Solana Staking ETFs Poised for US Approval: What it Means for Altcoins and Crypto ETFs

Several Solana staking exchange-traded funds (ETFs) could gain U.S. approval within the next two weeks, according to ETF analyst Nate Geraci. This approval is seen as a potential catalyst for the broader altcoin market, signaling new opportunities for Solana and other crypto assets.

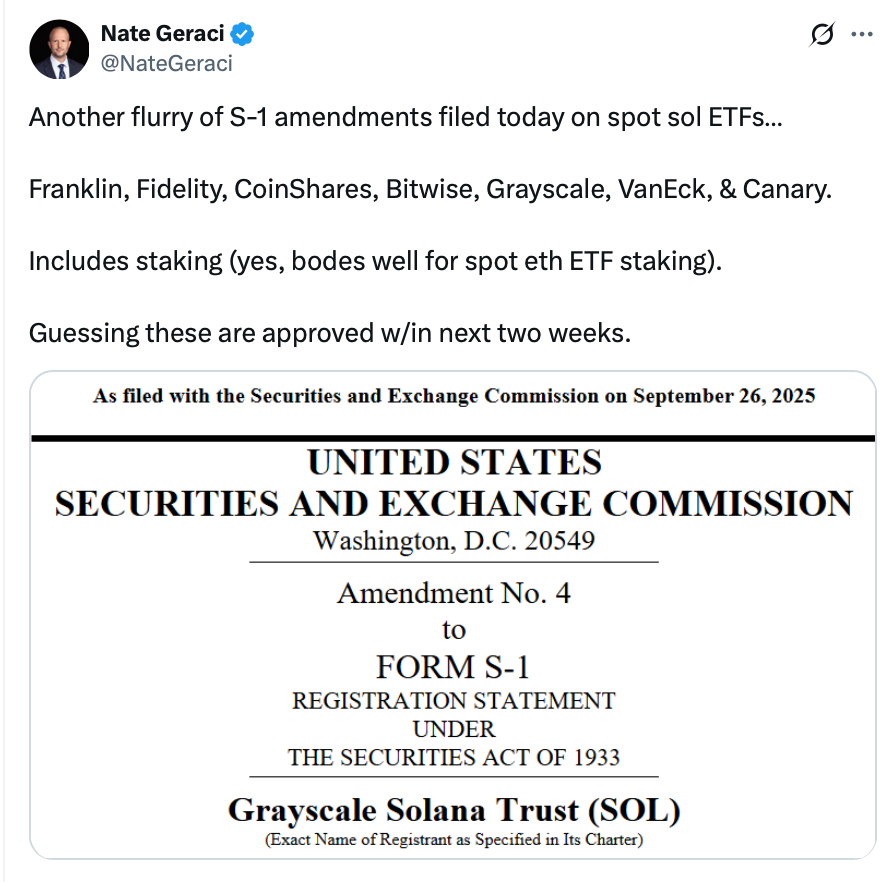

The anticipation surrounding Solana staking ETFs in the U.S. is growing, with analysts forecasting their approval by mid-October. Nate Geraci, president of NovaDius Wealth Management, stated that it’s likely the Solana ETFs will be approved within the next two weeks, based on the recent regulatory filings by major asset managers. Notably, firms such as Franklin Templeton, Fidelity Investments, CoinShares, Bitwise Asset Management, Grayscale Investments, VanEck, and Canary Capital all filed amended S-1 documents with the U.S. Securities and Exchange Commission (SEC) on Friday. The S-1 documents provide detailed financial disclosures and describe the securities the firms intend to offer, a key step in the approval process.

The launch of Solana staking ETFs comes just over two months after the debut of the REX-Osprey Solana Staking ETF on the Cboe BZX Exchange. This product garnered $33 million in trading volume and $12 million in inflows on its launch day, marking a strong start for Solana’s entry into the ETF space. The success of this initial ETF has fueled the momentum for further Solana-related products, with major asset managers looking to tap into the growing demand for crypto ETFs.

Analysts, including those at Pantera Capital, have noted that Solana (SOL) is “next in line for its institutional moment,” citing its relative under-allocation compared to Bitcoin (BTC) and Ether (ETH). This suggests that there is significant institutional interest in Solana, and staking ETFs could further unlock capital inflows to the asset. Geraci pointed out that the next month could be pivotal for the crypto market, with the first Hyperliquid ETF filing and the SEC’s approval of generic listing standards for crypto ETFs on the horizon. His comment, “Get ready for October,” highlights the importance of these developments in shaping the future of the crypto ETF market.

Meanwhile, the approval of Solana staking ETFs is seen as a positive sign for other crypto ETFs, especially those for Ether (ETH). Geraci suggested that staking in U.S. ETF filings could indicate that spot Ether ETFs may soon incorporate staking as well. This would be a major development for the Ether market, increasing yields for investors and potentially reshaping the market for Ethereum-based ETFs. The SEC’s decision to allow staking in Ether ETFs is still pending, as issuers have filed numerous requests earlier this year seeking approval to offer staking services.

Europe has already seen strong interest in Solana staking products. Bitwise’s Solana staking ETP in Europe saw $60 million in inflows over the past five trading days, a clear signal that Solana is on investors’ radar. Bitwise’s Chief Investment Officer, Hunter Horsley, noted in an X post that “Solana is on people’s minds,” further bolstering the case for Solana’s growth in both the institutional and retail markets.

Many analysts believe that the broader altcoin market will not see a large rally until more crypto ETFs are approved, providing investors with exposure to altcoins lower down the risk curve. These anticipated Solana ETFs could be the tipping point for a broader altcoin season, offering institutional investors a more secure way to gain exposure to Solana’s growth.

Final Thought

The expected approval of Solana staking ETFs in the U.S. could be a pivotal moment for the cryptocurrency market, not just for Solana but also for the broader altcoin ecosystem. As institutional interest builds, the approval of staking in ETFs is likely to increase yields and attract more capital to Solana and other cryptocurrencies. Investors will need to watch October closely as these developments unfold, potentially signaling the start of a new phase in the crypto market.