Solana Co-Founder: “Ethereum L2s Don’t Inherit ETH Security – That Claim Is Wrong”

- Anatoly Yakovenko, co-founder of Solana, says Ethereum’s L2s don’t truly inherit ETH’s security.

- Claims L2 networks have huge attack surfaces and can’t be properly audited due to their massive codebases.

- Warns that multisig custody on L2s allows funds to be moved without user consent.

- The debate intensifies as experts clash on whether L2 proliferation strengthens or fragments Ethereum.

- Binance Research warns that the explosion of L2s may be cannibalizing Ethereum’s base-layer revenue.

Ethereum’s layer-2 (L2) networks are facing renewed scrutiny – this time from Anatoly Yakovenko, the co-founder of Solana, who argues that the claim that L2s “inherit Ethereum’s security” is fundamentally false.

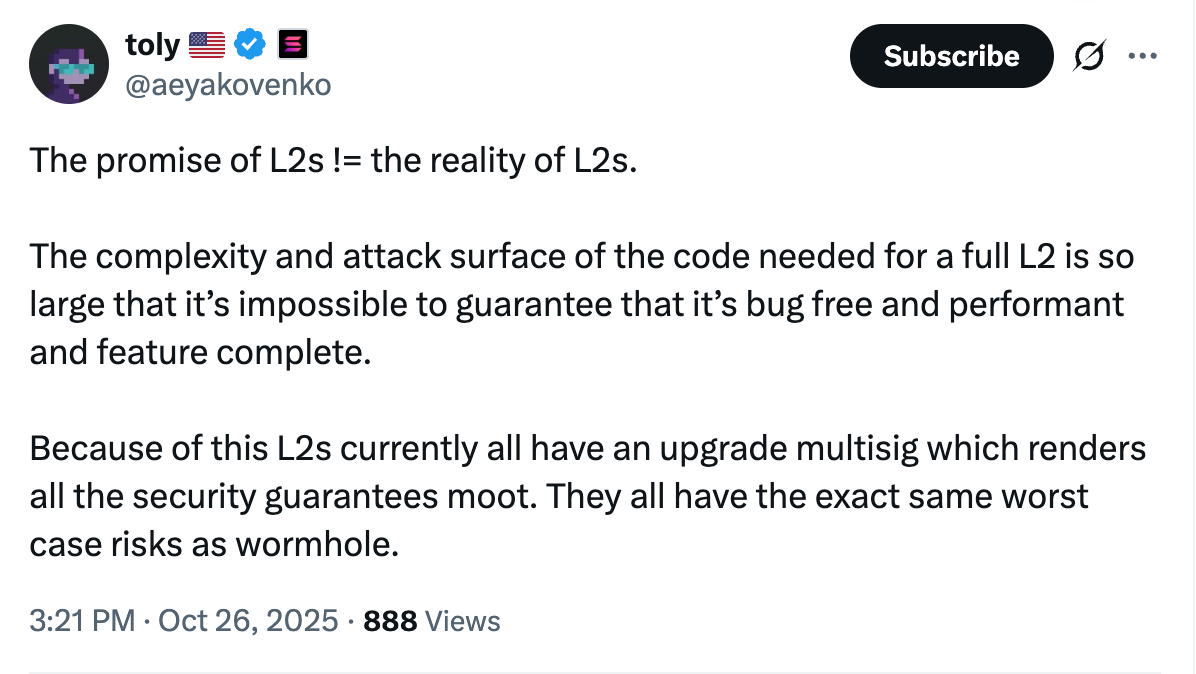

In a heated discussion on Sunday, Yakovenko said that Ethereum’s scaling networks – including optimistic and zero-knowledge rollups — have major decentralization and security flaws that undermine the notion of inheriting Ethereum’s base-layer security.

“The claim that layer-2s inherit ETH security is erroneous,” said Yakovenko.

“Five years into the L2 roadmap, wormhole ETH on Solana has the same worst-case risks as ETH on Base and generates as much revenue for ETH L1 stakers. It’s wrong no matter how you slice it.”

L2 Networks Have ‘Huge Attack Surfaces,’ Yakovenko Warns

According to Yakovenko, the large codebases of many Ethereum layer-2 solutions make them impossible to audit for vulnerabilities fully. He also emphasized the centralized control present in many L2s — particularly those using multisignature custody setups, which theoretically allow funds to be moved or frozen without user consent.

These design flaws, he argues, contradict the idea that L2s can offer Ethereum-level security while providing faster and cheaper transactions.

His comments reignited the ongoing debate about Ethereum’s scaling strategy – whether the proliferation of L2s actually strengthens Ethereum’s ecosystem or creates fragmentation and security risks.

Too Many L2s? The Industry Is Divided

The Ethereum ecosystem currently has 129 verified layer-2 networks, according to data from L2Beat, with 29 more still under review.

While some, like Adrian Brink, co-founder of Anoma, believe there are far too many L2s, others see it as a sign of growth and innovation.

“The blockchain industry has about 10 times more L2s than is needed,” Brink said.

On the other hand, Igor Mandrigin, co-founder of Gateway.fm, argues that the explosion of L2s is healthy and demonstrates Ethereum’s network diversity and scalability progress.

Similarly, Anurag Arjun, co-founder of Avail and Polygon, noted that every Ethereum L2 effectively acts as a high-throughput blockchain, giving Ethereum a range of scaling options across different use cases.

L2 Proliferation May Hurt Ethereum’s Base Layer

While diversity might sound positive, Binance Research warns that this proliferation could undermine Ethereum’s base-layer economics.

Because L2s offer lower transaction fees, they draw liquidity and activity away from Ethereum’s mainnet – effectively fragmenting liquidity and reducing revenue for Ethereum’s layer-1 stakers.

This means that while Ethereum benefits from scalability and ecosystem expansion, it may

Yakovenko’s critique underscores a growing tension in Ethereum’s scaling roadmap. While L2 networks promise speed and affordability, their centralization risks, audit challenges, and economic side effects could make them less secure and sustainable than many assume.

As the Ethereum community continues to expand its L2 ecosystem, the question remains – will these scaling networks ultimately strengthen Ethereum’s foundation, or erode the trust and security that made it the industry’s backbone in the first place?