Solana DeFi Ecosystem 2025: Powering the Future of DeFi

Key Takeaways

- Solana DeFi Ecosystem leads 2025 with record growth, reaching 17.5 billion USD in TVL and handling over 80 percent of all DEX volume.

- Jupiter, Jito, Kamino, Raydium, and Sanctum define the network’s strength through speed, liquidity, and automation.

- Active wallets pass 2.2 million, while daily DEX trading averages 3.9 billion USD — proof of strong adoption and capital flow.

- Liquid staking, real-world assets, and cross-chain links push Solana toward a global financial role.

- The ecosystem’s balance of performance and innovation sets a new standard for open, efficient DeFi.

The Solana DeFi ecosystem is redefining the rhythm of modern finance. It began as an experiment in speed and precision, then grew into a force of liquidity and innovation. Solana processes transactions at the pace of a global market, turning every movement of capital into a seamless flow. While other blockchains struggle with congestion and rising fees, Solana delivers instant execution and near-zero cost, creating an environment built for real financial motion.

Billions of dollars move each day across exchanges, lending pools, and staking protocols inside the Solana DeFi ecosystem. Every interaction fuels liquidity, feeds lending, staking drives yield, and automation keeps the system alive and accelerating. The network has become a dynamic financial engine where performance meets purpose.

This article will explore the rise of the Solana DeFi ecosystem, uncover the leading projects driving its momentum, and present the data proving why Solana stands among the most powerful forces in decentralised finance today.

Power Behind Solana DeFi

The Solana DeFi ecosystem operates with precision and energy. Every block fuels motion, every transaction adds rhythm. Built for scale and speed, Solana transforms blockchain into a living financial network where capital flows with ease. Fees remain minimal, confirmation happens in seconds, and liquidity moves at the same pace as demand.

