Solana and Coinbase’s Base Connect Using Chainlink to Enable Crosschain Transfers

- Base launched a new Chainlink CCIP-secured bridge to Solana.

- Users can now transfer assets between Solana and Base smoothly.

- Developers can integrate Solana tokens directly into Base apps.

- The bridge connects an EVM chain with non-EVM Solana, marking a major technical milestone.

- Solana and Base remain top chains for low-fee, high-speed trading and memecoin activity.

- SOL and LINK both dropped around 3% after the announcement.

Solana and Coinbase’s Ethereum layer-2 network Base are now connected through Chainlink technology, opening the door to smoother crosschain transfers and better liquidity between the two ecosystems. Base announced that it has launched a new bridge secured by Chainlink’s Cross-Chain Interoperability Protocol (CCIP), with support from Coinbase.

The bridge is already live on mainnet and is available for developers to integrate. It is also rolling out for everyday users through several apps, including Zora, Aerodrome, Virtuals, Flaunch, and Relay. With this bridge, people can move assets directly between Base and Solana without needing multiple wallets or complicated steps.

As part of this launch, users will now be able to trade SOL and many Solana-based tokens on Base. Developers on Base can also integrate the bridge to support Solana’s SPL tokens inside their applications, allowing them to offer Solana assets natively. This creates more opportunities for trading, building apps, and accessing liquidity across chains.

Solana is currently the second-largest blockchain by total value locked, with around $9 billion in assets. Base is the sixth-largest, holding roughly $4.5 billion, according to DefiLlama. Both chains are popular for fast transactions, low fees, and high-frequency trading activity — especially in the world of memecoins.

A major interoperability achievement

One of the biggest achievements of this bridge is that it connects the Ethereum Virtual Machine (EVM) ecosystem with Solana’s non-EVM architecture. EVM chains can easily connect with one another, but Solana operates very differently, making crosschain communication more challenging. Chainlink’s CCIP makes this possible in a secure, standardized way.

This move also supports Base’s goal of becoming a multichain hub, rather than competing only inside the EVM world. As users increasingly want access to assets across different networks without needing multiple wallets, Base could benefit from becoming a central point for crosschain activity.

Network activity trends

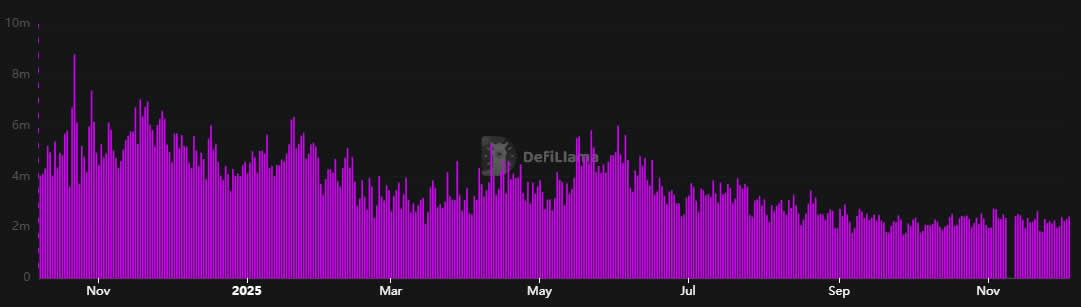

Both Solana and Base have been popular choices for memecoin minting and trading, thanks to their speed and low costs. However, network activity has seen mixed trends.

Solana’s active addresses have dropped significantly over the past year — falling from over 6 million in November 2024 to around 2.4 million today, according to DefiLlama. Despite this decline in activity, Solana remains one of the largest blockchains by total value and remains a top choice for high-speed trading.

Base has also seen a decline in active addresses since its peak in June 2025. However, Base has seen strong transaction growth, reaching nearly 407 million monthly transactions in November. This suggests users are still highly active, even if the number of unique wallets has fallen.

Token prices after the announcement

Despite the major technological milestone, token prices did not react positively. Solana (SOL) slipped about 3%, falling below $140. SOL is now more than 50% down from its all-time high of over $293 in January 2025.

Chainlink (LINK) also dropped around 3%, trading near $14.30. LINK remains down around 73% from its all-time high of nearly $53, even after the launch of the first U.S. spot LINK ETF. Many altcoins have underperformed in this market cycle, and LINK is no exception.

Final Thought

The new Chainlink-secured bridge marks a big step forward for crosschain interoperability. By connecting Solana and Base, two major high-performance blockchains, users and developers now gain easier access to liquidity and assets across both ecosystems. Even with mixed network activity and falling token prices, the long-term impact of this bridge could be significant for multichain adoption.