Solana ETFs Gain Momentum While Bitcoin and Ether Funds See Major Outflows

- Bitcoin ETFs saw $578M in net outflows in a single day.

- Ether ETFs recorded $219M in withdrawals, extending a five-day trend.

- Nearly $1B has exited ETH ETFs since late October.

- Solana ETFs posted six straight days of inflows.

- Institutions appear to be rotating into Solana amid macro uncertainty.

Bitcoin and Ether exchange-traded funds (ETFs) continued to face strong selling pressure this week, with both assets experiencing ongoing capital outflows. According to data from Farside Investors, spot Bitcoin ETFs saw around $578 million in net withdrawals on Tuesday — the largest single-day outflow since mid-October. Major funds such as BlackRock’s IBIT and Fidelity’s FBTC led the redemptions during the decline. Meanwhile, Ether ETFs followed a similar pattern, losing $219 million on the same day. Over the past five trading sessions, nearly $1 billion has left Ether-linked funds, signaling cautious sentiment among institutional investors.

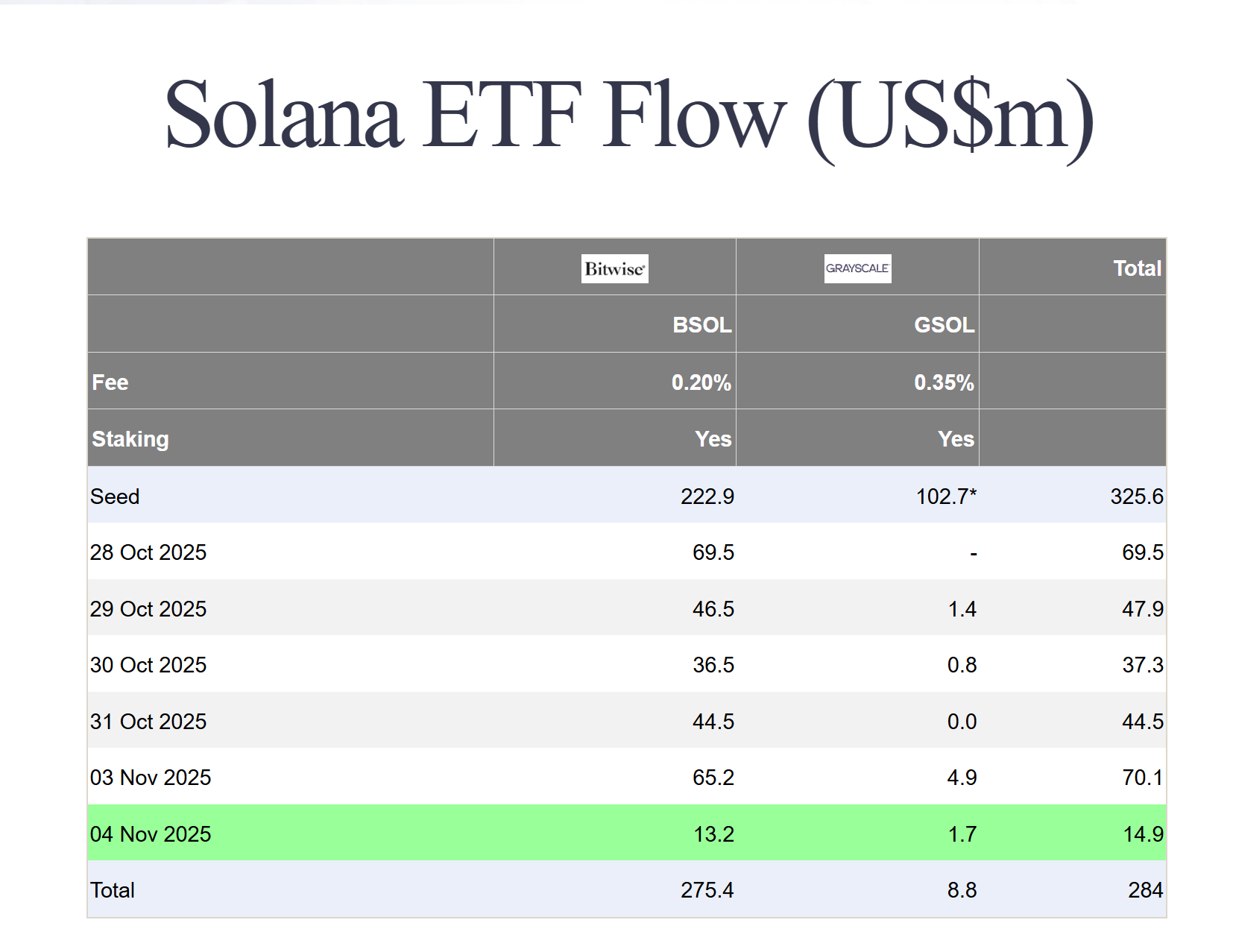

In contrast, Solana-based ETFs continued to move in the opposite direction. Spot Solana ETFs recorded nearly $15 million in inflows on Tuesday, marking their sixth consecutive day of positive fund movement. Bitwise’s BSOL and Grayscale’s GSOL both contributed to this steady rise. The inflow trend suggests that investors are showing renewed interest in Solana, particularly because of its staking yield and emerging role as an alternative to Ethereum in decentralized applications.

Market analysts say the pattern is less about declining faith in Bitcoin or Ether and more about broader macroeconomic factors. Vincent Liu, Chief Investment Officer at Kronos Research, explained that global markets are currently experiencing a period of increased caution. A strengthening U.S. dollar and tighter liquidity conditions are pushing institutions to reduce risk exposure across multiple asset classes. This means traditional and crypto markets are being affected in similar ways, with investors choosing to pull back until volatility settles.

However, Solana’s momentum appears to be driven by a different narrative. Liu noted that Solana is benefiting from what he described as “fresh flow meets fresh story.” The launch of new Solana ETFs, combined with the network’s staking rewards and strong performance over the past year, has attracted investors seeking growth opportunities even during uncertain conditions. Still, he warned that while interest in Solana is growing, this trend remains early and concentrated among more risk-tolerant participants.

Overall, the recent ETF movements highlight both caution and curiosity in the crypto investment landscape. Bitcoin and Ether continue to dominate institutional portfolios, but Solana is emerging as a notable alternative as investors look for assets with yield potential and active development momentum.

Final Thought

The ETF outflows suggest a temporary risk-off environment rather than a long-term shift in confidence. Solana’s recent momentum shows that investors are still willing to explore new opportunities — but broader stability in financial markets may be needed before large inflows return to Bitcoin and Ether.