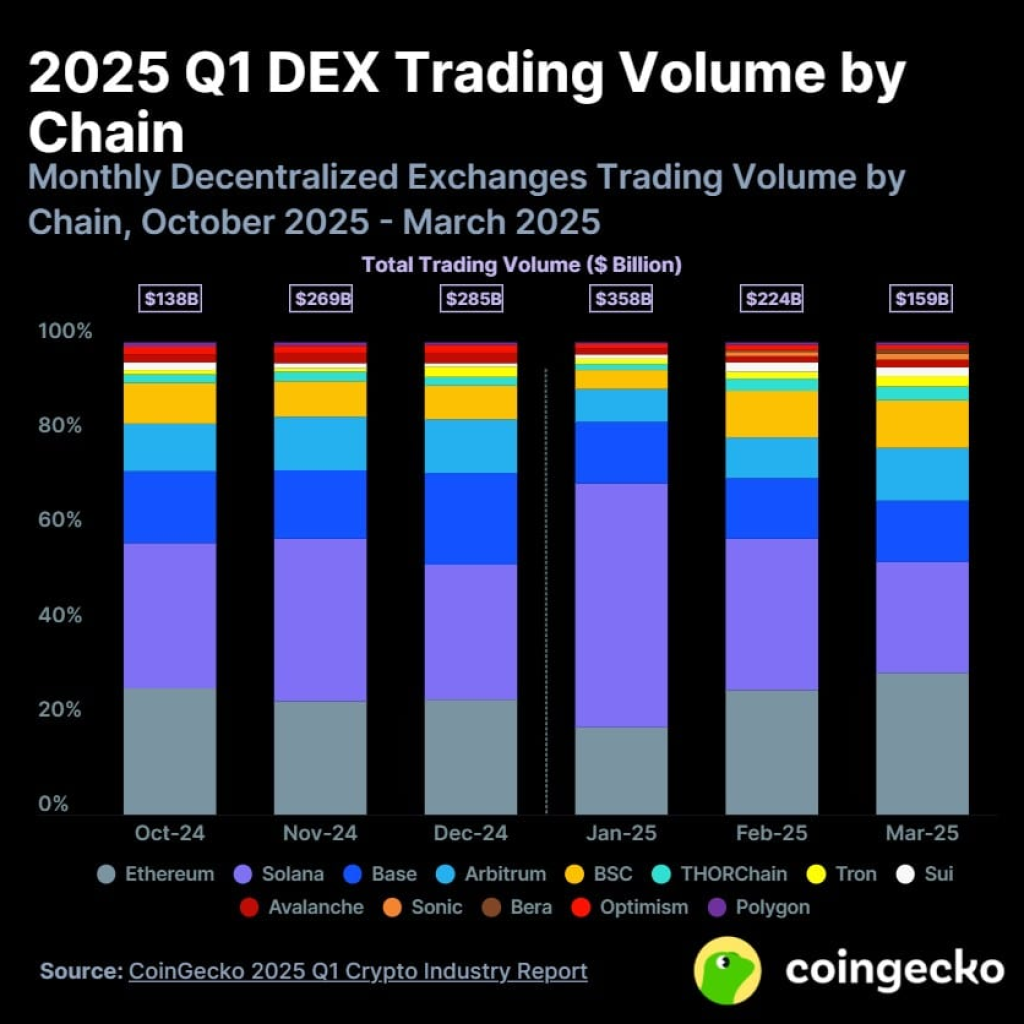

Growth comes from constant refinement. Each improvement increases throughput and stability, strengthening the foundation for builders and investors alike. In the first half of 2025, Solana processed more than 80% of all decentralised exchange activity worldwide, with trading volume exceeding 890 billion USD in five months. The numbers reveal both confidence and capability, showing how deeply Solana has become woven into the fabric of modern finance.

The Solana DeFi ecosystem thrives on circulation. Assets move through swaps, lending pools, staking protocols, and yield platforms in a continuous cycle of value creation. Liquidity supports more liquidity, creating an environment where every action multiplies opportunity. Developers find a responsive system, traders enjoy instant execution, and investors engage with markets that never lose momentum.

Solana DeFi embodies the future of open finance: fast, interconnected, and alive with purpose.

Scale Solana DeFi Ecosystem in Numbers

The Solana DeFi ecosystem proves its strength through measurable growth. Every quarter adds new records in liquidity, usage, and development, forming a clear picture of sustained expansion.

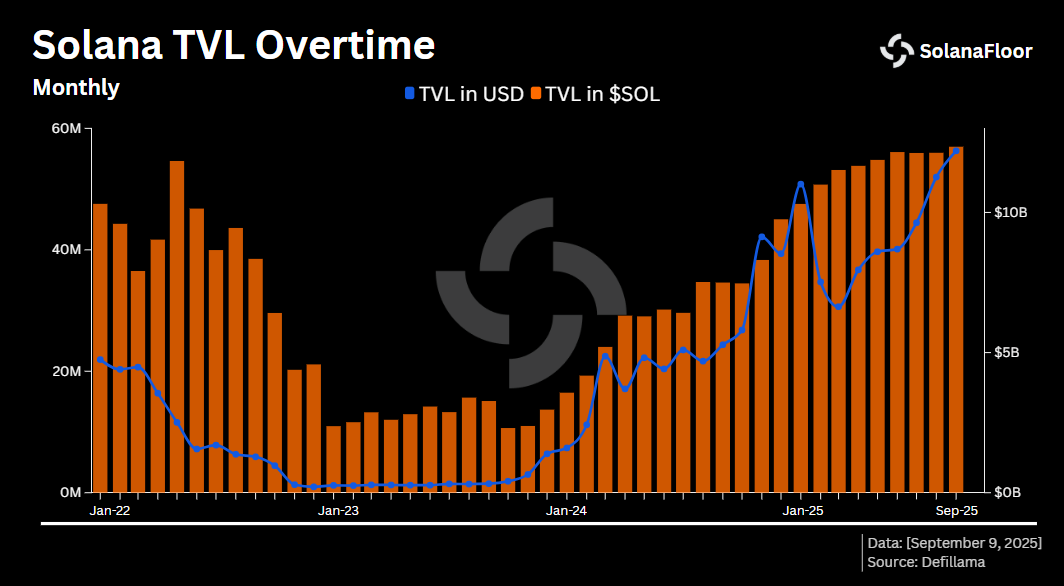

In early 2025, total value locked reached 9 billion USD, a 22% rise from the previous quarter. By mid-year, the figure climbed to 17.5 billion USD. More than 213 protocols now contribute to this pool of capital, supported by a stablecoin market cap of roughly 14.9 billion USD. Average daily DEX volume holds near 3.9 billion USD, showing active participation and deep liquidity across the chain.

