manage diverse portfolios and control risk. By understanding its mechanics and benefits, traders can optimize their strategies and improve overall performance in volatile markets.