Network revenue, often called “chain GDP,” grew from 971 million USD to 1.2 billion USD in the first quarter of 2025, a 20% gain in three months. Wallet activity followed the same direction, reaching 2.2 million daily users by March, up 60% year on year. April alone generated 107 billion USD in DEX trades, doubling the result from 2024.

Innovation keeps pace with this momentum. In 2024, Solana attracted over 7,600 new developers, an 83% increase that fuels constant product launches and technical refinement. New lending platforms, staking engines, and liquidity tools appear every week, expanding both market depth and use cases.

Together, these figures reflect an ecosystem in full motion. Liquidity grows, users stay engaged, and builders continue to push boundaries, turning Solana into one of the most active and capital-efficient environments in decentralised finance.

Top Solana DeFi Projects in 2025

The Solana DeFi ecosystem in 2025 is led by a group of standout projects shaping the network’s strength and identity. Each plays a unique role in expanding Solana’s reach, deepening liquidity, and turning DeFi into a seamless, high-speed experience.

Jupiter Exchange

Jupiter sits at the center of Solana’s trading landscape. In the second quarter of 2025, it processed over 80 billion USD in trading volume, accounting for more than 90% of all DEX aggregation on the network. With total value locked surpassing 3.8 billion USD, Jupiter delivers smooth routing, strong liquidity, and advanced products including perpetual trading and launch features. Its precision and scale make it the key driver of market activity across Solana.

Jito

Jito leads Solana’s staking economy through a blend of staking rewards and MEV yield. More than 3 billion USD in assets flow through its network, generating consistent returns while strengthening validator performance. The protocol transforms staking into an active, liquid process, allowing capital to circulate freely across DeFi platforms and reinforcing the network’s overall efficiency.

Kamino Finance

Kamino represents Solana’s push toward intelligent yield management. Managing over 2 billion USD in deposits, it automates liquidity and lending strategies that adjust in real time. Users gain access to sophisticated tools without complex management, creating an experience that is both powerful and approachable. Kamino embodies Solana’s spirit of automation and growth.

Raydium

Raydium anchors Solana’s liquidity network. It supports concentrated pools, efficient order books, and one of the most active launchpads in DeFi. By 2025, its total value locked exceeded 1.8 billion USD, a rise of more than 50% from the previous year. Raydium’s depth and stability keep trading vibrant, offering a reliable foundation for both projects and users.

Sanctum

Sanctum unlocks unified access to Solana’s liquid staking market. With more than 1 billion USD in total value locked, it connects multiple LSTs into a single platform where users can stake, swap, and earn efficiently. This structure simplifies the staking experience and strengthens liquidity across the broader ecosystem.

These five projects capture the essence of Solana DeFi in 2025: fast, collaborative, and full of potential. Together they form a complete financial loop where trading, staking, and yield flow naturally, creating a network ready for global scale and lasting impact.

Core Layers of Solana DeFi

The Solana DeFi ecosystem grows through connection and rhythm. Each protocol adds purpose, and together they form a network where liquidity moves in one seamless flow. Every swap, loan, and stake links to the next, creating a living cycle of movement and reward.

Exchanges and Liquidity Hubs

Decentralized exchanges set the pace. Raydium, Jupiter, and Saber handle millions of swaps daily, giving Solana one of the busiest trading environments in crypto. Raydium runs as a core automated market maker. Jupiter searches across all major DEXs to secure the best trading route. Saber focuses on stable-pair swaps, offering minimal slippage and deep liquidity. These platforms give Solana the constant pulse of a real financial market.

Lending, Staking, and Yield Platforms

Lending keeps the network alive. Solend allows users to earn from idle assets or borrow capital instantly. Jet Protocol refines this model with dynamic interest rates that match market demand. Port Finance builds on it further, adding cross-collateral lending and flash loans. Together they turn locked value into liquid, productive capital.

Liquid staking adds flexibility and income. Jito leads the field with more than 3 billion USD locked, rewarding users with both staking yield and MEV profits. Marinade Finance spreads risk across validators through mSOL, a token stakers can use anywhere in DeFi. Kamino connects staking with liquidity management, letting users earn yield in multiple layers at once. These protocols make Solana’s staking system fluid instead of static.

Yield optimization brings the next stage of sophistication. Tulip aggregates yield strategies across pools, compounding returns automatically. Kamino adjusts concentrated liquidity in real time, maximising profit with minimal effort. Platforms like Zeta Markets and Cega introduce derivatives and structured products, opening access to options, hedging, and leverage inside DeFi itself.

Cross-Chain Interoperability and Network Flow

Interoperability ties everything together. Wormhole bridges Solana with Ethereum, Avalanche, and other ecosystems, allowing assets to move freely between chains. This bridge turns Solana into an open gateway for liquidity, linking the ecosystem to the wider DeFi world.

Every part of Solana DeFi feeds the next. Exchanges bring liquidity, lending multiplies it, staking activates it, and yield engines refine it. The result is a system built on constant motion: fast, connected, and full of possibility.

Real Use Across Solana DeFi

The Solana DeFi ecosystem thrives because it works in motion. Users don’t simply hold assets; they trade, lend, and stake them within seconds. Each action connects to the next, forming a smooth cycle of liquidity and reward.

Swapping tokens marks the start of most journeys on Solana. Traders move between assets through Jupiter or Raydium, taking advantage of instant execution and almost zero cost. Liquidity providers add funds to pools and earn a steady share of trading fees. Every swap keeps the market liquid and active, turning simple trades into part of a much larger rhythm.

Lending builds the second layer. Platforms like Solend, Jet, and Port Finance allow users to earn from deposits or borrow against collateral. Rates adjust automatically, reflecting real market demand. Borrowers often use the assets they receive to reinvest elsewhere, feeding capital back into the system. Transparency and speed make this process efficient and accessible to anyone.

Liquid staking adds another dimension of growth. Instead of locking SOL and waiting for rewards, users stake through Jito or Marinade and receive liquid tokens such as JitoSOL or mSOL. These tokens continue to earn yield while being used across DeFi: in lending pools, liquidity farms, or trading pairs. Assets stay productive at every step.

Automation gives Solana DeFi its precision. Protocols like Kamino and Tulip manage positions on behalf of users, shifting funds to capture the best returns. This hands-free structure makes participation easier for both newcomers and professionals.

Cross-chain activity extends Solana’s reach beyond its own borders. With Wormhole, capital moves freely from Ethereum, Avalanche, and other ecosystems. This bridge attracts new liquidity and traders who value faster settlement and lower cost.

Every element in Solana DeFi feeds another. A trade fuels a pool, lending drives staking, and staking generates yield. The result is a financial network that never stands still: efficient, fluidly, and built for real use.

Strengths Driving Solana DeFi

The Solana DeFi ecosystem grows from the harmony between speed, scale, and smart design. Every part of the network supports another, creating balance and flow.

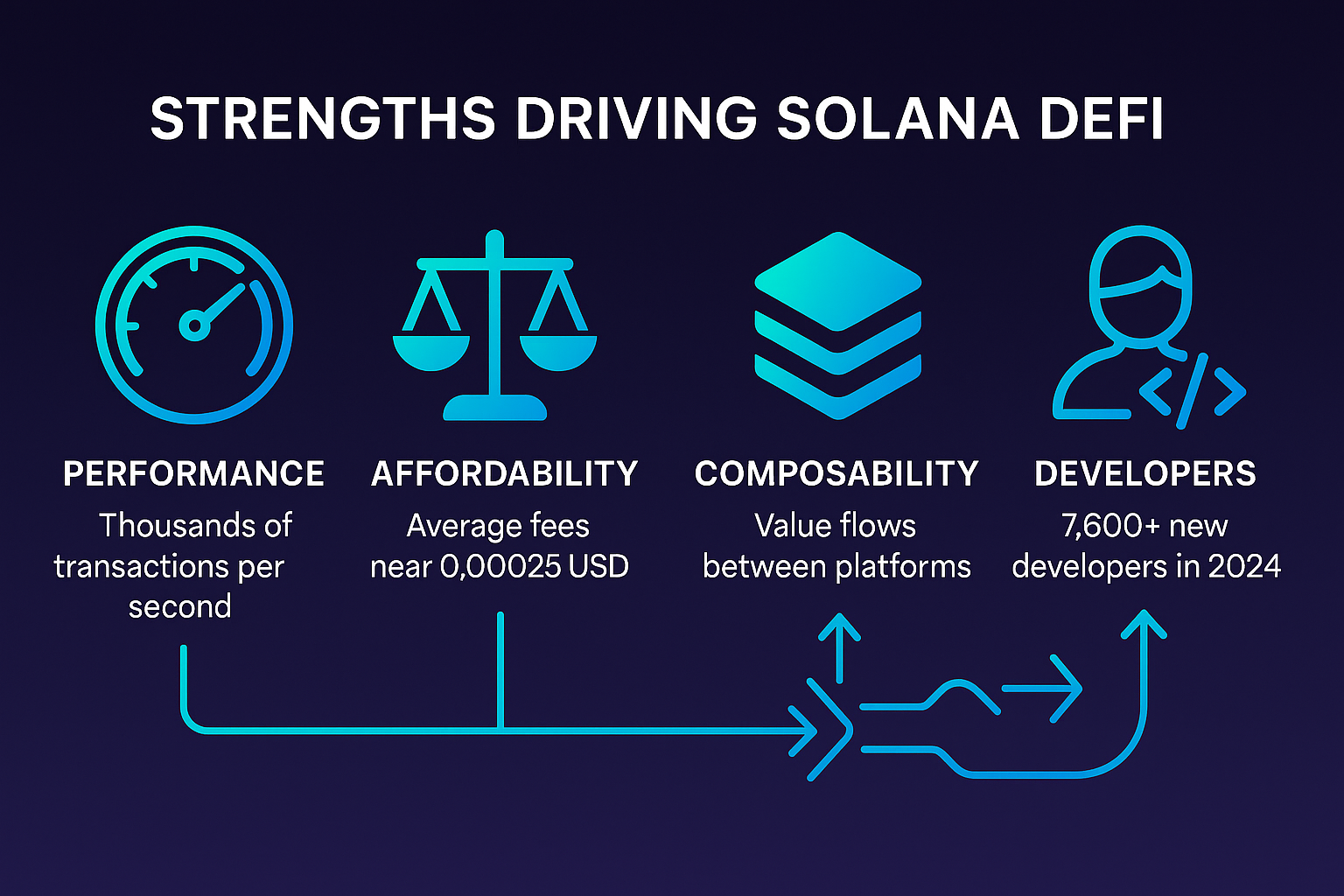

Performance gives Solana its core power. The network handles thousands of transactions each second while keeping average fees near 0.00025 USD. Confirmation happens almost instantly. In 2025, throughput increased by 20%, ensuring stability even during heavy trading. This reliability turned Solana into one of the most efficient infrastructures in decentralised finance.

Affordability keeps the system open to everyone. Large funds, small traders, and developers share the same pace and cost. That accessibility fuels constant activity and liquidity, making Solana a place where innovation moves freely.

Composability brings the ecosystem to life. Liquidity from exchanges flows into lending pools. Lending generates staking derivatives. Staking feeds yield platforms. Each element amplifies the next, keeping value in circulation instead of sitting idle. This loop gives Solana DeFi exceptional capital efficiency and natural growth.

Developers push the rhythm forward. More than 7,600 new builders joined in 2024, creating new tools, interfaces, and products. Their work keeps the system evolving and ensures Solana remains at the front of DeFi innovation.

Each upgrade builds on the last, forming a steady chain of progress. Strong performance attracts users, their activity deepens liquidity, and growing liquidity brings in new builders. In short, this cycle keeps the Solana DeFi ecosystem expanding with direction and power.

Challenges on the Road

The Solana DeFi ecosystem keeps growing, but expansion always comes with pressure. The same qualities that make it fast and open also demand careful balance.

Security and Smart Contract Stability in Solana DeFi

Security stands at the top of every concern. Smart contracts handle millions in value each day, so even a small vulnerability can have a big impact. As capital increases, stronger audits, safety nets, and transparent governance become essential. Each new layer of protection adds stability and reinforces user confidence.

Network Reliability and Performance Optimization

Network performance also shapes trust. Solana has made great progress in reliability, yet moments of congestion remind everyone how crucial consistency is for large-scale use. Developers now focus on smoother validator coordination and smarter resource allocation, keeping transactions fast even during volatile periods.

Liquidity Risks and Market Flow in Solana DeFi

Liquidity brings both strength and risk. Capital often moves toward higher yield, and when incentives shift, that flow can reverse. To manage this rhythm, projects design more balanced reward systems that encourage long-term participation instead of short-term speculation. Sustained liquidity keeps the network steady and productive.

Interconnected Protocols and Systemic Risk Management

Interconnection gives Solana its composability, but it also links protocols closely together. When one system depends on another, problems can spread quickly. Teams now build safeguards such as collateral buffers and circuit breakers to contain shocks and preserve confidence across the ecosystem.

Regulation and Institutional Integration in Solana DeFi

Regulation forms the next frontier. Global financial rules are evolving, and DeFi must adapt. Clearer compliance frameworks will determine how projects scale and how institutions join in. Preparing early for transparency and accountability will help Solana keep its momentum while earning broader trust.

Each challenge sharpens the system. Security inspires stronger code. Market shifts encourage smarter design. Regulation pushes maturity. Through every test, Solana DeFi learns, adapts, and grows into a more resilient version of itself.

The Road Ahead

The Solana DeFi ecosystem moves into a stage of focus and depth. After a powerful growth cycle, attention now turns to refinement, integration, and real-world impact. Speed and liquidity remain central strengths, while the next goal is to convert this energy into lasting financial value.

Expansion Through Liquid Staking and Tokenization

Liquid staking keeps expanding across the network. Platforms like Jito and Marinade introduce new ways for SOL holders to earn without locking capital. These tools keep funds active and circulating, turning staking into a continuous source of income and liquidity.

Real-World Integration and User Experience

Real-world assets mark the next frontier. Tokenised versions of bonds, treasuries, and commodities bring stability to a market known for volatility. By blending blockchain performance with institutional-grade products, Solana builds a bridge between digital innovation and global finance.

Connectivity amplifies this progress. Bridges such as Wormhole strengthen liquidity channels between Solana, Ethereum, and other ecosystems. Cross-chain integration turns Solana into a fast settlement layer for a connected financial world.

User experience will decide the pace of adoption. Clean interfaces, mobile access, and seamless onboarding make participation intuitive for both newcomers and professionals. The easier it becomes to use, the faster DeFi grows.

Each advance fuels the next. Liquid staking increases liquidity, tokenisation builds credibility, and better access widens participation. In short, they set Solana on a clear path toward an open, borderless financial system powered by speed and precision.

FAQs

1. What makes Solana DeFi stand out?

Solana delivers high transaction speed, minimal fees, and deep liquidity, allowing DeFi applications to function efficiently even at peak demand.

2. Which projects lead the ecosystem in 2025?

Jupiter, Jito, Kamino, Raydium, and Sanctum shape the core of Solana DeFi, each driving trading, staking, yield, or liquidity innovation.

3. How much capital flows through Solana DeFi?

By mid-2025, total value locked reached 17.5 billion USD across more than 200 active protocols, showing strong network engagement.

4. How does liquid staking support the network?

It lets SOL holders earn staking rewards while keeping their tokens active in DeFi markets, enhancing liquidity and capital efficiency.

5. What direction will Solana DeFi take next?

Future growth centers on real-world asset integration, stronger cross-chain links, and an easier user experience to expand global participation.

Comclusion

The Solana DeFi ecosystem has matured into a complete and connected financial network. Built for speed and scale, it now stands as one of the most vibrant centers of decentralised finance. Each component works in sync, creating movement, liquidity, and opportunity across every layer.

Exchanges record billions in daily volume, while lending and staking platforms keep funds active within the system. Developers refine protocols to make interactions smooth and intuitive. This cooperation between builders and users keeps the network dynamic and constantly improving, turning DeFi on Solana into a real, functioning economy.

The next phase focuses on depth and connection. Liquid staking will make capital more efficient, keeping assets productive while earning yield. Tokenised instruments such as bonds and treasuries will bring stability and attract institutional interest. Cross-chain integration will connect Solana to global liquidity pools, opening access to wider markets. A simpler interface and improved user experience will encourage more people to participate, turning complex DeFi tools into everyday financial products.

Solana’s rise reflects a mix of precision, creativity, and relentless motion. Each upgrade adds trust, each collaboration expands reach, and each transaction reinforces growth. The network continues to evolve with purpose, shaping an open financial system driven by speed, innovation, and confidence.